Nippon India Nifty Realty Index Fund: Really a Worthwhile Proposition Now?

Nov 13, 2024

In the last couple of years after the COVID-19 pandemic, the need for more space, increase in disposable income, low borrowing rates, reduction in stamp duty, and the government focus on infrastructure development, have given a boost to construction activity and the realty sector as a whole.

A significant transformation is apparent -- whether it's new residential complexes coming up, demand for bigger homes due to acceptance to work from home culture, flex spaces, commercial hubs, data centres, retail spaces, logistic spaces, and more!

India's real estate sector is emerging as a pivotal player in the country's growth after agriculture, contributing to employment generation.

As per a Business Standard report, India's real estate sector currently contributes 7.3% of GDP and is valued at USD 493 billion. It is projected that it will to Rs 5.8 trillion by 2047, or 15.5% of India's economic output.

Owing to the positive undercurrents, the Nifty Realty Index has been one of the best-performing indices in the last couple of years. Last year, i.e. the calendar year 2023, the Nifty Realty Index exhibited an exceptional performance and outdid the Nifty 50 - TRI.

Table 1: Performance of Nifty Realty- TRI v/s Nifty 50 - TRI

|

Calendar Year |

Nifty Realty - TRI (%) |

Nifty 50 - TRI (%) |

|

2019 |

26.51 |

13.02 |

|

2020 |

5.91 |

16.01 |

|

2021 |

53.57 |

25.33 |

|

2022 |

-11.66 |

4.11 |

|

2023 |

81.11 |

20.91 |

|

2024* |

27.40 |

12.79 |

*YTD as of November 12, 2024

TRI - Total Return Index considered.

(Source: ACE MF, Data collated by PersonalFN Research)

Even in the calendar year 2024, the Nifty Realty - TRI has clocked over 27% absolute returns so far (as of November 12, 2024).

Capitalising on the wealth creation opportunity in India's real estate sector, Nippon India Mutual Fund has launched the Nippon India Nifty Realty Index Fund. It is an open-ended scheme replicating/tracking the Nifty Realty Index. Thus, the returns would commensurate with that of the underlying benchmark index., i.e. the Nifty Realty TRI, subject to tracking error.

During the NFO period, the Scheme is open for subscription from November 14, 2024, to November 28, 2024. Thereafter the scheme re-opens for subscription on December 10, 2024.

[Read: Real Estate Vs Mutual Funds - Which Is a Better Investment?]

Under normal circumstances, the Scheme would allocate 95% to 100% of its total assets in securities constituting the Nifty Realty Index.

The Scheme may also take up to 20% exposure to equity derivatives -- the index itself or its constituent stocks -- for hedging (to reduce the risk of the portfolio) and non-hedging purposes. This would be done when equity shares are unavailable, insufficient or for rebalancing in case of corporate actions for a temporary period. Such exposure to derivatives will be rebalanced within 7 days.

The Scheme may engage in Securities Lending not exceeding 15% of the net assets of the scheme and shall not lend more than 5% of its net assets to a single counterparty (here counterparty means an intermediary/broker through whom we deal in securities) or such other limits as may be permitted by SEBI.

Up to 5% of the fund's total assets would be held in cash & cash equivalents, money market instruments, and/or Schemes which invest predominantly in the money market securities or Liquid Schemes.

The Scheme may invest up to 5% net assets in money market/liquid schemes without charging any fees, provided that aggregate inter-scheme investment made by all schemes under the same management company or in schemes under the management of any other AMC shall not exceed 5% of the NAV of the mutual fund. In the case of debt & money market instruments, the Scheme may invest up to 5% in unrated instruments.

The Scheme will not invest in securitized debt, ADR, GDR, Foreign Securities, REITs and InvITs, Fund of Fund (FoF) Scheme, Credit Default Swaps (CDS), Debt Instruments with special features (AT1 and AT2 Bonds), debt Instruments with Structure Obligations (Sos) or Credit Enhancements (CEs), nor will it engage in short selling and Repo in corporate debt.

The Fund Manager would monitor the tracking error of the Scheme on an ongoing basis and would seek to minimize the tracking error.

Tracking error or tracking difference may arise due to the following reasons:

-

Delay in purchase or non-availability of underlying securities forming part of the index.

-

Delay in liquidation of securities which have been removed by the Index.

-

Fees and expenses of the Scheme.

-

Cash balance held by the Scheme due to interest received during subscriptions, redemption, etc.

-

Halt in trading on the stock exchange due to circuit filter rules.

-

In the case of corporate actions.

-

If the Scheme has to invest in the securities in whole numbers and has to round off the quantity of securities.

-

In the case of dividend payout

-

Changes in the constituents of the underlying Index. Whenever there are any changes, the Scheme has to reallocate its investment as per the revised Index but market conditions may not offer an opportunity to rebalance its portfolio to match the Index and such delay may affect the NAV of the Scheme

Under normal circumstances, the AMC shall endeavour that the tracking error of the Scheme shall not exceed 2% per annum.

However, in case of unavoidable circumstances like force majeure, which are beyond the control of the AMCs, the tracking error may exceed 2% and the same shall be brought to the notice of Trustees with corrective actions taken by the AMC, if any.

There is no assurance or guarantee that the Scheme will achieve any particular level of tracking error relative to the performance of the underlying Index.

What is the Investment Objective?

The investment objective of the Scheme is to provide investment returns that commensurate to the total returns of the securities as represented by the Nifty Realty Index before expenses, subject to tracking errors.

However, there is no assurance that the investment objective of the Scheme will be achieved.

