RBI Opens Window for Premature Redemption of Sovereign Gold Bonds. Should You Opt for It?

Rounaq Neroy

Aug 27, 2024 / Reading Time: Approx. 5 mins

Listen to RBI Opens Window for Premature Redemption of Sovereign Gold Bonds. Should You Opt for It?

00:00

00:00

Perhaps, borrowing further through SGBs is now considered to be an expensive proposition for the government. Also, it appears that after a cut in customs duty on gold, there may not be many takers for SGBs as Indians, who have a penchant for owning gold in physical form.

The RBI last week (on August 23, 2024), in fact, announced a premature redemption window for SGBs issued between May 2017 and March 2020. It should be noted that premature redemption of SGB is permitted after five years from the date of issuance of such bonds.

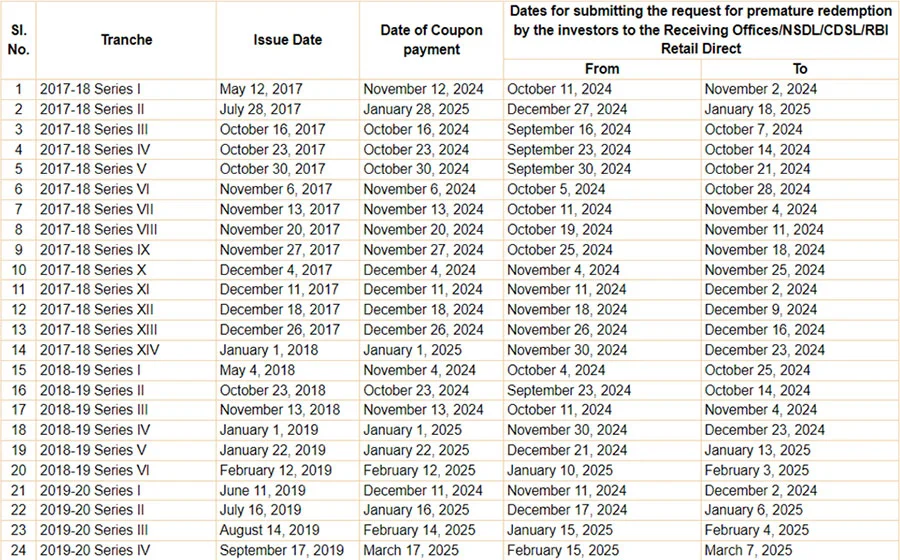

The premature redemption of the SGBs issued between May 2017 and March 2020, depending on the series or tranches, will be carried out in phases (as under) beginning on October 11, 2025, and ending on March 1, 2025.

Table: Schedule for Premature Redemption of SGBs

(Source: https://www.rbi.org.in)

(Source: https://www.rbi.org.in)

However, it is also stated by the Reserve Bank that the aforementioned dates may undergo a change in case of unscheduled holiday/s. Thus, if you are an investor in SGBs, you are advised to take note of the period of submission of requests for premature redemption of SGB, in case you are opting to exit early.

Why Is RBI Allowing Premature Redemption of SGBs?

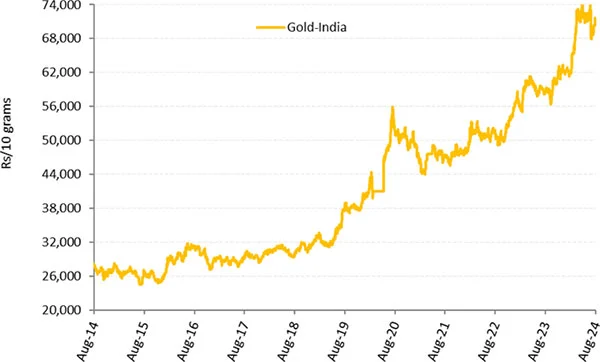

The price per 10 grams of gold has scaled over Rs 71,000 and is near its peak. In the calendar year 2024, the precious yellow metal has thus far clocked a year-to-date (YTD) absolute return of 13.0% (as of August 26, 2024). In other words, gold is exhibiting its sheen.

