Industry-level Stress Test for Small Cap Funds: Here is What SEBI’s Move Means for Investors

Divya Grover

Aug 26, 2024 / Reading Time: Approx. 5 mins

Listen to Industry-level Stress Test for Small Cap Funds: Here is What SEBI’s Move Means for Investors

00:00

00:00

The Securities and Exchange Board of India (SEBI) will soon release the results of an industry-level stress test conducted for Small Cap Funds. Earlier, the stress test was conducted at the scheme level by each mutual fund house. This development was revealed by SEBI whole-time member, Mr Ananth Narayan, in a recent conference organised by Cafe Mutual.

What is a Stress Test in Mutual Fund?

A stress test is an assessment of the liquidity of the portfolio. In other words, it tells investors how many days it would take to for a scheme to liquidate or encash the underlying portfolio in case it faces heavy redemption pressure (such as in the case of adverse market conditions/severe market crash).

For this purpose, mutual funds are required to disclose to the Association of Mutual Funds in India (AMFI), the time required to liquidate 80% of the portfolio to AMFI considering 10% Participating Volume and multiplying it 3 times. The 80% of the portfolio is considered after excluding the least liquid 20% of the portfolio. The liquidity analysis will be done for the balance portfolio by calculating the time required to liquidate 50% and 25% of portfolios on a pro-rata basis.

In March 2024, amid unprecedented inflows witnessed in the Mid Cap Fund and Small Cap Fund categories, SEBI had raised red flags regarding frothy valuations in the mid and small-cap segments.

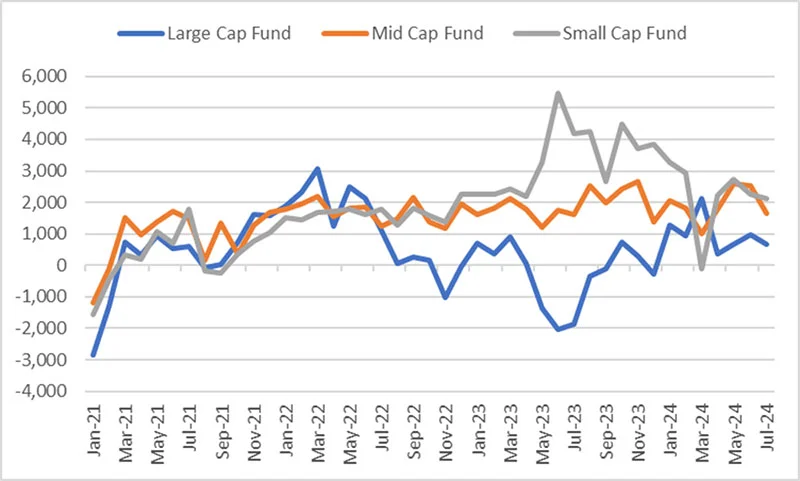

Small Cap Funds registered high inflows in recent years

Data as of July 31, 2024

Data as of July 31, 2024

(Source: ACE MF, data collated by PersonalFN)

Subsequently, SEBI asked fund houses to conduct a stress test to assess the liquidity positions of their mid-cap and small-cap schemes every fortnight.

Click here to find out how fund houses fared in their first-ever stress test.

What is the broader stress test result expected to reveal?

The industry-wide stress test for Small Cap Funds is expected to offer a more comprehensive view of the segment's stability, overall health, and resilience. While Mr Narayan has indicated that the preliminary findings were encouraging, he has asked investors to remain cautious.

According to Mr Narayan, the stress levels within the mutual fund industry remained largely unchanged from March 2020 to March 2024. The number of days required for mutual funds to liquidate 5%, 10%, 15%, or 20% of their portfolios hasn't changed significantly over the years, even during periods of market stress. This raises concerns about whether the market could sustain these liquidity levels if faced with actual withdrawals.

Notably, trading volumes in the Indian equity market have increased driven by strong demand from domestic investors. The holdings of mutual funds, domestic institutional investors, and individuals in the mid-cap and small-cap companies have increased from 54.3% to 60.6% of the free float between during this period.

But it remains to be seen whether these volumes would hold up during periods of significant stress. For instance, in March 2023, when delivery volumes were weaker, the stress levels in the market appeared to be higher. This uncertainty raises questions about the market's ability to absorb large-scale sales of securities during challenging times.

Mr Narayan also spoke about the rapid rise in the equity market valuations, particularly in the mid and small-cap segments. He noted that values of over 40% of stocks in these categories have increased by more than five-fold over the past five years.

What should investors in Small Cap Funds and Mid Cap Funds do?

The stress test results for several Mid Cap Funds and Small Cap Funds have been satisfactory till now. A few schemes, however, revealed higher liquidity days, suggesting that they may face challenges in quickly meeting redemption demands in case of adverse market conditions as there may not be many buyers.

While the rapid pace of rally in the mid-cap and small-cap segment has proved to be extremely rewarding for investors in Mid Cap Funds and Small Cap Funds, investors need to be mindful of the potential risks associated with investing in a market that has been on a prolonged upward trajectory.

In the current market environment where the world is witnessing high uncertainties and rising risk levels along with expensive valuations, making investment decisions based solely on past returns can be risky. Notably, Small Cap Funds are high risk - high returns investments. This means that these funds can face higher downside risk if the current market optimism reverses.

It is therefore vital that investors align investments to their risk appetite, financial goals, and investment horizon. This will enable them to minimise the risk and earn optimal returns. If you find the process of building and managing the portfolio challenging, it is best to seek the help of a SEBI-registered investment advisor.

Watch this video to know about the potential risks involved in Small Cap Fund investment:

We are on Telegram! Join thousands of like-minded investors and our editors right now.

DIVYA GROVER is the co-editor for FundSelect, the flagship research service of PersonalFN. She is also the co-editor of DebtSelect. Divya is an avid reader which helps her in analysing industry trends and producing insightful articles for PersonalFN’s popular newsletter – Daily Wealth letter, read by over 1.5 lakh subscribers.

Divya joined PersonalFN in 2019 and has since then used stringent quantitative and qualitative parameters to analyse funds to provide honest and unbiased research to investors. She endeavours to enable investors to make an informed investment decision and thereby safeguard their wealth.

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing.

This article is for information purposes only and is not meant to influence your investment decisions. It should not be treated as a mutual fund recommendation or advice to make an investment decision in the above-mentioned schemes.