Court Asks Franklin Templeton Not to Go Ahead With Winding-Up of Schemes without Investors’ Consent

Listen to Court Asks Franklin Templeton Not to Go Ahead With Winding-Up of Schemes without Investors’ Consent

00:00

00:00

Six months after Franklin Templeton wound up six of its debt schemes, the Karnataka High Court has pronounced its judgement in the case. If you recall, the Supreme Court had transferred all legal cases relating to winding up of the schemes to Karnataka High Court in June and directed that the matter be completed within 3 months.

The Karnataka High Court has ruled that FT cannot go ahead with the winding up of the schemes without obtaining the consent of a simple majority of unitholders.

However, the court has stayed its order for 6 weeks to give the parties a chance to approach the SC. This means that the voting process will not be held any time soon. During this period, the schemes will continue to remain frozen for redemptions (by unitholders). The fund house and the trustees cannot make any borrowing or create any liability during this period.

What does it mean for investors in the shuttered schemes?

The court's decision means that the winding up of schemes will be held valid only if the unitholders' consent is received. Once the decision is held valid, disbursal of the amount from the respective schemes can be made after it turns cash positive.

photo created by freepik - www.freepik.com

photo created by freepik - www.freepik.com

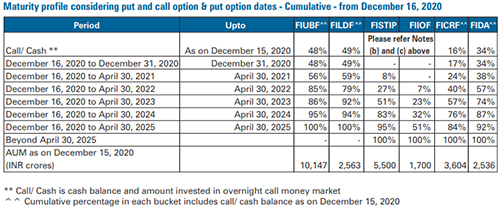

Till now 4 out of 6 schemes have turned cash positive after repaying the borrowings. These are Franklin India Ultra Short Bond Fund (FIUBF), Franklin India Dynamic Accrual Fund (FIDA), Franklin India Low Duration Fund (FILDF), and Franklin India Credit Risk Fund (FICRF),. Franklin India Short Term Income Plan (FISTIP), and Franklin India Income Opportunities Fund (FIIOF) still have outstanding borrowings.

FT has received Rs 8,262 crore as of September 30 from the six schemes in the form of maturities, prepayments and coupons. Of this, Rs 5,084 crore is available for distribution to unitholders in the four cash positive schemes.

What if unitholders' consent is not received?

If the decision of winding up is held invalid (due to non-consent of unitholders), the schemes will have to be reopened for redemption. It is likely that the schemes will receive severe redemption pressure once that happens. Consequently, to meet these requests the schemes will have to undertake sale of assets at deep discount, which would negatively impact the NAV of the schemes. The fund house may thus set withdrawal limits to deal with redemption requests.

Table: Expected timeline of payout from wound-up schemes of FTMF

(Source: Franklin Templeton Mutual Fund)

(Source: Franklin Templeton Mutual Fund)

Court raps SEBI

The Karnataka HC has rapped SEBI for its handling of the FT fiasco. As per court's observation, SEBI failed to reply to the letter in which the trustees sought permission and guidance of the regulator for winding up of the schemes. It also criticized SEBI for failing to enquire whether compliance of sub-clauses (a) and (b) clause (3) of Regulation 39 (that deals with notice for disclosing the circumstances leading to the closure the scheme) was made by the trustees

"As a watchdog, SEBI was expected to play a very proactive role by questioning the AMC, trustees, and sponsor about the compliances with the provisions of the MF regulations. The investors/unitholders of the said schemes will be justified in their criticism that SEBI was a silent spectator," the court stated in its 336-page judgement.

Though the court did not delve into the correctness of the investments made by the fund house, it has directed SEBI to take appropriated action within 6 weeks once the regulator receives the final forensic audit report. Notably, SEBI had ordered a forensic audit to determine if there had been any regulatory violation by the fund management team in handling the transactions of the schemes. Unitholders will not be entitled to receive a copy of the forensic report.

Meanwhile, FT has said that it may appeal certain aspects of the HC order in the apex court. If SC admits the case and stays the winding up of schemes, it could further delay the recovery timeline for investors.

Warm Regards,

Divya Grover

Research Analyst

Join Now: PersonalFN is now on Telegram. Join FREE Today to get ‘Daily Wealth Letter’ and Exclusive Updates on Mutual Funds