VIVEK CHAURASIA AUG 29, 2023 / READING TIME: APPROX. 18 MINS

In the world of investing, many people

pick mutual funds based on how well they've done in the past. But there's a hidden side they often miss - the element of risk. Think of it like a seesaw: on one side is the potential for making money, and on the other is the chance of losing it. This connection is especially clear with mutual funds. When there's a promise of big profits, there's also a hint of big risks. The big question is, how do you figure out how risky a mutual fund is? And how do you know if the possible rewards are worth the risks you're taking? In this journey, we'll dig into the idea of risk in

mutual funds, learn its language, and find a way to judge whether the potential rewards match up with the risks.

In this article, we'll explore different ratios that help measure the risks associated with investing in mutual funds. Among these ratios, some are useful for assessing the balance between risk and potential reward in mutual funds. They help us figure out if a mutual fund is worth the risk by looking at how much return we could get. They achieve this by considering the returns in relation to the risks involved, ultimately aiding in the identification of some of the best and top-performing mutual funds.

However, while using these ratios, it is vital to make comparisons among funds within the same category and with relevant benchmarks. This approach ensures accurate assessment and helps determine whether they align with your own risk tolerance.

So, here are the seven risk ratios to help you measure the risk level of mutual funds and identify the best funds:

1. Standard Deviation

Standard Deviation is a ratio that helps us measure the overall risk in a mutual fund. In investing, risk means a result or an outcome that is different from what is anticipated or expected out of investment. When things don't follow our expectations, we term it a 'deviation.' And in the realm of investing and portfolio management, it is referred to as 'Standard Deviation'.

Standard Deviation simply denotes how much a fund's return would deviate from the average expected return and depicts how risky the fund is.

|

Fund A |

Fund B |

| Standard Deviation |

21% |

23% |

(For illustrative purpose only)

So if 'Fund A' has a Standard Deviation of 21% and 'Fund B' has a Standard Deviation of 23%, it means 'Fund B' is more volatile compared to 'Fund A' and will be a riskier fund suitable for investors willing to take a higher risk. You can use this measure to evaluate the level of risk the fund carries and compare it with the peers and the benchmark.

2. Sharpe Ratio

Sharpe Ratio is a commonly used ratio to measure and compare the risk-adjusted returns of two or more similar funds. This ratio indicates the return a fund is able to generate compared to the level of risk taken.

While calculating the Sharpe Ratio, we account for the difference between the returns of the investment and the risk-free return. This variance is then divided by the Standard Deviation of the fund or investment.

By looking at the Sharpe Ratio, you can assess the level of returns generated by the fund in addition to the risk-free instruments, such as 10-year G-Sec bonds and compare it with the Standard Deviation, i.e., the total risk taken by the fund to generate returns.

Simply put, the higher the Sharpe Ratio, the better the fund's ability to reward investors with higher returns for the level of risk taken.

If a fund's Standard Deviation is higher, it needs to earn a higher return to justify the excess risk taken. If it is unable to do so, it means the fund has delivered lower risk-adjusted returns and will have a lower Sharpe Ratio.

The Sharpe Ratio can be used to compare the outperformance or underperformance of a mutual fund vis-a-vis its peers and the benchmark index.

|

Fund A |

Fund B |

| Returns |

23.4% |

20.5% |

| Risk-free Rate |

6% |

6% |

| Std. Deviation |

18% |

15% |

| Sharpe Ratio |

0.97% |

0.97% |

(For illustrative purpose only)

The table above shows that though Fund A has generated higher returns of 23.4% compared to Fund B's return of 20.5%, it has been able to do so by taking higher risk, i.e., the Standard Deviation of 18%.

From a risk-reward perspective, as denoted by the Sharpe Ratio, both funds are similar. This means there is no additional advantage in choosing Fund A over Fund B.

|

Fund X |

Fund Y |

| Returns |

22.0% |

20.0% |

| Risk-free Rate |

6% |

6% |

| Std. Deviation |

18% |

15% |

| Sharpe Ratio |

0.89% |

0.93% |

(For illustrative purpose only)

Here Fund X has generated higher returns of 22% compared to Fund Y's return of 20%. At the same time, it has taken a higher risk, i.e., the Standard Deviation of 18%, compared to 15% of Fund Y.

From a risk-reward perspective, Fund Y has a higher Sharpe Ratio of 0.93% despite a relatively lower return of 20%. This means Fund Y has generated a better risk-adjusted return compared to Fund X and can be chosen over Fund X.

Ideally, one should pick a mutual fund scheme that does not chase high returns by exposing investors to very high risk.

