The Midcap mutual fund category has generated an average return of 45.97% in the last one year, as of 18th January, 2022. This is leaps and bounds ahead of most equity mutual funds, especially the large-cap funds that have generated an average (category) return of 27.21% in the last one year.

On an index level, the Nifty Midcap 150 index is up by 46.43% in the last one year, while the Nifty 50 index is up by 24.74%. So, irrespective of whether you are investing in direct equities or mutual funds, it is quite clear that midcap mutual funds are the superior choice vis-a-vis the last one-year returns.

So, if you are an aggressive investor with a long-term investment horizon, then midcap funds can be an ideal match for you. But like always, the dilemma continues...

Which are the best midcap mutual funds to invest in 2022?

There is a total of 27 midcap mutual funds in India and their combined average net assets under management (AUM), as of December 2021, stands at a mammoth Rs 1,55,442 crore, the third highest AUM in the equity mutual fund space.

With a universe of 27 midcap mutual funds, identifying the best midcap fund/s becomes crucial because unlike large-cap funds, which more or less invest in the same top 100 companies, albeit in varying allocations, investing in midcap funds is a tricky business. This is because midcap mutual funds invest in relatively lesser known companies that are striving to establish their brand value in the lives of the Indian consumers. Also, unlike large-cap mutual funds, where creating alpha is difficult since the investible universe is the same, when it comes to midcap mutual funds, fund managers and the investment strategy they follow can truly make a difference.

This is why, PersonalFN has shortlisted the three best midcap mutual funds to invest in 2022 after stringently evaluating each of the 27 midcap mutual funds on numerous qualitative and quantitative parameters. To give you a glimpse of our recommended best midcap funds for 2022, the average one-year return generated by midcap mutual fund category is 45.97% (as of 18th January 2022), whereas one of our shortlisted best midcap funds for 2022 has delivered a return of 49.27% in the last one year, as of 18th January 2022.

I'm sure you are eager to get your hands on this list of the best midcap mutual funds for 2022. But like your investment in midcap mutual fund demands, you will have to exercise a little patience as we will reveal this coveted list of the three best midcap mutual funds to invest in 2022 shortly. But before that, let us revisit the basic definition of a midcap mutual fund.

What is a Midcap Mutual Fund?

The Securities and Exchange Board of India (SEBI) defines a midcap mutual fund as an 'open-ended equity scheme that must invest a minimum 65% of its total assets in equity and equity related instruments of midcap companies'. Now, midcap companies are typically defined as companies ranging from 101st to 250th in terms of full market capitalisation, which generally lies between Rs 5,000 to Rs 20,000 crore. The fund manager has the autonomy to invest the balance 35% in either large or small cap stocks, debt instruments, or simply maintain it as cash reserves.

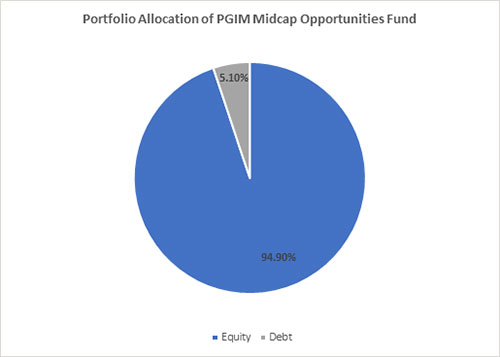

The chart below shows the portfolio of PGIM India Midcap Opportunities Fund, one of the top performing midcap funds of 2022 with a one-year return of 65.46% as of 17th January, 2022. The fund has an AUM of Rs 4,070 crore which is invested as follows -

*Portfolio as on 31st December 2021

*Portfolio as on 31st December 2021

(Source: ACE MF, PersonalFN Research Team)

The 94.90% equity allocation is further split as follows -

So, as per our SEBI definition of midcap mutual funds, PGIM Midcap Opportunities Fund is investing 68.81%, i.e. more than 65% in midcap stocks and the fund manager is free to allocate the balance 35%. In this case, PGIM Midcap Opportunities Fund invested 18.76% in large-cap stocks for stability and 12.42% in small cap stocks for added growth. Let us now take a look at the three best midcap mutual funds to invest in 2022.

