Is It Wise to Invest in Sector & Thematic Funds And Small Cap Funds Now? Know Here

Rounaq Neroy

Jul 12, 2024 / Reading Time: Approx. 10 mins

Listen to Is It Wise to Invest in Sector & Thematic Funds And Small Cap Funds Now? Know Here

00:00

00:00

The Indian equity market has scaled to a new lifetime high of 80,893.51 points on the BSE Sensex (on July 12, 2024).

Despite several risks in play, such as the rising geopolitical tensions, spike in volatility in the financial markets during the 2024 Lok Sabha elections, valuation concerns, tighter global financial conditions, and vacillating FPI outflows, among others, the Indian equity market continued its norward journey.

India being perceived to be a 'bright spot' in the global economy and several structural reforms being rolled over the last decade, has led to positive mood and momentum.

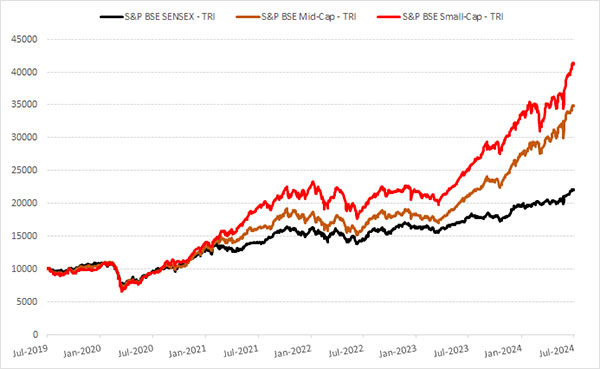

Graph 1: Performance BSE Sensex v/s BSE Mid Cap v/s BSE Small Cap

Data as of July 10, 2024.

Data as of July 10, 2024.

(Source: ACE, data collated by PersonalFN Research)

As seen in Graph 1, the smallcaps and midcaps (also called as SMIDs) have run up far ahead of largecaps. The YTD total return of the BSE Sensex is +11.5% (on an absolute basis) while, of the BSE Mid Cap TRI and BSE Small Cap TRI, +29.5% and 26.3%, respectively, on an absolute basis (as of July 10, 2024).

The equity Assets Under Management (AUM) has also sprung by 27% to Rs 27.68 lakh crore in the first six months of the calendar year 2024.

Table 1: Gains in Financial Years for Indian Equities and Increase in AUM of Equity Mutual Funds

| Calendar Years |

Equity Returns (%)* |

% increase in Total Equity AUM |

| 2019 |

15.66% |

2.49% |

| 2020 |

17.16% |

17.65% |

| 2021 |

23.23% |

47.07% |

| 2022 |

5.8% |

14.35% |

| 2023 |

20.33% |

42.91% |

| 2024* |

11.51% |

27.01% |

*S&P BSE Sensex- TRI returns considered

Equity returns as of July 10, 2024, and AUM data as of June 30, 2024

(Source: ACE MF, AMFI, data collated by PersonalFN Research)

With the continuation of policy reforms under Modi 3.0 (a coalition government) and a big push expected in the full budget for 2024-25 (which will be presented on July 23, 2024), it is possible that equity AUM continues to grow further, propelled by mark-to-market gains of underlying equities and inflows.

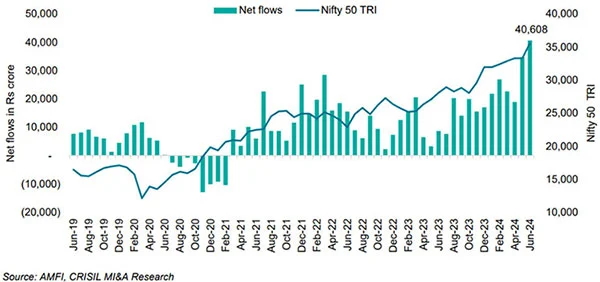

In June 2024, equity mutual funds witnessed the highest-ever inflows of Rs 40,608 crore, and therein sector & thematic funds have led the inflows over the past six months. The primary reason behind this is a slew of New Fund Offers (NFOs) in this sub-category of equity mutual funds appealing investors.

[Read: These Thematic Mutual Funds Offered Over 50% Returns In 1 Year. Should You Invest in Them?]

