What Are Hybrid Mutual Funds? Top 3 Aggressive Hybrid Mutual Funds for 2025

Mitali Dhoke

Nov 12, 2024 / Reading Time: Approx. 15 mins

Listen to What Are Hybrid Mutual Funds? Top 3 Aggressive Hybrid Mutual Funds for 2025

00:00

00:00

In today's dynamic financial market, investors are constantly on the lookout for investment options that offer a balance between growth and stability. Hybrid mutual funds stand out as one such investment avenue, merging the benefits of equity and debt assets into a single fund to cater to varied investment needs.

This unique allocation allows hybrid funds to absorb market shocks better than pure equity funds while providing greater growth potential than fixed-income investments alone. For investors looking for stability and growth, hybrid funds can offer the best of both worlds. Importantly, in times of economic uncertainty, the debt portion in hybrid funds helps cushion the portfolio against potential equity downturns.

What Are Hybrid Mutual Funds?

Hybrid mutual funds are a category of mutual funds that invest in a mix of asset classes, primarily equity and debt, to create a balanced portfolio. The goal of these funds is to reduce risk through diversification while still providing reasonable returns. By combining the growth potential of equity investments with the stability of debt instruments, hybrid funds cater to both conservative and aggressive investors.

Hybrid mutual funds come in several types, each with its asset allocation strategy. Some lean more toward equity for capital appreciation, while others prioritize debt for stability. They offer investors the advantage of a diversified portfolio within a single fund, managed by professionals to align with market conditions and investor goals.

[Read: How Hybrid Mutual Funds Can Help Investors Benefit from Best of Both Worlds]

Types of Hybrid Mutual Funds

The Securities and Exchange Board of India (SEBI) categorizes hybrid mutual funds based on their equity and debt allocations. Here's a breakdown of the types of hybrid funds:

-

Conservative Hybrid Funds

Conservative hybrid funds allocate a larger portion of their investments to debt (75-90%) and a smaller portion to equity (10-25%). This conservative allocation aims to provide stability and moderate returns, making them suitable for investors with low-risk tolerance.

-

Balanced Hybrid Funds

Balanced hybrid funds maintain an almost equal allocation in equity and debt, generally ranging from 40-60% in each asset class. They provide a balance between growth and income, ideal for investors looking for moderate risk and steady returns.

-

Aggressive Hybrid Funds

Aggressive hybrid funds invest predominantly in equity (65-80%) and the remaining in debt (20-35%). These funds aim for higher returns than conservative funds but come with a high level of risk. They are suitable for investors who can tolerate some market fluctuations and are seeking a blend of capital appreciation and stability.

-

Dynamic Asset Allocation or Balanced Advantage Funds

These funds have a flexible asset allocation strategy and can adjust their equity and debt exposure based on market conditions. They provide the flexibility to navigate market cycles, aiming to limit downside risk while capitalizing on growth opportunities.

-

Multi-Asset Allocation Funds

These funds invest across three or more asset classes, such as equity, debt, and gold, with a minimum of 10% allocated to each asset. Multi-asset funds are designed to diversify across various assets to minimize risk and maximize returns in different market conditions.

-

Arbitrage Funds

Arbitrage funds primarily invest in equity but use arbitrage opportunities (buying and selling the same stock in different markets) to generate returns. They are considered low-risk since the focus is on profiting from price differences in different markets, rather than direct market exposure.

-

Equity Savings Funds

Equity savings funds invest in equity, debt, and arbitrage, providing a blend of growth and income. They aim to benefit from equity returns while keeping risk levels in check through debt and arbitrage strategies.

[Read: The Ultimate Guide to the Best SIP Plans for 2025]

Advantages of Investing in Hybrid Mutual Funds

Hybrid mutual funds offer several advantages that make them appealing to a broad range of investors:

-

Diversification in a Single Fund: Hybrid funds provide exposure to both equity and debt markets within a single investment. This diversification helps mitigate risks as the debt component can cushion the impact of market downturns on the equity segment.

-

Balanced Risk and Return: By combining equity and debt, hybrid funds aim to balance risk and reward. Equity allocations offer growth potential, while debt investments provide stability, making these funds suitable for investors with moderate risk tolerance.

-

Professional Management: Hybrid funds are managed by professionals who monitor market conditions and adjust the asset allocation accordingly. This management helps investors navigate market fluctuations and aims to deliver optimal returns.

-

Tax Efficiency: Aggressive hybrid funds, with an equity allocation of over 65%, are taxed like equity funds, offering more favourable tax treatment compared to pure debt funds. This can result in lower tax liability for investors on long-term gains.

-

Regular Income: Some hybrid funds, such as balanced advantage and conservative hybrid funds, provide options for periodic dividends, which can be appealing to investors looking for regular income alongside capital growth.

-

Lower Volatility Compared to Pure Equity Funds: Hybrid funds typically experience lower volatility than pure equity funds. The debt component acts as a buffer against sudden market downturns, offering a smoother investment experience.