Best Midcap Mutual Funds to Invest in 2022

#1: Kotak Emerging Equity Fund

Our first recommendation as the best midcap mutual fund of 2022 is Kotak Emerging Equity Fund. The fund has generated a one-year return of 49.27% against a benchmark return (Nifty Midcap 150 TRI) of 48.28% and a category average return of 47.31% as of 18th January 2022. The fund was launched on 30th March 2007 and has generated a return of 14.54% since its inception. It is one of the popular midcap funds in India as it commands a massive AUM of Rs 17,529 crore as of 31st December, 2021.

Originally, the Kotak Emerging Equity Fund was a mid and smallcap fund, but was later recategorized as a pure midcap fund to align with the SEBI recategorization norms. Currently, this fund invests in a total of 67 stocks employing a bottom-up investment strategy. The fund follows a 'buy-and-hold' investment strategy as reflected by a low portfolio turnover ratio of 6.09%.

The fund invests 95.90% of its total assets in equities, which is further split as 20.29% in large-cap stocks, 74.37% in midcap stocks, and 5.34% in small cap stocks. The fund is bullish on the engineering, chemicals, and construction sectors with above average investments compared to its peers.

Kotak Emerging Equity Fund holds 16.25% of its assets in engineering stocks against the midcap category average of 9.49%. Similarly, it holds 14.84% in chemicals against a category average of 10.61% and 11.49% in construction sector against a category average of 7.12%.

Here's a list of the top 10 stocks that Kotak Emerging Equity Fund invests in as of 31st December, 2021.

Table 1: Top 10 Stocks Held by Kotak Emerging Equity Fund

| Company |

Sector |

% Assets |

| Persistent Systems |

Technology |

4.87 |

| Supreme Industries |

Chemicals |

4.85 |

| Schaeffler India |

Engineering |

4.02 |

| Thermax |

Engineering |

3.17 |

| SKF India |

Engineering |

3.01 |

| Sheela Foam |

Consumer Durable |

2.98 |

| Coromandel International |

Chemicals |

2.78 |

| Oberoi Realty |

Construction |

2.63 |

| JK Cement |

Construction |

2.59 |

| Solar Industries |

Chemicals |

2.56 |

*Portfolio as on 31st December 2021

(Source: ACE MF, PersonalFN Research Team)

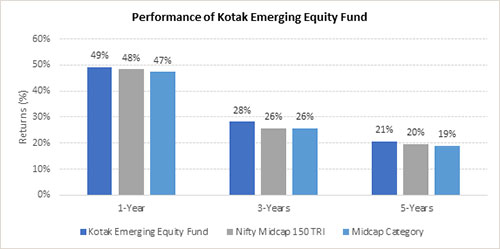

Performance-wise, Kotak Emerging Equity Fund has truly hit it out of the park. It has not only beaten its benchmark, but also all of its midcap peers across both the short-term and long-term. The graph below showcases the stellar returns generated by one of the best midcap mutual funds in India - Kotak Emerging Equity Fund.

Graph 1: Performance of Kotak Emerging Equity Fund against benchmark and midcap peers.

*Performance as on 18th January 2022

*Performance as on 18th January 2022

(Source: ACE MF, PersonalFN Research Team)

One of the main reasons that the Kotak Emerging Equity Fund is reputed as the best midcap mutual fund for 2022 is its consistent long-term performance over its benchmark and peers. And the best part is that the fund delivers this outperformance at a low cost as evident from its lower than average expense ratio of 0.53%.

Here are key financial details about Kotak Emerging Equity Fund -

| Launch Date |

30th March 2007 |

| Return since launch |

14.54% |

| AUM |

Rs 17,529 Crore |

| Expense Ratio |

0.53% |

| Turnover |

6% |

| Alpha |

3.21% |

| Sharpe Ratio |

0.96 |

| Sortino Ratio |

0.95 |

| 1-year return |

49.27% |

| 3-year return |

28.24% |

| 5-year return |

20.76% |

| Exit Load |

For units in excess of 10% of the investment,1% will be charged for redemption within 365 days |

| Minimum Lumpsum |

Rs 5,000 |

| Minimum SIP |

Rs 500 |

Best Midcap Mutual Funds to Invest in 2022 #2: Invesco India Midcap Fund

The second midcap fund to pass PersonalFN's stringent quality checks and emerge as the best midcap mutual fund of 2022 is Invesco India Midcap Fund. The fund has generated a one-year return of 44.58% as on 18th January, 2022. Despite such a stellar performance, its AUM stands at only Rs 2,195 crore as of 31st December, 2021, which might deter some investors but to us and for serious investors looking to create long-term wealth, this signals a great buying opportunity.

