In 2018 many investors suffered terrible losses due to their excessive exposure to mid and small cap space. Such ‘once beaten twice shy’ investors swore to give up their investment biases in 2019.

If you are one such investor, planning to invest in equity mutual fund schemes that have no market capitalisation bias, multi-cap funds are the right choice for you.

As per SEBI’s categorisation of mutual fund schemes, multi-cap funds are open-ended equity schemes that invest at least 65% of their assets in equity. They invest across the large-cap, mid-cap, and small-cap domain. So, you get the best of both worlds --- the high-return potential of mid-caps and stability of large-caps. Usually, multi-caps funds maintain a stable allocation to large-cap and mid-cap stocks.

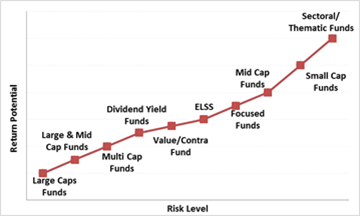

Graph 1: Risk-return spectrum

Note: for illustrative purpose only

(Source: PersonalFN Research)

On the risk-return spectrum, multi-cap funds usually fall between large-cap funds and mid-cap and small-cap funds. Hence, if you are willing to take high risk and want to enjoy capital appreciation across market capitalisation segments, a multi-cap fund may be appropriate for an investment time horizon of at least 5 years.

On the other hand, if you have a very high-risk appetite and longer time horizon can invest in mid and small-cap oriented schemes.

[Read: Should You Invest In Small-Cap Funds In 2019?]

But if you want to benefit from the high-risk potential of mid and small caps without constantly taking a high-risk exposure, prefer multi-cap funds.

Why should you consider investing in multi-cap funds in 2019?

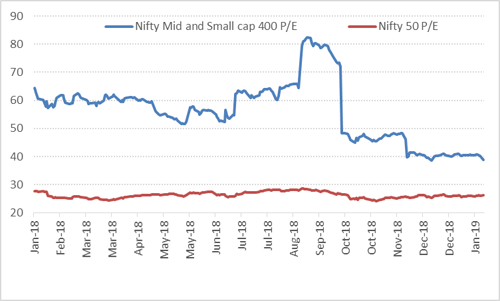

In 2018, the mid and small-cap segment was hammered. As a result, valuation wise although the space looks attractive at the outset, the valuation gap has fallen. Now, reporting healthy earnings growth for these market capitalisation segments will matter.

Graph 2: Narrowing premium of mid and small caps…

(Source: NSE)

On the other hand, the valuations in the large-cap space (see Nifty 50 P/E line), haven't corrected as much.

On the onset of 2019, most of the multi-cap funds hold the core portfolio of large-cap stocks and have exposure to mid-caps too, while the exposure to pure small caps in some schemes is small.

In other words, multi-cap funds appear to be evenly poised to handle uncertain market conditions going forward.

Most of you would now be keen on knowing which multi-cap funds you should consider?

Table: Best performing multi-cap funds

Data as on December 31, 2018

(Source: ACE MF)

*Please note, this table only represents the best performing Multi-Cap Funds based solely on past returns and is NOT a recommendation. Mutual Fund investments are subject to market risks. Read all scheme related documents carefully. Past performance is not an indicator for future returns. The percentage returns shown are only for an indicative purpose. Speak to your investment advisor for further assistance before investing.

Over the last one year, i.e. in 2018, despite the market turbulence Axis Multicap Fund has generated luring returns. The other multi-cap funds, which aren't in the aforesaid list, but hold the potential to do well in 2019 and beyond are:

Note: The above is by no means recommendations.

The outlook and strategy for 2019:

Please remember, 2019 being the election year in India and a year of great uncertainty on the global landscape, going overboard on mid and small cap funds may prove to be detrimental. Plus, if the anticipated earnings recovery doesn’t materialise, mid and small caps may underperform and valuations wise may look expensive.

Relying only on large caps might save you from volatile markets to an extent, but in case markets take a U-turn and rise sharply, large-cap funds might underperform mid and small cap schemes.

Thus, investing in multi-cap funds in 2019 makes a lot of sense.

