The habit of regular investing can be considered one of the best habits to attain financial freedom. Accordingly, Systematic Investment Plan or SIP is an ideal investment method to help you accumulate wealth and stay invested towards your future goals.

Now, a question many investors would have here is - How to calculate returns on SIP investments? Well, the answer to this is an online SIP Calculator. The SIP calculator allows you to calculate the amount you will accumulate over time on your monthly investments.

Do you want to calculate the future value of your mutual fund SIP?

Use PersonalFN's mutual fund SIP calculator. All you need to do is enter a few details such as the monthly SIP amount, the SIP tenure, and the compounded rate of return you expect from the mutual fund scheme in which you would be investing. The calculator is simple to use and you can calculate the expected value of your SIP investments, in an instant.

What is a SIP Calculator?

The SIP calculator is an advanced online tool which enables investors to make an informed investment decision. With the SIP calculator, you can easily calculate the approx. value or the maturity value of the investments you have made over the period of time. Using this calculator, you can plan your important life and financial goals such as buying a dream car, financing a wedding, living a blissful retired life, etc. and that too by just entering a few details such as:

-

Your SIP amount

-

Number of SIP payments (in months)

-

Number of Instalments made till date

-

Annual expected rate of return

The SIP calculator is the most convenient and user-friendly tool to know the future value of your investments. It will help generate the maturity amount of your investments within a split of seconds automatically with one click. Gone are the days when distributors/ relationship managers/ agents could fool their clients by complicating the return calculations and promising unrealistic returns. The Systematic Investment Plan calculator empowers investors in their financial planning in a smart way and helps them win the race for financial freedom

How does the mutual fund SIP Calculator work?

Below is the formula used for calculating the maturity value of your SIP:

The formula used by SIP Calculator

FV = Future Value

P = SIP amount

i = compounded rate of return

As the returns are compounded for every investment instalment, monthly SIP will be compounded as: i/12. Similarly, daily SIP will be compounded as i/365.

For instance, your SIP amount is Rs 10,000 for a tenure of 12 months. You expect a 10% annual rate of return. Then the future value of your SIP would be calculated as below:

Here, P= 10,000

i = 10% = (10/100)/12 = 1/120

N= 12 months

Therefore, for the total investment of Rs 1,20,000 in a period of 1 year; the amount at the end of the tenure will be Rs 1,26,703.

Ok! hold on, surely this formula looks gibberish. But it is not.

All thanks to technology, you do not have to perform these calculations by yourself. Our SIP Calculator will do the calculation for you.

It is a freely available online tool which you can use for calculating returns on your monthly SIP payments. This SIP Calculator will give you - an investor the freedom to calculate the maturity value of all the payments you plan to make now and in the coming future.

How to use PersonalFN's SIP Calculator?

The Four-Step Process:

Our SIP calculator is simple to use and provides accurate results by answering just 4 questions.

Step #1 - How much is your SIP amount?

You first need to enter the investment amount which you are willing to commit and invest regularly. Everyone has a varying income structure and risk appetite. Hence, enter any amount you wish to sacrifice say on a monthly or quarterly basis.

Step #2 - For how many months will you continue the SIP?

Next, you need to decide your investment horizon. In other words, enter the number of months you wish to make the SIP payments.

Step #3 - How many months ago did you start the SIP?

If in case, you have an ongoing SIP then you need to enter the number of instalments you have already made. If you have not started, then you may enter 0.

Step #4 - What rate of return do you expect p.a.?

As earning good returns is your prime motive for investing in mutual funds, enter the annual rate of return you aspire to earn from your SIP investments. With our SIP calculator, you can adjust different rates of interest and make your investment decision.

Thus, by entering these few details our calculator generates accurate results. This in turn will enable you to judge the returns for your investments.

What is SIP?

SIP refers to a Systematic Investment Plan, which is a mode of investing in mutual funds in a systematic and regular manner. The method of investing is similar to your investment in a Recurring Deposit (RD) with a bank, where you deposit a fixed sum of money (into your Recurring Deposit account). The only difference here is, your money is deployed in a mutual fund scheme (equity schemes and / or debt schemes) and not in a bank deposit, and hence your investments (in mutual funds) are subject to market risk.

