Mutual Funds Are Betting Big on These Sectors: Are You Missing Out?

Mitali Dhoke

Nov 20, 2023 / Reading Time: Approx. 10 mins

Listen to Mutual Funds Are Betting Big on These Sectors: Are You Missing Out?

00:00

00:00

The World Bank's latest India Development Update (IDU) report has retained India's GDP growth forecast of 6.3% for the Financial Year 2023-24. Despite global headwinds, India's economy has continued to thrive, and in the years to come, specific sectors are predicted to be crucial to this progress.

Mutual funds are a great way to have exposure to a variety of sectors and stocks. Mutual funds are playing an increasingly active role in shaping the investment landscape, making strategic bets on specific sectors that they believe hold promise for long-term growth and returns.

Mutual funds' sector allocations reflect their assessments of various industries' growth potential and risk profiles. By analysing economic trends, technological advancements, and consumer behaviour patterns, fund managers identify sectors that they believe are poised for success.

Recent data suggests that mutual funds are increasing their allocations to certain sectors, particularly those perceived as having strong growth potential.

[Read: The 4 Key Market Trends that Could Drive Mutual Fund Growth]

In recent months, the increased investment activity reflects the growing optimism among fund managers towards the Indian economy and its long-term growth prospects. Are you missing out on these potential opportunities?

Let's delve into the key sectors that are attracting significant attention from mutual funds and explore whether you should consider aligning your investment strategy accordingly.

Choosing the right sectors can not only get you closer to your financial goals but also protect you from losing your capital due to market downturns. Understanding these sectors can provide valuable insights for investors seeking to align their portfolios with future opportunities.

Several sectors have consistently captured mutual funds' attention in recent years, indicating their perceived potential for outperformance.

Here are some key sectors attracting mutual funds' attention

1. Healthcare Sector

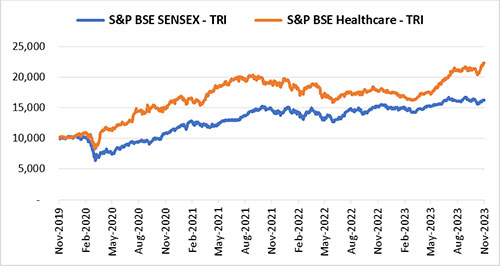

After more than three years, the S&P BSE Healthcare Index has recovered remarkably from its lows in March 2020, indicating that pharma and healthcare as a sector has been a large beneficiary and generated wealth for investors.

Graph 1: Movement of S&P BSE Healthcare v/s S&P BSE Sensex

Base = Rs 10,000

Base = Rs 10,000

Data as of November 20, 2023

Past performance is not an indicator of future returns.

(Source: ACE MF, data collated by PersonalFN Research)

The healthcare sector is quite broad and includes various industries like the medical equipment industry, pharmaceutical industry, diagnostic industry, hospitals, medical tourism, clinical trials, health insurance, and more.

The demand for healthcare services in India is rising as a result of the country's ageing population, an increase in chronic illnesses, and a rise in disposable income. India's domestic pharmaceutical industry is predicted to generate USD 30 billion by 2030, according to the Economic Survey 2022-2023.

Better healthcare services and investment prospects have resulted from the government's increase in the healthcare budget. The Ministry of Health and Family Welfare has been given Rs 89,155 crore (USD 10.76 billion) in the Union Budget 2023.

[Read: The Future for Pharma & Healthcare Looks Bright: Here Are 6 Mutual Funds to Invest in]

In India, the healthcare industry embraces cutting-edge technology like telemedicine, electronic medical records, and digital health platforms, giving the industry's businesses new development potential.

Well, many mutual fund schemes have been beneficiaries of India's growing pharma and healthcare sector. Mutual funds are investing in companies that are developing innovative healthcare solutions to address the growing needs of the Indian population.

2. Technology Sector (IT)

One of the main forces behind India's recent economic expansion has been the technology sector. The nation's growing population has made it easier for digital companies to expand, as has the country's soaring smartphone and internet connection rates.

As a result, the country's IT market has been growing rapidly; it is projected that sales will surpass $300 billion by 2025. This sector of the economy is constantly evolving and reshaping the contemporary world. These days, information technology covers a wide range of topics, including cloud computing, data analytics, artificial intelligence, and data science.

Many initiatives have been launched by the government to promote the advancement of these technologies in the country, and several Indian IT companies are investing heavily in these areas. Overall, it is anticipated that favourable government policies, a substantial pool of skilled labour, and growing consumer demand for digital technology will support India's IT sector's ongoing rapid expansion in the years to come.

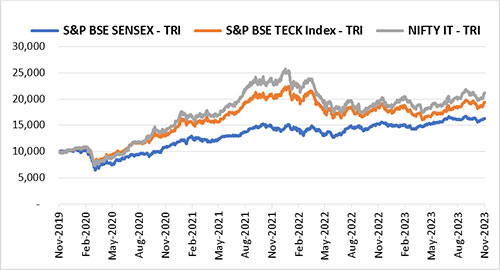

Graph 2: Movement of S&P BSE TECk -TRI and Nifty IT -TRI v/s S&P BSE Sensex

Base = Rs 10,000

Base = Rs 10,000

Data as of November 20, 2023

Past performance is not an indicator of future returns.

