Motilal Oswal Nifty MidSmall Financial Services Index Fund: Should You Invest?

Oct 30, 2024

Over the last few months, Motilal Oswal Mutual Fund has been building its product basket by adding a variety of equity-oriented index funds. The new one in the stable is Motilal Oswal Nifty MidSmall Financial Services Index Fund.

It is an open-ended equity fund replicating/tracking the Nifty MidSmall Financial Services Total Return Index.

During the NFO period, the scheme is open for subscription from October 29, 2025, to November 6, 2024. Thereafter the Scheme will re-open for subscription on November 19, 2024.

The launch of the Scheme comes at a time when the mid & small cap segments of the Indian equity market are at lofty valuations and the financial services industry is contributing to India's economic growth by the way of digital transformation, rise in fintech (disrupting traditional financial services), and enabling financial inclusion in terms of mobilisation of savings into various investment avenues, buying insurance, as well as demand for credit.

India's financial services sector has undergone a significant transformation over the years. Thanks to well-thought-of policies and technology playing a positive disruptor. The financial services sector is among the important sectors and themes of the Indian equity market today.

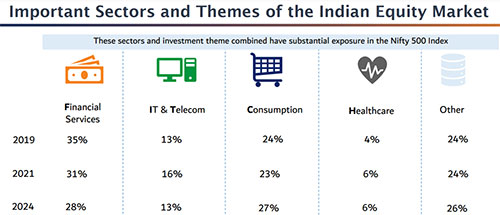

Image 1: Financial Services Exposure to the Nifty 500 Index

Data from September 30, 2019, to September 30, 2024

The above graph is used to explain the concept and is for illustration purposes only and should not be used for the development or implementation of an investment strategy.

Past performance may not be sustained in the future and is not a guarantee of any future returns.

(Source: Nifty indices and as given in the investor presentation by Motilal Oswal Mutual Fund.)

Further, over the last five years, it is the small & midcap companies that have led the growth in terms of profitability with innovative business ideas.

Motilal Oswal Nifty MidSmall Financial Services Index Fund has the mandate to invest 95% to 100% of its total assets in the constituents of Nifty MidSmall Financial Services Total Return Index.

The Scheme will hold all the securities that comprise of underlying Index in the same proportion as the index subject to tracking error. The expectation is that, over a period of time, the tracking error of the Scheme relative to the performance of the underlying index will be relatively low.

The investment manager would monitor the tracking error of the Scheme on an ongoing basis and would seek to minimise the tracking error to the maximum extent possible.

However, there can be no assurance or guarantee that the Scheme will achieve any particular level of tracking error relative to the performance of the underlying index.

The Scheme may take exposure to equity derivatives of the index itself or its constituent stocks (for non-hedging purposes) when equity shares are unavailable, insufficient or for rebalancing in case of corporate actions for a temporary period. Other than for the said purposes, the Scheme will not invest in equity derivatives.

These investments in derivatives would be for a short period of time i.e. days. The exposure towards equity derivatives instruments shall not exceed 20% of the net assets of the Scheme. If the exposure falls outside the asset allocation pattern, the portfolio would be rebalanced by AMC within 7 days from the date of said deviation. The fund shall not write options or purchase instruments with embedded written options. When the constituent's securities of the underlying index are available again, derivative positions in these securities would be unwound.

The Scheme may engage in securities/stock lending of not more than 20% of the net assets of the Scheme and not more than 5% of the net assets of the Scheme can generally be deployed in stock lending to any single counterparty.

The Scheme would hold up to 5% of its total assets Liquid Schemes/debt schemes, debt and/or money market instruments. This is mainly for liquidity purposes and to meet redemptions.

Money Market Instruments include Commercial Papers (CPs), Commercial bills, Treasury bills (T-bills), TREPS, Government securities (G-secs) having an unexpired maturity up to one year, call or notice money, certificate of deposit, bills rediscounting, usance bills, and any other like instruments as specified by the Reserve Bank of India(RBI)/ Securities and Exchange Board of India (SEBI) from time to time.

Similarly, the scheme may invest in their own mutual fund schemes or other mutual fund schemes.

The pending deployment of funds as per investment objective may be parked in short-term deposits of scheduled commercial banks, subject to guidelines and limits specified by SEBI.

