DSP Nifty SDL Plus G-Sec Jun 2028 30:70 Index Fund: Should You Invest?

Mitali Dhoke

Mar 15, 2022

Listen to DSP Nifty SDL Plus G-Sec Jun 2028 30:70 Index Fund: Should You Invest?

00:00

00:00

A Target Maturity Fund is an ideal solution for investors with a set Investment horizon, the strategy aims to negate any duration risk for investors who remain invested through the life of the fund. These funds predominantly invest in government securities, public sector undertakings (PSU) bonds, and state development loans (SDLs) and provide some degree of return predictability for those who stay invested until the maturity of the scheme.

Many fund houses have recently launched target maturity funds that are managed passively, such funds hold a bond-like structure with fixed maturity positioned to capture predictable and stable returns at maturity. Investors can potentially benefit from the current steepness in rates by investing in Target Maturity Funds.

DSP Mutual Fund has launched DSP Nifty SDL Plus G-Sec Jun 2028 30:70 Index Fund, an open-ended target maturity index fund investing in the constituents of the Nifty SDL Plus G-Sec Jun 2028 30:70 Index. A relatively high-interest rate risk and relatively low credit risk.

On the launch of this fund, Mr Sandeep Yadav, Head-fixed income at DSP Investment Managers, said, "About 70% of the investment in the fund is in G-Secs. The spreads between G-Sec and SDL are amongst the lowest ever. At such low spreads, it makes sense to have more investment in G-Secs than SDLs, given the relatively safer risk profiles of G-Secs. Also, we are of the view that the yield curve's rise is steep till 2028, and after that, its rise is relatively less. Since the annual spreads increase till 2028 and then flatten, the six-year point is the attractive point for a predictable passive strategy."

Table 1: Details of DSP Nifty SDL Plus G-Sec Jun 2028 30:70 Index Fund

| Type |

An open-ended target maturity index fund investing in the constituents of Nifty SDL Plus G-Sec Jun 2028 30:70 Index. A relatively high-interest rate risk and relatively low credit risk. |

Category |

Index Fund |

| Investment Objective |

The investment objective of the scheme is to track the Nifty SDL Plus G-Sec Jun 2028 30:70 Index by investing in Government Securities (G-Sec) and SDLs, maturing on or before June 2028 and seeks to generate returns that are commensurate (before fees and expenses) with the performance of the underlying Index, subject to tracking error. However, there is no assurance that the objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. |

| Min. Investment |

Rs 500 and in multiples of Re 1/- thereafter. Additional Purchase Rs 500/- and in multiples of Re. 1 thereafter. |

Face Value |

Rs 10/- per unit |

| SIP/SWP/STP |

Available |

|

|

| Plans |

|

Options |

- Growth

- Income Distribution cum capital withdrawal (IDCW)

|

| Entry Load |

Not Applicable |

Exit Load |

Nil |

| Fund Manager |

- Mr Laukik Bagwe

- Mr Vikram Chopra

|

Benchmark Index |

Nifty SDL Plus G-Sec Jun 2028 30:70 Index |

| Issue Opens |

March 11, 2022 |

Issue Closes |

March 17, 2022 |

(Source: Scheme Information Document)

The investment strategy for DSP Nifty SDL Plus G-Sec June 2028 30:70 Index Fund will be as follows:

DSP Nifty SDL Plus G-Sec June 2028 30:70 Index Fund seeks to track the Nifty SDL Plus G-Sec Jun 2028 30:70 Index subject to tracking errors. Accordingly, the scheme will invest in G-Secs and SDLs maturing within the maturity date of the Scheme. The Scheme is a Target Maturity Date Index Fund. It will mature on 30 June 2028 and will distribute all of its maturity proceeds (Net Assets) to the Unitholders within 10 (Ten) Business days from the date of maturity of the Scheme, in line with current regulatory timelines.

