Navi Nifty India Manufacturing Index Fund: Should You Invest?

Mitali Dhoke

Aug 20, 2022

Listen to Navi Nifty India Manufacturing Index Fund: Should You Invest?

00:00

00:00

Manufacturing is one of the high-growth sectors in India buoyed by the government's constant support to strengthen the sector. The statement noted that the 'Make in India' initiative, Production Linked Incentive (PLI) Scheme and the Skill India initiative are a few of the programmes aiming to put India on the world map as a global manufacturing hub.

There has been an increase in demand for the Indian manufacturing sector over the last three quarters. In Budget 2022-23, the government allocated Rs 2,403 crore for the promotion of electronics and IT hardware manufacturing. The manufacturing sector IIP (Index of Industrial Production) has been rising steadily over the years and the exports of manufactured goods have increased by 38%. Foreign Direct Investment policy initiatives aimed at reducing restrictions have led to an increase in foreign investment. FDI in the manufacturing sector increased by 25% to $16.3 billion in 2021.

Investors seeking to benefit from the growth potential of the manufacturing sector may consider investing in the Nifty India Manufacturing Index which measures the performance of these leading companies in the manufacturing sector.

Navi Mutual Fund announced the launch of its 6th fund of this year, the Navi Nifty India Manufacturing Index Fund. This is India's first index fund focusing on the manufacturing sector. It is an open-ended index fund that will seek to replicate the Nifty India Manufacturing Index. The scheme offers a highly diversified investment opportunity to invest in India's growing sector.

On the launch of this fund, Mr Sachin Bansal Co-founder & CEO of Navi Group said, "The launch of the Navi Nifty India Manufacturing Index Fund is yet another example of Navi's focus on innovative, cost-effective and simple investment products. Manufacturing is an important part of the Indian economy and we are glad to offer a product that allows our customers to play a part in that story."

Table 1: Details for Navi Nifty India Manufacturing Index Fund

| Type |

An open-ended scheme replicating /tracking Nifty India Manufacturing Index |

Category |

Index Fund |

| Investment Objective |

The investment objective of the scheme is to achieve a return equivalent to Nifty India Manufacturing Index by investing in stocks of companies comprising the Nifty India Manufacturing Index, subject to tracking error.

However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. |

| Min. Investment |

Rs 500/- and in multiples of Re 1 thereafter. Additional Purchase Rs 100/- and in multiples of Re 1 thereafter. |

Face Value |

Rs 10/- per unit |

| Plans |

|

Options |

Growth |

| Entry Load |

Not Applicable |

Exit Load |

Nil |

| Fund Manager |

Mr Aditya Mulki |

Benchmark Index |

Nifty India Manufacturing TRI (Total Return Index) |

| Issue Opens: |

August 12, 2022 |

Issue Closes: |

August 23, 2022 |

(Source: Scheme Information Document)

The investment strategy for Navi Nifty India Manufacturing Index Fund will be as follows:

Navi Nifty India Manufacturing Index Fund aims to invest in companies whose securities are included in the Nifty India Manufacturing Index in similar proportion and endeavours to achieve returns parallel to the index, subject to tracking error.

Image source: www.freepik.com

Image source: www.freepik.com

Join Now: PersonalFN is now on Telegram. Join FREE Today to get 'Daily Wealth Letter' and Exclusive Updates on Mutual Funds

The performance of the scheme may not be commensurate with the performance of the respective benchmark of the schemes on any given day or over any given period. Such variations are commonly referred to as tracking errors. The scheme intends to maintain a low tracking error by actively managing the portfolio in line with the index.

A small portion of the net assets will be held as cash or will be invested in debt and money market instruments permitted by SEBI/RBI including TREPS or in alternative investment for the TREPS as may be provided by the RBI, subject to prior approval, if any, to meet the liquidity requirements under the scheme.

Under normal circumstances, the asset allocation will be as under:

Table 2: Asset Allocation for Navi Nifty India Manufacturing Index Fund

| Instruments |

Indicative Allocation (% of net assets) |

Risk Profile |

| Minimum |

Maximum |

High/Medium/Low |

| Equities and equity-related securities covered by Nifty India Manufacturing Index |

95 |

100 |

Medium to High |

| Debt & Money Market Instruments. |

0 |

5 |

Low to Medium |

(Source: Scheme Information Document)

About the Benchmark

The Nifty India Manufacturing Index aims to track the performance of stocks representing India's manufacturing sectors. The stocks are selected from a combined universe of Nifty 100, Nifty Midcap 150, and Nifty Smallcap 50 index.