Motilal Oswal Nifty MidSmall Financial Services Index Fund shall not indulge in the following:

-

Investment in securitised debt

-

AT1 and AT2 bonds

-

Unrated debt securities

-

Repo in corporate debt and corporate reverse repo

-

Credit Default Swaps (CDS)

-

Structured Obligations (Sos) or Credit Enhancements (CEs)

-

Overseas Securities/ ADR & GDRs

-

REITs or InVITs

-

Short selling of securities

What is the Investment Objective?

The investment objective of Motilal Oswal Nifty MidSmall Financial Services Index Fund is to provide returns that, before expenses, correspond to the total returns of the securities as represented by Nifty MidSmall Financial Services Total Return Index, subject to tracking error.

However, there can be no assurance or guarantee that the investment objectives of the scheme will be achieved.

What is the Investment Strategy?

The Scheme will follow a passive investment strategy and seeks to invest in the constituents of the Nifty MidSmall Financial Services Total Return Index (TRI). The scheme aims to achieve returns equivalent to the benchmark subject to tracking error.

Tracking error may arise due to the following reasons:

-

Fees and expenses of the Scheme

-

Cash balance held by the Scheme due to dividends received, subscriptions, redemption, etc.

-

Halt in trading on the stock exchange due to circuit filter rules

-

Corporate actions

-

The Scheme has to invest in the securities in whole numbers and has to round off the quantity of securities shares.

-

Delay in dividend payout, and withholding tax on dividend

-

Changes in the constituents of the underlying Index. Whenever there are any changes, the Scheme will reallocate its investment as per the revised Index, but market conditions may not offer an opportunity to rebalance its portfolio to match the Index and such delay may affect the NAV of the Scheme.

-

Lack of Liquidity

The AMC would monitor the tracking error of the Scheme on an ongoing basis and would seek to minimise tracking error to the maximum extent possible.

Under normal market circumstances, such tracking error is not expected to exceed 2% p.a. In case of unavoidable circumstances like force majeure, which are beyond the control of the AMC, the tracking error may exceed 2% and the same will be intimated to the Trustees with corrective actions taken by the AMC, if any.

The Scheme would also invest in units of Liquid/ debt schemes, debt and money market instruments as mentioned earlier.

Also, subject to the SEBI regulations as applicable from time to time, the Scheme may participate in securities lending.

The Scheme will benchmark its performance against the Nifty MidSmall Financial Services Total Return Index (TRI).

About the Nifty MidSmall Financial Services Index

The Nifty MidSmall Financial Services Index (launched on August 3, 2022, with the base date as April 1, 2005) tracks the performance of midcap and smallcap stocks belonging to the financial services sector. This index includes up to 30 stocks and their weights are based on free-float market capitalisation.

This index is designed in such a way that the weight of no single stock shall be more than 33% and the weights of the top 3 stocks cumulatively shall not be more than 62% at the time of rebalancing.

The index is reconstituted semi-annually and rebalanced quarterly. Stocks forming part or going to form part of the Nifty MidSmallcap 400 index at the time of review are eligible for inclusion in the index.

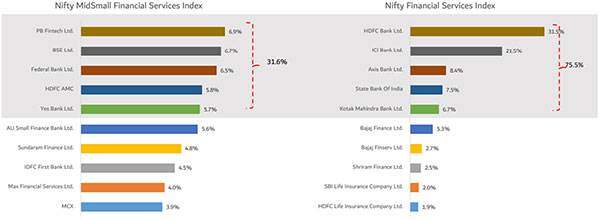

The Nifty MidSmall Financial Services Index is relatively better diversified compared to the Nifty Financial Services Index which has exposure to heavyweight banks and financial services companies. That said, the concentration to the financial services sector and on mid and smallcap companies in the space.

Image 2: Top Constituents: Nifty MidSmall Financial Services Index v/s. Nifty Financial Services Index

Data as of September 30, 2024

The stocks/sectors mentioned above are used to explain the concept and are for illustration purposes only and should not be used for the development or implementation of an investment strategy. The stock may or may not be part of our portfolio/strategy/ schemes. It should not be construed as investment advice to any party.

Past performance may or may not be sustained in future and is not a guarantee of any future returns.

(Source: Nifty indices and as given in the investor presentation by Motilal Oswal Mutual Fund.)

Since the base date of April 1, 2005, the Nifty MidSmall Financial Services Index has clocked a price return of 15.2% CAGR and a total return (which includes dividends) of 17.2% (as of September 30, 2024).

