HDFC Nifty India Digital Index Fund: Will It Power Your Portfolio?

Nov 29, 2024

Over the last decade, there has been a sea change in the way many of us transact -- be it ordering food, booking movie tickets, booking a cab, buying train and air tickets, sending money, investing, performing our banking activities, and much more!

Thanks to the Modi-led-NDA government's praiseworthy 'Digital India' initiative (of July 2015), designed with the vision of transforming India into a digitally empowered society and knowledge economy, today we have increased internet penetration, the rollout of 5G connectivity, and continuous advancements in technology. At present Machine Language (ML) and Artificial Intelligence are used in almost all sectors to drive growth. In short, technology and digitisation are playing a pivotal role in driving growth and proving to be an enabler.

According to the State of India's Digital Economy Report, 2024, unveiled by the Indian Council for Research on International Economic Relations (ICRIER), India is at third place in terms of digitalisation of the economy. India's digital infrastructure has been a key driver of its third-place ranking. According to the government, in terms of cutting-edge technologies like artificial intelligence, quantum computing and space exploration, India is envisioned to emerge as a global leader under the Viksit Bharat vision. Watch this video to learn more about equity mutual funds to benefit from India's tech boom.

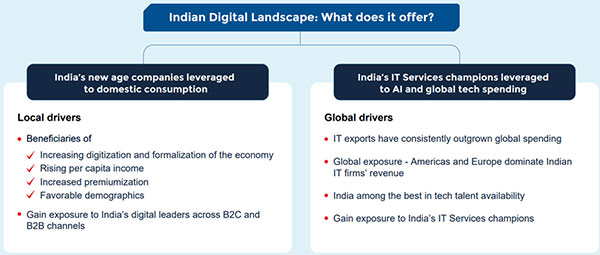

Against this backdrop, HDFC Mutual Fund has launched the HDFC Nifty India Digital Index Fund to tap the investment opportunities in India's digital sector.

(Source: HDFC Mutual Fund Investor Presentation)

(Source: HDFC Mutual Fund Investor Presentation)

HDFC Nifty India Digital Index Fund is an open-ended scheme replicating/tracking the Nifty India Digital Total Return Index (TRI).

During the NFO period, the Scheme is open for subscription from November 22, 2024, to December 6, 2024. Thereafter the Scheme will re-open for continuous Sale and Repurchase within 5 business days from the date of allotment of units under the New Fund Offer (NFO).

HDFC Nifty Digital India Index Fund holds the mandate to invest around 95% to 100% of its total assets in securities covered by the Nifty India Digital Index (TRI).

Up to 20% of the net assets of the Scheme may be invested in equity derivatives for hedging and non-hedging purposes.

HDFC Nifty Digital India Index Fund will also invest up to 5% of its total assets in Debt Securities & Money Market Instruments, Units of Debt Schemes of Mutual Funds. This will be mainly for liquidity purposes.

Repo/ Reverse Repo / TriParty Repos/ Reverse Repos (TREPS) on Government Securities and Treasury Bills (G-Secs and T-Bills) may be used to meet liquidity requirements or pending deployment as per regulatory limits. In addition, from time to time the Scheme may hold cash.

The Scheme may engage not more than 20% of the net assets in securities lending, wherein not more than 5% of the net assets of the Scheme can generally be deployed at a single intermediary level, i.e. broker level.

HDFC Nifty Digital India Index Fund will not invest in the following:

- Debt derivatives

- Credit Default Swaps

- Securitized Debt

- Repo/ Reverse Repo in permitted corporate debt securities

Debt instruments having special features viz. subordination to equity (absorbs losses before equity capital) and/or convertible to equity upon trigger of a prespecified event for loss absorption

- Structured obligations (SO rating) and/or credit enhanced debt (CE rating)

- ADR/GDR/Foreign Securities

- Units of REITs and InvITs

Further, the Scheme will not engage in short selling of securities.

What Is the Investment Objective?

The investment objective of the Scheme is to generate returns that are commensurate (before fees and expenses) with the performance of the Nifty India Digital Index (TRI), subject to tracking error.

There is no assurance that the investment objective of the Scheme will be achieved.

What Is the Investment Strategy?

To achieve the stated investment objective, HDFC Nifty India Digital Index Fund will be managed passively with investments in stocks comprising the underlying index (i.e. Nifty India Digital Index - TRI) subject to tracking error.