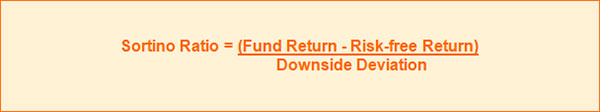

3. Sortino Ratio

The Sortino Ratio helps determine a fund's ability to contain the downside risk, especially during depressed market conditions, where the fund returns are below a minimum threshold, such as risk-free returns or negative returns.

Unlike the Sharpe Ratio, Sortino uses only downside deviation or, as we can say, the Standard Deviation of negative returns to calculate risk-adjusted returns.

As mutual fund investments are subject to market risks, they come with possible downside risks. However, some schemes have a better ability to effectively manage and even mitigate these downward risks, leading to improved returns. Thus, the Sortino Ratio can be considered an important ratio to measure the fund's risk-adjusted returns.

Like the Sharpe Ratio, even a higher Sortino Ratio means the fund has a better potential of earning higher returns by not taking unwarranted risks.

|

Fund A |

Fund B |

| Returns |

25.0% |

27.0% |

| Risk-free Rate |

6% |

6% |

| Downside Deviation |

14% |

16% |

| Sortino Ratio |

1.36% |

1.31% |

(For illustrative purpose only)

In this table, Fund A has generated lower returns compared to Fund B, whereas its Sortino Ratio of 1.36% indicates that it has generated higher returns for each level of risk taken and has a greater chance of doing better during falling markets and limiting potential losses.

The Sortino Ratio is particularly helpful when the markets are highly volatile and will have many data points to calculate downside deviation.

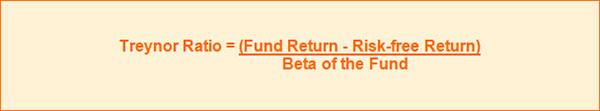

4. Treynor Ratio

The Treynor Ratio is a helpful measure to determine the excess returns generated by the fund against the systemic risk, i.e., the 'Beta' that indicates the market risk.

While the Sharpe Ratio uses Standard Deviation to calculate risk-adjusted returns, the Treynor Ratio uses the 'Beta' of the fund (which measures systemic risk) to calculate risk-adjusted returns.

Ideally, mutual funds should proficiently manage the assets in their portfolio and provide investors with a reasonable reward in proportion to the risk undertaken. This is essential as systemic risk (also known as market risk) cannot be mitigated through diversification.

The Beta of a mutual fund scheme indicates its volatility relative to its benchmark index. A Beta of 1 denotes that the mutual fund scheme will move in line with its benchmark. Accordingly, a beta of more than 1 denotes that the scheme is more volatile than its benchmark, while a beta of less than 1 means volatility lesser than the benchmark. While high-beta stocks or funds can be expected to do well in a rising market, they can also fall more during market corrections.

As mutual funds aim to outperform the underlying market index, the Treynor Ratio can be useful for assessing the scheme's performance vis-a-vis its benchmark.

|

Fund X |

Fund Y |

| Returns |

18.0% |

18.0% |

| Risk-free Rate |

6% |

6% |

| Beta |

1.1 |

0.9 |

| Treynor Ratio |

0.11% |

0.13% |

(For illustrative purpose only)

In this table, both Fund X and Fund Y have generated similar returns of 18%.

However, Fund X has a higher beta compared to Fund Y due to which its Treynor Ratio is lower than Fund Y. This means the returns of Fund X have come from investing in a portfolio of highly volatile stocks, whereas Fund Y has generated similar returns with a portfolio of less volatile stocks.

Like other risk-adjusted return ratios, a fund with a higher Treynor Ratio can be considered better as it has generated higher returns for each level of risk.

Even this ratio helps you compare different funds and shortlist the one that could be suitable for your risk profile.

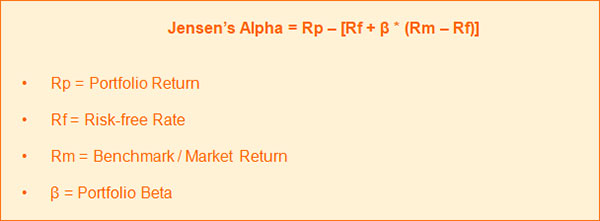

5. Jensen's Alpha

Investors consider investing in mutual funds with the aim of achieving Alpha or returns that outperform the market by utiising the knowledge and expertise of the fund manager. The term Alpha, or Jensen's Alpha as we call it, measures the level of outperformance or underperformance of the fund compared to its benchmark index.

Simply put, it is the difference between the actual returns of a fund and those generated by the benchmark index.

|

Large Cap 1 |

Large Cap 2 |

S&P BSE 100 Index |

| Returns |

14.0% |

11.0% |

12.0% |

| Alpha |

2% |

-1% |

NA |

(For illustrative purpose only)

Suppose if a large-cap fund has delivered a return of 14% in the last one year, while the benchmark S&P BSE 100 index has simultaneously generated a return of 12%, it means the fund has generated an Alpha of +2%. Simultaneously, if another large-cap fund has underperformed and generated only 11% return, then the Alpha of that particular large-cap fund is -1%.

