How a Centralised Pension Payment System Shall Benefit Pensioners

Rounaq Neroy

Sep 05, 2024 / Reading Time: Approx. 5 mins

Listen to How a Centralised Pension Payment System Shall Benefit Pensioners

00:00

00:00

For pensioners or retirees, here's good news. The Modi 3.0 government has approved the Centralised Pension Payments System (CPPS) for Pension under the Employee Pension Scheme, 1995.

What Is a Centralised Pension Payment System?

It is a facility launched as part of the Employee Provident Fund Organisation's (EPFO's) ongoing IT modernization project, the Centralised IT Enabled System (CITES 2.01), from January 1, 2025, which will enable pension disbursement throughout India. In other words, CPPS is a national-level centralised system for pension disbursement.

CPPS is a paradigm shift from the existing pension disbursement system that is decentralised, with each Zonal/Regional Office of EPFO maintaining separate agreements with only 3-4 banks.

What Does This Mean for Pensioners?

Under the CPPS, as a pensioner or retiree, you will now be able to receive a pension from any bank, branch or location in India starting January 01, 2025.

There will also be no need for pensioners to visit the branch for any verification at the time of commencement of pension, and the pension shall be immediately credited upon release.

Even if you, the pension or retiree, move from one location to another, or say change the bank or branch, the CPPS ensures your pension is disbursed and received by you throughout India without any need for transfer of Pension Payment Orders (PPO) from one office to another.

By harnessing advanced IT and banking technologies, CPPS will offer a more efficient, seamless, and user-friendly experience for pensioners.

It is particularly a great relief for pensioners who move to their hometowns or smaller cities after retirement.

Here's what Dr Mansukh Mandaviya, the Union Minister of Labour and Employment, said in a press release dated September 4, 2024.

"The approval of the Centralized Pension Payment System (CPPS) marks a significant milestone in (the) modernization of the EPFO. By enabling pensioners to receive their pensions from any bank, any branch, anywhere in the country, this initiative addresses the long-standing challenges faced by pensioners and ensures a seamless and efficient disbursement mechanism. This is a crucial step in our ongoing efforts to transform the EPFO into a more robust, responsive, and tech-enabled organization, committed to serving the needs of its members and pensioners better."

According to the government, the Centralised Pension Payments System is expected to benefit more than 78 lakh EPS pensioners of the EPFO.

[Read: All You Need to Know About the Unified Pension Scheme]

How Will CPPS Help the Government?

For the government and the EPFO, a national-level centralised system to process pension payments will help in a significant cost reduction plus ensure no delay and inconvenience to beneficiaries eligible.

Who Is Eligible for a Pension and How Is It Calculated?

To be eligible for the pension under the Employees' Pension Scheme, you must meet the following criteria:

-

You should be a member of the EPFO

-

Should have completed 10 years of service

-

Must have attained 58 years of age (That said, you can also choose to receive a reduced pension at age 50, or you could also defer the pension until you reach 60 years of age)

Note, that EPS is mandatory for all employees who are a part of the EPF scheme.

The EPS 1995 is funded by the diversion of 8.33% of monthly wages -- subject to the wage ceiling which is presently Rs 15,000/- per month -- from the employers' share of contribution. The central government also contributes 1.16% of monthly wages.

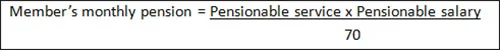

The formula for calculating member pension under EPS'95 is as follows:

Note, that the actual service period of the member is considered as the pensionable service. The pensionable service period is considered on a 6-month basis. In other words, the minimum pensionable service period is 6 months.

Service periods under different employers are added at the time of calculating the pensionable service period. If you switch jobs, you, the employee, have to get the EPS Scheme Certificate issued and submit it to the new employer every time the job is switched.

As regards, the pensionable salary is the average monthly salary in the last 60 months before the member exits the Employees' Pension Scheme.

If there are non-contributory periods in the last 60 months of the employment, the non-contributory days in the month will not be considered and the benefit of those days is given to the employee.

What's Coming Next?

In the next phase, CPPS will enable a smooth transition to an Aadhaar-based payment system (ABPS).

The UIDAI website states, "Aadhaar and its platform offer a unique opportunity for the government to streamline its delivery mechanism under welfare schemes, thereby ensuring transparency and efficiency. The use of Aadhaar as an identity document enables beneficiaries to get their entitlements directly and in a convenient and seamless manner by obviating the need to produce multiple documents to prove one's identity."

Thus, going forward with ABPS, receiving Provident Fund (PF) disbursement pension payouts, and other social welfare benefits will be even more easy and expedient, without the hassle of physically going to the bank with the documents to prove your identity.

However, for this purpose, it is sensible to link your Universal Account Number (UAN) and pension account number with Aadhaar, so that the government verifies your details.

Final words...

CPPS is a transformative step by the government that shall make life easier with a user-friendly experience for several pensioners or retirees to receive their pension. Going forward, the pension can be accessed or received from anywhere in India without having to face hassles and restricted to only a few banks.

Join Now: PersonalFN is now on Telegram. Join FREE Today to get PersonalFN’s newsletter ‘Daily Wealth Letter’ and Exclusive Updates on Mutual Funds.

-New.png)

ROUNAQ NEROY heads the content activity at PersonalFN and is the Chief Editor of PersonalFN’s newsletter, The Daily Wealth Letter.

As the co-editor of premium services, viz. Investment Ideas Note, the Multi-Asset Corner Report, and the Retire Rich Report; Rounaq brings forth potentially the best investment ideas and opportunities to help investors plan for a happy and blissful financial future.

He has also authored and been the voice of PersonalFN’s e-learning course -- which aims at helping investors become their own financial planners. Besides, he actively contributes to a variety of issues of Money Simplified, PersonalFN’s e-guides in the endeavour and passion to educate investors.

He is a post-graduate in commerce (M. Com), with an MBA in Finance, and a gold medallist in Certificate Programme in Capital Market (from BSE Training Institute in association with JBIMS). Rounaq holds over 18+ years of experience in the financial services industry.

Disclaimer: This article is for information purposes only and is not meant to influence your investment decisions. It should not be treated as a mutual fund recommendation or advice to make an investment decision in the above-mentioned schemes. Use of this information is at the user's own risk. The user must make his own investment decisions based on his specific investment objective and financial position and use such independent advisors as he believes necessary.