DIVYA GROVER FEB 07, 2024 / READING TIME: APPROX. 18 MINS

Multi Cap Funds are equity mutual funds that invest across large, mid, and small-cap companies, thus offering diversification across the market cap spectrum through a single fund. With substantial exposure across the investment universe, Multi Cap Funds can potentially generate superior returns for investors in the long run without any concentration risk.

In this article, find out the 3 best Multi Cap Mutual Funds for 2024. Before we reveal the list, let us get to know about the category in detail.

What are Multi Cap Mutual Funds?

Though Multi Cap Funds have existed for many years now, the category underwent a change in definition a few years ago. Earlier, in the absence of any restriction on the market cap allocation, most Multi Cap Funds held a predominantly large-cap biased portfolio along with strategic allocation to mid-cap and small-cap stocks.

In September 2020, SEBI changed the definition of Multi Cap Funds as those mandated to invest at least 75% of their total assets in equities, with at least 25% exposure each in large-cap, mid-cap, and small-cap stocks.

Multi Cap Funds have to maintain the minimum exposure of 25% in each market cap, regardless of the market conditions. Large-cap stocks refer to the top 100 publicly listed companies in India by full market capitalisation, mid-cap stocks refer to companies ranking 101st to 250th in terms of full market capitalisation, while companies ranking 251st onwards in terms of full market capitalisation are categorised as small-cap stocks.

Examples of Multi Cap Mutual Funds in India

| Scheme Name |

AUM (Rs Crore) |

| Nippon India Multi Cap Fund |

24,590 |

| SBI Multicap Fund |

14,269 |

| HDFC Multi Cap Fund |

11,030 |

| ICICI Pru Multicap Fund |

10,342 |

| Kotak Multicap Fund |

8,087 |

| Quant Active Fund |

7,413 |

| Aditya Birla SL Multi-Cap Fund |

4,933 |

| Axis Multicap Fund |

4,766 |

| Invesco India Multicap Fund |

3,041 |

| Tata Multicap Fund |

2,814 |

The securities quoted are for illustration only and are not recommendatory.

AUM data as of December 31, 2023

(Source: ACE MF, data collated by PersonalFN)

This was done to ensure that Multi Cap Funds hold a diversified portfolio across large-cap, mid-cap, and small-cap companies, are true to their label, and to distinguish it clearly from other scheme categories.

To prevent significant churning of the portfolio, many erstwhile Multi Cap Funds migrated to the Flexi Cap category, while only a few others chose to remain under the Multi Cap Fund. But buoyed by the broad-based market rally, various fund houses have recently launched new schemes in the Multi Cap category. Accordingly, several schemes in the Multi Cap Fund category are relatively young.

Will Multi Cap Funds continue to outperform Flexi Cap Funds in 2024?

Mid-cap and small-cap stocks did exceptionally well in the last couple of years compared to their large-cap counterparts.

Since Multi Cap Funds hold higher allocation to mid-cap and small-cap stocks, the category benefitted from the extraordinary rise in prices of smaller companies. On the other hand, Flexi-cap Funds held relatively lower allocation to the stocks in the mid-cap and small-cap segment.

During bull market phases, such as the one we have witnessed in recent years, Multi Cap Funds can outpace Flexi Cap Funds because mid-cap and small-cap stocks generally soar higher than large-cap stocks during a broad-based market rally. Consequentially, Multi Cap Funds can benefit from higher allocation in the segment and reward investors with higher gains.

Market cycle performance: Multi Cap Fund vs Flexi Cap Fund

| Category |

Bear phase of 2020 |

Bull phase of 2020-24 |

| Absolute (%) |

CAGR (%) |

| Flexi Cap Fund |

-34.16 |

34.60 |

| Multi Cap Fund |

-35.81 |

41.21 |

| NIFTY 500 - TRI |

-37.85 |

36.58 |

Past performance is not an indicator for future returns

Data as of February 02, 2024. Direct plan - Growth option considered

(Source: ACE MF, data collated by PersonalFN)

However, if the volatility in the equity market intensifies in the coming months, which is likely, stocks in the mid-cap and small-cap segments may face liquidity constraints and high volatility. In other words, if the bullish momentum fizzles out in 2024, Multi Cap Funds can record lower returns than Flexi Cap Funds. It can even witness a higher drawdown compared to Flexi Cap Funds if the market sentiment turns bearish. However, the presence of large caps in the portfolio can offset some of the volatility.