So, an actively managed mutual fund scheme has the potential to demonstrate an Alpha that is either positive or negative. While a Positive Alpha indicates Outperformance, a Negative Alpha indicates Underperformance. A fund with a Neutral Performance will have a zero alpha (i.e., it closely tracks the benchmark, as with the index funds).

The alpha generation is determined by the capability of the fund manager and the quality of fund management. So, while actively managed funds would be able to create a positive or negative Alpha, passively managed index funds will not produce any Alpha and deliver returns nearly in line with the benchmark.

In recent years, a substantial number of actively managed funds have faced difficulties in outperforming their benchmarks and generating Alpha. Conversely, the passively managed funds have showcased better performance by keeping pace with the markets.

Here is the formula to calculate Jensen's Alpha:

So Jensen's Alpha is equal to the Portfolio Return minus a combination of the Risk-free rate and the Return Premium as calculated by Beta into Market Return minus the Risk-free rate. Simply put, Jensen's Alpha measures the return generated by the portfolio above or below the expected return of the asset class.

Now, using the above formula, let us assume that a large-cap fund has generated a return of 14% in the last one year. Simultaneously, the benchmark S&P BSE 100 index returned 12%. The Beta of the fund versus the BSE 100 index is 1.1, and the Risk-free rate is 6%.

| Large Cap 1 |

14.0% |

| S&P BSE 100 Index |

12.0% |

| Risk-free Rate |

6% |

| Beta |

1.1 |

|

|

| Jensen's Alpha |

=14 - [6 + 1.1 * (12 - 6)] |

| Jensen's Alpha |

1.4 |

(For illustrative purpose only)

Thus, in this case, Jensen's Alpha = 1.4% if calculated using the given formula.

Apart from other important ratios like Sharpe, Sortino, and Treynor... Jensen's Alpha, too, is an important ratio considered to analyse which funds are worth recommending to investors. The higher the Alpha value, the more rewarding the option is.

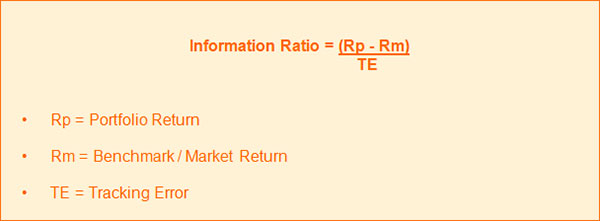

6. Information Ratio

Information Ratio helps measure the fund's returns above the returns of the benchmark index and even takes into account the volatility encountered for those returns.

Information Ratio can help you measure the fund manager's ability to consistently generate benchmark-beating returns. The Tracking Error used in the calculation of the information ratio helps assess the consistency. The Tracking Error of the fund is the Standard Deviation of the difference between the fund's returns and the index returns.

You can calculate the Information Ratio of the fund by using the formula RP - RM divided by the Tracking Error. In this, RP is the Portfolio Return, RM is the Market or Index Return, and TE is the Tracking Error.

|

Large Cap 1 |

Large Cap 2 |

| Fund Return |

14.0% |

14.0% |

| S&P BSE 100 Index |

12.0% |

12.0% |

| Tracking Error |

1.08 |

1.05 |

|

|

|

| Information Ratio |

= (14-12) / 1.08 |

= (14-12) / 1.05 |

| Information Ratio |

1.85 |

1.90 |

(For illustrative purpose only)

Let's consider an example where 2 funds have generated similar returns of 14% over a year, as compared to a return of 12% by the market index, but have a Tracking Error of 1.08 for Fund 1 and 1.05 for Fund 2.

If we want to pick one of these on the basis of their Information Ratio and apply the formula -- Portfolio Return Minus the Benchmark Return and Divided by the Tracking Error of the Fund, it will give us an Information Ratio of 1.85 for Fund 1 and 1.90 for Fund 2. Which means Fund 2 is better than Fund 1.

A higher Information Ratio indicates that the fund manager is more consistent in generating returns relative to the benchmark. So, a fund with a higher Information Ratio could be preferred over a fund with a lower Information Ratio.

7. Capture Ratio

Capture Ratio is used to measure the relative performance of a mutual fund scheme in comparison to its benchmark index during upside and downside market phases. It depicts how much more the fund has risen during market rallies and how much less it fell during market corrections in proportion to the benchmark. It determines how the fund has performed and how effectively the fund manager has managed the fund during different market conditions while handling risk.

