Kotak Nifty Midcap150 Momentum 50 Index Fund: A Worthwhile Proposition?

Sep 24, 2024

As the Indian equity market is heading northward, making new lifetime, and there is positive momentum favouring growth investing, no one wants to miss the bus -- not even mutual funds. Several fund houses have capitalised on the market sentiments and launched a variety of schemes, both actively managed and passively managed index funds. Kotak Mahindra Mutual Fund too has launched a range of index funds this year since May 2024.

The latest addition to the product basket of Kotak Mahindra Mutual Fund is the Kotak Nifty Midcap150 Momentum 50 Index Fund. It is an open-ended scheme replicating/tracking the NIFTY Midcap150 Momentum 50 Index.

During the NFO period, the Scheme is open for subscription from September 19, 2024, to October 3, 2024. Thereafter the scheme re-opens for subscription on or before October 11, 2024.

The launch of the Scheme is at a time when the bellwether index has scaled to a new lifetime high, and investors are chasing midcaps and smallcaps for better returns.

[Read: How to Choose Mutual Funds at a Market High]

The overall market momentum is favouring growth investing, as the Indian economy has exhibited an alluring growth rate. India is one of the fastest-growing major economies in the world (driven by consumption and public investment in infrastructure) and is perceived to be a "bright spot" with several reforms carried out over the last two decades.

Also, what is noteworthy is that despite various factors such as geopolitical tensions, supply chain disruptions, economic fragmentation, sanctions, inflation risk, and the last pandemic, India has done well. This is why the bulls have gained force and the Indian equity market is scaling new highs.

Historically it has been observed that the momentum strategy works well in the bull and recovery phase of the market. And much of the momentum, usually, is in the midcap and smallcap segments of the market.

Momentum investing relies on the hypothesis that financial instruments which have shown an upward or downward price trend will continue to do so for a certain period.

This strategy is grounded in behavioural finance, which suggests that investors' psychological biases and market sentiment can drive prices in the short term. And for now, broadly, the trend appears to be positive favouring momentum investing.

Having said that, the operational performance of a company is also a factor in momentum investing.

[Read: All You Need to Know About Momentum Mutual Funds]

The Kotak Nifty Midcap150 Momentum 50 Index Fund will invest 95%-100% of its total assets in equity and equity-related securities covered by Nifty Midcap150 Momentum 50 Index.

The Scheme may also take exposure to equity derivatives of constituents or index derivatives of the underlying index for a short duration when securities of the index are unavailable, insufficient or for rebalancing at the time of change in the index or in case of corporate actions, as permitted subject to rebalancing within 7 calendar days. The equity derivative exposure for non-hedging purposes shall be up to 20% of equity and equity-related securities of the Scheme.

Up to 5% of the Scheme's total assets will be invested in debt/money market instruments. This shall be to meet the liquidity requirements of the Scheme.

Money Market instruments include Commercial Papers (CPs), commercial bills, Treasury bills (T-bills), Government securities (G-secs) having an unexpired maturity of up to one year, call or notice money, Certificate of Deposit (CPs), usance bills, and any other like instruments as specified by the Reserve Bank of India (RBI) from time to time and subject to regulatory approval.

The Scheme may invest up to 5% of net assets in Liquid Mutual Funds & Overnight Mutual Fund schemes without charging any fees, provided that aggregate inter-scheme investment made by all schemes under the management of Kotak Mahindra Asset Management Company (AMC) Limited or in schemes under the management of any other asset management company shall not exceed 5% of the net asset value of Kotak Mahindra Mutual Fund.

Further, the Scheme will engage in securities lending and borrowing. At present, since only lending is permitted, the Scheme may temporarily lend securities held with the custodian to reputed counter-parties or on the exchange, for a fee, subject to prudent limits and controls for enhancing returns. The Scheme will lend securities subject to a maximum of 20%, in aggregate, of the net assets of the Scheme and 5% of the net assets of the Scheme in the case of a single intermediary.

The Scheme does not intend to undertake/invest/engage in:

-

ADR/GDR/overseas securities/ foreign securities

-

Credit Default Swaps

-

Units of Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs)

-

Debt instruments with special features

-

Securitized debt

-

Investment in commodity derivatives, debt derivative instruments

-

Structured obligations and credit enhancements

-

Repo/ reverse repo transactions in corporate debt securities

-

Short selling of securities

What Is the Investment Objective?

The investment objective of the scheme is to provide returns that, before expenses, corresponding to the total returns of the securities as represented by the underlying index, subject to tracking errors.

However, there is no guarantee or assurance that the investment objective of the scheme will be achieved.

What Is the Investment Strategy?

To achieve the investment objective, the scheme will follow a passive investment strategy with investments in stocks in the same proportion as in the Nifty Midcap150 Momentum 50 Index.

The investment strategy would revolve around reducing the tracking error through rebalancing the portfolio, taking into account the change in weights of stocks in the index as well as the incremental collections/redemptions from the Scheme.

