This does not constitute investment advice. Returns mentioned herein are in no way a guarantee or promise of future returns. Mutual Fund investments are subject to market risks

Attention, All Mutual Fund Investors:

Here's Our Question to You...

Is Your Portfolio Healthy?

Perhaps Not.

What's Worse, You Might Never Know about It Until You

Start Incurring Potential Losses In The Future.

Dear Reader,

Keep the next five minutes of your life completely distraction free and read this letter very, very carefully .

This is for your own good, we assure you.

You see, we have reason to believe that you have probably created an "unhealthy" portfolio for yourself.

...An unhealthy portfolio that not just stops you from fulfilling your financial goals but also weakens your financial tomorrow.

What's worse, you would probably never know about this till it's too late.

Until you start incurring potential losses over time and are not able to fulfill your financial goals in time.

And it's not just you.

We fear that it might be the same with most mutual fund investors that you might know of, in your life.

That's the reason why their returns never seem to match those of the smart investors as we call them.

Perhaps that might be the reason why they are unable to buy their dream home, get children to study abroad or save enough take a vacation when they want it the most.

They probably didn't know that their mutual fund portfolio was 'sick'.

The Root Of The Problem Lies Herein...

Let us explain in a bit, but before that here's a question.

Answer it honestly.

Do you really think before you invest in a mutual fund?

By that, we mean do you look up the historical performance sheets, the real expenses and the long-term investment strategy of a fund?

It's highly likely that you don't.

But it's not just you.

Have you ever seen any mutual fund investor checking out the asset allocation of a fund?

Maybe not.

And they probably don't even try to figure out who manages the fund, what investment strategy they follow or whether the investment makes any sense for their financial plan or not.

Unfortunately, you are probably one of them.

And therein lies the real problem.

That is, most investors believe that a mutual fund is always safe and profitable.

...As if every mutual fund is destined to make you money no matter what.

You don't need to study its monthly factsheets.

You don't check the fine prints in the offer document.

You don't need to keep track of the latest developments of the market.

All you need to do is put your money in any mutual fund, just like your neighbor did, and it will grow on its own.

WRONG.

And this rash approach to mutual fund investing, as always, leads to heavy losses or if you are lucky, insignificant gains in the future.

You need to understand one simple thing here.

The truth is, NOT all mutual funds are good.

Most importantly, not all mutual funds are good for YOU.

Every mutual fund comes with its own strengths and weaknesses, and it actually depends on the investor to decide whether it suits his investment horizon, expected financial needs and risk appetite or not.

Needless to say, it involves pouring down into the factsheets and running the numbers and checking business channels on TV to keep up with the latest trends.

In other words, it's practically IMPOSSIBLE for you after a full day's of hard work.

It's just not possible for you to pick out the best funds for your optimum portfolio just by going through few headlines in the newspapers or checking a few Buy or Sell recommendations from unknown mutual fund advisors.

It requires a strict step by step process as mentioned above to minnow the best from the rest.

Unfortunately, most investors don't know how to follow it.

The result?

You go for the wrong funds in most cases and end up with a sick portfolio!

Worried what to do about it?

We have a solution for you.

Presenting To You...

PersonalFN's Most Popular Service

Mutual Fund Portfolio Review

PersonalFN's Mutual Fund Portfolio Review service is a personalized portfolio review service designed to boost the returns of mutual fund investors.

It reviews your existing mutual fund portfolio, helps you correct your past investment mistakes, if any and suggests you with possibly the best options more suitable for you.

In simple words, PersonalFN's Mutual Fund Portfolio Review service rectifies your course of action in the 'present', so that you don't have to worry about your 'future'.

Through this service, our investment advisor will provide personalized attention to you by reviewing your existing mutual fund investments, and also recommending the future course of action.

With our well-analyzed recommendations, creating an optimal mutual fund portfolio will be a piece of cake for you.

What's more...

You don't need to do a thing during the review process.

Our investment advisor will guide you step by step to solve all your doubts and concerns.

We will recommend which funds to redeem immediately and which ones to hold on to and buy - with proper reasons for the recommendations - and how you must allocate the money that you receive from selling the non-performing funds.

And that's not all!

