SEBI Proposes Two Approaches to Performance-linked Expense Ratio for Mutual Funds

Divya Grover

May 23, 2023 / Reading Time: Approx. 7 mins

Listen to SEBI Proposes Two Approaches to Performance-linked Expense Ratio for Mutual Funds

00:00

00:00

The underperformance of various actively managed mutual fund schemes in the last few years has induced SEBI to sit up and take notice.

If you recall, I had mentioned in a recent article that in view of the above, SEBI is mulling the introduction of performance-linked expense ratio for mutual funds. More details have emerged on SEBI's plan to implement the same. But first, let's look at SEBI's observation that prompted it to mull this step.

[Read: What Is Expense Ratio in Mutual Funds, And How Is It Calculated?]

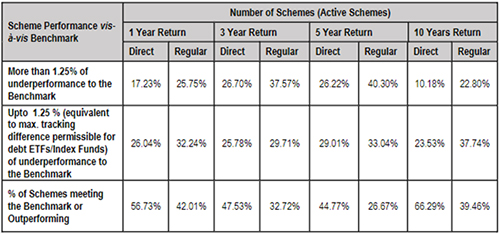

At present, fund houses charge management fees and expenses on a daily basis, regardless of the scheme's performance. An analysis of the performance data of active mutual fund schemes over a period of 1 year, 3 years, 5 years, and 10 years as on February 2023 indicates the following:

(Source: SEBI Consultation Paper)

(Source: SEBI Consultation Paper)

From the above, SEBI observed that the underperformance of Regular plans of mutual fund schemes is higher as compared to Direct plans. Further, more than 22% of the Regular plans of schemes have underperformance of more than 1.25% (equivalent to the maximum tracking difference permissible for debt ETFs/Index Funds) vis-a-vis the benchmark for all periods mentioned above.

SEBI further added that it can be argued that given that there are certain constraints applicable to mutual fund schemes which are not applicable to the benchmarks, and thus, the replication of benchmark's performance may not always be possible.

Even in the case of passive mutual fund schemes such as ETFs/Index Funds, which replicate the relevant benchmarks, there may be a variance between the performance of the schemes and the benchmarks.

According to SEBI, the underperformance of schemes can be, to an extent, attributed to the following factors/constraints which the benchmark does not have:

-

Sectoral, issuer level investment limits for mutual fund schemes

-

Scheme expenses (TER)

-

Transaction, liquidity, impact cost

-

Cost of rebalancing of the portfolio due to daily investment and redemptions in the scheme

Notwithstanding the above, SEBI stated that any significant underperformance of mutual funds versus its benchmark is not in the interest of unitholders. Further, AMCs outperforming the market may find merit in charging unitholders with performance-linked TER, wherein the management fee is based on scheme performance. Thus, SEBI is looking to explore the concept of variable TER based on the performance of the schemes. It has sought views on the same from the public.

How SEBI proposes to implement performance-linked expense ratio for mutual funds

SEBI has proposed that performance-linked TER can be enabled for active open-ended equity mutual fund schemes wherein AMCs can charge higher management fees if the scheme performance is more than an indicative return above the tracking difference adjusted benchmark (Tracking difference adjusted benchmark means benchmark returns adjusted for the permissible operational cost of managing the fund).

[Related link: Here is How SEBI is Planning to Overhaul the Expense Ratio for Mutual Fund Investments]

(Image source: www.freepik.com - photo created by jcomp)

(Image source: www.freepik.com - photo created by jcomp)

Join Now: PersonalFN is now on Telegram. Join FREE Today to get 'Daily Wealth Letter' and Exclusive Updates on Mutual Funds

Alternatively, AMC can be permitted to charge higher management fee based on a pre-decided hurdle rate, as may be disclosed in the SIDs. Such higher management fees under both models can be either at a fixed rate or on returns sharing basis. In such cases, the base expense ratio for mutual funds (for Direct and Regular plans) can be at TER limits as applicable for passive schemes, which are lower than active schemes. For this, SEBI has proposed two approaches:

Approach A: During the period in which the investor remains invested, the base expense ratio for mutual funds may be charged to the investor. At the time of redemption, the management fees may be charged if a return of more than the indicative rate is generated or annualised returns received by the investor is above the hurdle rate. The maximum management fees may also be specified to discourage fund managers from taking imprudent risks in order to earn higher fees. The NAV paid out at the time of redemption may be netted for the management fees, and the balance amount may be paid to the investor.

In simpler words, the fund house will charge a management fee only at the time of redemption and base expense ratio on a regular basis. If, at the time of redemption, an investor's money has grown higher than the benchmark (beyond a certain pre-determined limit), the fund house will be able to deduct a management fee. In this case, the net amount to be received by the investor will be slightly lower than the actual gains.

Approach B: There can be another approach where a higher expense limit for performance-based TER may be fixed, and TER inclusive of management fee is charged to the investor. The TER charged by the mutual funds in such cases should be based on the schemes' performance during the previous year. At the time of redemption by the investor, if AMC fails to generate a return above the indicative returns for the investor or the annualised returns for the investor are below the hurdle rate fixed in advance, the AMC may retain base TER as may be applicable and return the remaining expenses charged to the investor, along with the redemption amount.

In other words, mutual funds will charge management fee throughout the tenure of investment. If, at the time of redemption, the returns are lower than the pre-determined rate, the fund house will only charge the base expense ratio and will return the management fee charged to investors.

It will be optional for the AMCs to offer such a scheme(s). Further, as performance-based TER is a new concept for the Indian Mutual Fund industry, at this stage, SEBI has proposed to test the model under the Regulatory Sandbox. Meaning SEBI will test it in a regulatory environment before rolling out the proposal. Currently, only PMS (Portfolio Management Service) and AIF (Alternative Investment Fund), the investment vehicles used by high-net-worth individuals, follow the performance-linked expense ratio model.

Will the performance-linked expense ratio benefit investors?

SEBI expects the move to encourage funds to perform better by aligning the interest of fund managers with that of investors. But whether the move actually translates into better performance will be a challenge. Notably, mutual fund schemes are already rewarded for outperformance by way of higher inflows from investors.

[Read: Does the Expense Ratio Matter to Select the Best Mutual Fund Schemes?]

There might be several possible downsides to performance-based expense ratios for mutual funds. It is possible that the performance-linked expense ratio will prompt fund managers to undertake excess risk in a bid to generate better returns. Some schemes might resort to focusing on short-term gains, thereby compromising long-term growth. The move may also make it challenging for investors to choose between plans based on different expense ratio options.

Thus, SEBI will have to carefully evaluate its options and select the one which is in the best interest of the mutual fund investors.

DIVYA GROVER is the co-editor for FundSelect, the flagship research service of PersonalFN. She is also the co-editor of DebtSelect. Divya is an avid reader which helps her in analysing industry trends and producing insightful articles for PersonalFN’s popular newsletter – Daily Wealth letter, read by over 1.5 lakh subscribers.

Divya joined PersonalFN in 2019 and has since then used stringent quantitative and qualitative parameters to analyse funds to provide honest and unbiased research to investors. She endeavours to enable investors to make an informed investment decision and thereby safeguard their wealth.

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing.

Disclaimer: This article is for information purposes only and is not meant to influence your investment decisions. It should not be treated as a mutual fund recommendation or advice to make an investment decision.