MITALI DHOKE MAR 29, 2023 / READING TIME: APPROX. 5 MINS

Are you considering investing in Mutual Funds? Well, then, it is crucial to understand the various mutual fund types and the benefits they offer. It can also help you to diversify your investment portfolio. The Securities and Exchange Board of India (SEBI), which regulates the mutual fund industry in India, has classified mutual funds depending on the types of investments they make.

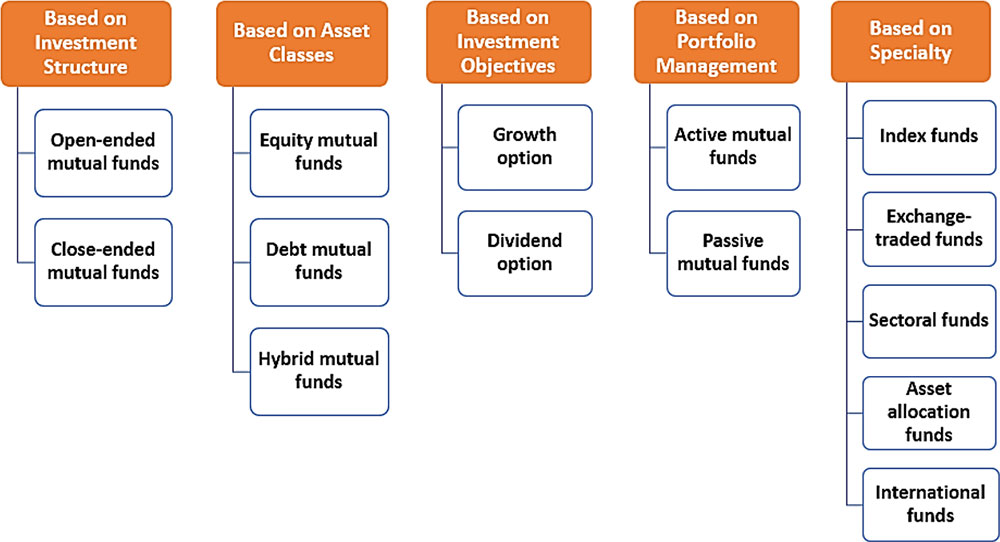

For instance, mutual funds can also be classified based on structure, portfolio management style, asset class and the risk that they take. Mutual fund types can be classified based on various characteristics.

Types of Mutual Funds

1. Types of mutual funds based on their structure

Mutual funds are generally differentiated into two types based on their investment structure - i.e., whether they are Open-ended Funds or Closed-ended Funds. However, these two categories differ significantly.

-

Open-ended Mutual Funds

An open-ended fund is a type of mutual fund that does not have restrictions on the number of shares the fund can issue. Investors can buy or sell units at the prevailing NAV from and to the mutual fund on any business day. These funds do not trade in the open market. There is no cap on the number of units they can issue, and there is no set maturity date. Due to daily fluctuations in the share/stock markets and fund's bond values, the NAV is subject to change. These funds are not generally listed on any exchange. Open-ended schemes are preferred for their liquidity.

-

Close-ended Mutual Funds

A closed-ended mutual fund scheme is where your investment is locked in for a specified period of time. You can subscribe to closed-ended schemes only if your investment is locked in for a predetermined amount of time in a closed-ended mutual fund plan. Closed-ended plans can only be subscribed to during the New Fund Offer period (NFO), and the units can only be redeemed once the lock-in period or the scheme duration has passed. Once that window closes, such schemes cannot issue new units except in case of bonus or rights issues.

Due to market considerations such as supply and demand, investor expectations, and other market factors, the market price of the units may differ from the scheme's NAV. However, some closed-ended funds become open-ended after the completion of the lock-in period, or sometime AMCs might transfer the proceeds of closed-ended funds post the maturity period to another open-ended fund. But, in order to do this, the investors in the aforementioned closed-ended fund must agree.

While comparing open-ended and closed-ended funds, some investment experts argue that lock-in periods ensure that the assets of the fund remain stable due to the stipulated lock-in, giving the fund management flexibility to build a portfolio with a variety of assets.