We will also guide you to the path of long-term wealth creation by suggesting:

What Asset Allocation you should follow for all your future investments.

Where you should invest your future investments to achieve your financial goals.

And so on.

You will get all this information and recommendations in a 'special customized report' that our investment advisor will prepare for you.

And how you can grab this special customized report?

By simply signing up for PersonalFN's Mutual Fund Portfolio Review service right now.

Let us guide you to correct your past investment mistakes right now, and take better care of your future mutual fund investment decisions.

But now you might be thinking...

"Why Should I Trust You?"

We are glad you asked this question, as the failure to ask this is what leads investors to choose untrustworthy financial advisors, and thus make poor investment decisions.

So, let us introduce ourselves.

Launched in 1999, PersonalFN is one of India's first online personal finance companies and currently one of the leaders in the fund research industry.

With over 1.50 lakh readers worldwide and serving more than 10,000 clients far and wide, PersonalFN has come a long way.

And that's only because of the trust it gained from our valuable readers like you.

That's because we at PersonalFN have always ensured that our advice is not driven by commissions, like it probably does for many other financial advisors.

Instead, we have always tried our best to recommend the 'right' mutual funds that fit our subscribers' investment needs.

Our research team follows a time-tested process to identify such funds for our clients, where each scheme is tested on both quantitative and qualitative parameters.

In fact, what we do is a deep analysis on the real worth of a mutual fund before advising our clients to buy or sell them.

This analysis includes...

Studying the mutual fund house's investment process and philosophy.

Studying the fund's long term performance (at least for 5-10 years), across market cycles.

Performing risk reward analysis, judging portfolio concentration, strategic consistency and quality, etc.

Checking the fund manager's long term performance and his overall work experience.

This process not only helps us in identifying the right mutual funds our clients must invest in, but also helps us eliminate the ones that they must not touch with a 10-foot pole.

But you don't have to take our word for that!

Read what some of our long term believers have to say about the quality and trustworthiness of our services.

I was reviewing my portfolio today. I am happy to note that all my investments have outperformed market both in down as well as up market condition. The recommendations of PersonalFN are unbiased and generally have a long term views suitable for common investor like me.

When I look back, the timely advice and assurances of PFN, quite contrary to experts on TV during the last year's downturn not only saved me from huge loss, it helped to maximize my return in the cycle. I once again thank you all in PersonalFN for educating common investors and unbiased advice.

- Anup Kumar Guru, Mumbai

With their unbiased research and personalized financial planning, PersonalFN helped me overcome the fear of investing into mutual funds. I think I have become an informed investor, thanks to the easy-to-understand literature and research articles that PersonalFN publishes and their friendly staff who never pressurize a customer into anything.

- SrinivasaRao, Bengaluru

These comments sum up who we are and what we do. Nothing makes us happier than seeing a satisfied PersonalFN subscriber!

But then, you may also ask...

"What's PersonalFN's Track Record?"

We're just coming to that.

We understand that in the financial world, trust and past performance always go hand in hand.

And PersonalFN will NEVER disappoint you on that front.

In the past, our recommended mutual fund portfolios have consistently outperformed the market!

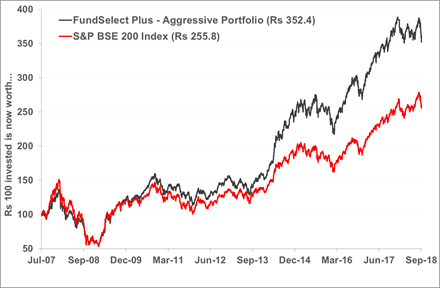

Like in July 2007, we recommended 3 equity mutual fund portfolios based on one's risk profile - ranging from aggressive, moderate and conservative.

At the same time, we also recommended 3 debt mutual fund portfolios based on investment time horizon of the investors - Less than 3 Months, 3 to 12 Months and More than 12 Months.

Out of over thousands of schemes in existence, we selected 5 to 7 suitable schemes for each equity mutual fund portfolio, and 2 to 4 suitable schemes in each debt mutual fund portfolio.

We just kept three things in mind - the client's need, his investment objective and risk appetite.

And the result?

Just take a look at the chart below...

