Why Gold Would Continue to Shine in 2023

Rounaq Neroy

May 27, 2023 / Reading Time: Approx. 9 mins

Listen to Why Gold Would Continue to Shine in 2023

00:00

00:00

A day before Gudi Padwa, one of the auspicious muhurats for gold buying, I wrote a piece -- why it's an opportune time to invest in gold. Since then, gold prices in Indian rupee (INR) terms have risen +2.0% (as of May 25, 2023) with the following factors proving supportive:

- Elevated headline inflation

- Central banks raising policy interest rates to control inflation but, in return, pushing up borrowing cost

- The collapse of banks in the U.S. and Switzerland viz. Credit Suisse, Silicon Valley Bank, Signature Bank, Silvergate Bank and First Republic Bank due to asset-liability mismatches

- Ongoing Russia-Ukraine war

- Geopolitical risks

- Climate-related events

- And the global economy possibly witnessing a significant slowdown or recession (which is a widespread and protracted downturn in economic activity)

Currently, the talking point is the U.S. Debt ceiling.

The U.S. debt ceiling is currently around USD 31.4 trillion. If the U.S. misses the deadline of June 1, 2023 (the date when Treasury bills are maturing) to increase the debt ceiling limit or suspend its debt limit in time, rating agency Fitch has warned that it could cut the U.S. AAA sovereign ratings. For now, Fitch has put the U.S. on a negative watch as the risk has increased. However, the rating agency is hopeful that there will be a resolution to the debt limit will before the x-date.

If consensus is not achieved on the U.S. debt ceiling, it could have serious repercussions on the global economy. Primarily, the U.S. government would not be meet its debt obligations, and there would be an impact on businesses and households.

The White House warns:

The (U.S.) government would be unable to enact counter-cyclical measures in a breach-induced recession, and there would be limited policy options to help buffer the impact on households and businesses. The ability of households and businesses, especially small businesses, to borrow through the private sector to offset this economic pain would also be compromised. The risks engendered by the default would cause interest rates to skyrocket, including those on the financial instruments that households and businesses use-Treasury bonds, mortgages, and credit card interest rates.

Let's assume for a moment that the Joe Biden administration would increase the debt ceiling limit or suspends the statutory limit on debt. Even in such a case, the fact that debt-to-GDP will burgeon shall upset the financial markets. It may lead to turbulence in major equity markets of the world, push up short-term bond yields, set in risk-averse sentiments, impact private investments, increase unemployment, and weaken business and consumer confidence.

"If Treasury securities are no longer perceived as risk-free by global investors, future generations of Americans would pay a steep economic price," warns Moody's, another U.S.-based rating agency. The U.S. dollar may encounter high volatility and could lose its eminence of being a reserve currency.

In other words, the economic gains in the U.S. may be reversed -- whether it is a reduction in the unemployment rate, business confidence, consumer spending, etc. -- and a 'breach-induced' recession may have its ripples in many parts of the world.

Germany has already entered a recession.

Europe's largest economy, Germany, has already contracted -0.3% GDP growth in Q12023 after -0.5% GDP growth in the last quarter of 2022. Higher energy prices on account of Russia's invasion of Ukraine, elevated inflation in general, higher interest rates, a decrease in government spending, and a drop in consumption have weighed on Germany's economic growth.

U.K. is reporting timid GDP growth, and the outlook remains subdued.

The International Monetary Fund (IMF) expects that the U.K. could avoid a recession in 2023 -- contrast to a contraction of -0.3% predicted in April 2023. However, the way macroeconomic risks are looming, the IMF has warned that the outlook remains subdued.

Asia is a bright spot, but...

Asia is relatively better placed than many parts of the world. China and India are expected to be drivers of growth in the Asian region, as per the IMF.

(Source: www.imf.org)

(Source: www.imf.org)

But these countries too would be posed by challenges --mainly the risk of spillovers from greater-than-expected US monetary policy tightening, supply chain disruptions, and inflation. The IMF observes that while Asia's financial systems haven't seen a major impact of the banking turmoil in the U.S. and Europe, they need to be carefully monitored given high leverage among households and corporates.

Graph 1: Leverage amongst corporates

(Source: www.imf.org)

(Source: www.imf.org)

Currently, the higher borrowing costs are adding to the risk. The IMF in its study observes that China, India, and Thailand have a greater concentration of corporate debt in firms with interest coverage ratios below 1, a level signalling susceptibility to default. Further, the Fund explains that across the region, the cash holdings are generally lower in firms with a low-interest coverage ratio.

