This does not constitute investment advice. Returns mentioned herein are in no way a guarantee or promise of future returns. Mutual Fund investments are subject to market risks

Are You A Long Term Investor, Who Likes To Take Calculated Risks To Build Wealth Faster Than Others?

:: Agenda 2025 ::

Build Solid Wealth

Using This Less Known Time-Tested Strategy

Read On If You Are Interested In Discovering A Less Known Strategy

That May Help 2025 Be A Great Year For You...

Dear Reader,

In the next few minutes, you will find out something that could change your investment approach... Forever!

Yes, we are sharing with you a proven strategy that can help you increase your wealth over the next few years...

By that, we don't mean the same old meagre fixed deposit returns!

So the question is...How much?

Higher

A lot higher...What if we say, in double digits!

Our research says the next few years are going to be super interesting.

Which would make it an ideal time to build some wealth.

Want to send your child abroad for studies?

Want to retire wealthy and in peace?

Want to finally head to that foreign vacation?

Want to maximize your average return on your total investments?

Yes? Great, read on...

This investment strategy will not only help you achieve your financial goals and objectives, but also...

Beat inflation.

Grow your wealth.

Live your life...financially free and secure.

Sounds good?

But wait!

That's not what this letter is about.

Before we proceed, let's face one of the harshest facts of life.

While high returns may seem attractive, the very act of chasing them all day and night is rather taxing.

Following financial journals every day, listening to financial shows on TV, consulting your financial advisor...it's quite hectic!

And even then, you are almost completely disappointed with the profits you make.

What if we tell you that from this day onwards, you don't have to spend another minute on your investments?

What if we tell you that from this day onwards, you don't have to depend only on "investment advisors"?

What if we tell you that part of your life is over...

...The part where you were probably forced to act on bad advice, day in and day out.

...The part where you took investment decisions you did not completely believe in, but yet went along because you did not have a choice.

...The part where all that your investment portfolio did was probably disappoint you.

The Smarter Way To Making Higher Gains...

You see, today, we want to reveal to you a time-tested strategy to get what you always looked for...

But before that let us tell you something...

What we are about to tell you does NOT involve any of the following...

...NO staying glued to the TV or bending over business newspapers trying to comb for individual stocks all the time.

...NO losing your sleep worrying about how your portfolio is doing every minute of your life.

...NO trying to beat the market in vain to lose significant sums of money every time.

...NO spending a fancy sum of money year after year only on investment advisory services that do not meet your expectations!

Imagine if you could grow your investments on autopilot, and still relax in your easy chair and enjoy your life, with your friends, family and relatives.

Finally, you are able to take that long foreign vacation you always sought for...

Finally, you can send your daughter to the foreign institution for her higher studies.

Finally, you can pay-off your loan and call your house your 'home'.

Finally, you can sit back and relax, and cherish the world around you.

Finally, life seems so interesting and meaningful.

...Because finally, you have the free time and money to live life well!

A Well Kept Secret Of Smart Investors

Have you ever wondered why is that you are not making enough of your investments, while some others just rake in the returns?

What is it that they do differently?

Of what is that you are doing wrong?

Well, the secret lies in building the most efficient and ultimate portfolio based on...

"Strategic Portfolio Theory"

In fact, it is very likely that many successful investors you know, use this strategy to build wealth consistently and effortlessly over time.

This clever strategy has been around for a long time...but known only to the successful investors.

And not everyone is comfortable sharing their investment secrets.

Fortunately, you will discover it today, changing your investing outlook forever.

What Is This Special Strategy?

To start with...

No, you do NOT invest in a variety of stocks.

No, you do NOT invest in any one mutual fund.

No, you do NOT hedge risk with derivatives even.

You invest in the specific lot of equity mutual funds with the right investment styles in the right allocation...

To start with, here are a few rules that you might follow while creating your Strategic Portfolio:

The portfolio should be built with a time horizon of at least 5 years

It should be diversified across investment style and fund management

Each fund should be true to its investment style and mandate

They should be managed by experienced and competent fund managers and belong to fund houses that have well defined investment systems and processes in place

They should be amongst top scorers in their respective categories

Each fund should have seen at least 3 market cycles of outperformance

The portfolio should contain right number of schemes in the right proportion. In short it should carry the most optimum allocation to each scheme and investment style

No exceeding the limit of seven mutual funds in your portfolio.