(Image Source: www.freepik.com)

(Image Source: www.freepik.com)

Join Now: PersonalFN is now on Telegram. Join FREE Today to get 'Daily Wealth Letter' and Exclusive Updates on Mutual Funds

The Scheme will follow Buy & Hold investment strategy. Existing bonds will be held until maturity unless sold for meeting redemptions, payment of IDCW, rebalancing requirement, or optimizing portfolio construction process. The portfolio of eligible securities invested by the Scheme is expected to have, in aggregate, fundamental characteristics such as modified duration, weighted average maturity, aggregate credit ratings, aggregate Yield To Maturity (YTM) etc. along with other liquidity parameters in line with the Nifty SDL Plus G-Sec Jun 2028 30:70 Index.

The Issuer weight of the Scheme will be in line with the Issuer weights in the Index subject to suitability and availability of the eligible G-Secs and SDLs from time to time. The Scheme may also participate in new issuances / private placement by the eligible issuers which are currently not part of the index but will eventually get included in the index during the next rebalancing period in line with the SEBI circular no. SEBI/HO/IMD/DF3/CIR/P/2019/147 dated November 29, 2019.

The Scheme may participate in such issuances only if they meet all eligibility criteria as defined by the index and suitable from an asset allocation perspective and other parameters of the Scheme. Further, the norms as indicated in para (1) of SEBI circular no. SEBI/HO/IMD/DF3/CIR/P/2019/147 dated November 29, 2019 reproduced below shall be adopted for the SDL portion of the index -

(a) The constituents of the index shall be aggregated at the issuer level.

(b) The index shall have a minimum of 8 issuers.

(c) No single issuer shall have more than 15% weight in the index.

(d) The rating of the constituents of the index shall be investment grade.

(e) The constituents of the index shall have a defined credit rating and defined maturity as specified in the index methodology.

The Scheme's exposure to money market instruments will be in line with the Asset Allocation table.

Under normal circumstances, the Asset Allocation will be as under:

Table 2: Asset Allocation for DSP Nifty SDL Plus G-Sec Jun 2028 30:70 Index Fund

| Instruments |

Indicative Allocation (% of net assets) |

Risk Profile |

| Minimum |

Maximum |

High/Medium/Low |

| Government Securities forming part of the G-Sec portion of Nifty SDL Plus G-Sec Jun 2028 30:70 Index |

95 |

100 |

Low to Medium |

| # State Development Loans (SDLs) forming part of the SDL portion Nifty SDL Plus G-Sec Jun 2028 30:70 Index |

| *Money Market Instruments including cash and cash equivalents |

0 |

5 |

Low |

*Money Market Instruments will include Triparty REPO (TREPS), Commercial Paper, Certificates of Deposit, Treasury Bills, Bills Rediscounting, Repos, short-term Government securities and any other such short-term instruments as permitted by SEBI / RBI from time to time, including schemes of mutual funds.

(Source: Scheme Information Document)

About the Benchmark

The Nifty SDL Plus G-Sec Jun 2028 30:70 Index seeks to measure the performance of the portfolio of SDLs and G-Secs maturing during the twelve-month period ending June 30, 2028. The proportion of investment into SDLs & G-Secs is in the ratio of 30:70.

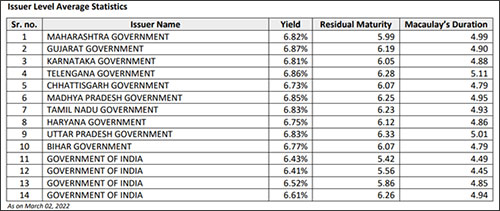

Here's the list of top constituents under the Nifty SDL Plus G-Sec Jun 2028 30:70 Index:

(Source: NSE Nifty SDL Plus G-Sec Jun 2028 30:70 Index)

(Source: NSE Nifty SDL Plus G-Sec Jun 2028 30:70 Index)

Note that all papers will mature on or before June 30, 2028 and the index will be rebalanced on an annual basis.

Who will manage DSP Nifty SDL Plus G-Sec Jun 2028 30:70 Index Fund?

Mr Laukik Bagwe and Mr Vikram Chopra will be the designated fund managers for this scheme.

