DIVYA GROVER AUG 21, 2023 / READING TIME: APPROX. 18 MINS

Editor’s Note: To create remarkable wealth over the long term, Mid Cap Mutual Funds could be worthwhile provided you are a high-risk taker and have a longer horizon. That said, not all Mid Cap Funds are the best. Some have even disappointed investors. Thus, enough care ought to be taken so that it turns out to be a wealth-creating experience for you. In November 2023 we released a new article explaining whether investing in Mid Cap Funds makes sense in 2024, the risks involved, and which are the 5 best Mid Cap Funds for 2024. Click here to read.

Mid Cap Mutual Funds offer investors the opportunity to create significant long-term wealth. However, not all Mid Cap Mutual Funds are worthy of investment. It is vital to select only those mutual funds that focus on picking quality stocks in the mid-cap segment. In this article, we bring to you PersonalFN's list of 5 Best Mid Cap Mutual Funds to invest in 2023 that have solid growth potential.

What are Mid Cap Mutual Funds?

The Securities and Exchange Board of India (SEBI) defines Mid Cap Mutual Fund as an 'open-ended equity scheme that invests a minimum of 65% of its total assets in equity and equity-related instruments of mid-cap companies'. Now, mid-cap companies are typically defined as companies ranking from 101st to 250th in terms of full market capitalisation. Generally, these companies have a market cap of more than Rs 5,000 but less than Rs 20,000 crore. The fund manager has the flexibility to invest the balance 35% in either large-cap stocks, small-cap stocks, debt instruments, or simply maintain it as cash reserves.

Examples of Mid Cap Mutual Funds in India

| Scheme Name |

AUM (Rs Crore) |

| HDFC Mid-Cap Opportunities Fund |

45,449 |

| Kotak Emerging Equity Fund |

31,389 |

| Axis Midcap Fund |

22,178 |

| Nippon India Growth Fund |

17,350 |

| DSP Midcap Fund |

14,595 |

| SBI Magnum Midcap Fund |

11,809 |

| Mirae Asset Midcap Fund |

11,360 |

| PGIM India Midcap Opp Fund |

9,261 |

| Franklin India Prima Fund |

8,651 |

| UTI Mid Cap Fund |

8,606 |

AUM data as of July 31, 2023

(Source: ACE MF, data collated by PersonalFN)

What are the advantages of investing in Mid Cap Mutual Funds?

Mid Cap Mutual Funds have the potential to deliver superior returns because mid-sized companies are usually in their growth phase. Historical data suggests that Mid Cap Mutual Funds have the ability to outperform Large Cap Mutual Funds over the long term.

Notably, mid-cap companies have better access to capital and various resources when compared to small-caps but fewer opportunities as compared to large-caps. Their management team is also stronger than that of small-caps and they adapt to new trends with better ease. They hold the potential to become the large-caps of tomorrow. In addition, investors also get the opportunity to get exposure to certain niche stocks/sectors that may have high future potential.

It is preferable to invest in Mid Cap Mutual Funds via the Systematic Investment Plan (SIP) to mitigate the risk and reap the benefit of rupee-cost averaging and compounding of wealth.

Watch this Video to Understand how Mid cap Funds Have Fared on 10-Year SIP Returns.

[Must Read: 5 Best Equity Mutual Funds for SIP in 2023]

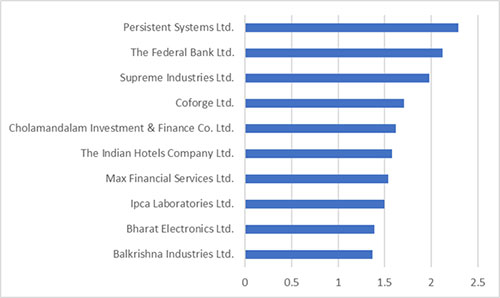

Top stock holdings of Mid Cap Mutual Funds

Data as of July 31, 2023

Data as of July 31, 2023

(Source: ACE MF, data collated by PersonalFN)

What are the risks involved in Mid Cap Mutual Funds?

Mid Cap Mutual Funds invest in emerging companies, and therefore, the risk involved is higher compared to Large Cap Mutual Funds but lower compared to Small Cap Mutual Funds.

Since Mid-cap companies have better growth opportunities, Mid Cap Mutual Funds tend to outperform their pure Large-cap and even their Large & Mid-cap peers by a significant margin during bull phases.

However, Mid Cap Funds are not as resilient during bear phases and may plunge lower than Large Cap Funds. Keep in mind that mid-cap companies have a limited scale of operation compared to their large-cap peers, lower customer outreach, and limited access to various resources. These factors make them vulnerable to high risk, especially during gloomy economic conditions.