(Source: ACE MF, data collated by PersonalFN Research)

The Nifty IT - TRI has clocked 11.09% YTD returns, while S&P BSE TECk - TRI (which has a broad representation) has clocked 5.05% YTD returns (as of November 20, 2023). Amidst the correction witnessed by the Nifty IT - TRI and S&P BSE TECk - TRI, several mutual fund houses have launched IT or Tech Funds, hoping to capitalise on the prospects of IT and Tech sector.

The dominance of artificial intelligence is fast increasing in every field whether it is education, healthcare, the banking sector, insurance, e-commerce, the automobile sector, etc. Mutual funds have been actively investing in companies across the technology spectrum, from software and IT services to e-commerce and digital payments.

[Read: 5 Equity Mutual Funds to Benefit from India's IT and Tech Boom]

3. Banking & Financial Services (BFSI)

The financial sector is also witnessing increased investment from Indian mutual funds. The sector is benefiting from the strong Indian economy, rising interest rates, and a growing population with increasing demand for financial products and services.

The Banking and Financial Services sector has been in the news due to many reasons like the rising NPAs, inflation, and the possibility of a recession in major economies across the world. Amidst all this gloomy news, the Indian BFSI sector is like a beacon as the monetary policies in the country have been able to manage inflation without damaging the growth of the economy.

A vital part of the Indian economy, the banking, financial services, and insurance (BFSI) sector is responsible for financial intermediation, risk management, and capital mobilisation for economic expansion. In 2023, government efforts, fintech, digitalization, artificial intelligence, and machine learning will all play a major role in the growth and transformation of the BFSI sector in India.

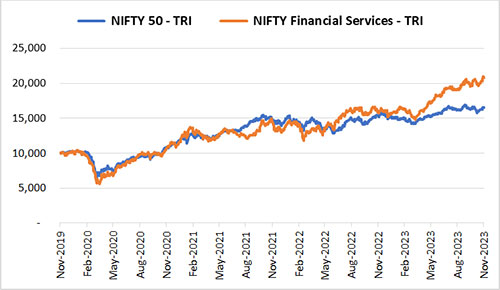

Graph 3: Movement of Nifty 50 -TRI v/s Nifty Financial Services Index

Base = Rs 10,000

Base = Rs 10,000

Data as of November 20, 2023

Past performance is not an indicator of future returns.

(Source: ACE MF, data collated by PersonalFN Research)

As the charts show, the Nifty Financial Services has outperformed the Nifty 50 by 5.3% year-to-date. This is due in part to the strong performance of the financial services sector in India in 2023.

Cybersecurity remains a critical concern for BFSI institutions as they face growing cyber threats. The regulatory landscape for the BFSI sector in India is evolving to keep pace with the changing technological and financial landscape. The Reserve Bank of India (RBI) is actively promoting responsible innovation and ensuring that the financial system remains safe and sound.

The BFSI sector in India is well-positioned for continued growth and transformation in the coming years. By embracing digital technologies, adapting to regulatory changes, and focusing on sustainable practices, BFSI institutions can play a vital role in driving financial inclusion, supporting economic growth, and enhancing the lives of Indian citizens.

Various mutual funds are investing in banks, non-banking financial companies (NBFCs), and insurance companies that are well-positioned to capitalize on these favourable conditions.

4. Automobile sector

The automobile industry substantially contributes to the nation's economy, it includes a broad variety of vehicles, including motorcycles, three-wheelers, commercial vehicles, and passenger cars. The Indian automobile industry has faced several difficulties recently, including decreased demand, regulation changes, and a move toward electric vehicles.

The automobile sector has been witnessing excellent and consistent levels of demand, despite talks of economic recession. Also, with the sudden push towards electric mobility coming from manufacturers of fossil fuel-powered vehicles, the EV industry is all set to grow by leaps and bounds soon.

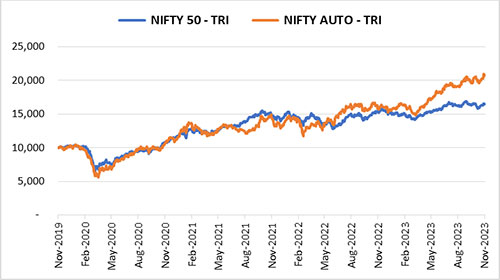

Graph 4: Movement of Nifty 50 -TRI v/s Nifty Auto Index

Base = Rs 10,000

Base = Rs 10,000

Data as of November 20, 2023

Past performance is not an indicator of future returns.

(Source: ACE MF, data collated by PersonalFN Research)

As of November 2023, the automobile sector in India has outperformed the Nifty 50 Index due to strong economic growth, lower interest rates, a rising demand, and supportive government policies.

One of the many programmes the Indian government has established to support the growth of the automobile sector is the Faster Adoption and Manufacture of Electric Vehicles (FAME) plan, which aims to promote the usage of electric vehicles across the country.