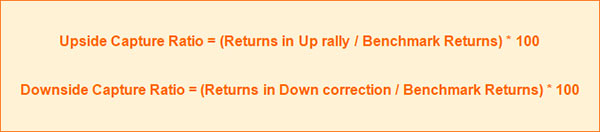

Capture Ratio has two types to it... Upside Capture Ratio and Downside Capture Ratio, which is expressed in percentage. The Upside Capture Ratio helps analyse the performance efficiency of the fund or the fund manager during bullish rallies, whereas the Downside Capture Ratio helps analyse the ability of the fund or the fund manager to limit the downside during bear phases.

Upside Capture Ratio and Downside Capture Ratio can be calculated using these formulas, where we take the fund's average returns during the upside or downside period and divide it by the benchmark returns of the same periods, and multiply it by 100 to express it in percentage terms.

Now let's apply the formula in this calculation here:

|

Large Cap 1 |

Large Cap 2 |

| Upside Capture |

|

|

| Fund Return |

9.5% |

13.0% |

| S&P BSE 100 Index |

10.0% |

10.0% |

| Upside Capture Ratio |

95 |

130 |

|

|

|

| Downside Capture |

|

|

| Fund Return |

-9.0% |

-12.0% |

| S&P BSE 100 Index |

-10.0% |

-10.0% |

| Downside Capture Ratio |

90 |

120 |

(For illustrative purpose only)

An Upside Capture Ratio of more than 100 means the fund has outperformed the benchmark during an upside rally, whereas an Upside Capture Ratio of less than 100 means it has underperformed.

Conversely, a Downside Ratio of more than 100 means the fund has underperformed the benchmark during downside correction, whereas a Downside Capture Ratio of less than 100 means it has outperformed.

So, a fund having an Upside Capture Ratio of 130 means that it has shown an additional gain of 30% of its benchmark during upside rallies. A fund with a higher Upside Capture Ratio has the potential to do well in a rising market.

Similarly, a fund having a Downside Capture Ratio of say 90 means that it has lost less by 10 percent of its benchmark during downside rallies. A low Downside Capture Ratio of less than 100% can be considered good because it means the fund manager has been able to limit the downside during falling markets.

By applying this ratio, we gain an understanding of the fund's potential to outperform the benchmark in various market phases. A mutual fund scheme that manages to outperform the benchmark during both upward trends and market downturns presents a compelling case for generating risk-adjusted returns that are highly favourable for investors.

In a nutshell...

These seven ratios equip investors with valuable tools to quantify the risk in mutual funds and their risk-reward potential to identify the funds that are worth investing.

While returns play a vital role in selecting mutual funds, it's important to consider more than just returns when evaluating mutual fund schemes. Understanding these risk ratios enables you to thoughtfully analyse mutual fund schemes that consistently perform well and could be a good fit for your investment goals.

It is noteworthy that many mutual funds tend to do well during rising markets, but most of these funds' performance does not sustain when the markets show a reversal and correction. Thus, it's important to account for the potential risk and evaluate it by using a variety of risk-reward ratios to measure the risk-adjusted returns they deliver.

While shortlisting funds, you should ensure that the funds you choose are compatible with your risk profile and match your risk appetite, investment objective, financial goals, and investment horizon to achieve those goals, which could help you avoid taking undue risk. Additionally, it's recommended to keep an eye on how your funds are performing during different market conditions. Moreover, it's prudent to avoid considering the past performance of funds as a guarantee of future results.

We are on Telegram! Join thousands of like-minded investors and our editors right now.

VIVEK CHAURASIA is the editor of FundSelect and FundSelect Plus, the flagship research services of PersonalFN.

Having over a decade of experience in analysing mutual funds, Vivek understands the functioning of the mutual fund industry very well and applies his financial and analytical skills to closely scrutinize each fund to his satisfaction.

Vivek joined PersonalFN as a Senior Research Analyst in 2009 and quickly adopted the philosophy of our research team, i.e. honest and unbiased research for naive investors who are tired of being mis-sold. Over these years, he has developed a robust fund selection and filtration model - 'SMART Score matrix' that has been tested across various cycles now and constantly looks for a scope to strengthen it further. Vivek follows the principle of safety first when it comes to picking funds for investors. That is the reason why he has a long list of rejected funds as compared to the ones he has endorsed so far.

Vivek is an avid follower of John C. Bogle (the founder of The Vanguard Group and the author of the bestseller book - Common Sense on Mutual Funds: New Imperatives for the Intelligent Investor) and Warren Buffet (one of the most successful investors of all time)

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing.

This article is for information purposes only and is not meant to influence your investment decisions. It should not be treated as a mutual fund recommendation or advice to make an investment decision in the above-mentioned schemes.