This positions midcap funds as a high risk - high return investment avenue. On the risk-return spectrum, Mid Cap Mutual Funds are just below Small Cap Mutual Funds and Thematic/Sectoral Funds.

Who should invest in Mid Cap Mutual Funds?

Investors who have the appetite for high risk and are looking to create an inflation-beating and wealth-generating avenue with a long-term perspective can consider investing a portion of their portfolio in Mid Cap Mutual Funds. It is advisable to have a long-term investment horizon of at least 5-7 years when investing in Mid Cap Mutual Funds.

How much to invest in Mid Cap Mutual Funds?

Aggressive investors who can tolerate short-term market volatility for high future gains can consider allocating around 25%-30% of their equity mutual fund portfolio in Mid Cap Mutual Funds. The balance can be allocated in Large Cap Funds, Value Funds, Flexi Cap Funds, etc.

On the other hand, investors with moderate risk appetite can consider allocating 15%-25% in Mid Cap Mutual Funds. Conservative investors and investors who have an investment horizon of less than 5 years should ideally avoid investing in Mid Cap Mutual Funds.

How are Mid Cap Mutual Funds taxed?

Mid Cap Mutual Funds are equity-oriented mutual funds and hence they follow equity taxation. The holding period for Mid cap Mutual Funds from a tax perspective is 12 months. So, if investors sell their Mid Cap Mutual Fund units before 12 months, they are liable to pay short-term capital gains (STCG) tax of flat 15%.

On the other hand, if they sell their Mid Cap Mutual Fund units after completing one year, they pay a long-term capital gains tax (LTCG) of 10% without indexation, but only if the gains exceed Rs 1 Lakh in a financial year. If the long-term gains are below Rs 1 Lakh and investors redeem after completing one year, then they do not have to pay any tax on these gains.

Which are the best Mid Cap Mutual Funds to invest in 2023?

With a universe of 29 schemes in the category, identifying the best Mid Cap Mutual Fund becomes crucial because unlike Large Cap Funds, which more or less invest in the same top 100 companies, albeit in varying allocations, investing in Mid Cap Mutual Fund is a tricky business. This is because Mid Cap Mutual Funds invest in relatively lesser-known companies that are striving to establish their brand value in the lives of Indian consumers. Also, unlike Large Cap Mutual Funds, where creating alpha is difficult since the investible universe is limited, when it comes to Mid Cap Mutual Funds, the fund manager's investment style and the strategy they follow can truly make a difference.

Watch this video to get Vivek's insights on the remarkable performance witnessed in the mid-cap and small-cap segment, and also listen to his guidance on whether to maintain your current investments in mid and small-caps or explore asset reallocation.

This is why, PersonalFN has shortlisted five best Mid Cap Mutual Funds to invest in 2023 after stringently evaluating each of the schemes on numerous qualitative and quantitative parameters.

Let us now take a look at the five best Mid Cap Mutual Funds to invest in 2023...

List of best Mid Cap Mutual Funds to invest in 2023

Past performance is not an indicator for future returns. The securities quoted are for illustration only and are not recommendatory.

Data as of August 18, 2023. Direct plan - Growth option considered

(Source: ACE MF, data collated by PersonalFN)

Best Mid Cap Mutual Fund to invest in 2023 #1: Quant Midcap Fund

Launched in February 2001, Quant Midcap Fund is an actively managed small-sized scheme in the Mid-cap Fund category that follows aggressive investment strategies. Despite being small in size, Quant Midcap Fund has registered extraordinary performance in recent years and handsomely rewarded its investors. Quant Midcap Fund is now a top-performing Mid Cap Mutual Fund with commendable returns across time frames. More importantly, Quant Midcap Fund stands out in the category in terms of risk-adjusted returns.

Fund Snapshot - Quant Midcap Fund

Past performance is not an indicator of future returns. The securities quoted are for illustration only and are not recommendatory.

Past performance is not an indicator of future returns. The securities quoted are for illustration only and are not recommendatory.

Portfolio data as of July 31, 2023

Returns and NAV data as of August 18, 2023. Regular Plan - Growth Option considered

(Source: ACE MF, data collated by PersonalFN)

Quant Midcap Fund constantly looks for opportunities across stocks and sectors which has resulted in significant alpha for its investors. The fund is also quick in its approach to shift allocation between market caps depending on the market conditions, though it maintains a mid-cap biased portfolio. Notably, the fund has recorded a higher churn rate of over 100 to 225% in the last one year. Quant Midcap Fund has proved its ability to limit downside risk during depressed market conditions even though it has underperformed during bull phases in the past. This highlights the fund's ability to reward investors with noteworthy gains over the long run.