In contrast, the issuing company directly assumes responsibility for offering an entry and an exit in open-ended mutual funds. By doing this, the investors are given fast liquidity and avoid reliance on transfer deeds, signature verifications and bad deliveries. An open-ended fund allows one to enter the fund at any time and even to invest at regular intervals.

Thus, selecting a suitable type of mutual fund is crucial in the path of wealth creation. Let's take a closer look at different types of mutual funds and their subcategories.

2. Types of mutual funds based on Asset Classes

There are 3 categories of mutual funds that are classified as -- equity-oriented, debt-oriented, and hybrid schemes. Here's a look at some of the types of mutual funds depending on the asset class in which they invest:

-

Equity Mutual Funds

Equity Mutual Funds also go by the name of stock funds because they invest largely in stocks. They invest the money pooled from various investors from diverse backgrounds into shares/stocks of different companies. Gains and losses related to these funds are purely based on the performance of the invested shares (price increases or decreases) in the stock market. They are, therefore, typically regarded as high-risk, high-return investments.

Equity Mutual Funds invest at least 65% of their portfolio in equities. Naturally, equity funds have comparatively high risks. Therefore, from a suitability standpoint, only own them in your portfolio if you have the stomach for significant risk and an investment time horizon of at least 5-7 years. Also, equity funds have the potential to produce high returns or capital growth over an extended period of time. In the long run, these funds have lower tax obligations than debt funds. Be aware that equity-oriented mutual funds are best suited to planning long-term goals such as children's education needs, wedding expenses, and your own retirement.

-

Debt Mutual Funds

Debt Mutual Funds invest in fixed-income instruments like corporate bonds, government bonds, etc. The objective of Debt Mutual Funds is steady and regular income to investors but varies in accordance to a subcategory. Therefore, from a risk-return standpoint, they are less risky compared to equity-oriented mutual funds. However, keep in mind that investing in debt is not entirely risk-free or secure.

Debt Mutual Funds invest in debt securities, which serve as a form of borrowing for governments, banks, and businesses. Debt instruments are regarded as low-risk, low-return financial assets because the interest payments and the return on the capital are fixed. For the same reason, debt funds are relatively safer. Debt funds are further classified on the basis of the maturity period of the underlying assets - long-term and short-term. Certain debt funds only make investments in one specific kind of debt instrument. Gilt funds are an example of such a fund.

-

Hybrid Mutual Funds

As implied by their name, Hybrid Mutual Funds invest in a variety of debt, equities, and money market products. These funds seek to give investors the best of both worlds by combining the steady income from debt securities with the capital growth of equity assets. In general, investors with a moderate to high-risk tolerance will find hybrid funds to be excellent.

These funds' risk or volatility is determined by how their assets are split between debt and equity. For this reason, they are less risky than equity funds but more than debt funds. Similar to debt funds, they will probably offer you larger returns than equity funds but lower than debt funds. As a result, they are referred to as 'balanced funds'.

3. Types of mutual funds based on investment objectives

You have a choice between two mutual fund options: The Growth and Dividend Options. These choices have to do with how the fund should handle the gains it has made over time. Each choice has a unique set of benefits and drawbacks. The gains generated under the Growth option are reinvested in the portfolio to generate additional returns, whilst the HYPERLINK "https://www.personalfn.com/dwl/mutual-funds/all-you-need-to-know-about-idcw-option-in-mutual-funds" returns generated under the Dividend option are distributed as dividends.

-

Growth Option

If you choose the Growth Option of any mutual fund scheme, the profits made by the scheme would be invested back into the scheme, which would result in an increase in the scheme's NAV (net asset value) or the cost of each unit of the mutual fund. In a similar vein, the NAV decreases in the event of a loss. Thus, you would need to redeem the units in order to receive any benefit from the Growth Option of any mutual fund plan.

-

Dividend Option

If you choose the Dividend Option of any mutual fund scheme, the profits made by the scheme would be distributed to the investors at regular intervals (monthly, quarterly, or annually). The profit is deducted from the NAV (Net Aset value) from the price of each mutual fund unit.

There are a few more factors based on which mutual funds have been classified. To know about these factors, move to the second part of this chapter....