Since the Scheme is an index fund, it will only invest in securities constituting the underlying index. However, due to corporate action in companies comprising the index, the Scheme may be allocated/allotted securities which are not part of the index. Such holdings would be rebalanced within 7 Calendar Days from the date of allotment/listing of such securities.

The investment strategy would revolve around reducing the tracking error to the least possible through regular rebalancing of the portfolio, taking into account the change in weights of stocks in the Index as well as the incremental collections/redemptions in the Scheme.

As part of the fund management process, the Scheme may use derivative instruments such as index futures and options, or any other derivative instruments that are permissible or may be permissible in future under applicable regulations. However, trading in derivatives by the Scheme shall be for restricted purposes as permitted by the regulations.

A part of the funds may be invested in debt and money market instruments, to meet liquidity requirements.

The Scheme will benchmark its performance against the Nifty India Digital Total Return Index (TRI).

About the Nifty India Digital Index

The Nifty India Digital Index (launched on December 14, 2021, with the base date as April 1, 2005) aims to track the performance of the portfolio of stocks that broadly represent the Digital theme. The largest 30 stocks from eligible basic industries are chosen based on a 6-month average free-float market capitalization. The weight of each stock in the index (based on their free-float market capitalization) is currently capped at 7.5% each.

Stocks part of or going to be part of the Nifty 500 at the time of review are eligible for inclusion in this index. Also, stock forming part of the certain eligible 'basic industries' based on AMFI Industry Classification shall be eligible to be included from the universe at the time of review.

The Nifty India Digital Index is reconstituted semi-annually (in March and September) while the weights of the stocks are rebalanced quarterly (in March, June, September, and December).

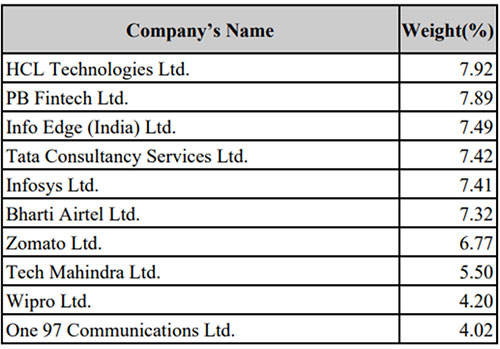

As per the October 2024 factsheet, the top constituents of this index are as under:

Table 1: Top 10 Constituents of the Nifty India Digital Index

(Source: NSE Indexogram Factsheet as of October 2024)

(Source: NSE Indexogram Factsheet as of October 2024)

The Nifty India Digital Index has representation to sectors such as Information Technology, Consumer Services, Telecommunication, and Financial Services. Currently, this index has the highest weight of 51.3% for Information Technology and the lowest weight of 11.9% for Financial Services. Market cap-wise, this index comprises largely of large caps and mid caps (cumulatively 95.7% as per the October 2024 factsheet) and the rest is in small caps (4.3%).

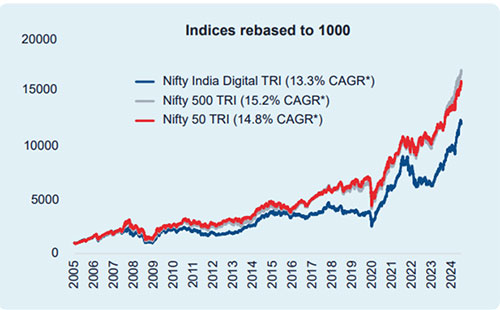

Since the base date of April 1, 2005, the Nifty India Digital Index has clocked a price return of 11.8% CAGR and a total return (which includes dividends) of 13.3% (as of October 31, 2024).

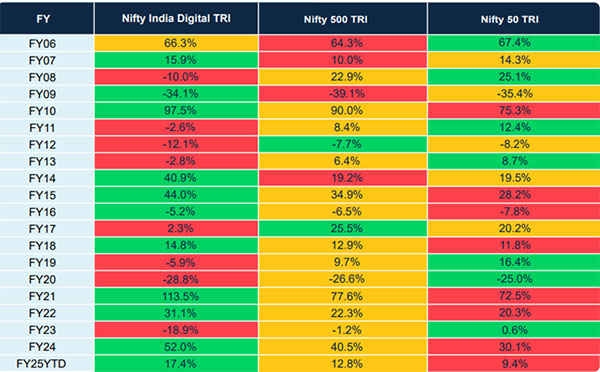

It's not that across time periods Nifty India Digital Total Return Index has clocked positive returns. In certain years (as seen in Table 2), this index has been unable to create wealth.

