Motilal Oswal Nifty Capital Market Index Fund: A Worthwhile Proposition?

Nov 28, 2024

In the year 2024, Motilal Oswal Mutual Fund has been launching a variety of Index Funds. As the National Stock Exchange (NSE) launched the Nifty Capital Markets Index on September 9, 2024, the fund house has launched the Motilal Oswal Nifty Capital Market Index Fund. It is an open-ended fund replicating/tracking the Nifty Capital Market Total Return Index (TRI).

During the NFO period, the Motilal Oswal Nifty Capital Market Index Fund is open for subscription from November 26, 2024, to December 10, 2024. Thereafter the Scheme re-opens for subscription on December 20, 2024.

As you may be aware, the Indian capital market has experienced remarkable growth, emerging as a key driver of the nation's economic development, largely attributed to increasing participation from domestic and global investors.

The fact that India is the fastest-growing major economy and is considered to be a "bright spot" in the global economy, is attractive investors. This is also reflected in the kind of returns Indian equities have delivered in the last couple of years.

Table 1: Nifty Capital Market Index Performance

Nifty indices performance from October 31, 2019, to October 31, 2024.

Nifty indices performance from October 31, 2019, to October 31, 2024.

TRI= Total Return Index, CAGR= Compounded annual growth rate

Performance results have many inherent limitations, and no representation is being made that any investor will or is likely to achieve.

Past performance may or may not be sustained in future and is not a guarantee of any future return.

The table is used to explain the concept and is for illustration purposes only and should not be used for the development or implementation of an investment strategy.

(Source: https://www.motilaloswalmf.com/)

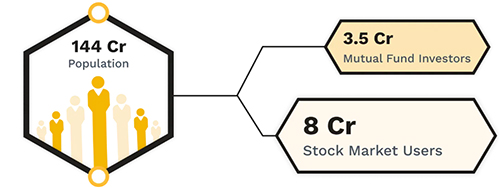

Favourable domestic macroeconomic undercurrents, encouraging earning, continuous advancements in technology (which supports app-based or online investing), rising financial literacy, the shift in household saving to variable return instruments, the cult for risk-on assets, and robust regulatory framework have been some of the abetting factors for the Indian capital markets. And given that there is still potential due to under-penetration, offers a probable runway for the capital market's growth in India.

Image: Untapped Potential of the Indian Capital Market

(Source: https://www.motilaloswalmf.com/)

(Source: https://www.motilaloswalmf.com/)

Motilal Oswal Nifty Capital Market Index Fund holds the mandate to invest 95% to 100% of its total assets in the constituents of the Nifty Capital Market Index.

The Nifty Capital Market Index aims to track the performance of stocks from the Nifty 500 index which represents the capital market theme.

The Scheme will hold all the securities that comprise of underlying index in the same proportion as the index subject to tracking error. The expectation is that, over a period of time, the tracking error of the Scheme relative to the performance of the Underlying Index will be relatively low.

The investment manager would monitor the tracking error of the Scheme on an ongoing basis and would seek to minimize tracking error to the maximum extent possible. There can be no assurance or guarantee that the Scheme will achieve any particular level of tracking error relative to the performance of the underlying index, i.e. the Nifty Capital Market Index.

The Scheme may also take exposure to equity derivatives (not exceeding 20% of the net assets of the Scheme) of the index itself or its constituent stocks may be undertaken when equity shares are unavailable, insufficient or for rebalancing in case of corporate actions for a temporary period. Other than for the above purposes, the Scheme will not invest in equity derivatives. These investments would be for a short period of time i.e. 7 days. When the exposure falls outside the asset allocation pattern for equities, the portfolio will be rebalanced by AMC within 7 days from the date of deviation.

Motilal Oswal Nifty Capital Market Index Fund will also invest up to 5% of its total assets in units of Liquid schemes and Money Market instruments.