Why It Makes Sense to Invest in Aggressive Hybrid Funds Now

In the current market scenario, with global uncertainties and fluctuating interest rates, aggressive hybrid funds provide a balanced approach. Here are key reasons why investing in aggressive hybrid funds makes sense:

1. Market Resilience

The Indian equity market is expected to show resilience, but volatility is inevitable. Aggressive hybrid funds offer higher growth potential through their equity exposure, while the debt component provides a cushion during market fluctuations.

2. Long-Term Growth Potential

With a long-term investment horizon, aggressive hybrid funds can deliver substantial returns as equity markets grow over time. This makes them suitable for investors with moderate risk tolerance looking to build wealth over the years.

3. Balanced Tax Efficiency

As aggressive hybrid funds are taxed similarly to equity funds, they are more tax-efficient for investors in the long term, especially with indexation benefits on long-term capital gains.

4. Inflation-Beating Returns

The equity exposure in aggressive hybrid funds offers the potential to beat inflation over time. This makes them suitable for investors seeking growth that can outpace rising costs.

[Read: Best Mutual Funds to Invest Now]

Although Aggressive Hybrid Funds must follow SEBI's investment guidelines, they have considerable flexibility to adjust their portfolios according to changing market conditions. When the market outlook is positive, these funds can increase their equity exposure. Conversely, if the equity market appears overvalued, they can partially reduce their equity holdings and shift the proceeds into debt instruments for stability.

For those who are new to equities or seeking a diversified option that adapts to market shifts, aggressive hybrid funds provide a well-rounded solution. Their ability to adjust equity and debt proportions in response to market conditions allows investors to potentially enjoy capital growth while managing downside risk.

Data as of October 31, 2024

Data as of October 31, 2024

Past performance is not an indicator of future returns

(Source: ACE MF, data collated by PersonalFN)

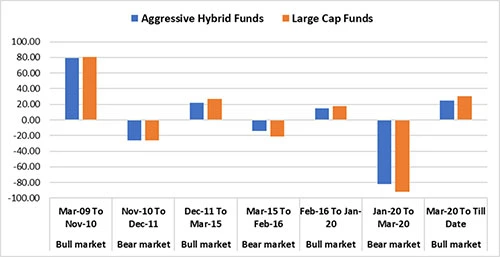

As you can see from the above graph, aggressive hybrid funds appear to have managed downside risk better than large-cap funds during bear markets. For instance, in the January 2020 to March 2020 bear market, aggressive hybrid funds experienced a significantly smaller negative return compared to large-cap funds. This resilience in hybrid funds likely stems from their diversified asset allocation, which includes both equity and debt.

Additionally, while both aggressive hybrid and large-cap funds perform similarly during bull markets, aggressive hybrid funds provide added downside protection, showcasing their value as a balanced investment option.

In an uncertain market environment, Aggressive Hybrid Funds provide flexibility to adapt to changing conditions, rebalancing equity and debt allocations as needed. This suggests that when markets are favourable, aggressive hybrid funds can capture growth opportunities, and in periods of volatility, they can rely on debt to provide a buffer against losses.

3 Best Aggressive Hybrid Mutual Funds for 2025

Here are three top-performing aggressive hybrid mutual funds that stand out based on historical performance, fund management, and growth potential for 2025.

Top Performing Aggressive Hybrid Funds for 2025

Data as of October 31, 2024

Past performance is not an indicator of future returns

(Source: ACE MF, data collated by PersonalFN)

Best Aggressive Hybrid Fund for 2025 #1: ICICI Prudential Equity & Debt Fund

Managed by one of India's top fund houses, the ICICI Prudential Equity & Debt Fund has a well-balanced portfolio with a significant allocation to large-cap stocks and a diverse range of debt securities. Launched in November 1999, ICICI Prudential Equity & Debt Fund has been in existence for almost 25 years.

Since its inception, the fund has shown superior performance, generating returns at around 15.52% CAGR and holds an AUM of Rs 40,203.38 crores. It currently has an NAV of Rs 371.68 and the expense ratio is 0.98% (as of October 31, 2024)

| Top Holdings |

Sector |

Allocation (%) |

| Government of India |

G-Sec |

6.80 |

| NTPC Ltd. |

Power |

6.47 |

| ICICI Bank Ltd. |

Bank |

6.29 |

| HDFC Bank Ltd. |

Bank |

5.52 |

| Maruti Suzuki India Ltd. |

Automobile & Ancillaries |

4.76 |

Past performance is not an indicator of future returns.

The securities quoted are for illustration only and are not recommendatory.

Portfolio data as of October 31, 2024

(Source: ACE MF, data collated by PersonalFN)

The equity component of the fund is diversified across sectors, capturing growth opportunities in various segments of the economy, while the debt allocation serves as a cushion to mitigate risks during market downturns. The fund's debt portfolio primarily consists of highly liquid sovereign-rated G-Secs, supplemented by some allocation to moderate-rated corporate debt instruments, which can enhance the returns.

