HDFC NIFTY50 Value 20 ETF: Will This Scheme Add Value to Your Portfolio?

Mitali Dhoke

Sep 14, 2022

Listen to HDFC NIFTY50 Value 20 ETF: Will This Scheme Add Value to Your Portfolio?

00:00

00:00

Smart-beta investing is popular globally, with AUM rising steadily and it is backed by extensive empirical research. The stock selection and weighting are based on pre-defined factors, the commonly known factors are Value, Momentum, Quality, Low Volatility etc.

Stock selection and weighting based on factors, rather than market cap which is used for commonly followed indices like NIFTY 50 endeavours to provide better risk-adjusted returns than broad market cap weighted indices. Quality, Value and Growth indices have provided better or similar downside protection during market stress. Performance of various factors changes across different market environments. Investors can consider diversifying their investments across factors based on individual preferences to improve portfolio returns.

The equities markets are currently enduring increased market volatility, however, there are few themes that have performed better than others since the start of the year. 'Value' theme is one of them. The objective of value investing is to purchase stocks of companies that are 'inexpensive' in comparison to their fundamentals and have a high 'margin of safety'. The approach is based on the concept that undervalued stocks should be held until the market recognises their mispricing and corrects its course, and then sell these stocks when the trading price exceeds their intrinsic value.

Instead of investing in value stocks directly, investors may consider investing in the NIFTY50 Value 20 Index, which measures the performance of the top 20 'Value stocks' from the NIFTY50 Index. HDFC Mutual Fund has launched HDFC NIFTY50 Value 20 ETF, it is an open-ended scheme replicating/tracking NIFTY50 Value 20 Index.

On the launch of this scheme, Mr Navneet Munot, Managing Director and Chief Executive Officer at HDFC Asset Management Co. Ltd, said, "Smart beta investing is popular globally with assets under management (AUM) rising steadily. Smart Beta ETFs offer one-shot diversification of portfolio at a low cost, and is proven tool for investors who seek returns over the long-term. "

Table 1: Details of HDFC NIFTY50 Value 20 ETF

| Type |

An open-ended scheme replicating/tracking NIFTY50 Value 20 Index |

Category |

Exchange Traded Fund |

| Investment Objective |

The investment objective of the Scheme is to provide investment returns that, before expenses, correspond to the total returns of the Securities as represented by the NIFTY50 Value 20 Index, subject to tracking errors. There is no assurance that the investment objective of the Scheme will be realized. |

| Min. Investment |

Rs 500/- and in multiples of Re 1/- thereafter. |

Face Value |

Rs 10/- per unit |

| Entry Load |

Not Applicable |

Exit Load |

Nil |

| Fund Manager |

- Mr Krishan Kumar Daga

- Mr Arun Agarwal |

Benchmark Index |

NIFTY50 Value 20 Index (TRI) |

| Issue Opens |

September 09, 2022 |

Issue Closes |

September 20, 2022 |

(Source: Scheme Information Document)

The investment strategy for HDFC NIFTY50 Value 20 ETF will be as follows:

HDFC NIFTY50 Value 20 ETF endeavours to mirror the benchmark index, subject to tracking errors. The scheme aims to invest in stocks comprising the underlying Index in the same ratio as per the index to the extent possible and to that extent follows a passive investment strategy.

Since the Scheme is an exchange traded fund, it will only invest in securities constituting the underlying Index. However, due to corporate action in companies comprising the index, the Scheme may be allocated/allotted securities which are not part of the index. Such holdings would be rebalanced within 7 Business Days from the date of allotment/listing of such securities.

Image source: www.freepik.com

Image source: www.freepik.com

Join Now: PersonalFN is now on Telegram. Join FREE Today to get 'Daily Wealth Letter' and Exclusive Updates on Mutual Funds

The performance of the scheme may not be commensurate with the performance of the underlying Index on any given day or over any given period. Such variations are commonly referred to as tracking errors. These schemes intend to maintain a low tracking error by aligning the portfolio in line with the Index. The stocks comprising the underlying Index are periodically reviewed by Index Service Provider. The scheme would invest in Constituents of NIFTY50 Value 20 Index, it may also invest in debt & money market instruments, in compliance with regulations to meet liquidity and expense requirements.

Under normal circumstances, the asset allocation will be as under:

Table 2: Asset Allocation for HDFC NIFTY50 Value 20 ETF

| Instruments |

Indicative Allocations (% of Net Assets) |

Risk Profile |

| Minimum |

Maximum |

High/Medium/Low |

| Securities covered by NIFTY50 Value 20 Index |

95 |

100 |

Very High |

| Debt Securities & Money Market Instruments, units of Debt Schemes of Mutual Funds |

0 |

5 |

Low to Medium |

(Source: Scheme Information Document)

About the benchmark

The NIFTY50 Value 20 Index is designed to reflect the behaviour and performance of a diversified portfolio of value companies forming a part of NIFTY 50 Index. It consists of the 20 most liquid value blue chip companies listed on NSE.

At the time of rebalancing of shares/ change in index constituents/ change in investable weight factors (IWFs), the weightage of the index constituent (wherever applicable) is capped at 15%. Weightage of such stock may increase beyond 15% between the rebalancing periods.

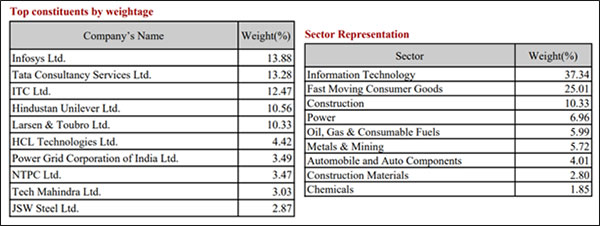

Here's the list of top 10 constituents by their weightage and sector representation under the index:

(Source: NSE NIFTY50 Value 20 ETF)

(Source: NSE NIFTY50 Value 20 ETF)

Note that the index will rebalance annually.