The fund has generated a compounded annualised return of 21.58% over the past 5 years, comfortably beating its benchmark, S&P BSE 150 Midcap TRI's return of 19.73%. The fund follows a bottom-up approach to stock picking with a top-down overlap to discover and invest in growth-oriented companies trading at reasonable valuations. This is clearly visible as the fund's PE ratio is 25.92 compared to 28.59, the PE ratio of Kotak Emerging Equity Fund.

The fund invests in a relatively compact portfolio of 45 stocks. Of the fund's total corpus, 97% is invested in equities and the balance 3% in cash and cash equivalents. The equity portfolio is further diversified as 21.20% in large-cap stocks, 68.84% in midcap stocks, and 9.96% in small cap stocks.

Like the best midcap mutual fund of 2022, Kotak Emerging Equity Fund, the Invesco India Midcap Fund is also bullish on the engineering sector with 15.87% allocation against a category average of 9.49%. The fund is also bullish on the automobile sector with an allocation of 14.24% against a category average of 8.48%.

Here's a list of the top 10 stocks that Invesco India Midcap Fund invests in as of 31st December, 2021.

Table 2: Top 10 Stocks Held by Invesco India Midcap Fund

| Company |

Sector |

% Assets |

| Minda Industries |

Automobile |

4.02 |

| Persistent Systems |

Technology |

3.86 |

| Mphasis |

Technology |

3.29 |

| Voltas |

Consumer Durable |

3.11 |

| Sundaram Fasteners |

Engineering |

3.07 |

| Bharat Electronics |

Engineering |

3.07 |

| Craftsman Automation |

Engineering |

2.85 |

| Tata Power Company |

Energy |

2.81 |

| Ashok Leyland |

Automobile |

2.66 |

| Kei Industries |

Engineering |

2.58 |

*Portfolio as on 31st December 2021

(Source: ACE MF, PersonalFN Research Team)

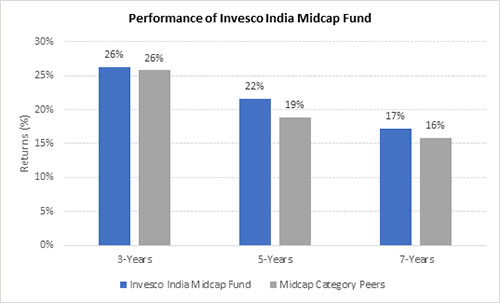

The graph below shows the performance of Invesco India Midcap Fund against its midcap category peers. As evident, the fund has beaten its peers quite handsomely in the long-term, i.e. over a 5-year and 7-year periods.

Graph 2: Performance of Invesco India Midcap Fund against midcap peers

*Performance as on 18th January 2022

*Performance as on 18th January 2022

(Source: ACE MF, PersonalFN Research Team)

Here are key financial details about Invesco India Midcap Fund -

| Launch Date |

19th April 2007 |

| Return since launch |

16.16% |

| AUM |

Rs 2,195 Crore |

| Expense Ratio |

0.79% |

| Turnover |

76% |

| Alpha |

3.00% |

| Sharpe Ratio |

0.95 |

| Sortino Ratio |

0.98 |

| 1-year return |

44.58% |

| 3-year return |

26.25% |

| 5-year return |

21.58% |

| Exit Load |

For units in excess of 10% of the investment,1% will be charged for redemption within 365 days |

| Minimum Lumpsum |

Rs 1,000 |

| Minimum SIP |

Rs 500 |

And our final recommendation for the best midcap mutual fund to invest in 2022 is Axis Midcap Fund.

Best Midcap Mutual Funds to Invest in 2022

#3: Axis Midcap Fund

A list of the best midcap funds would be incomplete without the presence of Axis midcap fund, and rightly so. The fund has generated a one-year return of 43.43% as of 18th January, 2022. It has also given the highest return over a 5-year period, generating a compounded annualised return of 24.65%, far superior than other midcap funds.

Axis Midcap fund is the most popular midcap mutual fund in India with a colossal AUM of Rs 16,835 crore as on 31st December, 2021. The fund is well diversified with investment in 62 stocks, but unlike other midcap funds, the Axis Midcap fund is conservative as it invests only 61.54% in midcap stocks against a category average of 74.25%.

The fund also does not invest in small cap stocks, while other midcap funds invest around 5%-10% of their corpus in small cap stocks. So as a pure midcap fund, the Axis Midcap Fund is technically conservative in its approach and ideal for moderately aggressive investors with a long-term investment horizon.