What Is the Investment Strategy?

The Nippon India Nifty Realty Index Fund will follow a passive investment approach designed to track the performance of the Nifty Realty TRI. The Scheme seeks to achieve this goal by investing in securities constituting the Nifty Realty Index in the same proportion as in the Index.

Simply put, investments will be made in stocks comprising the Nifty Realty Index in approximately the same weightage that they represent in the Nifty Realty Index. At least 95% of its total assets will be in the securities comprising the underlying index.

The AMC does not make any judgments about the investment merit of the Nifty Realty Index nor will it attempt to apply any economic, financial or market analysis.

Further, the Scheme may also invest a small portion (of up to 5% of total assets) in money market instruments to meet the liquidity and expense requirements.

The Scheme will benchmark its performance against the Nifty Realty TRI.

About the Nifty Realty Index

The Nifty Realty Index (launched on August 30, 2007, with a base date of December 29, 2006) is designed to reflect the performance of real estate companies that are primarily engaged in the construction of residential and commercial properties. The Index comprises 10 companies listed on the National Stock Exchange of India (NSE).

The Nifty Realty Index is computed using the free float market capitalisation method, wherein the level of the index reflects the total free float market value of all the stocks in the index relative to particular base market capitalisation value and the index rebalanced semi-annually (in March and September).

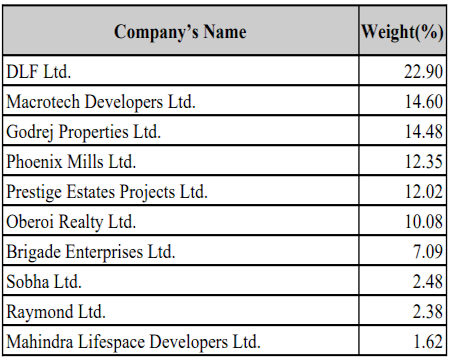

At present, the top constituents of this index are as under:

Table 2: Ten Constituents of the Nifty Realty Index

(Source: NSE Indexogram Factsheet as of October 31, 2024)

(Source: NSE Indexogram Factsheet as of October 31, 2024)

In the last one year, the Nifty Realty Index has clocked a remarkable 53.1% price return and total return (which includes dividends) of 53.5% on an absolute basis (as of November 12, 2024).

In the last 5 years, the Nifty Realty Index has clocked a price return of 29.7% CAGR and a total return (which includes dividends) of 30.2% (as of November 12, 2024).

Since RERA (Real Estate Regulation Authority) came into existence in 2016 (to protect the interests of homebuyers), the Nifty Realty Index has multiplied investors' money nearly 6 times.

Who Will Manage Nippon India Nifty Realty Index Fund?

Mr Himanshu Mange, who has over 5 years of experience will be managing the Scheme. He has been with Nippon India Mutual Fund since February 2022. From December 2023, he was appointed as Fund Manager & Dealer - ETF, at Nippon Asset Management Company. Before that, his role was Dealer - ETF.

Before joining Nippon Asset Management, Himanshu was with TATA AIA Life Insurance Co. Ltd. as an Assistant Manager (Investment Operations - Finance & Accounts).

Himanshu is a Chartered Accountant by qualification. At Nippon Indian Mutual Fund, he manages various other index funds and Exchange Traded Funds (ETFs).

How much is the Minimum Investment in Nippon India Nifty Realty Index Fund?

During the NFO period and ongoing/continuous basis, the minimum investment in the Scheme is Rs 1,000/- and in multiples of Re. 1/- thereafter.

Investors can also avail of the Systematic Investment Plan (SIP) mode to make investments. In case the investor has not specified the frequency then by default the frequency will be treated as monthly.

Both, the Direct Plan and Regular Plan for available for investments plus the options available are Growth and Income Distribution cum Capital Withdrawal (IDCW).

Who Should Consider Nippon India Nifty Realty Index Fund?

Investors looking to take exposure to India's realty sector primarily to companies engaged in the construction of residential and commercial properties (10 companies in the Nifty Realty Index) with a low-cost option, have a very high-risk appetite, and longer investment horizon of 7-8 years or so, can consider the Nippon India Nifty Realty Index Fund.

That said, the fortune of the Scheme will be closely aligned with that of the Nifty Realty Index. In other words, the returns would commensurate with that of this underlying index and there would be concentration risk.

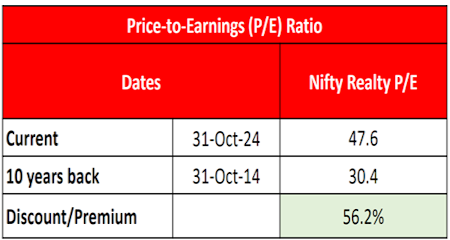

Table 3: Nifty Realty Index Valuations Aren't Cheap

(Source: Nippon India Mutual Fund Investor Presentation)

(Source: Nippon India Mutual Fund Investor Presentation)

Currently, the trail Price-to-Equity (P/E) ratio of the Nifty Realty Index is at 47.6x -- noticeably higher than 10 years ago and the long-term average. The Price-to-Book Value (P/BV) ratio of this index is nearly 6x as of October 31, 2024, not cheap.

A fact also is that Indian equities, by and large, are commanding a premium compared to global peers.

Given this, the margin of safety does not seem very comforting. Given the market risk involved due to geopolitical and economic uncertainty, it is not a very conducive environment to take sector-specific concentration risk.

To learn more about the Nippon India Realty Index Fund, read the Scheme Information Document and Key Information Memorandum.

Happy Investing!