What is PPF?

Public Provident Fund (PPF) is a scheme of the Central Government, framed under the PPF Act of 1968. Briefly, PPF is a Government backed, long-term small savings scheme which was initially started by the Government in order to provide retirement security to self-employed individuals and workers in the unorganized sector. Today, PPF is every Indian citizens’ darling investment avenue.

So, if you are keen on a safe corpus, earning a decent tax-free rate of return, enjoying tax benefit; then PPF is for you. The contributions (i.e. investments) made to the PPF account, will earn a tax-free interest and the maturity proceeds are exempt from income-tax. But while you invest, have a long-term investment horizon; it can help you in retirement planning.

Keep in mind, you need to be disciplined to make the most of the PPF investments, and also meet your liquidity needs elsewhere; because under this investment avenue your money is blocked for good 15 years.

PPF offers loans against the account which can also help you during occasions such as a wedding in the family, further studies of your children, etc. if need be. Above all, it gives you a peace of mind as your money is safe.

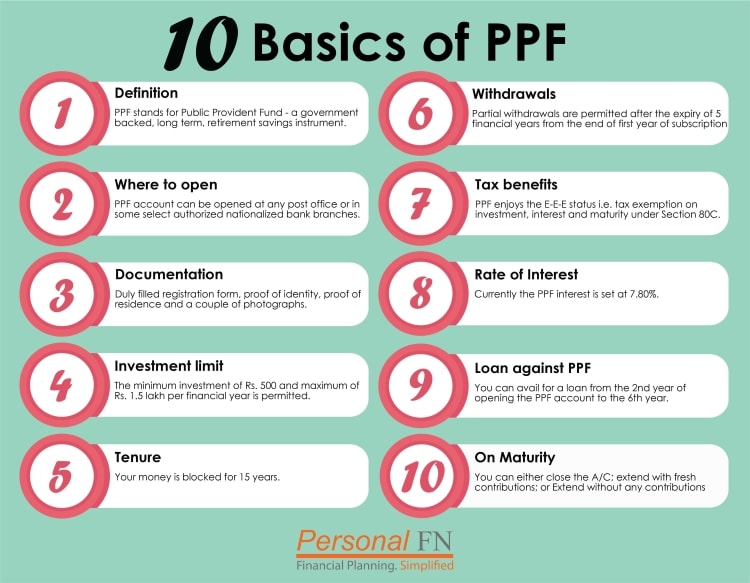

10 Basics of a PPF account

The main features of the PPF account scheme are:

| Eligibility |

Applicant needs to be a Resident Indian |

| Who cannot invest |

Hindu Undivided Family (HUF’s);

Non-resident Indians (NRIs); and

Person of Foreign Origin |

| Entry Age |

No age is specified (Minor is allowed through guardian) |

| Can be opened at |

Any Post Office and some authorized branches of Banks |

| Mode of Payment |

Cash / Crossed Cheque / Demand Draft / Pay Order / Online Transfer in favour of the Accounts Officer |

| Nomination |

Nomination facility is available |

*The current PPF interest rate is 7.80% p.a. as on October 1, 2017 which is subject to change.

Note: The PPF interest rate is benchmarked against the 10-year G-Sec yield and is usually 0.25% higher than the average yield on G-Secs. The current PPF interest rate as on October 1, 2017 is set at 7.80%.

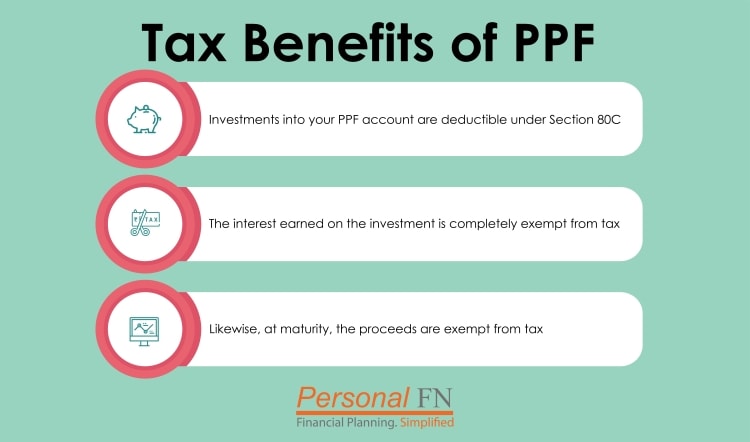

Tax Benefits of PPF Account

- To reiterate, investments into your PPF account are deductible under Section 80C of the Income Tax Act, 1961 subject to the maximum permissible limit of Rs 1,50,000 in the financial year.