SIPs usually allow you to invest a fixed sum of money on a weekly, monthly, or quarterly basis. A SIP enforces a disciplined approach towards investing and infuses regular saving habits which we all probably learnt during our childhood days when we used to maintain a piggy bank. Yes, those good old days when our parents provided us with some pocket money, which after expenditure we deposited in our piggy banks and at the end of tenure, we saw that every penny saved has together become a big amount.

SIPs too work on the simple principle of investing regularly which enables you to build wealth over the long term. In the case of SIPs, on a specified date, a fixed amount as desired by you is debited from your bank account (either through an ECS mandate or through post-dated cheques forwarded) and invested in the scheme as selected by you for a specified tenure.

Today some Asset Management Companies (AMCs) / mutual fund houses / robo-advisory platforms also provide the ease and convenience of transacting online for SIP investments by following the procedure as made available on the websites. Thus, it avoids hassles while investing as well as tracking your investment dates.

What are the types of SIP?

-

Perpetual SIP - Here investors need not mention a fixed period for SIP investments. You can continue investing in the fund through SIP for as long as you wish, it could be 3 years, 5 years, or 10 years, etc. As and when you accumulate an adequate corpus to reach your financial goals, you can redeem the amount.

-

Flexible SIP - SIP refers to investing a fixed amount regularly. What if you are unable to invest the same amount each month? Here Flexible SIP comes to the rescue. You can alter your monthly investments as per your cashflows. In case of financial distress, you can reduce the SIP amount and amidst high cash flows, you can increase the same. This prevents investors from skipping their monthly SIP.

-

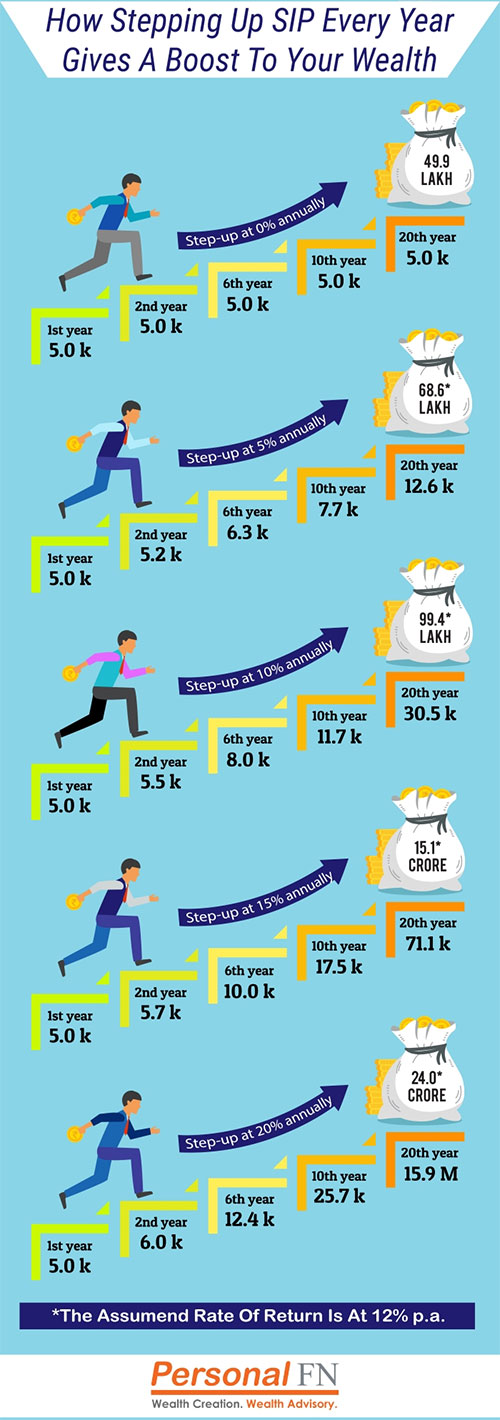

Top-Up SIP - In a Top-Up SIP you can change the amount of SIP instalment by a fixed amount at pre-defined intervals. For instance, if you have been investing Rs 2,000/- in a mutual fund monthly, you can increase it by Rs 1,000 in future through the Top-Up SIP Option.