Table 2: Performance of Nifty India Digital TRI v/s Nifty 500 TRI v/s Nifty 50 TRI

*FY25 YTD data as of October 31, 2024

*FY25 YTD data as of October 31, 2024

NSE Indices Ltd. and internal calculations of HDFC Mutual Fund

Past performance may or may not be sustained in the future and is not a guarantee of any future returns.

(Source: HDFC Mutual Fund Investor Presentation)

That being said, since FY06, the Nifty India Digital TRI has outperformed or fallen less than the Nifty 500 TRI in 11 out of 19 financial years (excluding the data of FY25YTD data).

Graph: Long-Term Performance of Nifty India Digital TRI v/s Nifty 500 TRI v/s Nifty 50 TRI

Data as of October 31, 2024

Data as of October 31, 2024

April 1, 2005, is the inception date for the Nifty India Digital TRI

NSE Indices Ltd. and internal calculations of HDFC Mutual Fund

Past performance may or may not be sustained in the future and is not a guarantee of any future returns.

*CAGR: Compounded Annual Growth Rate

(Source: HDFC Mutual Fund Investor Presentation)

Since the lows of the COVID-19 pandemic, the Nifty Digital TRI has done well but compared to the Nifty 500 TRI and Nifty 50 TRI, it has faltered. Historically, the Nifty Digital Index has exhibited higher volatility and drawdowns than broad market indices like the NIFTY 500 and NIFTY 50.

Here's what Mr Navneet Munot, MD and CEO of HDFC Asset Management, said at the launch:

"At HDFC Mutual Fund, we continue to expand our range of investment solutions to meet the diverse needs of investors. The HDFC Nifty India Digital Index Fund will allow investors to participate in India's digital revolution through a single investment solution that combines exposure to both domestic digital innovators and export-focused IT services champions. Our two decades of expertise in Index Solutions position us strongly to deliver this investment opportunity to our investors."

Who Will Manage HDFC Nifty India Digital Index Fund?

HDFC Nifty India Digital Index Fund will be managed by Mr Nirman Morakhia and Arun Agarwal.

Nirman has over 16 years of experience in equity dealing and holds an MBA in Financial Markets. He has been with HDFC Asset Management Company Ltd. since March 2018 and before that was with Mirae Asset Global Investment Management India Pvt. Ltd. as an Equity Dealer. Currently, Nirman co-manages various schemes at HDFC Mutual Fund.

Arun has a collective experience of over 26 years of experience in equity, debt and derivative dealing, fund management, internal audit and treasury operations. He is a commerce graduate (B.Com) and a Chartered Accountant (CA). He has been with HDFC Asset Management Company Ltd. since September 2010. He too currently co-manages various schemes at the fund house.

How Much is the Minimum Investment in HDFC Nifty India Digital Index Fund?

During the NFO Period and on a continuous basis, the minimum investment is Rs 100/- and any amount thereafter.

Apart from lump sum, the Scheme also offers the Systematic Investment Plan (SIP) and the Systematic Transfer Plan (STP), switches etc. from existing schemes into the NFO of this Scheme.

HDFC Nifty India Digital Index Fund offers both, the Regular and Direct Plan for investment, but each plan offers only the Growth Option.

Who Should Consider Investing in HDFC Nifty India Digital Index Fund?

The fund is suitable for investors looking to tap opportunities across the Indian digital landscape by investing in companies that are part of the Nifty India Digital Index Fund. The Nifty India Digital Index provides diversified exposure to the Digital theme across 8 basic industries currently.

The returns would commensurate with the performance of the Nifty India Digital Index (TRI), over the long term, subject to tracking error. In other words, the fortune of the HDFC Nifty India Digital Index Fund will closely be linked to how the underlying stocks in the fare perform.

Being a thematic index fund, there is a high concentration risk involved. On the risk-o-meter, the HDFC Nifty Digital Index Fund is positioned as a very high-risk fund.

At present, the Price-to-Equity (PE) and Price-to-Book Value (PB) ratios of the Nifty India Digital Index are around 40x are around 17x, respectively, which seems expensive and not do offer enough margin of safety. Even if you have a very high-risk appetite, the margin of safety does not seem comforting.

To know more about the HDFC Nifty India Digital Index Fund, read the Scheme Information Document and Key Information Memorandum.

Make an informed investment decision and be a thoughtful investor.

Happy Investing!