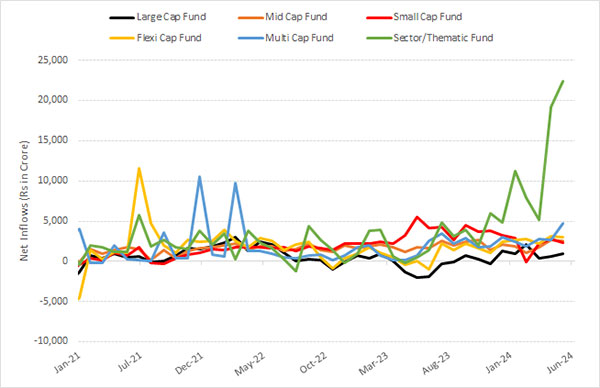

Graph 2: Net Inflows into Small Cap Funds, Mid Cap Funds, Large Cap Funds, Multi Cap Funds, Flexi Cap Funds, and Sectoral/Thematic Funds

Data as of June 30, 2024

Data as of June 30, 2024

(Source: AMFI, data collated by PersonalFN Research)

Among the other equity-oriented mutual fund schemes, of late, multi-cap funds and flexi cap funds have also reported sizeable inflows as some investors are wisely choosing them in the endeavour to be from opportunities across market capitalisations, i.e. largecaps, midcaps, smallcaps, and microcaps.

That being said, certain investors are also investing in small cap funds and mid cap funds, perhaps having tasted success themselves or having heard of the investment success stories of their relatives, friends, colleagues and/or neighbours in these sub-categories of equity mutual funds.

In addition, the launch of several passive funds - index funds and equity-oriented Exchange Traded Funds (ETFs) - have led to inflows and a rise in folio count. As per AMFI data, passive funds reported Rs 14,602 crore worth of net inflows, marking the 44th consecutive month of positive inflow into this segment.

Table 2: Trend of Monthly Flows into Passive Funds (Rs in Crore)

(Source: AMFI)

(Source: AMFI)

Within the passive funds segment, as seen in the table above, ETFs (other than gold ETFs) have seen remarkable inflows followed by index funds with strong participation of individual investors (retail and HNIs). Equity-oriented ETFs, in particular, contributed to 71% of the segment's AUM in June 2024.

In all, over 8.5 lakh accounts were added in June 2024 in these types of passive funds. Fund houses capitalised on the upbeat sentiments by launching passive funds at the peak of the market.

Graph 3: Monthly Equity Net Inflows Have Hit an All-time High

(Source: AMFI)

(Source: AMFI)

At present, the share of equity mutual funds in India's mutual funds industry is at 45% as of June 2024, approaching the global average (including ETFs) of 48% as of the first quarter of 2024.

India has logged the highest growth in AUM over the last 5, 10, and 15 years abetted by M-T-M gains and inflow, according to the data disclosed by the International Investment Funds Association.

Most of the folio additions today are coming from equity-oriented mutual funds, wherein individual investors hold a larger share of assets.

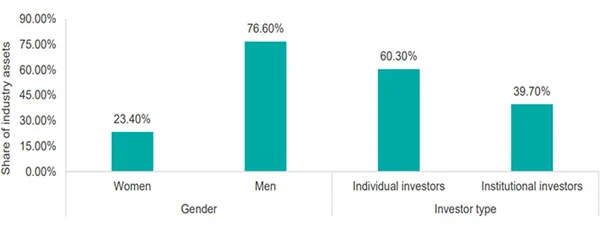

Graph 4: Investor break-up based on AUM share

Data as of FY24

Data as of FY24

(Source: AMFI's Annual Report)

If we consider the demographics, both among the individual investors, a larger share of the AUM is from men.

That said, an increasing number of women are also taking charge of their finances and adding mutual funds to their portfolios for wealth-building and accomplishing the envisioned financial goals. The combined participation of AMFI, fund houses, mutual fund distributors, and registered investment advisors has contributed to the increased participation of women in mutual fund investments.

Choose Your Mutual Funds Thoughtfully

While the increase in inflows into mutual funds and AUM is good, investors ought to choose their schemes carefully.

In the case of NFOs, remember that not all of them are worth your hard-earned money. Some NFOs deserve to be skipped. Don't consider the Rs 10/- NAV proposition to be cheap - it's unlike buying stocks.

A host of factors need to be considered when evaluating mutual funds, among all, the most important one is whether it would be a 'suitable' fit for your portfolio. Want to know the key factors in choosing mutual funds? Watch this video:

It should be noted that sector & thematic funds -- be they actively managed ones or passive ones --tracking a sector or thematic index, carry very high risk. When investing in these, you are subject to concentration risk: if the sector or theme does not play well or fails, it impacts your investment.