What are the benefits of SIP?

1. Light on the wallet

SIPs enable you to invest smaller amounts at regular intervals (daily, monthly, or quarterly). This in turn reduces your burden of defraying a lumpsum - at one go - from your bank account. If you cannot invest Rs 5,000 in one shot, that's not a huge stumbling block, you can simply take the SIP route and trigger the mutual fund investment with as low as Rs 250 per month.

2. Makes market timing irrelevant

SIPs can help you manage (even out) the market volatility well. Timing the market can be hazardous to your wealth and health. Instead, focus on 'time in the market' in the endeavour to create wealth by selecting the best mutual fund scheme to invest in. Studies have repeatedly highlighted the ability of equities to outperform other asset classes (debt, gold, even real estate) over the long term (at least 5 years) as also to effectively counter inflation.Now one may ask: If equities are such a great thing, why are so many investors complaining? Well, it's because they either got their stock or the mutual fund wrong or the timing wrong. In our opinion, both these problems can be solved through a SIP in a mutual fund scheme with a steady track record, stay invested for the long term as the SIP route enables you to even out the volatility of the equity markets effectively.

3. Enables rupee-cost averaging

Many a time, a SIP works better as opposed to one-time, lumpsum investing. This is because of the rupee-cost averaging. Under rupee-cost averaging, you would typically buy more of a mutual fund unit when prices are low, and similarly, buy fewer mutual units when prices are high. This infuses good discipline since it forces you to commit cash even at market lows when other investors around you are wary and exiting the market. It also enables you to lower the average cost of your investments.

4. Benefits from the power of compounding

As SIPs subscribe you to the habit of investing regularly, it enables you to compound your money invested. So, say you start a SIP of Rs 1,000, in a mutual fund scheme following a prudent investment system and processes, with a SIP tenure of 20 years and expect a modest return of 15% p.a., your money would grow to approximately Rs 15 lakh.

So, over the long term, SIPs can compound your wealth better and systematically as opposed to investing a lump sum, especially when the journey of wealth creation is volatile.

5. An effective channel for goal planning

All of us have certain financial goals - maybe buying a house, buying a dream car, providing good education to children, getting them (children) married, retiring, etc. But all this comes with the need for proper financial planning. Very often investors invest in the equity markets, with the motive of making quick short-term gains, and often ignore using the equity markets as a window for long-term wealth creation, in order to achieve their financial goals. You can effectively achieve your financial goals by enrolling for SIPs. The earlier you start the better it is.

How to start a SIP?

Well, you have broadly two ways: offline and online.

In case of the former, approach the office a mutual fund house / mutual fund distributor / agent / relationship manager / investment adviser. For prudent handholding, seek services of a Certified Financial Guardian who is a mark of trust and respect. They can help you construct a robust investment portfolio based on your financial goals.

Here's what you need to do to start a SIP offline

-

Select a mutual fund scheme that best suits your needs, investment objectives, financial goals

-

Fill in the Common Application Form / SIP form carefully and completely mentioning the name of the scheme and other details

-

Provide your NACH mandate form mentioning all you SIP details

-

If the KYC is not done, fill in the KYC form and comply with it

-

Hand over the forms (as mentioned above) to the office of mutual fund distributor / agent / relationship manager / investment adviser / Certified Financial Guardian, or you can even directly submit to Registrar and Transfer Agents (RTAs) / AMC.

In case if you choose to SIP online, you can log on to respective mutual fund house's website, or use other transaction platforms viz. MFU, or opt for services of robo-advisory platforms and follow the steps and instructions mentioned.

But when buying into mutual funds, ensure that you are opting for only 'direct plans' owing to the benefit we explained earlier.

If you still have some doubts on SIP mode of investing, read on to debunk the 7 common SIP myths.