That said, over the long term, both categories can reward investors with superior gains since they have the freedom to select from a large universe of stocks. Accordingly, investors can opt for either Flexi Cap Mutual Funds or Multi Cap Mutual Funds based on their investment objective and risk-taking ability.

What are the advantages of investing in Multi Cap Mutual Funds?

As you may know, market cap performance differs every year; sometimes large-caps outperform, while other times, it could be mid and small-caps. Hence, diversification across the market cap, viz. large-cap, mid-cap, and small-cap, can help you lower the impact of volatility on your portfolio and thereby earn better risk-adjusted returns. Investing in Multi Cap Funds is a great way to get well-balanced exposure across market caps, which helps diversification and helps in maximising portfolio returns over the long run.

Favourite stocks of Multi Cap Mutual Funds

The securities quoted are for illustration only and are not recommendatory.

The securities quoted are for illustration only and are not recommendatory.

AUM data as of December 31, 2023

(Source: ACE MF, data collated by PersonalFN)

The fund managers of Multi Cap Funds have the flexibility to select stocks from a large investment universe, allowing them to identify high alpha-generating opportunities.

A Multi Cap Fund's exposure to mid-cap and small-cap stocks gives it high returns potential, and the ability to generate substantial gains during broad-based market rally. At the same time, it keeps the risk balanced by investing in large-cap stocks, which adds stability to the portfolio. Moreover, Multi Cap Funds do not restrict investments to any particular sector, theme, or industry, which helps them benefit from the growth potential of the Indian economy.

Investing in Multi Cap Funds also eliminates the need to buy different funds belonging to a particular market cap. As a result, investors get comprehensive market coverage and may benefit from better risk-adjusted returns compared to investments in a single cap fund.

What are the risks involved in Multi Cap Mutual Funds?

Unlike Flexi Cap Funds, the fund managers of Multi Cap Funds do not have much flexibility to swing allocation to one particular market capitalisation segment in a market phase. Thus, the market cap exposure limit curbs the fund manager's ability to switch allocation between stocks belonging to different market caps, depending on the market conditions.

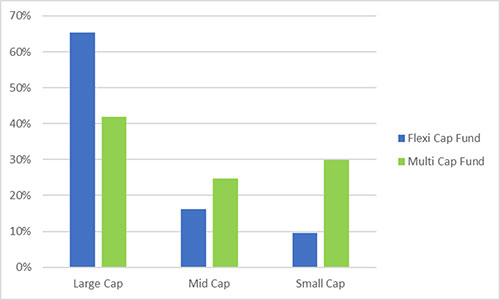

Average market cap allocation of Multi Cap Fund and Flexi Cap Fund category

Data as of December 31, 2023

Data as of December 31, 2023

(Source: ACE MF, data collated by PersonalFN Research)

In addition, while a Multi Cap Fund is a good option for diversification and long-term wealth creation, it can also be very risky in the short term since it has at least 50% exposure to small and mid-cap stocks, which are vulnerable to high volatility in the short term.

[Read: Multi Cap Fund v/s Flexi Cap Fund: Which is a Better Fit for Your Portfolio?]

Who should consider investing in Multi Cap Mutual Funds?

Those looking for well-balanced exposure across the investment universe through a single fund. Multi Cap Funds are suitable for those who have a time horizon of at least 5-7 years and have a high risk appetite. It would be prudent to assess the current exposure to various market cap segments in the existing mutual fund portfolio and then evaluate Multi Cap Fund's place in the portfolio.

How are Multi Cap Mutual Funds taxed?

Multi Cap Mutual Funds are equity-oriented mutual funds and hence, they follow equity taxation. The holding period for Multi Cap Mutual Funds from a tax perspective is 12 months. So, if investors sell their Multi Cap Mutual Fund units before 12 months, the gains are subject to short-term capital gains (STCG) tax of 15%.

On the other hand, if they sell their Multi Cap Mutual Fund units after completing one year, the gains are subject to long-term capital gains tax (LTCG) of 10%, but only if the gains exceed Rs 1 Lakh in a financial year.

Which are the best Multi Cap Mutual Funds for 2024?

