CPI Inflation at 3.65% in August: Will RBI Cut Policy Rates in October Meeting?

Rounaq Neroy

Sep 13, 2024 / Reading Time: Approx. 10 mins

Listen to CPI Inflation at 3.65% in August: Will RBI Cut Policy Rates in October Meeting?

00:00

00:00

India's CPI inflation unexpectedly increased to 3.65% in August 2024 after having fallen to a 5-year low of 3.60% in the previous month.

Correspondingly the CPI inflation rates for the rural and urban regions of India, were 4.16% and 3.14%, respectively (as against 4.10% for urban and 3.60% for rural in the previous month).

The CPI inflation reading for August 2024 is to some extent higher than the Reuters poll of 53 economists who expected it to be 3.50%, slightly below the previous month's final CPI reading of 3.60%.

The main reason for higher CPI inflation was higher food prices, particularly vegetables, fruits, cereals, pulses, milk & milk products, and prepared meals, snacks, sweets, etc. This was due to erratic and heavy rainfall that bore on crop yields.

Note, the food basket currently has a weightage of 54.2% in India's CPI inflation. In other words, food accounts for more than half of the CPI inflation basket.

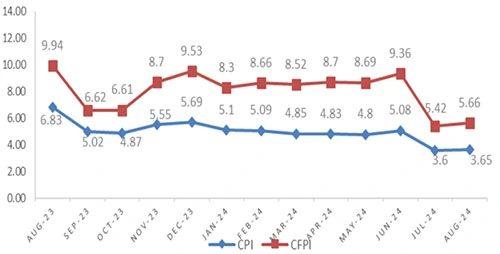

Graph: Inflation Trend Based on All India CPI and CFPI

(Source: MOSPI Press Release, dated September 12, 2024)

(Source: MOSPI Press Release, dated September 12, 2024)

Similarly, inflation in transport & communication, clothing & footwear, recreation & amusement, as well as education also increased. The miscellaneous groups also witnessed a rise in prices.

As regards, fuel & light inflation, the reading for August 2024 was -5.31% versus -3.66% in the previous month.

Core inflation, which excludes food and fuel inflation, seemed benign at 3.50% in August, with it reduced marginally from 3.60% in the previous month.

Now while, there is visible moderation in CPI inflation from the peak and the recent readings are well within the tolerance range of the RBI (medium target of 4.00% with a band of +/- 2%, while supporting growth), the minutes of the last bi-monthly monetary policy held in August 2024 reveals that a majority of the six-member Monetary Policy Committee (MPC) of the RBI concur that durable alignment of inflation to the target of 4.00% is still some distance away.

Given this, the MPC has kept the policy repo rate unchanged at 6.50% since April 2023.

Plus, the MPC has remained focused on the withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth.

Any faltering from this commitment to the durable alignment of inflation could undermine the prospects of the Indian economy, in their view.

Only two external members of the RBI, Dr. Ashima Goyal and Prof. Jayanth R. Varma are of the view -- and voted in this respect -- that the policy repo rate be reduced by 25 basis points (bps) plus the stance be changed to neutral.

Table: Voting on the Resolution to Keep Policy Rep Rate Unchanged and Stance of the Monetary Policy

| Members |

Vote to Keep Policy Repo Rate Unchanged at 6.50% |

Vote to Remain Focused on Withdrawal of Accommodation Stance |

| Dr. Shashanka Bhide |

Yes |

Yes |

| Dr. Ashima Goyal |

No |

No - suggested change to neutral |

| Prof. Jayanth R. Varma |

No |

No - suggested change to neutral |

| Dr. Rajiv Ranjan |

Yes |

Yes |

| Dr. Michael Debabrata Patra |

Yes |

Yes |

| Mr Shaktikanta Das |

Yes |

Yes |

(Source: Minutes of the Monetary Policy Committee Meeting, August 6 to 8, 2024)

The RBI observes that in Q2:2024-25, though favourable base effects are large, the sharper uptick in price momentum relative to earlier expectations is likely to result in a shallower softening of CPI headline inflation.

According to the RBI, CPI inflation is expected to edge up in Q3 as favourable base effects taper off. The central bank views the following as the key risks to the inflation trajectory:

-

Adverse climate events (which remain an upside risk to food inflation)

-

Volatile global crude oil prices (on demand concerns)

-

Geopolitical tensions

-

Pickup in selling prices in the second half of this year manufacturing, services and infrastructure firms (as surveyed by the RBI)

-

The upward revision in the mobile tariff rate, which is likely to lead to an increase in core inflation.

Moreover, the manufacturing, services and infrastructure firms surveyed by the Reserve Bank expect a pickup in selling prices in the second half of this year.

Households' inflation expectations have also gone up and consumer confidence has weakened.

Assuming a normal monsoon, CPI inflation for 2024-25 is projected at 4.50% and 4.10% in 2025-26.

Will RBI Cut Policy Rates in October 2024?

Well, speaking on the fluctuations and dip in CPI inflation, RBI governor, Mr Shaktikanta Das has commented that it's important to stay on course and not get carried away by some dips in inflation.

However, he also expressed that "market expectations of rate cuts are now regaining momentum, especially after indications of a policy pivot from the US Fed, but the adverse spillovers from the 'higher for longer' interest rate scenario remains a contingent risk."