Mr Laukik Bagwe has over 21 years of experience in the financial services industry. He is a B.Com graduate and has completed PGDBA (Finance). Before joining DSP, he was associated with Derivium Capital & Securities Private Limited - Head Fixed Income- Trading - SLR & NONSLR Broking and Birla Sunlife Securities Ltd. - Manager - SLR & NONSLR Broking.

At DSP AMC, Mr. Bagwe currently manages DSP Fixed Maturity Plans, DSP US Flexible^ Equity Fund, DSP Short Term Fund, DSP Low Duration Fund, DSP Global Allocation Fund, DSP Credit Risk Fund, DSP Floater Fund, DSP Banking & PSU Debt Fund, DSP Government Securities Fund, DSP Dynamic Asset Allocation Fund, DSP Strategic Bond Fund and DSP 10Y G-sec Fund.

Mr Vikram Chopra has over 20 years of experience in financial services. He holds PGDM (MBA) and B.Com. (HONS) degree. Prior to joining DSP, he was working as Fund Manager at L&T Mutual Fund, Fund Manager at Fidelity Mutual Fund, as Manager at IDBI Bank and Manager at Axis Bank.

At DSP AMC, Mr. Chopra currently manages DSP 10Y G-sec Fund, DSP Banking & PSU Debt Fund, DSP Equity & Bond Fund, DSP Government Securities Fund, DSP Regular Savings Fund, DSP Short Term Fund and DSP Strategic Bond Fund.

Fund Outlook - DSP Nifty SDL Plus G-Sec Jun 2028 30:70 Index Fund

DSP Nifty SDL Plus G-Sec Jun 2028 30:70 Index Fund is a passively managed index fund that aims to replicate the performance of the Nifty SDL Plus G-Sec Jun 2028 30:70 Index, subject to tracking errors. The scheme seeks to invest in G-Secs and State Development Loans (SDLs) under the index issued and backed by the government that matures on June 30, 2028.

The scheme will have a combination of highly liquid G-Secs and a selective list of SDLs with low leverage and high liquidity, all which are maturing during the 12-month period ending 30 June 2028. The scheme invests in sovereign securities only and the proportion of investment is 30:70 (i.e., 70% in G-Secs and 30% in SDLs).

The scheme provides investors an exposure to Government-backed instruments like G-Secs and SDLs, allows them to buy/sell as required without any lock-in period. The target maturity approach offers investors the benefit of indexation and to invest in individual G-Secs/SDLs passively through a mutual fund structure. Although the scheme may offer a low credit risk, do note that it is still prone to market risks.

As per the Union Budget 2022-23, there may be higher-than-expected government borrowings of the Central and State governments that can negatively impact the government bond yields. The Indian bond markets have already displayed discomfort in this respect, plus owing to the fact that is going forward, RBI is on the path to monetary policy normalisation.

In addition, the US Federal Reserve's announcement of a hike in interest rates from March 2022 and the recent geopolitical tension between Russia-Ukraine is also weighing down on the Indian debt market sentiments. As a result, the bond market is expected to remain volatile in the near term. The interest rate risk amidst the dynamic market conditions is likely to have a bearing on the scheme's performance.

Thus, DSP Nifty SDL Plus G-Sec Jun 2028 30:70 Index Fund is suitable for investors with a moderate risk profile looking forward to generating income over the long-term and ensuring that your investment horizon matches the fund's portfolio duration.

PS: If you wish to select actively managed worthy mutual fund schemes, I recommend that you subscribe to PersonalFN's unbiased premium research service, FundSelect.

As a bonus, you get access to PersonalFN's popular debt mutual fund service, DebtSelect.

PersonalFN adheres to a stringent process that assesses both quantitative and qualitative parameters providing you with Buy, Hold, and Sell recommendations on equity and debt mutual fund schemes. Read here for more details...

If you are serious about investing in rewarding mutual fund schemes, Subscribe now!

Warm Regards,

Mitali Dhoke

Jr. Research Analyst