No two schemes will be managed by the same fund manager

Not more than two schemes from the same fund house will be included in the portfolio.

That should be a good start for you.

Once you are done with this, now comes the MOST IMPORTANT part of this whole unique strategy of investing.

We call this “Core + Satellite” Strategy of Investing.

What’s so unique about this?

Good question.

If we were to explain it in layman’s term, we would say that this strategy aims to get the best of both worlds, that is, short-term high-rewarding opportunities and long-term steady-return investing, and the good thing is, it works!

The term “core” applies to the more stable, long-term holdings of the portfolio while the term “satellite” applies to the strategic portion that would help push up the overall returns of the portfolio, across market conditions.

Our research states that 60 percent of the portfolio is reserved for Core mutual funds and the rest 40 percent is invested in the Satellite mutual funds.

What’s more? The investment is done not across variant themes but...

...On differentiated investment styles with greater focus on optimum portfolio allocation.

You see, this investment strategy is applied only by a handful of successful investors, and no doubt, it is going to be rather difficult to deploy.

Whew! Being an average investor, will you be able to create such a portfolio?

But then again, will you be able to pick out the right funds by yourself?

Will you be able to put in hours after hours into analyzing the vast universe of mutual funds and beat the money managers in their game?

Will you be able to work 9-to-5 daily and still have the energy to sit down with thousands of studies and journals every night?

Will you be able to put up with this daily for the next 5-6 years?

Tough it will be.

What To Do... Confused?

Don't worry. We understand you.

We understand that it is not possible for an average investor to put this concept to work, just by himself.

Although you might want higher returns from your investments, you need to have time for yourself and your family too.

We believe that while building wealth is important, sacrificing life is definitely not the way!

And thus, to make your job a lot easier, we have brought to you what you may want the most.

Because we have created a readymade portfolio for you...for 2025.

...A robust mutual fund investment strategy, to build wealth consistently over long term.

We proudly present to you our Premium Report, exclusively for all those investors who want to invest in an easy and time-saving way...

Exclusive Report Especially

For

Our "High Reward, Moderate Risk" Investors

"The Strategic Funds Portfolio For 2025"

Based on the concept of "Strategic Portfolio Theory", this premium report will help you build your optimum mutual funds portfolio for 2025 WITHOUT any effort on your part.

In this exclusive report, you will get to know the top time-tested equity mutual funds that have shown the ability to build wealth over a long period.

Our research team, with their years of experience and extensive knowledge about mutual funds, have gone to great lengths to find out potentially the best and consistent performers across market conditions.

And they have discovered the top few gems in the mutual fund market that have the potential to...

Show superior consistency in performance over a long period.

Show stability and reliability across various market cycles.

Strike a better risk-return trade-off over time.

Are managed by process-driven mutual fund houses.

Rank highest in terms of active portfolio quality.

And much more.

All you have to do is consider investing your money in the funds recommended in the strategic portfolio, in the suggested allocation and you may reap benefits like you have never done before!

"I am obliged to PFN for educating me in management of personal finance. I have designed my MF portfolio taking guidance from PFN. I appreciate prompt responsiveness of PFN team to subscriber queries, and their approach to take onboard subscriber requests and feedback. In particular, I liked research reports for a couple of funds which clearly guide investors not to invest in spite of high returns, due to underlying risk and doubtful sustainability of returns in the long term. This differentiates PFN from other MF research services."

~ Rasesh Choksi

(FundSelect and FundSelect Plus subscriber since Oct 2012)

The Uniqueness Of This Portfolio Lies In Its Absolute Simplicity

Following the “Strategic Portfolio Theory”, we have chosen just a handful of diversified equity mutual funds out of over five hundred floating in the market, for you to consider investing in for superior long term gains.

Fund #1:

A large-cap equity fund that has outperformed the benchmark by a substantial margin over longer time periods in the past, while keeping volatility in check. The blend style strategy followed by the fund allows investors to benefit from a mix of stability and growth. The fund scores high on risk-adjusted returns and has managed to deliver superior returns at a much lower volatility compared to the benchmark. This makes it an ideal fund to form your core portfolio, keeping an investment horizon of 5 years and more.

