Oops! Transferred Funds to the Wrong UPI Address? Here's What to Do

Ketki Jadhav

Jul 14, 2023 / Reading Time: Approx. 3.5 mins

Listen to Oops! Transferred Funds to the Wrong UPI Address? Here's What to Do

00:00

00:00

Last week, when I covered an article on what to do if you mistakenly transfer the funds to the wrong bank account, I received numerous queries regarding a similar situation involving the wrong UPI address. It became evident that this is a common predicament faced by many individuals. So, I have decided to address this issue by providing guidance through this article on what to do if you mistakenly transfer the funds to the wrong UPI address.

In the digital era, electronic payment systems have become an integral part of our daily lives, offering convenience and speed when it comes to transferring funds. One popular method used by millions worldwide is the Unified Payments Interface (UPI), which enables instant money transfers between banks using mobile devices. As per the PwC report - "The Indian Payments Handbook - 2022-27", UPI has contributed about 75% of the total retail segment transaction volume during FY 2022-23. Moreover, the contribution of UPI in the retail segment is expected to reach 90% in the next five years.

However, as with any technology, mistakes can happen, and one such common mishap is mistakenly transferring funds to the wrong UPI address. So, what should you do if you mistakenly transfer the funds to the wrong UPI address?

Try to Contact the Beneficiary:

The first and easiest step you can take in the event of mistakenly transferring the funds to the wrong UPI address is promptly reaching out to the beneficiary/ receiver. In the transaction details, you can find the contact information such as the phone number or UPI address of the recipient. By making contact, you can politely explain the situation and request a refund for the amount mistakenly transferred. Using the available communication channels ensures direct engagement with the involved party and increases the likelihood of a favourable resolution.

Image source: www.freepik.com

Image source: www.freepik.com

Join Now: PersonalFN is now on Telegram. Join FREE Today to get 'Daily Wealth Letter' and Exclusive Updates on Mutual Funds

What Does RBI Say?

Initiate a Complaint with the UPI Platform:

According to the guidelines set forth by the Reserve Bank of India (RBI), individuals who encounter such situations are advised to initiate a formal complaint with the payment system they utilised. Therefore, if someone has used popular UPI platforms like Google Pay, PhonePe, BHIM, Paytm, or Freecharge and mistakenly transferred funds to an unintended recipient, their first action should be notifying the customer service departments of the respective applications, such as Google Pay and PhonePe. They should promptly report the incident, provide relevant details, and request a refund for the wrong transaction.

File a Complaint on the NPCI Portal:

If you find the customer service provided by the UPI platform unsatisfactory, you have an option available for filing a complaint through the official website of the National Payments Corporation of India (NPCI) portal. Here's how you can proceed:

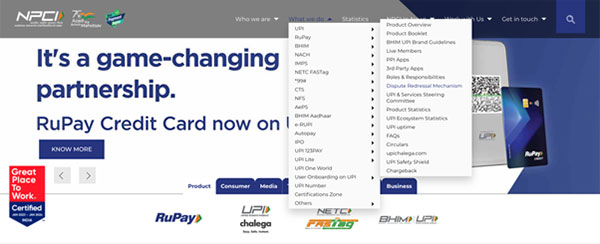

1. Visit the official website of NPCI at npci.org.in.

2. Navigate to the "What we do" section and select "UPI."

3. Choose the "Dispute Redressal Mechanism" option.

4. In the complaint section, complete the required fields, including transaction details (such as the type of transaction and selecting "Incorrectly transferred to another account" as the issue), UPI transaction ID, bank name, virtual payment address, transaction amount, date of transaction, email ID, and mobile number.

5. Upload the bank statement that shows the deduction of the amount from your account for the transaction.

6. Submit the complaint by following the instructions provided.

Here's a screenshot that shows where to find the "Dispute Redressal Mechanism" option:

By following these steps, you can file a formal complaint through the NPCI portal, ensuring that your concerns regarding the wrongly transferred funds are addressed appropriately.

What Are the Alternative Options?

To rectify a wrong transaction, you can contact your bank and furnish them with the relevant transaction details. This includes information such as the transaction ID, phone number or UPI ID of the unintended receiver, date and time of the transaction, the amount transferred, etc.

If the unintended receiver holds an account with the same bank as yours, your bank can take the initiative to communicate with them on your behalf and seek their consent for reversing the transaction. However, if the unintended receiver holds an account with a different bank, your bank can only provide you with the receiver's bank branch details. In such cases, it is advisable to approach the receiver's bank directly and request their assistance in facilitating the transaction reversal.

Reversal of the funds can only take place if the receiver gives his/ her consent. If the receiver agrees, the money will be transferred back to your account within a period of 7 days.

However, if the receiver does not respond to your request or the bank is unable to recover the amount, it is advisable to file a complaint on the NPCI portal (https://npci.org.in/) for further assistance.

What if You Are Not Satisfied with the Solution?

Approach the Ombudsman for Digital Transactions:

As per the guidelines of the Reserve Bank of India (RBI), the Ombudsman for Digital Transactions is a designated senior official responsible for addressing customer complaints against System Participants, as outlined in the Scheme for deficiencies in certain services covered under the specified grounds of complaint mentioned in Clause 8 of the Scheme.

If the complaint remains unresolved after following the aforementioned processes, you have the option to approach the Banking Ombudsman and/or the Ombudsman for Digital Transactions. The Reserve Bank of India (RBI) stipulates that you can file a complaint with the Ombudsman by writing on plain paper and sending it through post, fax, or hand delivery to the relevant office of the Ombudsman. Alternatively, you can also submit a complaint via email to the Ombudsman for Digital Transactions. The complaint form is available on the RBI website, however, it is not mandatory to use the same and you can submit the complaint in any format, provided all the required details are mentioned.

To conclude:

If you find yourself in the situation of mistakenly transferring funds to the wrong UPI address, it is important to act swiftly and responsibly. Begin by contacting the beneficiary/ receiver and UPI platform, requesting a refund, and providing the necessary transaction details. If unsatisfied with the customer service response, you can escalate the matter by filing a complaint through the official channels, such as the NPCI portal or the Ombudsman for Digital Transactions. Remember to provide accurate information and supporting documents, as this will increase the chances of a successful resolution. By following these steps, you can navigate the process effectively and work towards rectifying the error and retrieving the wrongly transferred funds.

KETKI JADHAV is a Content Writer at PersonalFN since August 2021. She is an MBA (Finance) and has over seven years of experience in Retail Banking. Ketki specialises in covering articles around banking, insurance, personal finance, and mutual funds and has been doing it for over three years now.

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing.

Disclaimer: This article is for information purposes only and is not meant to influence your investment decisions. It should not be treated as a mutual fund recommendation or advice to make an investment decision.