- Moreover, the interest earned on the investment is completely exempt from tax. So, that’s a return of 7.80% p.a. tax-free.

- Likewise, at maturity, the proceeds are exempt from tax.

PPF Calculator

PPF calculator is an online tool which you can use to calculate returns on the investments made in the PPF Account. This tool will facilitate you to make smart investment and tax saving plan. It will calculate returns for your investments in a split of second. All you need to provide is few details such as investment amount, number of instalments made and son on. This PPF calculator calculates not only the interest on your investment but also the permissible withdrawal limit and possible loan against your PPF account. We will discuss about some facilities of PPF Account in later part of the write up.

Since the money you deposit in a PPF account is blocked for 15 years with partial withdrawal facility under some conditions, it is advisable to have an estimate on how your fund grows. In this PPF calculator you have two options, you can either chose to make fixed investments or variable investments over the tenure of 15 years. You can use any of these options as per your financial plan and understand the returns you would earn on the two options.

In Fixed Investment Option it is assumed that you will a deposit fixed sum in the PPF account every year till the maturity (15 years).

Here we require you to answer just two questions such as:

- In which year did you open your PPF account?

- What was your investment amount (in Rs)?

On the other hand, Variable Investment Option enables you to calculate maturity amount of your PPF account deposits even when your investment amount is not constant. For example, in 2016 you deposited Rs 1 lakh and 2017 you deposit say Rs 50,000 and in 2018 you invest Rs 1,50,000 so on. Hence it will calculate the return on the variable investments our PPF calculator will generate result for you.

Benefits of PPF Calculator

Not only is this calculator easy to use and understand but also

- Calculates interest on both fixed and variable investment

- Calculates permissible withdrawal limit during the tenure of 15 years

- Calculates possible loan amount you can opt for against your PPF account

More About PPF Account

Historic interest rates on PPF

The Public Provident Fund interest rate has steadily dropped over the years…

| Period |

Interest Rate p.a. |

| 01 Apr 1986 – 14 Jan 2000 |

12% |

| 15 Jan 2000 – 28 Feb 2001 |

11% |

| 01 Mar 2001 – 28 Feb 2002 |

9.50% |

| 01 Mar 2002 – 28 Feb 2003 |

9.00% |

| 01 Mar 2003 – 30 Nov 2011 |

8.00% |

| 01 Dec 2011 – 31 Mar 2012 |

8.60% |

| 01 Apr 2012 – 31 Mar 2013 |

8.80% |

| 01 Apr 2013 – 31 Mar 2016 |

8.70% |

| 01 Apr 2016 – 30 Sep 2016 |

8.10% |

| 01 Oct 2016 – 31 Mar 2017 |

8.00% |

| 01 Apr 2017 – 30 Jun 2017 |

7.90% |

| 01 Jul 2017 – 30 Sep 2017 |

7.80% |

PPF interest rate calculation

Interest is calculated for the calendar month on the lowest balance at credit of your PPF account, between the close of the 5th day and the end of the month, and is credited at the end of every year. Thus, the best time to invest is between the 1st and the 5th of any month, preferably April each year.

Tenure of PPF Account

Since PPF account scheme is targeted as a retirement savings product, the money is blocked for 15 years. With a 15-year lock in, this is the longest horizon for an investment that exists in India.

However, a PPF account does offer a partial withdrawal facility and a loan against the corpus. This can help you during occasions like a wedding in the family, further studies of your children, etc.

Where to open a PPF account

You can open a PPF account at any Post Office and some authorized branches of nationalised and private banks.

Documents required for opening a PPF account

All you got to do is:

- Application Form

- Couple of passport size photographs

- Proof of identity

- Proof of address

PPF Withdrawal

Any time after the expiry of the 5th year from the date that the initial subscription is made, you become eligible to withdraw an amount of not more than 50% of the previous year’s balance or of the 4th year immediately preceding the year of withdrawal, whichever is less. If you have taken any loan on your PPF, this also gets factored in and reduces your balance. You cannot make more than a single withdrawal in the year. You need to apply with Form C for any withdrawals.