Axis Midcap fund is bullish on the financial sector with 15.51% allocation, technology sector with a 14.54% allocation, and chemicals sector with a 10.76% allocation. Here's a list of the top 10 stocks that Axis Midcap Fund invests in as of 31st December, 2021.

Table 3: Top 10 Stocks Held by Axis Midcap Fund

| Company |

Sector |

% Assets |

| Coforge |

Technology |

3.93 |

| ICICI Bank |

Financial |

3.78 |

| Cholamandalam Investment & Finance Company |

Financial |

3.50 |

| Avenue Supermarts |

Services |

3.33 |

| MindTree |

Technology |

3.25 |

| Astral |

Chemicals |

3.18 |

| Bajaj Finance |

Financial |

3.07 |

| Mphasis |

Technology |

2.97 |

| PI Industries |

Chemicals |

2.81 |

| Crompton Greaves Consumer Electricals |

Consumer Durable |

2.69 |

*Portfolio as on 31st December 2021

(Source: ACE MF, PersonalFN Research Team)

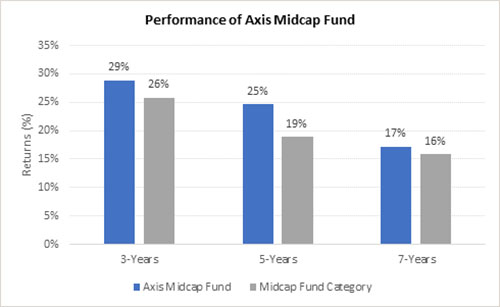

A mere glance at the performance of Axis Midcap Fund will show you why this is undoubtedly one of the best midcap mutual funds in 2022. Axis Midcap Fund has consistently beaten its peers across all time frames and has generated an alpha of 7.20%.

Graph 3: Performance of Axis Midcap Fund against midcap peers

*Performance as on 18th January 2022

*Performance as on 18th January 2022

(Source: ACE MF, PersonalFN Research Team)

Here are key financial details about Axis Midcap Fund:

| Launch Date |

18th February 2011 |

| Return since launch |

19.65% |

| AUM |

Rs 16,835 Crore |

| Expense Ratio |

0.47% |

| Turnover |

27% |

| Alpha |

7.20% |

| Sharpe Ratio |

1.19 |

| Sortino Ratio |

1.21 |

| 1-year return |

43.43% |

| 3-year return |

28.82% |

| 5-year return |

24.65% |

| Exit Load |

For units in excess of 10% of the investment,1% will be charged for redemption within 365 days |

| Minimum Lumpsum |

Rs 5,000 |

| Minimum SIP |

Rs 500 |

This completes our list of the three best midcap mutual funds to invest in 2022. Before you jump to invest in these midcap funds, please note that while midcap mutual funds have the ability to deliver superior returns, they carry very high risk. Hence, it is better to first evaluate your risk profile and align your financial goals instead of chasing a high return investment option.

We might all want to drive a race car, but only a few of us have the stomach to handle the giddying turns of a race track. Similarly, everyone wants to earn superior returns, but very few have the ability to take risks and hold their investments when chaos hits the stock markets.

If you wish to have super compressive and detailed research reports on the best midcap funds for 2022 and other diversified equity mutual funds to invest in, subscribe to PersonalFN's premium research service, FundSelect.

PersonalFN's FundSelect service provides insightful and practical guidance on the mutual fund schemes to Buy, Hold, and Sell. We will also help you choose some of the best Equity Linked Saving Schemes (ELSS) for your tax-saving with PersonalFN's premium research service, FundSelect. Apart from this, you get access to our special reports, including the latest Tax Saving Mutual Fund Report. Here's a peak at the 3 best ELSS funds for 2022.

At PersonalFN, we apply a host of qualitative and quantitative parameters using the S.M.A.R.T. score matrix.

S - Systems and Processes

M - Market Cycle Performance

A - Asset Management Style

R - Risk-Reward Ratios

T - Performance Track Record

The stringent process has helped our valued mutual fund research subscribers to own some of the best mutual fund schemes in their investment portfolio with a commendable long-term performance track record. PersonalFN's service is apt if you are looking for insightful guidance and recommendations on some worthy funds that have high growth potential in the years to come.

If you are serious about investing in a rewarding mutual fund scheme, subscribe now!