Mutual Fund Taxation: Here Are the Key Changes After the Union Budget 2024-25

Divya Grover

Jul 24, 2024 / Reading Time: Approx. 6 mins

Listen to Mutual Fund Taxation: Here Are the Key Changes After the Union Budget 2024-25

00:00

00:00

One of the key highlights of the Union Budget 2024-25 was the revamp of the capital gains tax structure. The Finance Minister tweaked long-term and short-term capital gains tax on various asset classes. These changes also apply to capital gains earned on the redemption of mutual fund units.

Read on to find out how the gains on redemption of mutual fund units for different categories will be taxed after the announcement of the Union Budget for 2024-25 and how it will impact your tax liability.

[Read: The Changes in Capital Gain Tax Done by Modi 3.0 Budget 2024-25 You Need to Know]

1) Equity Mutual Funds

Equity mutual funds are schemes investing a minimum of 65% of their assets in equity and equity-related instruments.

Gains on redemptions of equity mutual fund investment held for 12 months or more will be considered long-term capital gains (LTCG) and will be taxed at 12.5%, provided the gains are in excess of Rs 1.25 lakh in a financial year with effect from July 23, 2024. LTCG on equity mutual funds was earlier taxed at the rate of 10% if the gains exceeded Rs 1 lakh in a financial year.

Gains on redemption of equity mutual fund investment held for less than 12 months will be considered short-term capital gains (STCG) and will be taxed at 20% compared to 15% earlier. The higher tax rate on STCG is expected to deter investors engaged in speculative trading often resulting in higher volatility in the equity market.

It is important to note that units redeemed between April 01, 2024 and July 22, 2024 will be taxed as per the old tax structure.

2) Debt Mutual Funds

Debt mutual funds are schemes investing a minimum of 65% of their assets in debt and money market instruments.

There has been no change in tax rates on gains from debt mutual funds. The gains on redemption of these funds will continue to be taxed at the marginal rate (i.e. as per the income tax slab rate applicable to investors) irrespective of the holding period.

Notably, the government had amended the Finance Bill in 2023 under which it removed the indexation benefit for debt mutual funds which was applicable on long-term holdings to make it on par with Bank FDs.

[Read: Debt Mutual Funds are Now at Par with Fixed Deposits for Taxation]

3) Other mutual funds

For other mutual funds that invest less than 65% of their assets in domestic equities and less than 65% in debt instruments, such as Multi Asset Allocation Funds, Fund of Funds, International Funds, and Gold ETFs, a holding period of two years or more will now be considered as long term. Gains on such investments will be taxed at 12.5% without indexation. Earlier, the holding period for funds investing 35-65% of their assets in equities was 3 years to be classified as long term and was taxed at 20% with indexation.

The indexation benefit (based on the cost on inflation index under Section 48 of the Income Tax Act, 1961) provided investors the benefit of adjusting the purchase price of an investment to reflect the inflation impact on the purchase value, which effectively reduced the tax liability.

For short-term holdings, the gains will continue to be taxed as per the investor's income tax slab but the holding period for that will now be considered as less than two years instead of three years earlier.

So, while the minimum holding period for LTCG taxation has now been lowered, the tax outgo could be a bit higher under the new structure with the removal of the indexation benefit.

Meanwhile, the government has marginally increased securities transaction tax on Futures and Options which may impact schemes engaged in Derivatives trading.

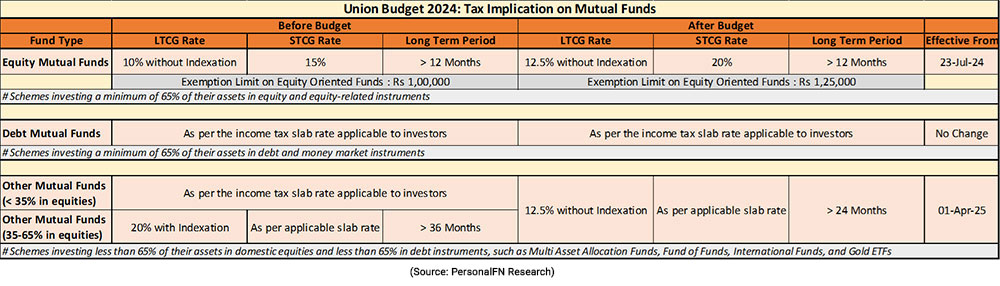

Here is the summary of changes in capital gains tax for mutual fund investments:

To conclude:

To conclude:

Despite a rise in LTCG on equity funds, they can potentially continue to be the preferred asset class for most investors as inflation-adjusted returns for the category still outshines most other asset classes. Moreover, the removal of indexation benefit in the case of real estate transactions also bodes well for equities.

While debt mutual funds may not be impacted by the budget proposals, other mutual funds may benefit from the reduction in holding period from three years to two years.

Investors should take note of the changes announced in the Union Budget 2024-25 and then choose the most suitable schemes for their portfolio as it can impact their tax liability.

We are on Telegram! Join thousands of like-minded investors and our editors right now.

DIVYA GROVER is the co-editor for FundSelect, the flagship research service of PersonalFN. She is also the co-editor of DebtSelect. Divya is an avid reader which helps her in analysing industry trends and producing insightful articles for PersonalFN’s popular newsletter – Daily Wealth letter, read by over 1.5 lakh subscribers.

Divya joined PersonalFN in 2019 and has since then used stringent quantitative and qualitative parameters to analyse funds to provide honest and unbiased research to investors. She endeavours to enable investors to make an informed investment decision and thereby safeguard their wealth.

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing.

This article is for information purposes only and is not meant to influence your investment decisions. It should not be treated as a mutual fund recommendation or advice to make an investment decision in the above-mentioned schemes.