The amount of withdrawal will be limited to 50% of the balance at credit at the end of the fourth year immediately preceding the year in which the amount is to be withdrawn, or the balance at the end of the preceding year, whichever is lower, as per the PPF rulebook.

Thereafter, you can make one withdrawal per year. The withdrawal amounts are not repayable. So, for example, if you opened your PPF account on April 1, 2014, you can make your first withdrawal after April 1, 2020, and the amount of withdrawal will be limited to 50% of the balance as on - March 31, 2016, or the balance as on - March 31, 2019, whichever is lower; subject to loan taken on your PPF account.

It is important to note that; if you have taken any loan on your PPF account (which is possible!), this also gets factored in and reduces your balance.

Maturity of PPF account

Once your account matures, you have 3 choices:

- Withdraw the maturity amount

- If you decide to withdraw your money, the maturity value is exempt from tax.

- Extend your account by a block of 5 years with fresh contributions

- If you decide to extend your account and continue making fresh contributions, you can extend it for a block of 5 years at a time, as many times as you want

- You can also make withdrawals from the account, up to 60% of the account balance that was there at the beginning of the extended period. So, your PPF account can act as an important source of inflow during your retirement years.

- Just remember, if you choose to extend your account, submit the necessary documentation i.e. Form H, for extension within one year from the maturity date.

- Extend the account without making any further contributions

- If you choose this option, you would continue to earn PPF interest on the balance public provident fund account.

- You are also permitted to withdraw without any restrictions; however, you can withdraw only once per year. The balance will continue to earn PPF interest until it is withdrawn.

On withdrawal, the PPF proceeds can be used to fund your life goals, such as your retirement, children's higher education or marriage and so on.

Loan against PPF account

Yes, you can take a loan from the fund in case of need. You don’t have to wait till you become eligible for withdrawals from the account.

The PPF rulebook states it as follows:

“Notwithstanding the provisions of paragraph 9, any time after the expiry of one year from the end of the year in which the initial subscription was made but before expiry of five years from the end of the year in which the initial subscription was made, a subscriber may, he so desires, apply in Form D or as near thereto as possible, together with his pass book to the Accounts Office for obtaining loan…”

In simple terms, the following are the steps to see how much loan you can avail.

Say you opened your PPF account in August 2015.The end of the financial year when the initial subscription was made is March 31, 2016.The expiry of one year from the end of that financial year makes it March 31, 2017.

So, from this date onwards, i.e. from March 31, 2017, until ‘before expiry of 5 years from the end of the year in which the initial subscription was made i.e. 5 years from March 31, 2016, that brings us to March 31, 2021, you are entitled to apply for a loan against your PPF balance.

Therefore, to simply put, from the second year of opening the PPF account to the sixth year, as a PPF account holder you can take a loan.

How much loan you can take is defined as follows:

“… A subscriber may, he so desires, apply in Form D or as near thereto as possible, together with his pass book to the Accounts Office for obtaining loan consisting of a sum of whole rupees not exceeding twenty-five per cent of amount that stood to his credit at the ends of the second year immediately preceding the year in which the loan is applied for.”

So, following the example given earlier, you are eligible to apply for a loan from March 31, 2017 to March 31, 2021.

Suppose you apply for a loan in February 2018, the financial year of loan application is FY 2018-19.

The second year preceding this year is 2016-17. Whatever is the balance standing to your credit at the end of this FY 16-17, you can take a loan of up to 25% of that balance, rounded to the nearest whole rupee.

However, the loan has to be repaid with interest at 2% per annum within 36 months, either in lump-sum or in instalments. If the principal is fully repaid, the balance for the interest should be defrayed in two monthly instalments.

In case you fail to repay after 36 months, penalty will be charged at the rate of 6% over your PPF rate. So, with the current PPF interest rate of 7.8%, the loan repayments after a period of 36 months will cost you 13.8% p.a. on your loan amount —which is very close to the rate charged on personal loans.

Further, if you fail to repay your interest entirely in next two months post the end of your loan term then the same will be deducted from your PPF account balance.

You can take a second loan against your PPF account before the end of your sixth financial year, but your second loan can be taken only once your first loan is fully settled.