(Performance from 2-July-2007 to 28-September-2018; Source: ACEMF, PersonalFN Research)

Past performance is no guarantee of future results

Our Aggressive Portfolio has returned 252.4% in the last 11 years, compared to 155.8% of S&P BSE-200 Index.

So, for every Rs 100 invested in the Aggressive Portfolio in 2007, it would have total to Rs 352 today. Isn’t that amazing?

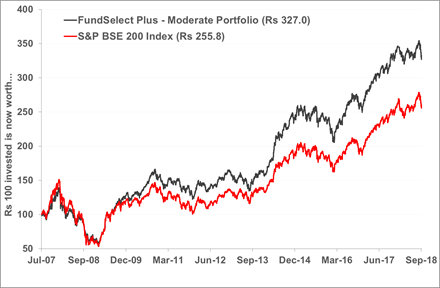

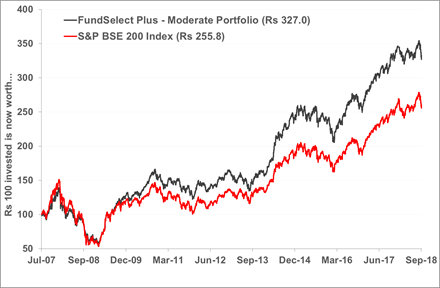

Well, let’s take a look at the Moderate Portfolio now.

The Moderate Portfolio is meant for the risk-averse investors who can tolerate moderate risk in hope of higher investment returns than average.

This is highly optimized portfolio that takes lot of “tinkering” to get the RIGHT BALANCE of risk and returns.

And we succeeded!

(Performance from 2-July-2007 to 28-September-2018; Source: ACEMF, PersonalFN Research)

Past performance is no guarantee of future results

The Moderate Portfolio returned 227% in the last 11 years, compared to 155.8% of S&P BSE-200 Index.

That's 70 Percent Over that of the S&P BSE-200 Index!

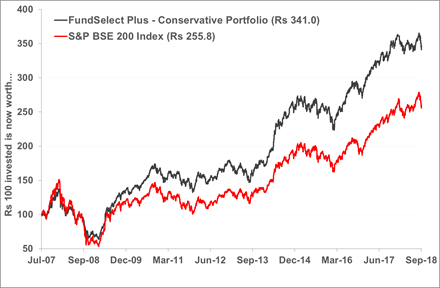

Here comes the Conservative Portfolio - the one for the investors who want to invest in equity but don’t want to bear significant market risk.

Trust us when we say that we took extra pains with this portfolio. Creating a portfolio that delivers high investment returns yet at nominal risk is hard, to be honest. It needs constant attention and care to be of any good to our investors.

How good are our results? Check it out for yourselves.

(Performance from 2-July-2007 to 28-September-2018; Source: ACEMF, PersonalFN Research)

Past performance is no guarantee of future results

Yes, you are right.

The Conservative Portfolio fetched investors an absolute return of around 241% in 11 years time, compared to the meagre 155.8% of S&P BSE 200 Index.

Not conservative at all, right?

Our recommended portfolio has grown at around 11.8% CAGR compared to S&P BSE 200 Index’s 8.9% CAGR. For all those who put their faith on us and staked their capital in our recommended portfolio, they gained an extra Rs 85 on every Rs 100 they invested. Not bad, eh?

So while the equity markets have grown by around 155%, our recommended portfolios have generated an absolute return of 252%, 227% and 241%.

That's an additional growth of approximately 70% to 95% in investor's wealth, when compared to growth seen in the equity markets.

And trust us; this performance has come with the least churning in the portfolios. We are still holding on to many of the investments in the funds we recommended then.

These are high end funds that we identify to be true long term performers.

Infact, we felt the least need to change any of the fund recommended in our best performing equity mutual fund portfolios.

Source: www.PersonalFN.com, PersonalFN Research;

(Calculated based on NAV as on 28-Sep-2018, Return from 02-Jul-2007 to 28-Sep-2018)

Past performance is no guarantee of future results

In terms of growth in the value of debt portfolios at the same time since July 2007, every Rs 100 invested in our recommended debt portfolios has grown to over Rs 235.

As against this, the investment of Rs 100 in the benchmark bond fund index has grown to around Rs 224 over the same time period.