List of best Multi Cap Mutual Funds for 2024

| Scheme Name |

Absolute (%) |

CAGR (%) |

Ratio |

| 1 Year |

3 Years |

5 Years |

7 Years |

SD Annualised |

Sharpe |

Sortino |

| Quant Active Fund |

15.57 |

36.02 |

23.49 |

21.48 |

18.05 |

0.37 |

0.71 |

| Nippon India Multi Cap Fund |

27.24 |

34.84 |

16.96 |

16.44 |

15.90 |

0.45 |

0.98 |

| Mahindra Manulife Multi Cap Fund |

19.97 |

30.36 |

19.78 |

-- |

16.55 |

0.40 |

0.78 |

| Category average |

16.39 |

28.19 |

16.99 |

16.42 |

15.74 |

0.36 |

0.72 |

| NIFTY 500 - TRI |

14.07 |

23.08 |

13.83 |

14.66 |

14.56 |

0.27 |

0.56 |

The securities quoted are for illustration only and are not recommendatory.

Past performance is not an indicator for future returns

Data as of February 02, 2024. Returns are on a rolling basis in %. Direct plan - Growth option considered

(Source: ACE MF, data collated by PersonalFN)

Let us finally take a look at the three best Multi Cap Mutual Funds for 2024 selected based on 3-year rolling returns:

Best Multi Cap Fund for 2024 #1: Quant Active Fund

Quant Active Fund is a Multi Cap Fund that was launched in March 2001 by Escorts Mutual Fund. The AMC was later acquired by the Quant Group in 2018 and the scheme was renamed. Earlier, in the absence of any allocation limit for Multi Cap Funds, Quant Active Fund used to dynamically manage exposure across market caps depending on the market conditions and generally maintained a large-cap biased portfolio with tactical allocation to mid and small-caps. It now maintains an on-par exposure across market caps.

Quant Active Fund follows a momentum-driven investment approach whereby it constantly hunts for attractive opportunities, which has helped it generate remarkable alpha in recent years and handsomely reward its investors.

Fund Snapshot - Quant Active Fund

Past performance is not an indicator of future returns. The securities quoted are for illustration only and are not recommendatory.

Past performance is not an indicator of future returns. The securities quoted are for illustration only and are not recommendatory.

Portfolio data as of December 31, 2023

Returns and NAV data as of February 02, 2024. Regular Plan - Growth Option considered

(Source: ACE MF, data collated by PersonalFN)

While Quant Active Fund's performance in the past was subdued, the fund witnessed a turnaround phase in recent years, which was driven by its in-house risk mitigation and predictive analysis tool called VLRT. The fund's strategy of timely identifying attractive-looking stocks and sectors and taking higher exposure in them has worked extremely well in its favour in the last few years, which helped it record extraordinary growth.

Despite following an aggressive investment approach, Quant Active Fund places great emphasis on risk management, which helped it fare outstandingly in terms of risk-adjusted returns.

Click here to read PersonalFN's analysis of Quant Active Fund.

Best Multi Cap Fund for 2024 #2: Nippon India Multi Cap Fund

Launched in March 2005, Nippon India Multi Cap Fund is the erstwhile Reliance Equity Opportunities Fund that was later renamed as Reliance Multi Cap Fund after its categorisation under Multi Cap Funds. Unlike most of its peers that preferred to maintain a large-cap-biased portfolio and later migrated to the Flexi Cap Fund category, Nippon India Multi Cap Fund has always been a true-to-name Multi Cap Fund that holds a well-balanced allocation across market caps.

Fund Snapshot - Nippon India Multi Cap Fund

Past performance is not an indicator of future returns. The securities quoted are for illustration only and are not recommendatory.

Past performance is not an indicator of future returns. The securities quoted are for illustration only and are not recommendatory.

Portfolio data as of December 31, 2023

Returns and NAV data as of February 02, 2024. Regular Plan - Growth Option considered

(Source: ACE MF, data collated by PersonalFN)

Notably, Nippon India Multi Cap Fund witnessed a lean phase between 2019 and 2020 as its bets in certain segments took time to pay off. However, the fund has gained immensely in the last few years as its high conviction calls in the Banking, Engineering, Retail, Hotels, and PSU segments turned out to be rewarding. The fund has done well and flourished under the supervision of Mr Shailesh Raj Bhan, who aims to identify high growth potential and fundamentally sound stocks across industries that are available at reasonable valuations.