India's domestic vehicle market has been growing steadily, the two-wheeler market dominated the auto industry, accounting for 19.45 million vehicle sales in FY23. According to the SIAM report, India's automobile industry achieved a remarkable feat in September 2023 by reporting record monthly sales.

[Read: Gear up Your Investment Portfolio with These Top 5 Automobile Mutual Funds]

By 2030, India aims to become a global leader in shared mobility, emphasising electric and driverless vehicles as a means of cutting emissions. This industry encompasses both the car and auto component industries, both of which are expanding in response to the rising demand for automobiles, particularly in India given the growing middle-class income and the young population of India.

Although, mutual funds are seen betting on the growth potential of the Indian automobile sector, do note, that the industry may encounter difficulties, including increasing fuel costs, shifting customer tastes, and escalating international rivalry.

5. Fast-Moving Consumer-Goods Sector (FMCG)

India's FMCG sector is the fourth largest sector in the economy and comprises three main segments namely, food and beverages (19% of the sector), healthcare (31% of the sector), and household and personal care (remaining 50% share of the sector).

Among the economic sectors with the highest degree of resilience is the FMCG sector. It is sometimes referred to as the defensive sector, on which one can place bets during recessions. Over the past few years, India has witnessed substantial expansion in this sector for a variety of reasons, including rising salaries, changing lifestyles, and increased urbanisation.

The demand for this sector is now coming from the remotest parts of the country which has led to huge investments by industry giants like Dabur, Britannia, Nestle, etc. The important developments in the Indian FMCG sector include the rising demand for organic and healthful products as well as the focus on e-commerce and digital marketing.

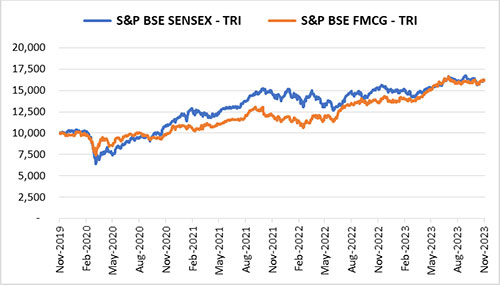

Graph 5: Movement of S&P BSE SENSEX - TRI v/s S&P BSE FMCG Index

Base = Rs 10,000

Base = Rs 10,000

Data as of November 20, 2023

Past performance is not an indicator of future returns.

(Source: ACE MF, data collated by PersonalFN Research)

As of November 2023, the S&P BSE Sensex is up by 15.2% year-to-date, while the S&P BSE FMCG is up by 18.6%. The strong performance of the FMCG sector can be attributed to several factors such as defensive nature, strong demand, rural growth, and government support.

Over the next few years, it is projected that India's FMCG business will grow rapidly due to expanding consumer demand, rising incomes, and favourable government policies.

According to data from NIQ India (formerly NielsonIQ), the FMCG market in India experienced double-digit value growth of 10.2% in Q1 FY 2023-24, driven by greater consumption growth, a 2.6% increase from the previous quarter.

With its vast market and plenty of well-known brands, the FMCG industry is one of the most alluring to investors due to its strong growth prospects. Recently, D2C start-ups like Mamaearth, The Moms Co., Bey Bee, Azah, Nua, and Pee Safe are seen competing against FMCG giants that have dominated the Indian industry for decades, such as Johnson & Johnson, Himalaya, Hindustan Unilever, ITC, Lakme, and others.

Investors who want to benefit from this evolving sector and be a part of India's growth story may consider investing in the FMCG sector via mutual funds. Know here - FMCG Mutual Funds: A Smart Way to Benefit from India's Large Consumer Market

You see, there is a possibility that you may be missing out on potential opportunities for growth if you do not consider the above-mentioned sectors. In addition, several other industries are doing well, including Manufacturing, Chemicals, Defence, Metals And Mining, Spacetech, and Real Estate.

To conclude...

The Indian economy is expected to remain one of the fastest-growing economies in the world in the coming years, and these sectors are well-positioned to benefit from this growth. However, it is important to remember that past performance is not an indicator of future results, and investing in any sector or stock carries inherent risks.

[Read: How to Choose Mutual Funds For Your Investment Portfolio]

If one considers aligning their investment strategy with the sectors that mutual funds are betting on, it is important to conduct thorough research and choose investment vehicles that align with your risk tolerance and investment goals.

Mutual funds offer a convenient way to gain exposure to these sectors, and there are a variety of options available to choose from. Therefore, one must make informed investment decisions to achieve their envisioned financial goals.

We are on Telegram! Join thousands of like-minded investors and our editors right now.

MITALI DHOKE is a Research Analyst at PersonalFN. She is an MBA (Finance) and a post-graduate in commerce (M. Com). She focuses primarily on covering articles around mutual funds including NFOs, financial planning and fixed-income products. Mitali holds an overall experience of 4 years in the financial services industry.

She also actively contributes towards content creation for PersonalFN’s social media platforms in the endeavour to educate investors and enhance their financial knowledge.

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing.

This article is for information purposes only and is not meant to influence your investment decisions. It should not be treated as a mutual fund recommendation or advice to make an investment decision in the above-mentioned schemes.