Fund #2:

A large-cap biased multi-cap fund that has shown exceptional performance and has established itself as one of the top contenders in its category. It has proven its ability to curb the downside risk and reward investors even in extreme conditions. The fund has not only kept risk under control, but has also managed to deliver benchmark-beating returns over longer time frames. It has rewarded investors with superior risk-adjusted returns and is an ideal fund to provide stability with growth to your portfolio.

Fund #3:

A multi-cap fund that gives high preference to value style of investing has rewarded investors substantially in the last few years. The fund seeks undervalued stocks across market caps without comprising on quality. Its strategy of diversification across geographies and sectorial allocation along with stable fund management makes the fund a dependable proposition for a core holding in one's long-term portfolio. The fund has delivered superior risk adjusted returns and follows effective portfolio strategies that should benefit investors having an investment horizon spanning five years or more.

Fund #4:

An actively managed fund that follows against-the-tide kind of investing style and takes contrarian bets to invest in sectors and stocks that are temporarily out of favour. Following a sub-version of value investing strategy, it constantly looks for stocks available at significant discount and cheap valuations. Backed by stringent processes and systems, the fund has delighted its investors with superior risk adjusted returns. Its ability to consistently generate returns supported by effective portfolio management and sound risk management strategies, makes it an ideal bet for a core portfolio of investors having longer time horizon and high-risk appetite.

Fund #5:

An aggressive hybrid style fund that follows asset allocation strategy to generate capital appreciation through equities, while adds some element of stability through significant allocation to debt. This fund has made a mark in a short span of time, outperforming most of the prominent category peers. In terms of performance, the fund has constantly appeared in the list of top quartile performers in the category and has been far ahead of its popular peers in the erstwhile balanced funds category that have struggled to beat the benchmark.

Fund #6:

A dark horse in the midcap funds category, that has a track record of over a decade. The fund shot in to the limelight only few years back and has dominated the midcap space on multiple occasions in the last five years. It has not disappointed investors over the recent market cycles and scores well in terms of managing risk too. Its active investment style makes it an ideal contender for the satellite portion of the portfolio. This being a mid cap fund involves higher risk, which may prove beneficial for the portfolio in the form of superior long term gains.

Fund #7:

A well-managed midcap fund that has not only outperformed its benchmark, but has also outpaced its category peers by a distinct margin. The fund uses sound risk management processes to deal with volatility. This has enabled the fund to outperform even in depressing conditions and reward investors with superior risk-adjusted returns. The funds strategy of focusing on quality stocks with a long term view helps it lower the risk, and enables it outperform the peers focusing on momentum stocks.

You could consider investing your money in these 7 funds and just forget about it for next few years...or to be specific, till 2025.

And after 2025, your portfolio could potentially return you in the double or even TRIPLE digits!

Of course, there is a chance that this might not happen... But then to make this kind of returns, you need to take that extra bit of risk.

Agree?

You may reap BIGGER gains at a relatively lower risk, than in plain old stock or bond investments.

Not to mention the fact that you do NOT have to put in any effort on your part.

No spending countless hours of time following stock movements on TV.

No reading thousands of research reports to know which funds to Buy every passing year.

No anxious checking of performance every now and then.

The simplicity of this theory is what makes it unique and useful.

"With their unbiased research and personalized financial planning, PersonalFN helped me overcome the fear of investing into mutual funds. I think I have become an informed investor, thanks to the easy-to-understand literature and research articles that PersonalFN publishes and their friendly staff who never pressurize a customer into anything."

~ Srinivasa Rao, Bengaluru

It's More About Philosophy Than Mathematics

The thing to understand here is that it is not just about calculating and evaluating the returns of a bunch of mutual funds.

It is more about which investment style is going to perform well and which is expected to fail in the long term.

It is more about reading between the lines than reading the numbers.

Ultimately, the success of a proper investment strategy rests on the selection of those well managed funds that have the potential to identify rewarding opportunities...

...and needless to say, it requires a lot of research and qualitative study.

If you select the wrong funds, the whole theory crumbles and your investment go down the drain.

However, it is worthy to be noted that if you select the right combination of funds, you may sit on gains much bigger than you can imagine.

And that we did...for you.

These 7 mutual funds have passed the stringent and exclusive parametric process, where we test each scheme on both quantitative as well as qualitative parameters:

Under quantitative parameters, we evaluate the fund’s performance over different time periods and market cycles apart from measuring volatility to judge the underlying risk; while the qualitative parameters are used to evaluate the performance of the fund management and their investment style vis-a-vis the mandate.