Being passively managed, the Index Scheme will carry lesser risk compared to active fund management. The portfolio follows the index and therefore the level of stock concentration in the portfolio and its volatility would be the same as that of the index, subject to tracking error.

Thus, there is no additional element of volatility or stock concentration on account of fund manager decisions.

The Scheme may take exposure to equity derivatives of constituents or index derivatives of the underlying index for a short duration when securities of the index are unavailable, insufficient or for rebalancing at the time of change in the index or in case of corporate actions, as permitted by SEBI from time to time.

A small portion of the net assets will be held as cash or will be invested in debt and money market instruments including TREPS or in alternative investment for the TREPS, as may be provided by the RBI, to meet the liquidity requirements under the Scheme.

The measures mentioned above are based on current market conditions and may change from time to time based on changes in such conditions, regulatory changes and other relevant factors.

The Scheme will benchmark its performance against the Nifty Midcap150 Momentum 50 Index (Total Return Index).

About the Nifty Midcap150 Momentum 50 Index

The Nifty Midcap150 Momentum 50 Index, launched on August 16, 2022 (with the base date as April 1, 2005) aims to track the performance of the top 50 companies within the Nifty Midcap150 selected based on their Normalized Momentum Score.

The Normalized Momentum Score for each company is determined based on its 6-month and 12-month price return, adjusted for volatility.

The stock weights are based on a combination of the stock's Normalized Momentum Score and its free-float market capitalisation. This index is rebalanced every six months.

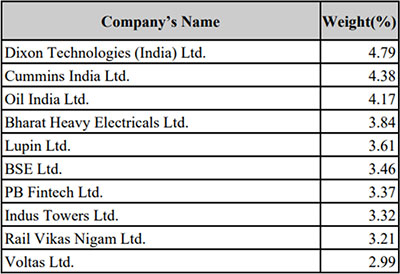

At present, the top constituents of this index are as under:

Table 1: Top Constituents of the Nifty Midcap150 Momentum 50 Index

(Source: NSE Indexogram Factsheet as of August 2024)

The Nifty Midcap150 Momentum 50 Index has representation across sectors such as capital goods, financial services, realty & construction, consumer durables, healthcare, power, oil & gas, metals & mining, automobiles & auto components, and telecom among others.

Since its inception, the Nifty Midcap150 Momentum 50 Index has delivered a compounded annualised price return of 24.1% and a total return (which includes dividends) of 25.4% (as of August 30, 2024).

Graph 1: Long-term Performance of Nifty Midcap150 Momentum 50 Index

(Source: NSE Indexogram Factsheet as of August 2024)

Particularly after the lows of the COVID-19 pandemic, the Nifty Midcap150 Momentum 50 Index has seen a sharp upswing and delivered attention-seeking returns.

Over the last one year, the Nifty Midcap150 Momentum 50 Index has clocked a stellar absolute total return of 66.1% as of August 30, 2024, rewarding investors very well.

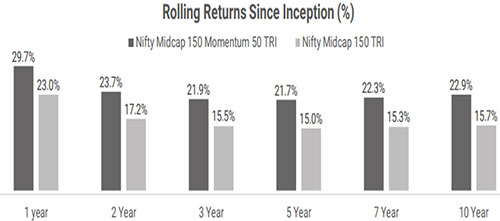

Graph 2: Rolling Return Performance of the Nifty Midcap150 Momentum 50 Index v/s Nifty Midcap150 TRI

Returns as of August 30, 2024

Returns = 1 year is Compounded Annualized Growth Rate ("CAGR")

Past performance may or may not be sustained in the future.

The performance of the index shown does not in any manner indicate the performance of the Scheme.

Kotak Mahindra Asset Management Company Limited (KMAMC) is not guaranteeing or promising any returns/futuristic returns.

(Source: Kotak Mutual Fund's leaflet)

When evaluated on a rolling return basis (see Graph 2), the Nifty Midcap150 Momentum 50 TRI has fared remarkably better than the Nifty Midcap150 TRI, generating a noticeable alpha.

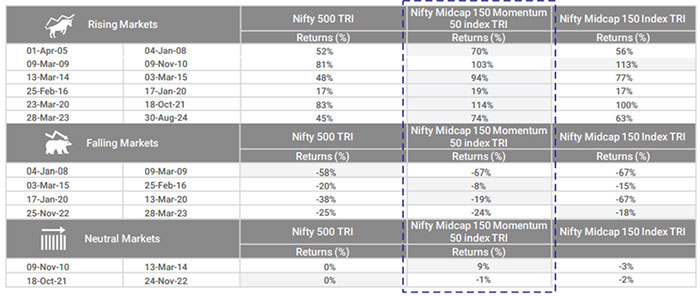

Table 2: The Nifty Midcap150 Momentum 50 TRI Has Also Managed the Downside Risk Better

Returns as of August 30, 2024

Returns = 1 year is Compounded Annualized Growth Rate ("CAGR")

Past performance may or may not be sustained in the future.