As regards, the health of banks in India is concerned, thanks to the prudent regulations of the RBI -- be it the Capital Adequacy Ratio, Statutory Liquidity Ratio, Cash Reserve Ratio, etc. -- that most banks in India are financially healthy. And a stress test conducted by RBI shows that even without capital infusion, banks are fully capable of absorbing macroeconomic shocks. That said, if corporate and households begin to default going forwards, banks could be at risk.

(Image source: freepik.com; image by xb100 on Freepik)

(Image source: freepik.com; image by xb100 on Freepik)

It makes sense to invest in gold in times of economic uncertainty and intensified credit risk.

A fact is unlike financial assets, gold is a real asset --meaning gold does not carry credit or counterparty risk. If the world economy slips into a recession, gold in the most likely case would exhibit its sheen.

[Read: Why You Must Own Gold]

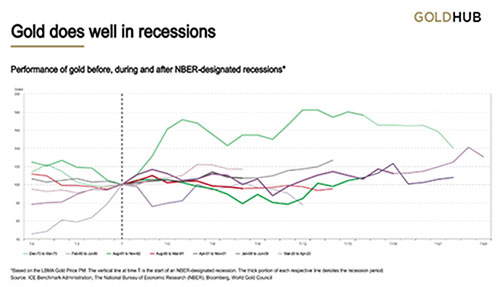

Graph 2: Performance of gold during recessions

(Source: World Gold Council)

(Source: World Gold Council)

A WGC study reveals that in the last five out of the seven last recessions, gold has delivered positive returns. Likewise, simmering geopolitical tensions would be a supportive factor for gold.

The central banks recognising the risks, too, are adding up gold as part of their reserves management. The RBI currently is holding USD 41,604 million worth of gold or 761.35 metric tonnes as a part of its forex reserves.

Gold would prove to be its trait of being a safe haven, hedge, and effective portfolio diversifier in times of economic uncertainty.

Graph 3: Performance of Indian equity index, Debt and Gold

*Data as of May 25, 2023

*Data as of May 25, 2023

MCX spot price of gold used. Returns expressed are in absolute terms considering domestic currency.

(Source: MCX, ACE MF, Data collated by PersonalFN Research)

Gold on a year-to-date basis so far has clocked an absolute return of +10.2%, and against the backdrop of the above risk factors may scale higher.

On the other hand, equity markets have been under pressure owing to global headwinds while debt has yielded around +4.1% absolute returns in a rising interest rate scenario.

Graph 4: Gold has displayed its lustre in the long run

Data as of May 25, 2023

Data as of May 25, 2023

MCX spot price of gold used.

(Source: MCX, Data collated by PersonalFN Research)

The long-term uptrend exhibited by gold as an asset class cannot be ignored. It highlights the importance of owing some gold strategically in the investment portfolio.

How much to allocate to gold?

Against the backdrop of the above, it would be sensible to allocate around 10%-15% of the entire investment portfolio to gold and hold it with a long-term view (of over 5 to 10 years) by assuming moderately high risk.

Consider gold ETF and/or gold savings funds -- the popular gold mutual funds -- which are the smart ways of investing in gold, as opposed to holding gold in a physical form. Note, for investment purposes holding gold in a physical form, attracts higher holding costs (by the way of locker rent), plus there is a risk of loss or theft, and liquidity if the quality of gold is questionable.

[Read: All You Need to Know About Gold Mutual Funds].

So, be a thoughtful investor. In times of economic uncertainty, gold would be the lender of last resort commanding a store of value.

Happy Investing!

ROUNAQ NEROY heads the content activity at PersonalFN and is the Chief Editor of PersonalFN’s newsletter, The Daily Wealth Letter.

As the co-editor of premium services, viz. Investment Ideas Note, the Multi-Asset Corner Report, and the Retire Rich Report; Rounaq brings forth potentially the best investment ideas and opportunities to help investors plan for a happy and blissful financial future.

He has also authored and been the voice of PersonalFN’s e-learning course -- which aims at helping investors become their own financial planners. Besides, he actively contributes to a variety of issues of Money Simplified, PersonalFN’s e-guides in the endeavour and passion to educate investors.

He is a post-graduate in commerce (M. Com), with an MBA in Finance, and a gold medallist in Certificate Programme in Capital Market (from BSE Training Institute in association with JBIMS). Rounaq holds over 18+ years of experience in the financial services industry.

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing.

Disclaimer: This article is for information purposes only and is not meant to influence your investment decisions. It should not be treated as a mutual fund recommendation or advice to make an investment decision in the above-mentioned schemes.