Our recommended schemes not only stand out on the basis of consistent past performance (as per the quantitative parameters) but also come with superior investment return potential in the future (as per the qualitative parameters).

In other words, these 7 mutual funds have already proven themselves, both qualitatively and quantitatively.

As an investor, this might be THE portfolio that you were looking for. In terms of returns, it might be potentially the BEST you can hope for.

How much?

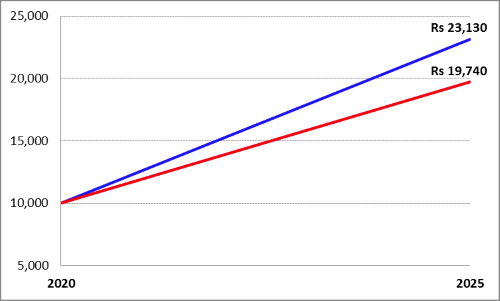

Look at the graph below.

Assume if you invest Rs 10,000 today in a portfolio of these SEVEN chosen funds, it becomes around Rs 23,130 in 6 years’ time, at a growth of over 130% (that is, an annual return of just 15%).

Even if we are to be a little conservative and consider an annualized return of 12%, which is very much possible given the present-day circumstances, it still returns around Rs 19,740 - a six-year return of around 100%! Not bad, right?

(Note: The figures in the graph are for illustration purpose only)

"I was reviewing my portfolio today. I am happy to note that all my investments have outperformed market both in down as well as up market condition. The recommendations of PersonalFN are unbiased and generally have a long term views suitable for common investor like me.

"When I look back, the timely advise and assurances of PFN, quite contrary to experts on TV during the last years downturn not only saved me from huge loss, it helped to maximize my return in the cycle. I once again thank you all in PersonalFN for educating common investors and unbiased advice."

~ Anup Kumar Guru, Mumbai

Enough talking now.

Let’s just say that once you get this exclusive report in your hand, there is absolutely...

No need to waste hours listening to blathering talk-heads on TV.

No need to subscribe to costly business journals every day in vain.

No need to sacrifice your present to gain in future.

All you have to do is click the link below and the secret to achieve potential higher gains for the next 5-6 years will be opened to you!

Give Me Instant Access to

This Exclusive Report Right Now.

Since we want this exclusive report to be accessible to as many investors out there as possible, we have presented it as a one-time offer to you!

Instead of the normal price of Rs 2,000 that we charge for this type of once-in-a-lifetime valuable opportunity, we will charge you just Rs 950.

That's a whopping discount of over 50%!

For a nominal price of Rs 950, you will get access to a readymade portfolio that has the potential to fetch higher returns without any heavy effort on your part whatsoever.

Considering the fact that you might potentially reap returns in the double or triple digits, this is just a nominal cost, frankly speaking.

So, what are you waiting for?

Beat the market.

Multiply your wealth like you never did before.

Get one step closer to becoming truly financially secure and free today.

I Want Instant Access To The Report Right

As we already told you, this letter may change your life.

Don't hesitate now.

This opportunity is available only for a limited time period. After that the price will revert to Rs 2,000.

Remember, this report will help you create your ultimate "portfolio of portfolios" for 2025.

It's a readymade solution for your goal of wealth creation.

Don't miss this awesome opportunity!

Be ready for an exciting financial journey this year onward.

Take action NOW and prepare for a better tomorrow.

Get Our Premium Report "The Strategic Funds Portfolio For 2025" Now. Click Here!

To Your Wealth,

Team PersonalFN

P.S. Don't miss this awesome opportunity. Get your hands on our all-new report on our recommended mutual fund investment strategy for 2025. Remember, this is a limited period offer and may vanish soon!

P. P. S. This report is strictly meant for “high reward, moderate risk” investors who want to gain consistent returns on their investments and willing to stay invested at least for the next 5-6 years.

*Price inclusive of applicable Goods and Services tax

** The performance data quoted above represents past performance and does not guarantee future results.

© Quantum Information Services Pvt. Ltd. All rights reserved.

Any act of copying, reproducing or distributing this newsletter whether wholly or in part, for any purpose without the permission of PersonalFN is strictly prohibited and shall be deemed to be copyright infringement.