But remember not to pick a multi-cap fund by:

-

Giving importance to the short-term market outlook

-

Ignoring your personalised asset allocation

-

Depending extensively on the past track-record of a scheme

-

Relying blindly on star-ratings

-

Disregarding qualitative aspects associated with mutual fund selection

-

Relying on the advice given by friends and relatives unqualified to give you advice on mutual funds

How to pick the best multi-cap funds for 2019?

To identify the best multi-cap funds, one shouldn’t rely excessively on past performance. It has become a less relevant indicator after mutual fund schemes reshuffled their portfolios significantly to adhere to SEBI’s reclassification guidelines.

Therefore, to select a winning multi-cap mutual fund scheme, you should adopt a combination of quantitative and qualitative criteria.

Quantitative criteria:

- Performance and risk analysis

This is to analyse if the fund has shown consistency in performance across various market periods with decent risk-adjusted returns. Under this, the fund needs to be ranked on quantitative parameters like rolling returns across short-term and long-term durations, such as 1-year, 3-year, and 5-year periods, and on risk-reward ratios like Sharpe Ratio, Sortino Ratio, and Standard Deviation over a 3-year period.

- Performance across market cycles

You need to ensure that the fund has the ability to perform consistently across multiple market cycles, i.e. bull and bear phases. Therefore, compare the performance of the schemes vis-à-vis their benchmark index across bull phases and bear market phases. A fund that performs well on both sides of the market should rank higher on the list.

Qualitative Parameters:

The portfolio quality of a fund points at how it is likely to perform in the future. Here’s what you should pay attention to:

Adequate Diversification - The fund should not hold a highly concentrated portfolio. A concentrated portfolio heightens the risk involved. Hence, the portfolio of a fund should be well-diversified and the exposure to the top-10 stocks should be ideally under 50% while concentration to one particular sector should not exceed 30-35%.

Credit Quality - For debt portfolios, you need to ensure that the fund does not hold a high proportion of low-rated (securities rated AA or below) or unrated debt instruments. A fund with a higher credit quality should be ranked higher.

Low Churn - Engaging in high churning of your portfolio can result in trading and high turnover cost. Therefore, you also need to consider the portfolio turnover ratio and expenses and penalise funds involved in high churning, i.e. those funds with a turnover ratio of above 100%.

- Quality of Fund Management

Further, consider the fund manager’s experience, his workload, consistency in clocking returns, and proportion of the AUM (Assets Under Management) of the fund house that are actually performing. Therefore, check the following points before investing:

The fund manager’s work experience – He/she should have a decent experience in investment research and fund management, ideally over a decade. But also note that mere experience isn't enough. Some schemes managed by fund managers with 15-20 years of experience have never done consistently well for a long time.

The number of schemes managed – A fund manager usually manages multiple schemes. Thus, you need to check if the fund manager is not loaded with a large number of schemes. If he is managing more than five open-ended funds, it should raise a red flag.

The efficiency of the fund house in managing your money – You need to check if the fund house is consistent in performance across schemes or if only a few selected schemes are doing well. A fund house that performs well across the board is an indication that sound investment processes and risk management techniques are in place.

Yes, we know that the above list is a lot for an average investor to look at. It involves a lot of number crunching and much of the data is not easily available in one place. But if you do need to narrow down on the top funds, these factors are of utmost importance.

To know more about selecting winning mutual funds, watch this short video:

PersonalFN adopts comprehensive mutual fund research process to select the best mutual funds. Based on a composite score, which has a weightage to each parameter, PersonalFN gives its views on each fund recommended under various mutual fund research services.

Once you select the right multi-cap funds for your portfolio start in investing in them through Systematic Investment Plans (SIPs) and choose direct plans.

[Read: Best SIPs To Invest in 2019]

Editor’s note:

Do you want to own an Ultimate Strategic Ready-made Portfolio based on the core and satellite approach of investing?

Yes?

PersonalFN offers you this great opportunity:

The 2019 Edition of PersonalFN’s Premium Report, “The Strategic Funds Portfolio For 2025"

If you’re looking for “high investment gains at relatively moderate risk”, this report is extremely worthy.

In this report, PersonalFN will provide you with a ready-made portfolio of its top equity mutual funds schemes for 2025 that have the ability to generate lucrative returns over the long term.

PersonalFN’s “The Strategic Funds Portfolio for 2025” is geared to potentially multiply your wealth in the years to come. Subscribe now!

Happy Investing!

Author: PersonalFN Content & Research Team