A Spree of New Mutual Funds to Hit the Market Soon. Will They Be Worth Considering?

Listen to A Spree of New Mutual Funds to Hit the Market Soon. Will They Be Worth Considering?

00:00

00:00

After over 2-months of pandemic-induced severe lockdown which brought major economic activities to a grinding halt, the government recently announced phased reopening of various business and other operations.

As the sentiments improved the equity market too recovered from its lows of March and is likely to have bottomed out. The reopening of economy is expected to drive demand in the coming months which bodes well for corporate earnings and the financial markets.

[Read: Will Rain God Be Kind On Your Investment Returns?]

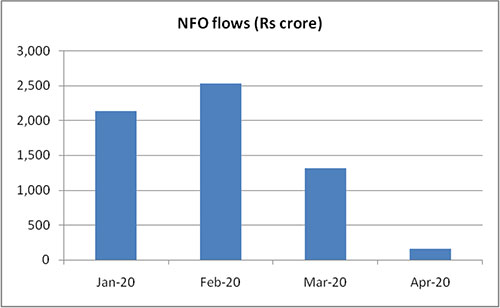

To capitalize on this expected recovery in the market, various fund houses are gearing up to launch new schemes. NFOs are gathering pace after witnessing 2 months of low number of launches.

Axis Mutual Fund, SBI Mutual Fund, ICICI Pru Mutual Fund, Motilal Oswal Mutual Fund, Mahindra Mutual Fund, Principal Mutual Fund, and HSBC Mutual Fund have recently filed draft papers with SEBI for the launch of new schemes.

Graph: New fund launches witnessed slowdown due to heightened uncertainty

Data as of April 30, 2020

Data as of April 30, 2020

(Source: AMFI)

The schemes belong to various categories, though passive theme clearly seems to be the current favourite of fund houses. Out of the 11 new fund papers filed with SEBI since May, six are either Exchange Trade Funds (ETFs) or Fund of Funds (FoFs).

Axis Mutual Fund and SBI Mutual Fund are betting on the banking sector as their role in economic recovery is critical. Both fund houses have filed for Banking ETF Fund. SBI also filed for Consumption themed ETF to ride on the demand recovery wave.

Axis is also seeking global growth opportunities with the launch of two international funds viz. Axis Global Equity Alpha Fund of Fund and Axis Global Disruption Fund of Fund which will track the respective Schroder International Selection Fund.

Notably, some international funds have generated extra-ordinary returns in the last 1 year. These funds mainly comprising of global technology and e-commerce giants like Amazon, Alphabet, Facebook, Neflix, Microsoft, have benefitted amid lockdown which lead to improved response towards these funds from investors.

[Read: Should You Opt For Offshore Funds to Reduce Portfolio Risk?]

Image Source: photo created by rawpixel.com - www.freepik.com

Image Source: photo created by rawpixel.com - www.freepik.com

Both Mahindra Mutual Fund and HSBC Mutual Fund have filed for a Focused Equity Fund. Quality companies/sectors that are expected to lead the recovery and are better poised to absorb the pandemic shock would be the focus of these funds.

Since the recent volatility and uncertainty in the equity market has caused many investors to rethink their risk-taking ability, some fund houses are looking to launch funds suitable for such risk-averse investors.

In the wake of this Mirae Asset recently launched an Arbitrage Fund which is considered to be less risky than pure equity funds while Mahindra is also looking to launch a fund in the category. ICICI Pru has filed for Alpha Low Vol 30 ETF which will track the Nifty Alpha Low-Volatility 30 Index.

Motilal Oswal Mutual Fund will soon launch a Multi-Asset Fund that will invest across equity, international equity, debt, and gold, for better diversification in a volatile and uncertain investment environment. Principal Mutual Fund has applied for a Large Cap Fund where it did not have presence earlier. HSBC has also applied for a Mid Cap Fund. The market crash has provided a lot of opportunities in large and mid-cap space to pick quality stocks with a better margin of safety.

Should you consider investing in NFOs?

NFOs are risky propositions as they do not have a proven track record of performance which makes evaluating and picking the right scheme difficult.

Timing the entry of launch is very more important, especially in case of sectoral/thematic funds as their returns are cyclical in nature. If the time lag between filing draft paper and the launch of scheme is high the valuations could turn expensive and the fund manager may miss the entry point it was aiming for.

That said, NFOs can be considered to be a part of your portfolio if they are unique i.e. if they offer something that is not available in the market and if they belong to a process-driven fund house.

Table: Mutual Funds rebalanced equity allocation to take advantage of dynamic market conditions

| Month |

Gross Purchase (Cr) |

Gross Sales (Cr) |

Net (Cr) |

| Jan-20 |

75721.95 |

74337.57 |

1384.38 |

| Feb-20 |

72982.01 |

62894.5 |

10087.51 |

| Mar-20 |

123257.19 |

93126.45 |

30130.74 |

| Apr-20 |

54525.1 |

62490.6 |

-7965.5 |

Data as of April 30, 2020

(Source: ACE MF)

During the market crash of March mutual funds took advantage of the opportunity to invest more in quality stocks available at attractive valuations. On the other hand, they cut equity exposure in April as the markets surged. This highlights that even existing mutual funds can help you gain from the recovery provided you have invested in worthy funds.

If your existing portfolio is well-placed to benefit from the recovery you should stick to it instead of aimlessly adding new funds. If not it is advisable to get a portfolio review done.

To make sure that your mutual fund portfolio is strategically placed to benefit from the recovery, opt for the 'Core & Satellite' approach to investing.

The term 'Core' refers to the more stable, long-term holdings of the portfolio; while the term 'Satellite' applies to the strategic portion that would help push up the overall returns of the portfolio, across market conditions.

The 'Core' holdings should form a major portion (around 65-70%) of the mutual fund portfolio and ideally should consist of a large-cap fund, multi-cap fund, and a value style fund.

The rest, say around 30-35%, can be 'Satellite' holdings consisting of a mid-cap fund, large & mid-cap fund and an aggressive hybrid fund. If as an investor you are willing to take the risk, a small portion could be allocated to small-cap as well in the satellite holding.

Even though the markets are expected to remain volatile the 'Core & Satellite' approach can help limit the downside risk.

Here are the key benefits of the 'Core & Satellite' approach

-

Optimum diversification across market capitalisations and investment styles;

-

Reduces to need to churn the portfolio constantly;

-

Reduces the risk to the portfolio;

-

You potentially gain from a variety of investment strategies;

-

Aims to create wealth limiting the downside risk;

-

Hold the potential to outperform the market

The weightage of each portfolio constituents in both 'Core' and 'Satellite' categories should be based on your investment objective, risk appetite and time horizon to goal.

If you wish to invest in a readymade portfolio of top recommended equity mutual funds based on the 'Core & Satellite' approach to investing, I recommend that you subscribe to PersonalFN's Premium Report, "The Strategic Funds Portfolio For 2025 (2020 Edition)".

Warm Regards,

Divya Grover

Research Analyst

Join Now: PersonalFN is now on Telegram. Join FREE Today to get ‘Daily Wealth Letter’ and Exclusive Updates on Mutual Funds