Disclaimer: Quantum Information Services Pvt. Ltd. All rights reserved. Any act of copying, reproducing or distributing this newsletter whether wholly or in part, for any purpose without the permission of PersonalFN is strictly prohibited and shall be deemed to be copyright infringement

Quantum Information Services Pvt. Limited (PersonalFN) is an independent Mutual Fund research house and SEBI Registered Investment Adviser (Registration No. INA000000680). All content and information is provided on an 'As Is' basis by PersonalFN. Information herein is believed to be reliable but PersonalFN does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. The Services rendered by PersonalFN are on a best effort basis. PersonalFN does not assure or guarantee the User any minimum or fixed returns. The Services are designed and provided based on the information and documentation furnished on this website/to the Personalfn by the User. The recommendations/advice made by PersonalFN are subject to several risks & other external factors not in the control of PersonalFN such as financial markets, macro and microeconomic factors, and other factors that can cause an adjustment in the User’s own financial situation and the progress of the User’s plan. The results may be based on certain assumptions. PersonalFN and its employees, personnel, directors will not be responsible for any direct / indirect loss or liability incurred by the user as a consequence of him or any other person on his behalf taking any investment decisions based on the contents and information provided herein. Use of this information is at the User's own risk. This is not directed for access or use by anyone in a country, especially USA, Canada or the European countries, where such use or access is unlawful or which may subject PersonalFN or its affiliates to any registration or licensing requirement. The User must make his own investment decisions based on his specific investment objective and financial position and using such independent advisors as s/he believes necessary. Past performance is no guarantee of any future results. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Quantum Information Services Private Limited (PersonalFN) may hold shares in the company/ies discussed herein. As a condition to accessing PersonalFN’s content and website, User agrees to our Terms and Conditions of Use and Privacy Policy, available here.

Quantum Information Services Private Limited Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021

Corp. Office: 103, Regent Chambers, Nariman Point, Mumbai 400 021.

Email: info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222 Mob.:8422907179 Mob.:8422907179 Mob.:8422907179 CIN: U65990MH1989PTC054667

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013

*Price inclusive of applicable Goods and Services tax

** The performance data quoted above represents past performance and does not guarantee future results.

© Quantum Information Services Pvt. Ltd. All rights reserved.

Any act of copying, reproducing or distributing this newsletter whether wholly or in part, for any purpose without the permission of PersonalFN is strictly prohibited and shall be deemed to be copyright infringement.

Disclaimer: Quantum Information Services Pvt. Ltd. All rights reserved. Any act of copying, reproducing or distributing this newsletter whether wholly or in part, for any purpose without the permission of PersonalFN is strictly prohibited and shall be deemed to be copyright infringement

Quantum Information Services Pvt. Limited (PersonalFN) is an independent Mutual Fund research house and SEBI Registered Investment Adviser (Registration No. INA000000680). All content and information is provided on an 'As Is' basis by PersonalFN. Information herein is believed to be reliable but PersonalFN does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. The Services rendered by PersonalFN are on a best effort basis. PersonalFN does not assure or guarantee the User any minimum or fixed returns. The Services are designed and provided based on the information and documentation furnished on this website/to the Personalfn by the User. The recommendations/advice made by PersonalFN are subject to several risks & other external factors not in the control of PersonalFN such as financial markets, macro and microeconomic factors, and other factors that can cause an adjustment in the User’s own financial situation and the progress of the User’s plan. The results may be based on certain assumptions. PersonalFN and its employees, personnel, directors will not be responsible for any direct / indirect loss or liability incurred by the user as a consequence of him or any other person on his behalf taking any investment decisions based on the contents and information provided herein. Use of this information is at the User's own risk. This is not directed for access or use by anyone in a country, especially USA, Canada or the European countries, where such use or access is unlawful or which may subject PersonalFN or its affiliates to any registration or licensing requirement. The User must make his own investment decisions based on his specific investment objective and financial position and using such independent advisors as s/he believes necessary. Past performance is no guarantee of any future results. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Quantum Information Services Private Limited (PersonalFN) may hold shares in the company/ies discussed herein. As a condition to accessing PersonalFN’s content and website, User agrees to our Terms and Conditions of Use and Privacy Policy, available here.

Quantum Information Services Private Limited Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021

Corp. Office: 103, Regent Chambers, Nariman Point, Mumbai 400 021.

Email: info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222 Mob.:8422907179 Mob.:8422907179 Mob.:8422907179 CIN: U65990MH1989PTC054667

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013