Invest in India's Digital Future with the Motilal Oswal Nifty MidSmall IT and Telecom Index Fund

Oct 31, 2024

Motilal Oswal Mutual Fund has launched Motilal Oswal Nifty MidSmall India IT and Telecom Index Fund

It is an open ended fund replicating / tracking the Nifty MidSmall India Consumption Total Return Index.

[Read: Best IT Sector Mutual Funds: ICICI Pru Technology Fund vs. Tata Digital India Fund]

The investment objective of the scheme is to provide returns that, before expenses, correspond to the total returns of the securities as represented by Nifty MidSmall IT and Telecom Total Return Index, subject to tracking error.

However, there can be no assurance or guarantee that the investment objectives of the scheme will be achieved.

India's IT & Telecom Sector

India's IT and telecom sectors are two of the country's most dynamic and fast-evolving industries, driven by global demand for digital services, domestic digital adoption, and government initiatives that aim to boost connectivity and innovation. These sectors collectively contribute significantly to GDP, exports, employment, and digital infrastructure, positioning India as a major player in the global technology ecosystem.

Both sectors are expected to be strong drivers of economic growth, employment, and digital infrastructure. The IT industry employs over 5 million people and continues to add jobs through tech advancements and new services. In telecom, investments in 5G infrastructure and spectrum acquisitions have laid the groundwork for higher future revenues.

As India continues on its digital path, these sectors are poised to not only transform the economy but also strengthen India's position as a global digital leader.

How will the scheme allocate its assets?

Under normal circumstances, Motilal Oswal Nifty MidSmall IT and Telecom Index Fund will hold an allocation of 95% to 100% in Constituents of Nifty MidSmall IT and Telecom Total Return Index, and 0% to 5% in Units of Liquid schemes and Money Market instruments.

Exit Load: 1%- If redeemed on or before 15 days from the date of allotment.

Nil- If redeemed after 15 days from the date of allotment.

What is the investment strategy of Motilal Oswal Nifty MidSmall IT and Telecom Index Fund?

The Motilal Oswal Nifty MidSmall IT and Telecom Index Fund follows a passive investment strategy and seeks to invest in the constituents of Nifty MidSmall IT and Telecom Total Return Index.

The investment strategy would be Passive in nature offering investment returns that are similar to the total returns of Nifty MidSmall India IT and Telecom Index before fees / expense and subject to tracking error.

About Nifty MidSmall India Consumption Index

The Nifty IT and Telecom Index is designed to track the performance of India's prominent companies in the information technology (IT) and telecommunications sectors. These sectors are two of India's most rapidly evolving and high-growth industries, and they play a crucial role in both the domestic economy and global markets.

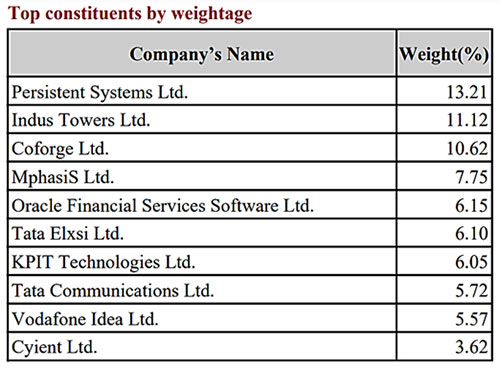

The Index tracks performance of the mid cap and small cap stocks within the information technology and telecommunication sector. The index includes upto 20 stocks selected from the parent Nifty MidSmallcap 400 index based on the stock's six-month average free-float market capitalization. The weight of each stock in the index is based on stock's free float market capitalization

Data as of September 30, 2024

(Source: NSE - Nifty MidSmall India IT & Telecom Index)

-

Motilal Oswal Nifty MidSmall IT and Telecom Index Fund is benchmarked against the Nifty MidSmall IT and Telecom Total Return Index.

-

Motilal Oswal Nifty MidSmall IT and Telecom Index Fund will be managed by Mr Swapnil Mayekar and Mr Rakesh Shetty

-

Motilal Oswal Nifty MidSmall IT and Telecom Index Fund is open for subscription from October 29, 2024 to November 06, 2024. The fund will reopen for continuous sale and repurchase on November 19, 2024

-

The minimum subscription amount is Rs 500/- and in multiples of Re. 1 thereafter. For Additional Purchase, Rs 500/- and in multiples of Re. 1/- thereafter.

-

The fund offers Direct Plan and Regular Plan. Under each plan the fund offers Growth option only.

Should investment in Motilal Oswal Nifty MidSmall IT and Telecom Index Fund be considered?

Motilal Oswal Nifty MidSmall IT and Telecom Index Fund offers exposure to mid- and small-cap companies in India's IT and Telecom sector. Many investors are seeking to invest in this segment to capture growth in India's technology and telecommunications segments, particularly among mid- and small-cap companies.

The fund focuses on tracking the Nifty MidSmall IT and Telecom Index, which includes a mix of mid- and small-cap firms specializing in information technology and telecommunications services. With India's digital transformation in full swing, this fund targets companies with high growth potential in sectors that are pivotal to the nation's technological advancement.

One primary advantage of investing in this fund is the growth trajectory of mid- and small-cap companies within the IT and telecom sectors. Consequently, this fund may appeal to investors looking for growth beyond large-cap tech companies and willing to capitalize on the next wave of tech innovators.

However, investing in mid- and small-cap companies, particularly in the tech and telecom sectors, does come with higher risk and volatility. Mid and small-cap stocks are typically more sensitive to market downturns, currency fluctuations, and economic shifts.

Additionally, the persistent macroeconomic uncertainty may keep short-term market volatility high. The performance of the scheme might therefore be impacted by these variables, among others, and may affect negatively if the sectors move out of favour.