The ICICI Prudential Equity & Debt Fund has shown a strong performance track record, consistently delivering competitive returns compared to its peers in the aggressive hybrid category. Over the past 3, 5, and 7-year periods, it has typically outperformed the benchmark index in most market conditions, demonstrating resilience even in volatile phases.

Best Aggressive Hybrid Fund for 2025 #2: Bank of India Mid & Small Cap Equity & Debt Fund

The BOI Mid & Small Cap Equity & Debt Fund is a hybrid fund that combines exposure to high-growth potential in mid and small-cap equities with the stabilizing influence of debt instruments. This unique mix offers investors an opportunity to capitalize on the higher growth typically associated with smaller companies while mitigating risk through a strategic allocation in debt.

Launched in July 2016, BOI Mid & Small Cap Equity & Debt Fund holds an AUM of Rs 1009.82 crores. Since its inception, the fund has shown superior performance, generating returns at around 17.45% CAGR and the expense ratio at 0.95% (as of October 31, 2024)

| Top Holdings |

Sector |

Allocation (%) |

| National Bank For Agriculture & Rural Development |

Bank |

4.43 |

| Small Industries Development Bank of India |

Bank |

3.37 |

| Jindal Stainless Ltd. |

Iron & Steel |

2.74 |

| Government of India |

G-Sec |

2.27 |

| Nippon Life India Asset Management Ltd. |

Finance |

2.21 |

Past performance is not an indicator of future returns.

The securities quoted are for illustration only and are not recommendatory.

Portfolio data as of October 31, 2024

(Source: ACE MF, data collated by PersonalFN)

In favourable market conditions, mid- and small-cap stocks tend to outperform, driving fund returns. Conversely, during volatile or bearish phases, the debt component helps to buffer against potential losses, offering some stability. To manage the inherent volatility of mid-and small-cap stocks, the fund invests a portion of its assets in high-quality debt instruments. This allocation helps balance the portfolio, offering stability during market downturns and reducing overall risk.

Since its inception, the fund's performance has been influenced by market trends in the mid-and small-cap space, which can be more volatile but also have significant upside potential. As the scheme matures, investors may expect this fund to show a track record that mirrors market trends in mid and small-cap equity while cushioning downturns through strategic debt allocation.

Best Aggressive Hybrid Fund for 2025 #3: Quant Absolute Fund

The Quant Absolute Fund is an actively managed scheme within the Aggressive Hybrid Fund category, employing a dynamic investment strategy. The fund has delivered exceptional performance in recent years and currently leads the returns rankings over extended periods.

Launched in March 2001, Quant Absolute Fund holds an AUM of Rs 2,250.71 crores. Since its inception, the fund has shown superior performance, generating returns at around 17.97% CAGR with a lower expense ratio of 0.70% (as of October 31, 2024) compared to its peers.

| Top Holdings |

Sector |

Allocation (%) |

| Reliance Industries Ltd. |

Crude Oil |

9.36 |

| ITC Ltd. |

FMCG |

9.29 |

| JIO Financial Services Ltd. |

Finance |

7.25 |

| Government of India |

G-Sec |

6.98 |

| Treasury Bills |

G-Sec |

6.55 |

Past performance is not an indicator of future returns.

The securities quoted are for illustration only and are not recommendatory.

Portfolio data as of October 31, 2024

(Source: ACE MF, data collated by PersonalFN)

Quant Absolute Fund has demonstrated a robust market performance, particularly due to its dynamic asset allocation strategy, which allows it to adjust its equity and debt exposure based on prevailing market conditions. This flexibility has enabled the fund to adapt to both bullish and bearish phases, which is crucial for delivering consistent returns over the long term.

While the fund does experience volatility typical of aggressive hybrid funds, it offers a strong risk-return profile over the medium to long term. Investors can expect steady growth potential, making it a solid choice for those with a higher risk appetite who are focused on long-term capital appreciation.

However, as always, investors need to evaluate the fund's recent performance in line with market conditions before making investment decisions.

In conclusion, hybrid mutual funds offer a robust investment solution for today's volatile market conditions. Their diversified asset mix, tailored risk options, and professional management make them a prudent choice for both conservative and growth-oriented investors. For those seeking stability with moderate growth potential, hybrid funds may be the right choice to weather market turbulence while building a resilient portfolio.

We are on Telegram! Join thousands of like-minded investors and our editors right now.

MITALI DHOKE is a Research Analyst at PersonalFN. She is an MBA (Finance) and a post-graduate in commerce (M. Com). She focuses primarily on covering articles around mutual funds including NFOs, financial planning and fixed-income products. Mitali holds an overall experience of 4 years in the financial services industry.

She also actively contributes towards content creation for PersonalFN’s social media platforms in the endeavour to educate investors and enhance their financial knowledge.

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing.

This article is for information purposes only and is not meant to influence your investment decisions. It should not be treated as a mutual fund recommendation or advice to make an investment decision in the above-mentioned schemes.