Click here to read our detailed analysis on Quant Midcap Fund.

Best Mid Cap Mutual Fund to invest in 2023 #2: SBI Magnum Midcap Fund

Launched in March 2005, SBI Magnum Midcap Fund aims to invest in a well-diversified basket of equity stocks of mid-cap companies. During its journey spanning over 18 years, the fund has been through lots of ups and downs. Despite this, SBI Magnum Midcap Fund has generated returns at a CAGR of around 16.6% since its inception. SBI Magnum Midcap Fund managed to limit the downside during the 2020 market crash to stand strong among its peers. Moreover, the fund also stood among the top performers in the category during the ensuing bull phase, thereby witnessing a complete turnaround.

Fund Snapshot - SBI Magnum Midcap Fund

Past performance is not an indicator of future returns. The securities quoted are for illustration only and are not recommendatory.

Past performance is not an indicator of future returns. The securities quoted are for illustration only and are not recommendatory.

Portfolio data as of July 31, 2023

Returns and NAV data as of August 18, 2023. Regular Plan - Growth Option considered

(Source: ACE MF, data collated by PersonalFN)

The fund stands out for its ability to stem losses during the bearish phase, wherein it has managed to outpace the benchmark as well as many of its peers. However, SBI Magnum Midcap Fund is not a great bull market performer and may occasionally underperform the benchmark and many of its peers. Despite facing bouts of underperformance, SBI Magnum Midcap Fund has managed to perform well over complete market cycles and reward investors for their patience.

Click here to read our detailed analysis on SBI Magnum Midcap Fund.

Best Mid Cap Mutual Fund to Invest in 2023 #3: HDFC Mid-Cap Opportunities Fund

Launched in June 2007, HDFC Mid-Cap Opportunities Fund is the largest scheme in the Mid Cap Mutual Fund category having a corpus of Rs 45,449 crore. The fund's popularity can be attributed to its track record of generating above-average returns across market conditions. The fund has done well under the supervision of Mr Chirag Setalvad, who is known for his high conviction mid-cap and small-cap bets. However, HDFC Mid-Cap Opportunities Fund witnessed a prolonged phase of muted growth between 2016 and early 2020 wherein it occasionally trailed the benchmark and its prominent peers. Nonetheless, the fund has bounced back in the last couple of years to stand strong among its peers.

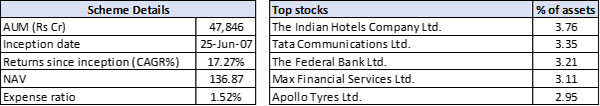

Fund Snapshot - HDFC Mid-Cap Opportunities Fund

Past performance is not an indicator of future returns. The securities quoted are for illustration only and are not recommendatory.

Past performance is not an indicator of future returns. The securities quoted are for illustration only and are not recommendatory.

Portfolio data as of July 31, 2023

Returns and NAV data as of August 18, 2023. Regular Plan - Growth Option considered

(Source: ACE MF, data collated by PersonalFN)

HDFC Mid-Cap Opportunities Fund focuses on identifying long-term growth opportunities in fundamentally sound mid-sized stocks. This enables the fund manager to invest in stocks with high intrinsic value allowing it more time to realize the growth potential of its investments. Moreover, it avoids momentum-driven bets which helps it reduce the risk and reward its investors adequately in the long run. This has enabled the fund to rank high in terms of risk-adjusted returns.

Click here to read our detailed analysis on HDFC Mid-Cap Opportunities Fund.

Best Mid Cap Mutual Fund to invest in 2023 #4: PGIM India Midcap Opportunities Fund

PGIM India Midcap Opportunities Fund is a growth-oriented mid-cap biased fund that aims to offer greater growth potential as compared to large caps but at a lower volatility and risk as compared to small caps. Launched in December 2013, the fund remained among the underperformers in its first 5 years. However, with a focus on high-quality stocks, it recorded a major breakthrough run in recent years wherein it has generated remarkable alpha over the benchmark and outpaced many of its peers.

Fund Snapshot - PGIM India Midcap Opportunities Fund

Past performance is not an indicator of future returns. The securities quoted are for illustration only and are not recommendatory.

Past performance is not an indicator of future returns. The securities quoted are for illustration only and are not recommendatory.