Some of our recommended debt portfolios have shown an additional growth of over 30% in investor's wealth.

And as you can see, by generating an absolute return of 155%, our recommended long term debt portfolio has rewarded investors with an additional return of around 31% when compared to the 124% returns earned by benchmark bond fund index.

Our Superior Performance Is Not

A Matter Of Luck...

It's a result of intensive studies done day in and day out by our research team at PersonalFN.

It's a matter of systemic weighing of the strengths, weaknesses, opportunities and threats of each of the funds, and zeroing in on the healthiest funds in the industry.

A well-tuned and time proven exclusive fund selection strategy developed over the last 10 years!

Only because of that, we have been able to identify well-managed mutual funds with the ability to beat their peers in the same category.

And now we will apply the same exclusive strategy while reviewing your portfolio too!

So you can rest be assured that you will get unbiased recommendations backed by solid research process.

Our only aim is to guide you in building a mutual fund portfolio that is best suited for you to achieve your life's goals.

We want you to grow your wealth, safely.

...Without taking any unnecessary risks.

And PersonalFN's special Mutual Fund Portfolio Review service does exactly that!

We are sure your next question will be...

How Can You Avail Of PersonalFN's

Mutual Fund Portfolio Review Service?

To get your fund portfolio reviewed by the fund advisors of PersonalFN...

-

Sign up for the PersonalFN's Mutual Fund Portfolio Review service below.

Once you are done with the initial formalities, share with us your portfolio (we'll explain you how to do it).

We will perform an in-depth study of your portfolio and revert with our opinion and plan to action.

Our report will be complete with our views and analysis of your existing portfolio, action steps and fund recommendations that would probably help you maximize your portfolio returns.

Our Financial Advisor/experts will guide you discard the non-performing mutual funds and selecting the right funds that goes with your financial goals and objectives.

Exploit our experience and knowledge in bettering your portfolio for potentially higher returns in the future while you still can.

YES! Please Review My Mutual Fund Portfolio Right Away

And we have something more for you.

A Deal You Just Couldn't Say No To...

You see, for the past few years, we had been working on something that could change the way investments work.

Yes, a combination of superior research and the best technology.

And finally, earlier this year, we launched our most ambitious project, our own ROBO ADVISOR.

Proudly named, “PersonalFN Direct”, this Robo Advisor is probably/one of the best in its class as it is backed by technology and our expert research.

Now, this Robo Advisor is available for subscription at Rs 5,000 per year!

But, if you choose to sign up to our Mutual Fund Portfolio Review service right now, we will give you 6 months complimentary access to PersonalFN Direct... FREE!

Yes! Absolutely Free...

Use it, take advantage of it, learn from it, invest using it for 6 months... FREE!

That means, access worth Rs 2,500 for FREE.

We have never done something like this in the past, and do not plan to repeat this again.

If you are still thinking, we have got yet another reason for you to sign up for the Mutual Fund Portfolio Review service

We normally charge Rs 10,000 for this exclusive one time review of mutual funds portfolios for our subscribers.

But we have decided to go against the rule at this time.

We have decided not to charge you this price.

Only for our valued subscribers like you, we are running a special offer at the moment.

We are accepting new reviews for just Rs 10,000 Rs 5,950/-.

That's a MASSIVE discount of 40%!

But it might not be viable for us to run this offer too long.

And we will end it very soon.

After that, the subscription price of our service will also go back to the usual Rs 10,000.

So you really need to act right now!

...For the price seems really small compared with the fact that it will help make your financial future safe and secure...and thus help you sleep peacefully at night.

Here is what all you get when you sign up for the PersonalFN Mutual Fund Portfolio Review service...

One time review of your 'existing' mutual fund portfolio (both equity and debt funds)

Analysis based on category-wise holding

Portfolio concentration and risk analysis

Consolidating your MF portfolio

Strategizing your portfolio as per your broad based risk appetite and investment time horizon.

Final View & Recommendations (BUY/HOLD/REDEEM)

Action plan for fresh investments

Isn't this a real deal?

Right.

What Are You Still Waiting For?

India is on the move.

Flurry of investors are entering the market every day.