Graph: Gold Has Been on an Uptrend

Data as of August 26, 2024

Data as of August 26, 2024

MCX spot price of gold used.

Past performance is not indicative of future returns.

(Source: MCX, data collated by PersonalFN Research)

If abetted by inflation major central banks across the world, resort to rate cuts to support economic growth, gold is expected to perform even better.

Furthermore, the ongoing geopolitical tensions, possible geoeconomic fragmentation, supply chain disruptions, and higher debt-to-GDP ratio of major economies than the pre-pandemic levels are expected to prove supportive for gold.

Considering the present positive undercurrents for gold and recognising the market dynamics, the RBI is offering a window for premature redemption from SGBs. It also shows that RBI is managing its financial obligations prudently by seizing the opportunity, which is in the favour of investors.

At What Price Premature Redemption of SGBs Will Be Done?

The liability of the government for these premature redemptions is hinged on the price of gold in Indian Rupee (INR) terms around the time of the maturity dates based on the simple average of closing price of gold of 999 purity of previous three working days published by India Bullion and Jewellers Association Ltd.

How to Prematurely Redeem SGBs?

Reach out to your bank or agent through whom you purchased the SGBs. Keep in mind that premature redemption requests are accepted by the RBI one month before the interest payout date. Thus, make sure you initiate the premature redemption well before the interest payment date.

What Will Be the Tax Implication of Prematurely Redeeming SGBs?

The interest earned semi-annually on SGBs will be taxed under the head "income from other sources" as per your income-tax slab, i.e. i.e. at the marginal rate of taxation.

As regards the premature redemption sum of the SGB (a listed financial asset or security) at the RBI window (after 5 years of holding) is concerned, as per the current tax rule, the proceeds will not be subject to Long Term Capital Gain Tax.

However, if these SGBs are sold or transferred on the stock exchange, then the Long Term Capital Gains (for a holding period of more than 12 months) will be taxable at a flat 12.5% tax as per Section 112 of the Income Tax Act, 1961 (plus the surcharge and health & education cess as applicable).

On the other hand, if you decide to hold on to the SGBs till the maturity period of 8 years, the capital gains arising therefrom will be exempt from tax, since it is not regarded as transfer for the purpose of capital gains.

Hence, if you are considering redeeming from SGB either utilise the premature redemption window made by the RBI or hold until maturity period 8 years to save from the axe of tax.

Final Words...

Even after the exit ensure you have adequate allocation -- around 15%-20 -- to gold (by the way of gold ETFs, gold saving funds, and/or SGBs) and in your portfolio for its trait of being a safe haven, a store of value during economic uncertainty, and an effective portfolio diversifier.

Follow a thoughtful approach.

Happy Investing!

Join Now: PersonalFN is now on Telegram. Join FREE Today to get PersonalFN’s newsletter ‘Daily Wealth Letter’ and Exclusive Updates on Mutual Funds.

-New.png)

ROUNAQ NEROY heads the content activity at PersonalFN and is the Chief Editor of PersonalFN’s newsletter, The Daily Wealth Letter.

As the co-editor of premium services, viz. Investment Ideas Note, the Multi-Asset Corner Report, and the Retire Rich Report; Rounaq brings forth potentially the best investment ideas and opportunities to help investors plan for a happy and blissful financial future.

He has also authored and been the voice of PersonalFN’s e-learning course -- which aims at helping investors become their own financial planners. Besides, he actively contributes to a variety of issues of Money Simplified, PersonalFN’s e-guides in the endeavour and passion to educate investors.

He is a post-graduate in commerce (M. Com), with an MBA in Finance, and a gold medallist in Certificate Programme in Capital Market (from BSE Training Institute in association with JBIMS). Rounaq holds over 18+ years of experience in the financial services industry.

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing.

Disclaimer: This article is for information purposes only and is not meant to influence your investment decisions. It should not be treated as a mutual fund recommendation or advice to make an investment decision in the above-mentioned schemes.