A stock's weight in the Nifty India Manufacturing index is based on its free-float market capitalisation subject to the maximum weight of each stock at 5%. The index also has a minimum weight of 20% for certain manufacturing sectors.

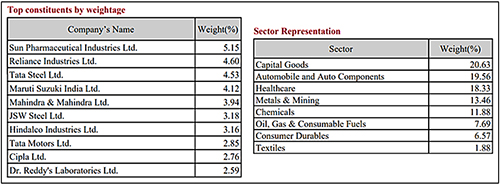

Here is the list of the top 10 constituents by weightage and sector representation of the index as of July 29, 2022:

(Source: NSE Nifty India Manufacturing Index)

(Source: NSE Nifty India Manufacturing Index)

Note, that the index will rebalance semi-annually.

Who will manage Navi Nifty India Manufacturing Index Fund?

The designated fund manager for this scheme is Mr Aditya Mulki. He is a CFA Charter holder and Bachelor of Commerce from Mumbai university. Prior to joining Navi Mutual Fund, he worked closely for 6 years at Quantum Advisors Ltd. as an Equity research analyst, covering consumable staples, consumer discretionary, building materials and the media sector.

At Navi Mutual Fund, Mr Mulki currently manages, Navi Nifty Next 50 Index Fund, Navi Nifty Bank Index Fund, Navi Nifty Midcap 150 Index Fund, Navi US Total Stock Market Fund of Fund, Navi Nasdaq100 Fund of Fund, Navi Large & Mid Cap fund, Navi Equity Hybrid Fund, Navi Flexi Cap Fund Navi Regular Savings Fund - Equity, Navi Equity Hybrid Fund - Equity, and Navi ELSS Tax Saver Fund.

Fund Outlook - Navi Nifty India Manufacturing Index Fund

Navi Nifty India Manufacturing Index Fund will seek to replicate the Nifty India Manufacturing Index, which tracks the performance of manufacturers among the top 300 companies in India.

The scheme will endeavour to simplify investing in the Indian manufacturing sector. It will provide easy and cost-effective access to the entire manufacturing landscape by investing in the underlying Nifty India Manufacturing index which is well diversified across various manufacturing segments and market caps.

The scheme allows investors to participate in the growth of key manufacturing segments, which are the government's focus areas through various initiatives like the Production Linked Incentive (PLI) scheme. Investors may generate optimal returns by investing in emerging spaces like Electric Vehicles, Defense electronics, battery tech, etc.

Although the scheme provides a relatively low-cost and rule-based investment approach to exposure to manufacturing themes, it is still prone to high market risks. Being a sector-oriented Index Fund, the Scheme will focus on investing in companies only under the manufacturing sector, which creates concentration risk. In addition, the persistent repercussions of the Russia-Ukraine conflict, rising interest rates, and spiralling inflation may pose a significant risk to economic growth.

While India has the potential to be the next manufacturing hub of the world, the right macro-economic environment is necessary. The manufacturing sector may remain under pressure and witness higher volatility in the near term. These factors, among many others, could have a bearing on the underlying index's performance and its top constituents and may affect the scheme's portfolio negatively if the sector moves out of favour.

The fortune of the Navi Nifty India Manufacturing Index Fund will depend on the performance of the underlying index. Thus, the scheme is a very high-risk investment proposition and suitable for investors possessing a decent understanding of the manufacturing segment and having a time horizon of at least 5-7 years.

PS: If you wish to select actively managed worthy mutual fund schemes, I recommend that you subscribe to PersonalFN's unbiased premium research service, FundSelect.

As a bonus, you get access to PersonalFN's popular debt mutual fund service, DebtSelect.

PersonalFN recommendations go through our stringent process that assesses both quantitative and qualitative parameters, providing you with Buy, Hold, and Sell recommendations on equity and debt mutual fund schemes. Read here for more details...

If you are serious about investing in rewarding mutual fund schemes, Subscribe now!

Warm Regards,

Mitali Dhoke

Research Analyst