In the last 5 years, the Nifty MidSmall Financial Services Index created wealth for an appealing pace with a price return of 18.7% CAGR and a total return of 19.9% CAGR.

Graph: Long-term Performance of Nifty MidSmall Financial Services Index

(Source: NSE Indexogram Factsheet as of September 2024)

Particularly after the COVID-19 pandemic with emphasis on digital infrastructure and technology to offer financial services – whether it is loans, insurance, investments and so on -- the Nifty MidSmall Financial Services Index has seen a sharp up move. The higher exposure to mid and small companies has accentuated the growth.

Who Will Manage Motilal Oswal Nifty MidSmall Financial Services Index Fund?

The equity portion of the Scheme will be managed by Mr Swapnil Mayekar, whereas the debt portion of the portfolio by Mr Rakesh Shetty.

Swapnil has over 13 years of experience in fund management and product development and currently is the Vice President - Fund Manager at Motilal Oswal Asset Management Company Ltd. He has been with the AMC since March 2010.

He holds a master's degree in commerce (M.Com) and a post-graduate advanced diploma in business administration.

His skillset lies in index investing and Exchange Traded Funds (ETFs). At Motilal Oswal Mutual Fund he manages various index funds and ETFs.

Mr Rakesh Shetty is a commerce graduate (B.Com) and an MBA (Finance). He has more than 14 years of overall experience and expertise in trading in equity, debt segment, ETF management, Corporate Treasury and Banking.

Before joining Motilal Oswal Asset Management Company Ltd, he worked with a company engaged in Capital Market Business wherein he was in charge of equity and debt ETFs, customised indices, and has also been part of product development. At Motilal Oswal Mutual Fund, Rakesh as Fund Manager – Fixed Income, co-manages a variety of schemes.

How Much is the Minimum Investment in Motilal Oswal Nifty MidSmall Financial Services Index Fund?

During NFO and on a continuous basis, the minimum lump sum investment in Motilal Oswal Nifty MidSmall Financial Services Index Fund is Rs 500/- and in multiples of Re. 1/- thereafter.

In the case of the Systematic Investment Plan (SIP), for the daily SIP, the minimum investment is Rs 100/- and multiple of Re 1/- thereafter (minimum instalments: 30 days).

For the weekly, fortnightly, and monthly SIPs the minimum investment amount is Rs 500/- and multiple of Re 1/- thereafter (minimum instalments: 12).

In the case of the quarterly SIP option, the minimum investment amount is Rs 1,500/- and multiple of Re. 1/- thereafter (minimum instalments: 4).

And for annual SIP the minimum SIP investment amount is Rs 6,000/- and multiple of Re 1/- thereafter.

Motilal Oswal Nifty MidSmall Financial Services Index Fund offers Regular and Direct Plans with a Growth option.

[Read: IDCW vs Growth Option: Which One Should You Opt for?]

Who Should Consider Investing in Motilal Oswal Nifty MidSmall Financial Services Index Fund?

Investors looking to take exposure to the financial services sector with exposure to mid and smallcap companies, who have the stomach for very high risk for sector & thematic index funds, and a long-term investment horizon of 7-8 years or so, may consider investing in this Scheme.

Stocks belonging to the banks and financial services sector have been among the strong performers in the last couple of years, and therein the smaller companies.

That being said, keep in mind that the small and midcap stocks of the Indian equity market are trading at loft valuations, much higher than the largecaps.

Even though the Indian equity has corrected since the lifetime high, valuations still are expensive. Indian equities continue to command a premium compared to global peers.

Now while some may justify the premium that Indian equities command relative to global peers as India is the fastest-growing major economy (at the fifth spot), in my view, given that there are other headwinds in play, such as escalating geopolitical tensions, geoeconomic fragmentation and uncertainty about future economic growth; it is not a very conducive environment to make fresh invest in midcaps and smallcaps even if you have a very high-risk appetite.

In my view, the margin of safety is not very comforting at this juncture, particularly in the mid and smallcap segment of the market and you will be exposed to high concentration risk if you are placing bets on the Nifty MidSmall Financial Services Index.

To know more about the Motilal Oswal Nifty MidSmall Financial Services Index Fund, read the Scheme Information Document and Key Information Memorandum.

You need to avoid getting swayed by irrational exuberance and make sensible investments.

Be a thoughtful investor.

Happy Investing!