HDFC NIFTY IT ETF: Aims to Benefit from the Growth of India’s leading IT Companies

Mitali Dhoke

Oct 29, 2022

Listen to HDFC NIFTY IT ETF: Aims to Benefit from the Growth of India’s leading IT Companies

00:00

00:00

"We are living through a generational shift in our economy and society. Digital technology is the most malleable resource at the world's disposal to overcome constraints and re-imagine everyday work and life." - Satya Nadella, Microsoft CEO.

While technology continues transforming the world - the demand for digital services is steadily increasing. According to NASSCOM, revenues for Indian IT services are forecast to grow at 12.3% CAGR to an estimated $300-350bn by FY2026 from $196bn in FY2021.

Amid a weakening macroeconomic environment, there has been margin pressure including high attrition rates in recent quarters for most IT companies. The information technology (IT) sector has turned out to be one of the worst affected by the recent volatility in the stock market. However, disruptive technologies such as cloud computing, data analytics, blockchain, artificial intelligence, etc., are offering new windows of opportunity and the IT Industry in India is expected to continue a 'double-digit' growth trajectory in the years to come.

Indian investors gain exposure to technology stocks when they invest in diversified equity funds. Investment in a leading industry may enable investors to get higher risk-adjusted returns. From humble beginnings, the Indian IT sector is now a vital pillar of the economy; in FY2021, Indian IT sector exports summed $152bn. To be a part of the digital transformation, take exposure to the IT sector by passively investing in the Nifty IT Index. Constituent companies of the NIFTY IT Index have strong fundamentals - the NIFTY IT Index has higher Return on Equity and profit margins than the NIFTY 50 Valuations.

HDFC Mutual Fund, one of India's leading fund houses, has launched HDFC NIFTY IT ETF. It is an open-ended scheme replicating/tracking the NIFTY IT Index (TRI). The scheme endeavours to capture the growth potential for leading IT companies in India by replicating the NIFTY IT Index, subject to tracking errors.

Table 1: Details of HDFC NIFTY IT ETF

| Type |

An open-ended scheme replicating/tracking the NIFTY IT Index (TRI) |

Category |

Exchange Traded Fund |

| Investment Objective |

The investment objective of the scheme is to provide investment returns that, before expenses, correspond to the total returns of the Securities as represented by the NIFTY IT Index, subject to tracking errors. There is no assurance that the investment objective of the scheme will be realised. |

| Min. Investment |

Rs 500/- and in multiples of Re 1/- thereafter. |

Face Value |

Rs 10/- per unit |

| Entry Load |

Not Applicable |

Exit Load |

Nil |

| Fund Manager |

Mr Krishan Kumar Daga

Mr Arun Agarwal |

Benchmark Index |

NIFTY IT Index (TRI) |

| Issue Opens |

October 28, 2022 |

Issue Closes |

November 09, 2022 |

(Source: Scheme Information Document)

The investment strategy for HDFC NIFTY IT ETF will be as follows:

HDFC NIFTY IT ETF will invest in stocks comprising the underlying index in the same ratio as per the index to the extent possible and, to that extent, follows a passive investment strategy, except to the extent of meeting liquidity and expense requirements.

Image source: www.freepik.com

Image source: www.freepik.com

Join Now: PersonalFN is now on Telegram. Join FREE Today to get 'Daily Wealth Letter' and Exclusive Updates on Mutual Funds

The underlying index consists of the 10 largest IT stocks listed on the NSE. The scheme endeavours to capture the growth potential of leading IT companies in India. Since the scheme is an exchange-traded fund, it will only invest in securities constituting the underlying index. However, due to corporate action in companies comprising the index, the scheme may be allocated/allotted securities which are not part of the index. Such holdings would be rebalanced within 7 Business Days from the date of allotment/listing of such securities.

As part of the Fund Management process, the scheme may use derivative instruments such as futures and options or any other derivative instruments that are permissible or may be permissible in future under applicable regulations. However, trading in derivatives by the scheme shall be for restricted purposes as permitted by the regulations. The scheme may also invest in debt & money market instruments in compliance with regulations to meet liquidity and expense requirements.

Under normal circumstances, the Asset Allocation will be as under:

Table 2: Asset Allocation for HDFC NIFTY IT ETF

| Instruments |

Indicative Allocations (% of Net Assets) |

Risk Profile |

| Minimum |

Maximum |

High/Medium/Low |

| Securities covered by the NIFTY IT Index |

95 |

100 |

Very High |

| Debt Securities & Money Market Instruments, units of Debt Schemes of Mutual Funds |

0 |

5 |

Low to Medium |

(Source: Scheme Information Document)

About the benchmark

The NIFTY IT index captures the performance of Indian IT companies. The NIFTY IT Index comprises of 10 companies listed on the National Stock Exchange (NSE). NIFTY IT provides investors and market intermediaries with an appropriate benchmark that captures the performance of the IT market segment in India.

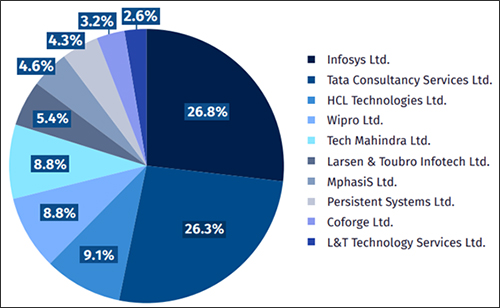

Here's the list of the top 10 constituents by their weightage under the index as on September 30, 2022:

(Source: HDFC NIFTY Private Bank ETF PPT)

(Source: HDFC NIFTY Private Bank ETF PPT)

# Note that the index is rebalanced semi-annually in March and September.

Who will manage HDFC NIFTY Private Bank ETF?