Similarly, small cap funds and mid cap funds are not for the faint-hearted. They are placed at the higher end of the risk-return spectrum. One needs to be mindful of the valuations when taking exposure to smallcap and midcap segments of the market.

Currently, the valuations in smallcaps and midcap segment, are even more expensive than largecaps. The price-to-equity (P/E) ratio of the BSE Small Cap index and the BSE Mid Cap index are over 36x and 33x, respectively, while the BSE 100 index is around 23x (as of July 10, 2024). The P/E of the bellwether BSE Sensex is over 24x.

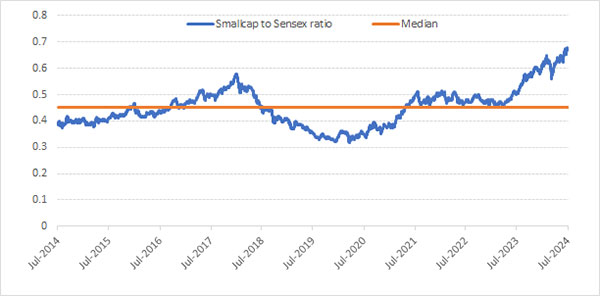

Graph 5: Smallcap-to-Sensex Ratio Is Well Above the Long-term Median

Data as of July 10, 2024

Data as of July 10, 2024

(Source: ACE MF, data collated by PersonalFN)

The Small Cap Index-to-Sensex ratio, which is also an indicator of the valuation gap, is around 0.7 vis-a-vis the long-term median of 0.5. Previously, when this ratio hit 0.6 in 2018, it led to a crash in mid and smallcap crash in 2018-19.

[Read: Small Cap Index Near an All-time High: Should You Rejoice or Worry?]

In such times, you ought to approach equity mutual funds prudently. It's time to devise a sensible investment strategy --- a strategy that some of the most successful equity investors around the world follow.

Want to know the investment strategy to follow now while investing in equity mutual funds as the BSE Sensex is above 80,000? Read my article here.

You can't be investing in an ad hoc manner hearing the success stories of someone else and investing mindlessly.

"When it comes to investing, there is no such thing as a one-size-fits-all portfolio." - Barry Ritholtz.

Investing is an individualistic exercise and must be approached far more seriously, considering your age, risk profile, broader investment objectives, the financial goals you are addressing, and time in hand to achieve those envisioned goals. This shall help you have the right asset allocation mix.

You cannot count on equities to deliver stellar returns year after year. There have been years -- like in like in 2015, 2016, 2018, and 2022 -- where equities have disappointed investors, while debt and gold have done better.

Hence, avoid banking one asset class, such as equity and skewing the portfolio to sector and thematic funds, small cap funds and/or mid cap funds. Follow a multi-asset allocation. For tactical allocation to equity, debt and gold, you may consider a Multi-Asset Fund in the wealth creation journey.

Keep in mind that, asset allocation is the cornerstone of investing. Ensure that you are following a prudent asset allocation and hold a well-diversified portfolio in 2024 and beyond!

Be a thoughtful investor.

Happy Investing!

Join Now: PersonalFN is now on Telegram. Join FREE Today to get PersonalFN’s newsletter ‘Daily Wealth Letter’ and Exclusive Updates on Mutual Funds.

-New.png)

ROUNAQ NEROY heads the content activity at PersonalFN and is the Chief Editor of PersonalFN’s newsletter, The Daily Wealth Letter.

As the co-editor of premium services, viz. Investment Ideas Note, the Multi-Asset Corner Report, and the Retire Rich Report; Rounaq brings forth potentially the best investment ideas and opportunities to help investors plan for a happy and blissful financial future.

He has also authored and been the voice of PersonalFN’s e-learning course -- which aims at helping investors become their own financial planners. Besides, he actively contributes to a variety of issues of Money Simplified, PersonalFN’s e-guides in the endeavour and passion to educate investors.

He is a post-graduate in commerce (M. Com), with an MBA in Finance, and a gold medallist in Certificate Programme in Capital Market (from BSE Training Institute in association with JBIMS). Rounaq holds over 18+ years of experience in the financial services industry.

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. Registration granted by SEBI, Membership of BASL and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.

Disclaimer: This article is for information purposes only and is not meant to influence your investment decisions. It should not be treated as a mutual fund recommendation or advice to make an investment decision in the above-mentioned schemes. Use of this information is at the user's own risk. The user must make his own investment decisions based on his specific investment objective and financial position and use such independent advisors as he believes necessary.