According to Das, the global macroeconomic outlook is judged to be balanced, but it can weigh on the downside in the near term.

He has also mentioned the risk to global financial stability due to stretched valuations, sudden shocks, and stress in the global commercial real estate sector, along with the impact of a stronger U.S. dollar on emerging market economies, the proliferation of non-banking financial institutions, and booming private credit space.

That being said, if the U.S. Federal Reserve (Fed) in its September 17-18 Federal Open Market Committee (FOMC) meeting cuts interest rates say by 25 bps to support growth -- as inflation is approaching the Fed's target of 2.00% -- it could be a pivot for the RBI to consider a rate cut.

Policymakers in the U.S. have signalled that the time has come to reduce the federal fund rate, which has been in the 5.25%-5.50% range since July 2023. It is perceived by many observers that the Fed is already behind the curve in cutting interest rates and advocating changing the stance of the policy to accommodative and not just keeping neutral

Earlier in August 2024, the Bank of England (BOE) cut interest rates for the first time since 2020, joining the European Central Bank (ECB) which had reduced rates in June.

Yesterday, September 12, 2024, the ECB cut rates by another 25 bps (to 3.50% as regards the deposit facility rate) on the concerns of subdued economic activity, weak private consumption, and investments.

The change in the deposit facility rate to 3.50% and on the main refinancing operations and the marginal lending facility to 3.65% and 3.90%, respectively, are effective September 18, 2024, and this is the second time the ECB has cut rates in three months.

In my view, the aforementioned backdrop may build pressure on the RBI also to cut the policy repo rate in its October 7 to 9, 2024 bi-monthly monetary policy meeting. It is possible that in the ensuing monetary policy meeting -- which is just ahead of Dussehra and Diwali -- the RBI could reduce the policy repo rate by around 25 bps. If not a rate cut at least, a change in the stance of the policy to neutral (from accommodative) may be seen.

To me, it appears that we are almost near the peak of the interest rate upcycle currently.

What Should Be Your Strategy to Invest in Debt Mutual Funds and Other Fixed-Income Investment Products Now?

It would be an opportune time to invest in medium-to-long and longer duration debt mutual funds with a view of 3 to 5 years whereby you benefit from higher yield and unlock the capital growth.

However, if you have a shorter investment horizon, consider investing in the shorter maturity debt funds, as they have a minimal mark-to-market impact when interest rates rise.

And say, if you have an investment horizon of up to or less than a year, it would be better to stick to the best Liquid Funds and/or Overnight Funds having no exposure to private issuers.

[Read: 3 Best Liquid Funds for 2024]

Always keep in mind that investing in debt funds, in general, is not risk-free. Hence, avoid investing in debt funds that engage in yield hunting to clock higher returns. Choose the safety of the principal over returns.

For senior citizens/retirees as well as for other risk-averse investors, this is an opportune time to invest money in bank fixed deposits (and other traditional interest-bearing investment avenues) at the current interest rates.

However, you need to be careful if a bank is offering an extraordinarily high interest rate on its term deposits because a very high interest rate also means high risk.

[Read: Why Senior Citizens Should Consider Investing in Bank FDs Now]

To ensure the liquidity of the investments made in FD, following a laddering strategy is meaningful.

Fixed Deposit laddering is a smart investment strategy, wherein you spread your investment in FDs over multiple maturity tenures or maturity buckets.

The FD laddering strategy ensures that you have one fixed deposit maturing at the end of every year. It will free up the capital systematically. It is particularly a useful strategy for retirees or senior citizens.

The maturing FD can either be used to meet liquidity needs and/or be reinvested, depending on your requirement and the prevailing interest rate scenario.

By systematically investing in bank FD following a laddering strategy, you could potentially earn more interest with the safety of your capital.

At the peak of the interest rate upcycle, it makes sense to invest more in medium-to-long maturities than short-term deposits (considering your liquidity requirements).

A sensible approach paves the way for financial success and security. So, be a thoughtful investor.

Happy Investing!

Join Now: PersonalFN is now on Telegram. Join FREE Today to get PersonalFN’s newsletter ‘Daily Wealth Letter’ and Exclusive Updates on Mutual Funds.

-New.png)

ROUNAQ NEROY heads the content activity at PersonalFN and is the Chief Editor of PersonalFN’s newsletter, The Daily Wealth Letter.

As the co-editor of premium services, viz. Investment Ideas Note, the Multi-Asset Corner Report, and the Retire Rich Report; Rounaq brings forth potentially the best investment ideas and opportunities to help investors plan for a happy and blissful financial future.

He has also authored and been the voice of PersonalFN’s e-learning course -- which aims at helping investors become their own financial planners. Besides, he actively contributes to a variety of issues of Money Simplified, PersonalFN’s e-guides in the endeavour and passion to educate investors.

He is a post-graduate in commerce (M. Com), with an MBA in Finance, and a gold medallist in Certificate Programme in Capital Market (from BSE Training Institute in association with JBIMS). Rounaq holds over 18+ years of experience in the financial services industry.

Disclaimer: This article is for information purposes only and is not meant to influence your investment decisions. It should not be treated as a mutual fund recommendation or advice to make an investment decision in the above-mentioned schemes. Use of this information is at the user's own risk. The user must make his own investment decisions based on his specific investment objective and financial position and use such independent advisors as he believes necessary.