Money Market Instruments include Commercial Papers(CPs), Commercial bills, Treasury bills (T-bills), TREPS, Government securities (G-secs) having an unexpired maturity up to one year, call or notice money, certificate of deposit, Bills Rediscounting, usance bills, and any other like instruments as specified by the Reserve Bank of India (RBI)/ Securities and Exchange Board of India (SEBI) from time to time.

The Scheme may engage not more than 20% of the net assets in securities lending, wherein not more than 5% of the net assets of the Scheme can generally be deployed to any single counterparty.

The Scheme will not invest in:

- Securitised debt

- AT1 and AT2 bonds

- Credit Default Swaps (CDS)

- Repo in corporate debt securities and corporate reverse repo

- Debt instruments having Structured Obligations (SO) or Credit Enhancements (CE)

- Unrated debt instruments

- Foreign securities

- REITs and InVITs

Further, the Scheme shall not engage in short selling of securities.

What Is the Investment Objective?

The investment objective of the scheme is to provide returns that, before expenses, correspond to the total returns of the securities as represented by the Nifty Capital Market Total Return Index, subject to tracking error.

However, there is no assurance or guarantee that the investment objectives of the scheme will be achieved.

What Is the Investment Strategy?

In the endeavour to achieve the stated investment objective, the Scheme follows a passive investment strategy and seeks to invest in the constituents of the Nifty Capital Market Total Return Index.

The scheme would also invest in units of liquid schemes and money market instruments as mentioned above.

The AMC would monitor the tracking error of the Scheme on an ongoing basis and would seek to minimize tracking error to the maximum extent possible. Under normal market circumstances, such tracking error is not expected to exceed 2% p.a. In case of unavoidable circumstances like force majeure, which are beyond the control of the AMC, the tracking error may exceed 2% and the same will be intimated to the Trustees with corrective actions taken by the AMC, if any.

The Scheme will benchmark its performance against the Nifty Capital Markets Total Return Index (TRI).

About the Nifty Capital Markets Index

As mentioned earlier, the Nifty Capital Markets Index was launched by the NSE on September 9, 2024 (with April 1, 2019, as the base date).

This index aims to track the performance of stocks from the Nifty 500 Index which represents the capital markets theme. The largest 20 stocks from eligible basic industries are selected based on a 6-month average free-float market capitalisation, and this is reconstituted semi-annually and rebalanced quarterly.

Currently, the Nifty Capital Markets Index comprises 20 stocks and the stock weights are capped at 20%.

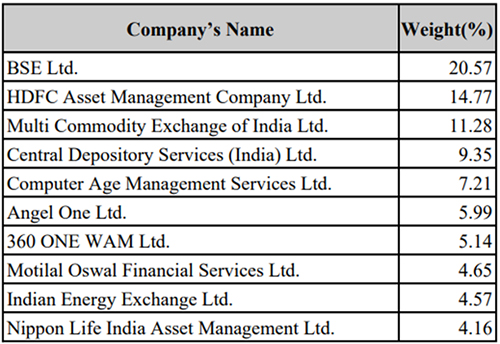

At present, the top constituents of this index are as under:

Table 2: Top 10 Constituents of the Nifty Capital Markets Index

(Source: NSE Indexogram Factsheet as of October 2024)

(Source: NSE Indexogram Factsheet as of October 2024)

Given that this index is called the Nifty Capital Markets Index, it has representation only to the financial services sector, which is the overall growth of India.

Since the base date of April 1, 2019, the Nifty Capital Markets Index has clocked a price return of 26.5% CAGR and a total return (which includes dividends) of 28.3% (as of October 31, 2024).

In the last one year, the Nifty Capital Markets Index has clocked an exceptional absolute price return of 94.8% and a total return of 96.9% as of October 31, 2024.

Graph 1: Long-term Performance of Nifty Capital Markets Index

(Source: NSE Indexogram Factsheet as of October 2024)

(Source: NSE Indexogram Factsheet as of October 2024)

Since the lows of the COVID-19 pandemic, the Nifty Capital Markets Index, by and large, has seen an uptrend backed by investor participation and encouraging corporate earnings.