7 common SIP myths debunked

Myth#1: Only Small investors go in for SIP

Please note that SIP stands for Systematic Investment Plan (SIP) and not Small Investors Plan. Hence, it is incorrect to be under the illusion and arrogance that SIP, is meant only for small investors.

SIP is for everyone, if you wish to create wealth systematically. Just as a piggy bank and recurring deposit subscribes you to habit of saving regularly with the needed discipline, even SIPs do. And you a better rate of return as against parking money in fixed deposits, recurring deposits and endowment policies offered by insurance companies. By investing your savings in a systematic manner -daily, monthly, quarterly -- for a said tenure (period of SIP) helps you build a corpus earning a rate of return, in order to attain your financial goal.

Myth #2: Rupee cost averaging is possible through investing in stock too - then why SIP?

A SIP experimented on single scrip, can expose you to more volatility unlike SIP in mutual funds which reduces the risk, due to benefit of diversification, professional fund management and liquidity offered by mutual funds.

Moreover, as per the market cap bias (i.e. large cap, mid cap and small cap) which a fund follows, you can also strategically structure your portfolio depending upon your risk appetite. Likewise, you can structure your portfolio on the basis of the style (viz. value, growth, blend, opportunities, flexi-cap, multi-cap etc.) of investing followed by the mutual fund. And by adopting the SIP mode of investing for mutual funds, you'll draw two major benefits: rupee cost averaging and compounding.

Myth #3: SIP mutual funds are different from lump sum mutual funds

Well many have this delusion. The fact is, there are no special schemes for SIP investments. SIPs are just a mode of investing.

Myth #4: Lump sum investments cannot be done in a scheme, where a SIP account exists

SIP as you know by now, is just a mode of investing in mutual funds. Hence, pumping a lump sum amount to a mutual fund where your SIP exists is possible. So, say you have a SIP of Rs 1,000 going on in a mutual fund scheme and suddenly you have a surplus of say Rs 50,000, you can pump a lump sum amount to your on-going Rs 1,000 SIP account.

Myth #5: I'll be penalised if I miss one or two SIP dates

While enrolling for the SIP mode of investing you are required to provide a NACH (National Automated Clearing House) mandate from NPCI (National Payments Corporation of India) form along with the common application form. Your SIP details (as selected) are already mentioned in this mandate apart from the SIP form, thus your bank at regular SIP dates keeps debiting the SIP amount in favour of the fund where you have opted a SIP. The start date and end date is mentioned in these forms. You also furnish has your contact details so that you're update on your transactions. Hence, the question of missing dates usually doesn't arise.

However, for some reason - say, you haven't maintained the balance in your bank account - and a SIP instalment doesn't get debited, you simply miss that instalment, but the folio / account remains active for further SIPs to debit from the bank account. So, it's not like the EMI (Equated Monthly Instalment) of your loan, where you miss an instalment; you are penalised.

Similarly, if you're facing financial crunch, today fund houses also allow you to pause your SIPs for period of 1 to 3 months until normalcy returns. So, a short-term crunch should not be a cause of worry for your SIPs. SIP pause facility is explained at great length in ensuing part of this editorial piece.

Myth #6: Markets are high to start a SIP

Well, if that's what you think, then you should be starting a SIP immediately. That's because as the market corrects you would by accumulating more number of units, with every fall in the NAV, thus enabling you to lower you average purchase cost. And, as the markets, post the correction surge once again, you would gain as the yield will work to be higher.

Myth #7: In a tax saver SIP, entire money can be withdrawn after 3 years

In case of a SIP in tax saving mutual funds (commonly known as Equity linked Saving Schemes - ELSS), very often a delusion exists that, the entire investment in a tax saving mutual fund can be withdrawn once the lock-in period is over. But that's not the case!

The fact is: your every instalment of SIP should have completed the lock-in tenure. So say if you put in Rs 5,000 through SIP in the month of January 2017, the lock-in period for only 1 instalment (i.e. January 2012) will get over on January 2020. While other SIP instalments need to complete 3 years as well.

Go ahead and take SIPs today!