What Home Loan Borrowers Expect from the Interim Budget 2024

Rounaq Neroy

Jan 30, 2024 / Reading Time: Approx. 5 mins

Listen to What Home Loan Borrowers Expect from the Interim Budget 2024

00:00

00:00

The interest rates in India have remained elevated ever since the time the RBI increased the policy repo rate to fight high inflation.

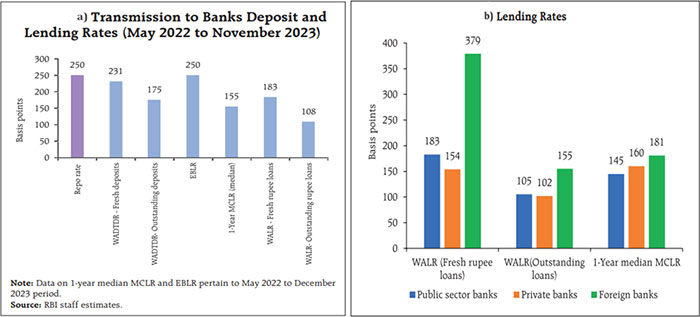

In response to the 250 basis points (bps) increase in the policy repo rate since May 2022, the Scheduled Commercial Banks (SCBs) hiked their External Benchmark Lending Rates (EBLRs) by a similar magnitude, while the Marginal Cost of funds Lending Rate (MCLR) increased by 155 bps. Concurrently, the Weighted Average Lending Rate (WALR) on fresh loans and outstanding rupee loans also increased by 183 bps and 108 bps during the period May 2022 to November 2023, according to the RBI data.

Graphs A and B: Transmission of Policy Rates

(Source: RBI Bulletin, January 2024)

(Source: RBI Bulletin, January 2024)

The transmission of the policy rate hikes has happened across bank groups, but the lending rates of Public Sector Banks (PSBs) remained lower than the private sector banks.

[Read: Will the New Year 2024 See Home Loan Rates Going Down]

If inflation moves up owing to geopolitical risks, supply chain disruptions, and weather conditions such as El Nino, lowering the policy repo rate (to support growth) would be challenging for the RBI.

Taking cognisance of the risk to the inflation trajectory, the RBI has remained focused on the withdrawal of accommodation to ensure that inflation progressively aligns with the target while supporting growth.

In a Bloomberg television interview on the sidelines of the World Economic Forum in Davos, RBI Governor, Mr Shaktikanta Das has stated, "Unless we see clear evidence that inflation is going to sustain at that level, it will be premature to talk about rate cuts". He has reiterated that the RBI's monetary policy will be "actively disinflationary."

For home loan (and other loans) borrowers, what this means is that those with floating-rate loans will have to bear higher interest costs.

Besides, a fact is the price of buying and/or constructing a house, particularly in the metros, has got dearer after the COVID-19 pandemic -- since it generated a demand for bigger homes and significant surge in property prices (owing to rising construction costs, viz. raw material, land, and labour).

In such times, it is natural, especially for home loan borrowers, to expect some tax relief from Finance Minister, Ms Nirmala Sitharaman in the Interim Budget 2024 announcements.

In the last Interim Budget 2019 (which was presented by Mr Piyush Goyal, as Mr Arun Jaitley was unwell and undergoing surgery in the U.S), the government proposed to exempt the levy of income tax on notional rent on a second Self-Occupied house Property (SOP), plus, some tax benefits for the real estate sector in the affordable housing category.

From the Interim Budget 2024, one of the longstanding expectations is that the current deduction limit of Rs 2 lakh for the interest paid on a home loan EMI in the case of Self-Occupied Property (SOP) available under Section 24(b) of the Income Tax Act, 1961 be increased to around Rs 4 or 5 lakh.

This is quite justified, given that home loan interest rates and property prices have moved up over the last couple of years.

Furthermore, the definition of 'affordable housing' should be looked at for the value, i.e. to include homes costing around Rs 65 lakh (from the present Rs 45 lakh) and carpet area of around 90 square meters (from the current 60 square meters).

A fact is that a majority (around 60%) of the residential property investments in India are for end-use (primary home) and not for investment purposes. Given this, the government should also consider extending the deduction available for first-time homebuyers (as available under Section 80EEA of the Income Tax Act 1961).

Increasing the deduction limit for SOP property, as well as for first-time homebuyers, and changing the definition of 'affordable housing' could also provide thrust to the residential real estate sector as a whole. These are reasonable expectations of the common man.

I do not see a separate deduction for the principal amount paid on the housing loan. It would continue to be part of the Section 80C deduction limit of Rs 1.50 lakh. This limit is unlikely to be altered ahead of polls.

Happy Planning and Investing!

We are on Telegram! Join thousands of like-minded investors and our editors right now.

-New.png)

ROUNAQ NEROY heads the content activity at PersonalFN and is the Chief Editor of PersonalFN’s newsletter, The Daily Wealth Letter.

As the co-editor of premium services, viz. Investment Ideas Note, the Multi-Asset Corner Report, and the Retire Rich Report; Rounaq brings forth potentially the best investment ideas and opportunities to help investors plan for a happy and blissful financial future.

He has also authored and been the voice of PersonalFN’s e-learning course -- which aims at helping investors become their own financial planners. Besides, he actively contributes to a variety of issues of Money Simplified, PersonalFN’s e-guides in the endeavour and passion to educate investors.

He is a post-graduate in commerce (M. Com), with an MBA in Finance, and a gold medallist in Certificate Programme in Capital Market (from BSE Training Institute in association with JBIMS). Rounaq holds over 18+ years of experience in the financial services industry.

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing.

This article is for information purposes only and is not meant to influence your investment decisions. It should not be treated as a mutual fund recommendation or advice to make an investment decision in the above-mentioned schemes.