Here's what Pratik Oswal, Chief of Business Passive Funds, Motilal Oswal AMC has to say about the launch of Motilal Oswal Nifty Capital Market Index Fund:

"Technological and operational ease with on-the-go investment, T+1 settlement time, UPI & IMPS based transfer on a real-time basis has boosted investor participation. In 2024, India will be leading in IPO issuances, with $8 billion raised between FY 19 and FY 24 and the investment through mutual funds, PMS, & AIF is also rising at 21% per annum.

With the IPOs expected to come in the upcoming years, more companies will be added to the index."

Who Will Manage Motilal Oswal Nifty Capital Market Index Fund?

The equity portion of the Scheme will be managed by Mr Swapnil Mayekar, whereas the debt portion of the portfolio by Mr Rakesh Shetty.

Swapnil has over 13 years of experience in fund management and product development and currently is the Vice President - Fund Manager at Motilal Oswal Asset Management Company Ltd. He has been with the AMC since March 2010.

He holds a master's degree in commerce (M.Com) and a post-graduate advanced diploma in business administration.

His skillset lies in index investing and Exchange Traded Funds (ETFs). At Motilal Oswal Mutual Fund he manages various index funds and ETFs.

Mr Rakesh Shetty is a commerce graduate (B.Com) and an MBA (Finance). He has more than 14 years of overall experience and expertise in trading in equity, debt segment, ETF management, Corporate Treasury and Banking.

Before joining Motilal Oswal Asset Management Company Ltd, he worked with a company engaged in Capital Market Business wherein he was in charge of equity and debt ETFs, customised indices, and has also been part of product development. At Motilal Oswal Mutual Fund, Rakesh as Fund Manager - Fixed Income, co-manages a variety of schemes.

How Much is the Minimum Investment in Motilal Oswal Nifty Capital Market Index Fund?

During NFO and on a continuous basis, the minimum lump sum investment in this Scheme is Rs 500/- and in multiples of Re. 1/- thereafter.

In the case of the Systematic Investment Plan (SIP), for the daily SIP, the minimum investment is Rs 100/- and multiple of Re 1/- thereafter (minimum instalments: 30 days).

For the weekly, fortnightly, and monthly SIPs the minimum investment amount is Rs 500/- and multiple of Re 1/- thereafter (minimum instalments: 12).

In the case of the quarterly SIP option, the minimum investment amount is Rs 1,500/- and multiple of Re. 1/- thereafter (minimum instalments: 4).

And for annual SIP the minimum SIP investment amount is Rs 6,000/- and multiple of Re 1/- thereafter.

Motilal Oswal Nifty Capital Market Index Fund offers Regular and Direct Plans with a Growth option.

[Read: IDCW vs Growth Option: Which One Should You Opt for?]

Who Should Consider Investing in Motilal Oswal Nifty Capital Market Index Fund?

The fund is suitable for those investors who are looking for long capital appreciation with a passively managed fund investing in a portfolio of companies forming part of the Nifty Capital Markets Index.

The Nifty Capital Markets Index has representation to only the financial services sector, and while it is the driver of India's economic growth and development, note that you would be exposed to high sector concentration risk.

On the risk-o-meter, the Motilal Oswal Nifty Capital Market Index Fund is positioned as a very high-risk fund. Returns may be affected by stock market movements and economic conditions.

At present the valuation of the Nifty Capital Markets Index looks rather stretched. Even if you have a very high-risk appetite, the margin of safety does not seem comforting. Note that the fortune of the Scheme will be closely linked to the performance of the Nifty Capital Markets Index.

To know more about the Motilal Oswal Nifty Capital Market Index Fund, read the Scheme Information Document and Key Information Memorandum.

Make an informed investment decision and be a thoughtful investor.

Happy Investing!