Please note the PPF money is technically illiquid until the 7th year of your account opening; meaning, you can’t ‘withdraw’. Only starting from your seventh year you’re eligible for partial withdrawals (vide application in Form C) every year. But before that, you can avail for loan against your PPF balance.

But mind you, you should avail such loans only when you are falling short of your finances and do not have any other option to achieve an important life goal such as child’s higher education or daughter’s marriage etc. Such loans should not be availed to improve your life style or to buy a costly gadget. After all, this is the money that you have kept aside for your retirement.

Terms & conditions to be met before applying for a loan against PPF

- You can apply for a loan only once in any particular financial year.

- You will be ineligible for the loan if the minimum mandatory investment/contribution of Rs 500 towards the PPF account was not made in past.

Is a second loan against PPF account possible?

Yes, you can take a second loan against your PPF account before the end of your sixth financial year, but the second loan can be taken only once you’ve fully settled your first loan.

Please note the PPF money is technically illiquid until the 7th year of your account opening; meaning, you can’t ‘withdraw’. Only starting from your seventh year you’re eligible for partial withdrawals (vide

application in Form C) every year. But before that, you can avail for loan against your PPF balance.

Now let us look at some of the commonly asked questions on Provident Fund Account.

Can a NRI open a PPF account

The rule pronounced on July 25, 2003 states that ‘Non-Resident Indians are not eligible to open an account under the PPF Scheme’. But there is a silver lining for some NRIs. If you already had a PPF account, when you were resident in India, and during the 15-year tenure of the PPF account you became an NRI, then you are eligible to continue investing in the account until it matures, but on a non-repatriable basis.

What happens when I invest above Rs 1.5 lakh in a year?

Any amount invested above Rs 1,50,000 will not earn any interest and would not be eligible for deductions u/s 80C of the Income Tax Act, 1961.

Can I make monthly deposits in my PPF account?

Second, you don’t need to invest it all in one shot; you can invest into your PPF the same way you would invest by way of a Systematic Investment Plan (SIP), i.e. by making up to 12 instalments in a year of different amounts, but not more than 12 investments in a year.

What if I forget to deposit money in my PPF account for one year?

Your account is considered de-activated. To re-activate your account, you need to pay a fine of Rs 50 for each year that you have not made any subscription, and also make a minimum subscription of Rs 500 for each year that you have missed. Then your account will be reactivated, and you will re-start earning interest.

The account will only be closed after maturity and will continue to earn interest till it is closed. The facility of loan or withdrawal will not be allowed from such account.

However, the account can be regularized by remitting a penalty of Rs 50 per financial year and this should be credited to the Government of India / Reserve Bank of India.

Can I have more than 1 PPF account?

No, at any point in your life, you are permitted to have only 1 PPF account in your name. If at any time it is seen that you have more than 1 account in your own name, the second account will be deactivated, and only your principal will be returned to you.

Is a minor child have a PPF account?

Yes, you can have an account in the name of a minor child of whom you are the parent / guardian. However, please remember that this will be the child’s account and you will simply be the guardian.

Can I have joint PPF Account?

No, you can never have a joint PPF account.

I have an EPF account can I open a PPF account?

Even if you have a General Provident Fund account or an Employees Provident Fund (EPF) account, you can still have a PPF account – there is no restriction.

Conclusion:

Broadly, the PPF account is a good retirement option, especially for those individuals who do not work in the corporate sector and hence don’t have an EPF account. But even for salaried individuals from a tax perspective. It is a sound avenue, giving you tax deductions on investment as well as tax exemption at the time of maturity. This money is yours for keeping – it cannot be attached by the order of a court to any debt or liability you may have.

However, it is important to note that from a liquidity point of view, your funds are locked in for 15 years, and withdrawals are limited. Given that it is such a long-term investment (16 years from beginning to end); the rate of return might be considered low by some for this tenure. But keep in mind, this is guaranteed, backed by the Government and cannot be attached to any debt.

To conclude, when choosing your tax saving avenue, be sure to choose according to your risk appetite. If you are a conservative to moderate investor, the PPF is a very good investment avenue. Even if you are an aggressive investor, the PPF can be a safe hedge against your riskier investments. Keep your liquidity needs, life goals, time horizon and risk appetite in mind while investing.

To know more how PPF serves as one of the Tax Planning Option for Conservative Investors- click here.