Portfolio data as of July 31, 2023

Returns and NAV data as of August 18, 2023. Regular Plan - Growth Option considered

(Source: ACE MF, data collated by PersonalFN)

PGIM India Midcap Opportunities Fund's performance is driven by prudent investment strategies and backed by strong systems and processes followed at the fund house. The fund is benchmark agnostic; the investments are typically made at the conviction of the fund manager, irrespective of their weightage in the index. PGIM India Midcap Opportunities Fund follows an active investment strategy and has a penchant for churning out a major portion of its portfolio. However, it has shown a lot of patience with many of its quality stocks and sectorial bets, which have paid off its investors in due course.

Click here to read our detailed analysis on PGIM India Midcap Opportunities Fund.

Best Mid Cap Mutual Fund to invest in 2023 #5: Kotak Emerging Equity Fund

Launched in March 2007, Kotak Emerging Equity Fund is a midcap-biased fund that seeks to identify the hidden growth potential of mid-sized companies. Kotak Emerging Equity Fund stood strong in the 2018-19 mid-cap crash as well as the market crash of 2020, even as many of its peers struggled to keep pace with the market returns, thus turning out to be one of the top performers in the category. Even in the recent bull phase, Kotak Emerging Equity Fund stood among the top performers in the category though it trailed the benchmark index.

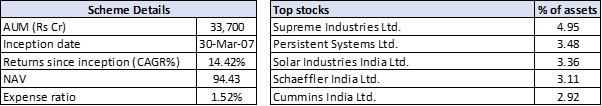

Fund Snapshot - Kotak Emerging Equity Fund

Past performance is not an indicator of future returns. The securities quoted are for illustration only and are not recommendatory.

Past performance is not an indicator of future returns. The securities quoted are for illustration only and are not recommendatory.

Portfolio data as of July 31, 2023

Returns and NAV data as of August 18, 2023. Regular Plan - Growth Option considered

(Source: ACE MF, data collated by PersonalFN)

Kotak Emerging Equity Fund holds a consistent track record of generating market-beating returns across most time periods. Kotak Emerging Equity Fund carries an impressive track record under the supervision of Mr Pankaj Tibrewal, who is known for his expertise in the mid and small-cap space. The fund's focus on identifying high-conviction quality stocks in the mid-cap space and holding it with a long-term view has worked in its favour. Moreover, the fund has delivered in terms of risk-adjusted returns.

Click here to read our detailed analysis on Kotak Emerging Equities Fund.

This completes our list of the five best Mid Cap Mutual Funds to invest in 2023. The only thing left to do now is to invest in these best Mid Cap Funds and reap the benefits of investing in the market leaders of tomorrow.

Related links:

7 Top-Performing Mid Cap Mutual Funds with High Returns on 10-Year SIP

Market at All-time High: Is This a Good Time to Invest in Mid Cap and Small Cap Mutual Funds?

The Investment Strategy Mutual Fund Investors May Follow as Sensex, Nifty Touch Record Highs

Should You Kick-start Your SIPs Amid Market Highs? Find Out Now

Disclaimer:

The schemes mentioned above are selected on the basis of PersonalFN's SMART Score, which considers various quantitative and qualitative parameters to arrive at fundamentally sound and reliable mutual fund schemes. These schemes may or may not be suitable for you. Hence, it is necessary that you understand your risk appetite and suitability well in case you consider investing in any of these funds. If unsure, do consult your SEBI registered investment advisor.

This write-up is for information purpose and does not constitute any kind of investment advice or a recommendation to Buy / Hold / Sell a fund. Returns mentioned herein are in no way a guarantee or promise of future returns. Mutual Fund Investments are subject to market risks, read all scheme-related documents carefully before investing.

Join Now: PersonalFN is now on Telegram. Join FREE Today to get PersonalFN’s newsletter ‘Daily Wealth Letter’ and Exclusive Updates on Mutual Funds.

DIVYA GROVER is the co-editor for FundSelect, the flagship research service of PersonalFN. She is also the co-editor of DebtSelect. Divya is an avid reader which helps her in analysing industry trends and producing insightful articles for PersonalFN’s popular newsletter – Daily Wealth letter, read by over 1.5 lakh subscribers.

Divya joined PersonalFN in 2019 and has since then used stringent quantitative and qualitative parameters to analyse funds to provide honest and unbiased research to investors. She endeavours to enable investors to make an informed investment decision and thereby safeguard their wealth.

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing.

This article is for information purposes only and is not meant to influence your investment decisions. It should not be treated as a mutual fund recommendation or advice to make an investment decision in the above-mentioned schemes.