Kotak Transportation & Logistics Fund Launched: A New Opportunity for Sectoral Exposure

Nov 29, 2024

Kotak Mutual Fund has launched Kotak Transportation & Logistics Fund, it is an open-ended equity scheme following Transportation & Logistics theme.

India's transportation and logistics sector in 2024 is poised for significant growth, driven by the country's expanding infrastructure, rapid urbanization, and through various initiatives, the government is targeting to build a robust Transport & Logistics network with an aim to bring down Transportation Cost as percentage of GDP from 13-14% to 8-10% by 2030.

With increasing demand for e-commerce and the need for efficient supply chains, the sector stands to benefit from technological advancements, digitalization, and improvements in connectivity.

[Read: These Thematic Mutual Funds Offered Over 50% Returns In 1 Year. Should You Invest in Them?]

For investors looking to tap into this growth, the Kotak Transportation & Logistics Fund (NFO) offers a way to gain targeted exposure to the sector. This NFO provides an opportunity to invest in companies across industries like aviation, road transport, railways, and shipping, all of which are central to the logistics and transportation ecosystem.

However, while the sector has immense potential, it is not without risks.

Details of Kotak Transportation & Logistics Fund:

|

Investment Objective |

The investment objective of the scheme is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in transportation & logistics and related activities. However, there is no assurance that the objective of the scheme will be achieved |

|

Category |

Thematic Fund |

|

SIP/STP/SWP |

Available |

|

Min. Investment |

Rs 100/- and in multiples of Re 1 thereafter. Additional Purchase Rs 100/- and in multiples of Re 1 thereafter. |

Face Value |

Rs 10/- per unit |

|

Plans |

|

Options |

-

Growth

-

Income Distribution cum Capital Withdrawal (IDCW) (Payout and Reinvestment Facility)

|

|

Entry Load |

Not Applicable |

Exit Load |

-

For redemption / switch out within 30 days from the date of allotment: 1%

-

If units are redeemed or switched out on or after 30 days from the date of allotment: NIL

|

|

Fund Manager |

- Mr Nalin Rasik Bhatt

- Mr Abhishek Bisen |

Benchmark Index |

Nifty Transportation & Logistics TRI |

|

Issue Opens: |

November 25, 2024 |

Issue Closes: |

December 09, 2024 |

(Source: Scheme Information Document)

What will be the investment strategy for Kotak Transportation & Logistics Fund?

Kotak Transportation & Logistics Fund aims to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in transportation & logistics and related activities.

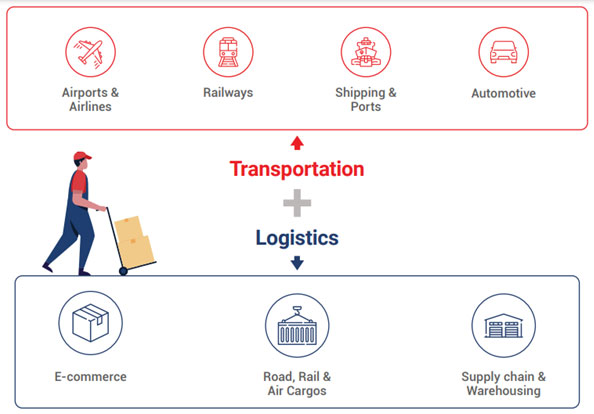

The investment strategy will be active in nature. The Transportation and Logistics theme focuses on investing in companies that facilitate the movement of goods and people. This includes businesses involved in transportation infrastructure, logistics services, and innovative solutions for efficient and sustainable transportation, as well as financial companies that support transportation and logistics.

(Source: Kotak Transportation & Logistics Fund - PPT)

(Source: Kotak Transportation & Logistics Fund - PPT)

Although the scheme will predominantly invest in stocks as per the transportation & logistic theme, it retains the flexibility to take some exposure beyond the sectors based on the asset allocation pattern of the scheme. The Fund Manager may add other sectors or stocks as may be added in Nifty Transportation & Logistics Index (TRI) and AMFI industry classification list issued from time to time.

[Read: The Ultimate Guide to the Best SIP Plans for 2025]

How will the scheme allocate its assets?

Under normal circumstances, Kotak Transportation & Logistics Fund will hold an allocation of 80% to 100% in Equity and Equity Related Securities of companies engaged in Transportation & Logistics and related activities, 0% to 20% in Equity and Equity Related securities of companies other than those engaged in Transportation & Logistics related activities, 0% to 20% in Debt and Money Market Instruments and 0% to 10% in Units issued by REITs & InvITs.

Should investments in Kotak Transportation & Logistics Fund be considered?

Kotak Transportation & Logistics Fund primarily invests in the transportation and logistics sector, which includes industries like aviation, shipping, road transport, and railways.

The transportation and logistics sector is a critical part of India's economic growth, driven by increasing infrastructure development, urbanization, and the rise in e-commerce. However, it can be sensitive to economic cycles, fuel price fluctuations, and regulatory changes.

The Indian logistics market has seen substantial growth in recent years and is expected to continue benefiting from the government's push toward infrastructure improvement, the National Logistics Policy (NLP), and technological advancements in supply chain management. Rising demand for faster delivery services, particularly from e-commerce, is also a key driver for growth in this sector.

Although the scheme offers investors sectoral exposure to the growing transportation and logistics industry. However, this sector-specific focus comes with inherent risks. The transportation and logistics industry is sensitive to economic cycles, fuel price fluctuations, and regulatory changes, making the fund potentially volatile.

Additionally, the sector's performance can be impacted by global trade disruptions and changes in government policies. While the fund presents growth opportunities, especially for those seeking targeted exposure to this sector, investors should be aware of the risks associated with its concentrated nature. The performance of the scheme might therefore be impacted by these variables, among others, and may affect negatively if the sector moves out of favour.

[Read: Power Your Portfolio: 5 Sector & Thematic Funds to Consider]