Who will manage HDFC NIFTY50 Value 20 ETF?

Mr Krishan Kumar Daga and Mr Arun Agarwal will be the designated fund managers for this scheme.

Mr Krishan Kumar Daga is a B. Com graduate and has over 32 years of experience, of which 13 years in Equity Research and over 14 years in Fund Management. Prior to joining HDFC AMC, he was associated with Reliance Capital Asset Management Company Ltd. as Fund Manager/Head - ETF, Reliance Capital Ltd. as Vice President, and Deutsche Equities as Vice President.

At HDFC Mutual Fund, Mr Daga currently manages HDFC Arbitrage Fund, HDFC Banking ETF, HDFC Equity Savings Fund (Arbitrage Assets), HDFC Gold ETF, HDFC Gold Fund (FOF), HDFC Index Fund - NIFTY 50 Plan, HDFC Index Fund - SENSEX Plan, HDFC Multi-Asset Fund (Gold related instruments and Arbitrage Assets), HDFC NIFTY 50 ETF, HDFC SENSEX ETF, HDFC Nifty 100 ETF, HDFC NIFTY Bank ETF, HDFC Nifty Next 50 ETF, HDFC Nifty 100 Index Fund, HDFC Nifty100 Equal Weight Index Fund, HDFC S&P BSE SENSEX ETF, HDFC NIFTY50 Equal Weight Index Fund, HDFC Developed World Indexes Fund of Funds, and HDFC NIFTY Next 50 Index Fund.

Mr Arun Agarwal is a Chartered Accountant and B.com graduate. Collectively he has over 23 years of experience in equity, debt and derivative dealing, fund management, internal audit and treasury operations. Prior to joining HDFC AMC, he was associated with SBI Funds Management Pvt. Ltd. as Assistant Vice President, ICICI Bank Limited as Chief Manager, UTI Asset Management Pvt. Ltd. as Manager and UTI Asset Management Pvt. Ltd. as Assistant Manager.

At HDFC Mutual Fund, Mr Agarwal currently manages, HDFC Arbitrage Fund, HDFC Banking ETF, HDFC Equity Savings Fund (Arbitrage Assets), HDFC Gold ETF, HDFC Gold Fund (FOF), HDFC Index Fund - NIFTY 50 Plan, HDFC Index Fund - SENSEX Plan, HDFC Multi-Asset Fund (Gold related instruments and Arbitrage Assets), HDFC NIFTY 50 ETF, HDFC SENSEX ETF, HDFC Nifty 100 ETF, HDFC NIFTY Bank ETF, HDFC Nifty Next 50 ETF, HDFC Nifty 100 Index Fund, HDFC Nifty100 Equal Weight Index Fund, HDFC S&P BSE SENSEX ETF, HDFC NIFTY50 Equal Weight Index Fund, HDFC Developed World Indexes Fund of Funds, and HDFC NIFTY Next 50 Index Fund.

Fund Outlook - HDFC NIFTY50 Value 20 ETF

HDFC NIFTY50 Value 20 ETF aims to invest in stocks of value companies forming a part of the underlying index and endeavours to generate returns parallel to the benchmark index, subject to tracking errors.

The schemes passively invest in stocks of undervalued companies with growth potential and offer diversification benefits by investing across market caps and sectors. Value investing is one of the oldest and best-known styles of investing. The scheme selects stocks based on their Price/ Earnings, Price / Book, Dividend Yield and Return on Capital Employed. Value investing has been a consistent performer across a variety of market environments and historically generated higher long-term returns than the NIFTY 50 TRI. This scheme provides investors an access to the Value factor via a diversified portfolio of 20 companies.

It is based on the foundation that stocks with relatively favourable values, or 'Low-value stocks', typically outperform stocks with higher valuations over the long term. The schemes provide investors with an opportunity to gain from a turnaround of value, as the undervalued stocks are expected to perform well during the market recovery. The fortune of this scheme will depend on the performance of the underlying index.

However, do note that these high-quality value stocks are currently undervalued due to dynamic market conditions and are expected to rise once the market recovers, they are still prone to high market risks. In addition, the persistent repercussions of the Russia-Ukraine conflict, spiralling inflation and the RBI's recent announcement to hike policy rates again by 50 basis points to curb demand and control inflation may cause a significant risk to economic growth. The margin of safety appears to be narrow, and the clear direction for the equity market from the current elevated levels is unknown. These factors, among many others, may affect the scheme's performance and it may face intensified volatility in the near term.

Thus, the scheme is suitable for refined investors with a high-risk appetite and a long investment horizon of at least 5-7 years to sustain volatile market phases. You should ensure that your investment objective aligns with the respective fund you decide to invest in.

PS: If you wish to select actively managed worthy mutual fund schemes, I recommend that you subscribe to PersonalFN's unbiased premium research service, FundSelect.

As a bonus, you get access to PersonalFN's popular debt mutual fund service, DebtSelect.

PersonalFN recommendations go through our stringent process that assesses both quantitative and qualitative parameters, providing you with Buy, Hold, and Sell recommendations on equity and debt mutual fund schemes. Read here for more details...

If you are serious about investing in rewarding mutual fund schemes, Subscribe now!

Warm Regards,

Mitali Dhoke

Research Analyst