Mr Krishan Kumar Daga and Mr Arun Agarwal will be the designated fund managers for this scheme.

Mr Krishan Kumar Daga is a B. Com graduate with over 32 years of experience, 13 years in Equity Research and over 14 years in Fund Management. Prior to joining HDFC AMC, he was associated with Reliance Capital Asset Management Company Ltd. as Fund Manager/Head - ETF, Reliance Capital Ltd. as Vice President, and Deutsche Equities as Vice President.

At HDFC Mutual Fund, Mr Daga currently manages HDFC Arbitrage Fund, HDFC Banking ETF, HDFC Equity Savings Fund (Arbitrage Assets), HDFC Gold ETF, HDFC Gold Fund (FOF), HDFC Index Fund - NIFTY 50 Plan, HDFC Index Fund - SENSEX Plan, HDFC Multi-Asset Fund (Gold related instruments and Arbitrage Assets), HDFC NIFTY 50 ETF, HDFC SENSEX ETF, HDFC Nifty 100 ETF, HDFC NIFTY Bank ETF, HDFC Nifty Next 50 ETF, HDFC Nifty 100 Index Fund, HDFC Nifty100 Equal Weight Index Fund, HDFC S&P BSE SENSEX ETF, HDFC NIFTY50 Equal Weight Index Fund, HDFC Developed World Indexes Fund of Funds, HDFC NIFTY100 Quality 30 ETF, HDFC NIFTY50 Value 20 ETF, HDFC NIFTY Growth Sectors 15 ETF, HDFC NIFTY200 Momentum 30 ETF, HDFC NIFTY100 Low Volatility 30 ETF, and HDFC NIFTY Next 50 Index Fund.

Mr Arun Agarwal is a Chartered Accountant and B.com graduate. He has over 23 years of experience in equity, debt and derivative dealing, fund management, internal audit and treasury operations. Prior to joining HDFC AMC, he was associated with SBI Funds Management Pvt. Ltd. as Assistant Vice President, ICICI Bank Limited as Chief Manager, UTI Asset Management Pvt. Ltd. as Manager and UTI Asset Management Pvt. Ltd. as Assistant Manager.

At HDFC Mutual Fund, Mr Agarwal currently manages HDFC Arbitrage Fund, HDFC Banking ETF, HDFC Equity Savings Fund (Arbitrage Assets), HDFC Gold ETF, HDFC Gold Fund (FOF), HDFC Index Fund - NIFTY 50 Plan, HDFC Index Fund - SENSEX Plan, HDFC Multi-Asset Fund (Gold related instruments and Arbitrage Assets), HDFC NIFTY 50 ETF, HDFC SENSEX ETF, HDFC Nifty 100 ETF, HDFC NIFTY Bank ETF, HDFC Nifty Next 50 ETF, HDFC Nifty 100 Index Fund, HDFC Nifty100 Equal Weight Index Fund, HDFC S&P BSE SENSEX ETF, HDFC NIFTY50 Equal Weight Index Fund, HDFC Developed World Indexes Fund of Funds, HDFC NIFTY100 Quality 30 ETF, HDFC NIFTY50 Value 20 ETF, HDFC NIFTY Growth Sectors 15 ETF, HDFC NIFTY200 Momentum 30 ETF, HDFC NIFTY100 Low Volatility 30 ETF, and HDFC NIFTY Next 50 Index Fund.

Fund Outlook - HDFC NIFTY IT ETF

HDFC NIFTY IT Index Fund aims to provide returns that closely correspond to the total returns as represented by the NIFTY IT Total Return Index, subject to tracking errors. The fortune of this scheme will be closely linked to how the Nifty IT Index performs.

The scheme offers investors an opportunity to benefit from innovation & development of futuristic technology by investing in emerging IT companies with quality management, global presence, and high growth potential. Indian IT companies are well poised to take advantage of structural tailwinds in tech spending, including the growth of cloud computing. They play a significant role in cloud migration and have gained market share from global IT services companies.

The scheme aims to invest in the fastest-growing IT sector, and investors have the opportunity to benefit from emerging technologies such as Cloud services, Fintech, E-commerce, Artificial Intelligence, Virtual Reality, and Blockchain technology.

However, do note that being a sectoral ETF, the scheme will aim to invest only in the Information Technology sector, which creates a concentration risk. In addition, the persistent repercussions of the geopolitical tension, spiralling inflation and the fears of a possible recession in the US in 2023, which is the biggest export market for Indian tech companies-on the back of sustained interest rate hikes may adversely affect the valuations these tech firms enjoy. This may cause a significant risk to economic growth and continue the prevailing high market volatility. The margin of safety appears to be narrow, and the clear direction for the equity market from the current elevated levels is uncertain.

These factors, among many others, could have a bearing on the index and its top constituents, which may impact the scheme's performance and affect negatively if the sector moves out of favour. Thus, Thus, HDFC NIFTY IT ETF is suitable only for aggressive investors with high-risk tolerance who better understand the IT sector and seek to benefit from its growth potential. More importantly, they should have an investment horizon of at least 5-7 years.

PS: If you wish to select actively managed worthy mutual fund schemes, I recommend that you subscribe to PersonalFN's unbiased premium research service, FundSelect.

As a bonus, you get access to PersonalFN's popular debt mutual fund service, DebtSelect.

PersonalFN recommendations go through our stringent process that assesses both quantitative and qualitative parameters, providing you with Buy, Hold, and Sell recommendations on equity and debt mutual fund schemes. Read here for more details...

If you are serious about investing in rewarding mutual fund schemes, Subscribe now!

Warm Regards,

Mitali Dhoke

Research Analyst