And you don't want to miss the opportunities that the markets, both equity and debt, throw up in the months and years ahead.

If you go for PersonalFN's Mutual Fund Portfolio Review service, you will probably reap higher gains than you have expected.

And also avoid the potential losses that could result from a 'sick' portfolio.

So, accept our invitation and get your portfolio reviewed right now. Simple.

And rest assured that you might not see such an amazing offer to get your hands to this invaluable service again!

Get Your Mutual Fund Portfolio Reviewed Now!

This might be the best opportunity of your life.

This might be the answer to your mutual fund investment worries.

This might be the ticket to your financial freedom.

Grab it while you can.

Because the longer you wait, the more you lose the opportunity of making more money as markets move up!

Now What Are You Waiting For?

Accept our invitation by becoming a subscriber to the PersonalFN Mutual Fund Portfolio Review service today!

You may not get your hands to this invaluable service again for a long time to come!

Original Price:

You Pay: Rs 5,950/-

*Price Inclusive of Goods and Services Tax

Sign Up For Right Now & Get Your Portfolio Reviewed By Our Experts

To your wealth always,

Team PersonalFN

P.P.S: This is a one-time service to help you review your existing portfolio of mutual funds, and suggest you mutual fund portfolio that match your financial goals. Since this is a personalized service, there will be no refunds.

P.P.P.S.: We request you to provide all your relevant mutual fund data for our analysis within a maximum of 3 months from the date of signing up for the service.

P.P.P.P.S.: If you have any queries, please do not hesitate to contact us at +91-22-61361200. If you find these numbers busy, which might be the case due to a lot of people calling in for enquiries on their portfolio review, kindly try calling up again after some time.

Get Your Mutual Fund Portfolio Reviewed Today!

Mutual Funds investments are subject to market risk. Kindly read the offer document carefully before investing.

*Price inclusive of applicable Goods and Services tax

** The performance data quoted above represents past performance and does not guarantee future results.

© Quantum Information Services Pvt. Ltd. All rights reserved.

Any act of copying, reproducing or distributing this newsletter whether wholly or in part, for any purpose without the permission of PersonalFN is strictly prohibited and shall be deemed to be copyright infringement.

Disclaimer: Quantum Information Services Pvt. Ltd. All rights reserved. Any act of copying, reproducing or distributing this newsletter whether wholly or in part, for any purpose without the permission of PersonalFN is strictly prohibited and shall be deemed to be copyright infringement

Quantum Information Services Pvt. Limited (PersonalFN) is an independent Mutual Fund research house and SEBI Registered Investment Adviser (Registration No. INA000000680). All content and information is provided on an 'As Is' basis by PersonalFN. Information herein is believed to be reliable but PersonalFN does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. The Services rendered by PersonalFN are on a best effort basis. PersonalFN does not assure or guarantee the User any minimum or fixed returns. The Services are designed and provided based on the information and documentation furnished on this website/to the Personalfn by the User. The recommendations/advice made by PersonalFN are subject to several risks & other external factors not in the control of PersonalFN such as financial markets, macro and microeconomic factors, and other factors that can cause an adjustment in the User’s own financial situation and the progress of the User’s plan. The results may be based on certain assumptions. PersonalFN and its employees, personnel, directors will not be responsible for any direct / indirect loss or liability incurred by the user as a consequence of him or any other person on his behalf taking any investment decisions based on the contents and information provided herein. Use of this information is at the User's own risk. This is not directed for access or use by anyone in a country, especially USA, Canada or the European countries, where such use or access is unlawful or which may subject PersonalFN or its affiliates to any registration or licensing requirement. The User must make his own investment decisions based on his specific investment objective and financial position and using such independent advisors as s/he believes necessary. Past performance is no guarantee of any future results. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Quantum Information Services Private Limited (PersonalFN) may hold shares in the company/ies discussed herein. As a condition to accessing PersonalFN’s content and website, User agrees to our Terms and Conditions of Use and Privacy Policy, available here.

Quantum Information Services Private Limited Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021

Corp. Office: 103, Regent Chambers, Nariman Point, Mumbai 400 021.

Email: info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222 Mob.:8422907179 Mob.:8422907179 Mob.:8422907179 CIN: U65990MH1989PTC054667

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013