The performance of the index shown does not in any manner indicate the performance of the Scheme.

Kotak Mahindra Asset Management Company Limited (KMAMC) is not guaranteeing or promising any returns/futuristic returns.

(Source: Kotak Mutual Fund's leaflet)

Table 2 above shows that the Nifty Midcap150 Momentum 50 TRI has not just gained better during bull markets, but even in bear markets or falling markets and neutral markets have shown limited downside compared to the Nifty Midcap150 TRI.

Here's what Mr Nilesh Shah, the Managing Director of Kotak Asset Management Company (AMC), said about the fund launch:

"The Kotak Nifty Midcap150 Momentum 50 Index Fund aligns with our commitment to offering active and passive products that cater to different risk appetites and investment horizons. This index fund offers investors an opportunity to invest in a rule-based index that invests in midcap companies selected with the momentum strategy.

The Midcap plus Momentum combination can provide investors the opportunity to invest in midcap companies with potential high growth without the hassle of constantly monitoring and adjusting investments."

Mr Devinder Singhal, the Executive Vice President and Fund Manager at Kotak AMC said,

"The Nifty Midcap150 Momentum 50 Index has historically outperformed other midcap indices. By focusing on momentum stocks, this fund offers investors a way to potentially benefit from price trends in a passive and disciplined manner. The strategy allows investors looking for growth and able to handle some level of risk to access the high-growth midcap segment while maintaining a systematic, rule-based approach."

Keep in mind, the fundamental principle behind momentum investing is that stocks or other financial assets that have performed well in the past will continue to perform well in the future, while those that have performed poorly will continue to perform poorly.

Now, while momentum investing tries to ride this wave of momentum stocks that are doing well, it also jumps on to the next wave before the first one slows down. This is one of the reasons why the downside is arrested.

Who Will Manage Kotak Nifty Midcap150 Momentum 50 Index Fund?

Mr. Devender Singhal and Mr. Satish Dondapati will be the designated Fund Managers for the Scheme.

Mr. Abhishek Bisen will be the Fund Manager for the debt securities of the Scheme.

Mr Singhal has more than 22 years of experience in fund management and equity research of which the last 15 years have been with Kotak AMC. Before that, he was part of various PMS like Kotak, Religare, Karvy and P N Vijay Financial Services.

He holds an honours degree in mathematics from Delhi University and PGDM (Finance, Insurance).

Currently, he is managing assets across multicap and hybrid strategies, plus various other index funds and equity-oriented Exchange Traded Funds (ETFs) at the fund house.

Mr Dondapati has over 16 years of experience in ETFs. He has been there with Kotak AMC since March 2008, and before that was in the mutual fund product team of Centurion Bank of Punjab. He holds an MBA (Finance). He co-manages various passive funds at the fund house.

Mr Bisen has been associated with Kotak AMC since October 2006 and his key responsibilities include fund management of debt schemes. Mr Kotak AMC, Mr Bisen has worked with Securities Trading Corporation of India Ltd where he was looking at Sales & Trading of Fixed Income Products apart from doing Portfolio Advisory. His earlier assignments also include two years of merchant banking experience with a leading merchant banking firm. He holds a bachelor's degree in arts (BA - Management) and an MBA (Finance).

How Much is the Minimum Investment in Kotak Nifty Midcap150 Momentum 50 Index Fund?

During the NFO period, i.e. from September 19, 2024, to October 3, 2024, the minimum investment in the Scheme for both, lump sum and SIP purchase, is Rs 100/- and in multiple of Re 1/- for initial/switch-in as well as SIPs during the NFO period, and offers both, the Direct Plan and Regular Plan for investment. Plus the options available are Growth and Income Distribution cum Capital Withdrawal (IDCW).

Who Should Consider Investing in Kotak Nifty Midcap150 Momentum 50 Index Fund?

Investors who want to participate in momentum investing and benefit from exposure mainly to midcaps and sectors with an underlying portfolio of top 50 companies with the highest Normalised Momentum Score from the Nifty Midcap Index can consider this fund.

But be ready to assume a very high-risk appetite while looking for long-term capital growth, and keep an investment time horizon of around 5 to 7 years or so.

Considering the stretch valuations of the midcap segment of the Indian equity market (Nifty Midcap150 Momentum Price-to-Equity ratio is over 36x), at present, even if you have a very high-risk appetite, it is suggested to have a very small exposure to the overall equity portfolio to this index fund.

The fortune of the Scheme will be closely linked to the performance of the Nifty Midcap150 Momentum 50 Index.

To know more about the Kotak Nifty Midcap150 Momentum 50 Index Fund, read the Scheme Information Document and Key Information Memorandum.

Make an informed investment decision and be a thoughtful investor.

Happy Investing!