The fund aims to seek both growth and value stocks that are likely to benefit from the growth in the economy, with a special focus on high ROE companies. It adopts a blend of the 'top-down' and 'bottom-up' approach to stock selection and takes active sector calls. While picking stocks, the fund endeavours to identify opportunities ahead of the market, even though it may result in underperformance in the short term.

Click here to read PersonalFN's analysis of Nippon India Multi Cap Fund.

Best Multi Cap Fund for 2024 #3: Mahindra Manulife Multi Cap Fund

Launched in May 2017, Mahindra Manulife Multi Cap Fund aims to create a well-diversified portfolio of companies and sectors with a long-term perspective. In the past, the fund maintained significant exposure across large-cap, mid-cap, and small-cap stocks with the flexibility to shift allocation based on market conditions. It still maintains exposure across market caps, but it now follows the limits prescribed by SEBI.

The scheme follows a top-down approach to select sectors and a bottom-up approach to pick stocks across the sectors based on the quality of business model and quality of management. It assesses the quality of business model and quality of management, evaluating various parameters such as profitability, utilisation of capital, industry leadership, and the track record of consistent & long-term execution potential.

Fund Snapshot - Mahindra Manulife Multi Cap Fund

Past performance is not an indicator of future returns. The securities quoted are for illustration only and are not recommendatory.

Past performance is not an indicator of future returns. The securities quoted are for illustration only and are not recommendatory.

Portfolio data as of December 31, 2023

Returns and NAV data as of February 02, 2024. Regular Plan - Growth Option considered

(Source: ACE MF, data collated by PersonalFN)

With a focus on quality businesses, Mahindra Manulife Multi Cap Fund performed reasonably well over the last few years. The fund managed to limit the downside risk better than many of its peers during the market crash of 2020, while it also stood among the category toppers in the ensuing bull phase. More importantly, Mahindra Manulife Multi Cap Fund has fared well in terms of risk-adjusted returns, as denoted by its Sharpe and Sortino ratio.

This completes the list of the 3 best Multi Funds for 2024. With higher exposure to mid and small-cap stocks, it will be better to take the Systematic Investment Plan (SIP) route when you invest in the best Multi Cap Mutual Funds.

Related links:

4 Best Large Cap Mutual Funds for 2024 - Top Performing Large Cap Mutual Funds in

3 Best Liquid Funds for 2024 - Top Liquid Mutual Funds for 2024

5 Best Mid Cap Funds for 2024 - Top Performing Mid Cap Mutual Funds in India

3 Best Banking & PSU Debt Funds for 2024

5 Best Small Cap Funds for 2024 - Top Performing Small Cap Mutual Funds in India

3 Best Corporate Bond Funds for 2024

3 Best Dynamic Bond Funds for 2024

4 Best ELSS for 2024 - Top Performing Tax Saving Mutual Funds in India

Best Debt Mutual Fund Categories for 2024

4 Best Flexi Cap Funds for 2024 - Top Performing Flexi Cap Mutual Funds in India

3 Best Value Funds for 2024 - Top Performing Value Mutual Funds in India

3 Best Large & Mid Cap Funds for 2024 - Top Performing Large & Mid Cap Mutual Funds in India

3 Best Multi Asset Allocation Funds for 2024 - Top Performing Multi Asset Allocation Mutual Funds in India

Note: This write-up is for information purpose and does not constitute any kind of investment advice or a recommendation to Buy / Hold / Sell a fund. Returns mentioned herein are in no way a guarantee or promise of future returns. Mutual Fund Investments are subject to market risks, read all scheme-related documents carefully before investing.

We are on Telegram! Join thousands of like-minded investors and our editors right now.

DIVYA GROVER is the co-editor for FundSelect, the flagship research service of PersonalFN. She is also the co-editor of DebtSelect. Divya is an avid reader which helps her in analysing industry trends and producing insightful articles for PersonalFN’s popular newsletter – Daily Wealth letter, read by over 1.5 lakh subscribers.

Divya joined PersonalFN in 2019 and has since then used stringent quantitative and qualitative parameters to analyse funds to provide honest and unbiased research to investors. She endeavours to enable investors to make an informed investment decision and thereby safeguard their wealth.

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing.

This article is for information purposes only and is not meant to influence your investment decisions. It should not be treated as a mutual fund recommendation or advice to make an investment decision in the above-mentioned schemes.