Mutual fund houses are on an asset-gathering spree. Equity funds (including tax-saving funds) have reported a net inflow in assets in 33 of the past 34 months. This has led to an inflow of a whopping Rs 2.07 lakh crore. The total assets managed by equity funds have shot up nearly 3 times to Rs 5.2 lakh crore as in February 2017, from a mere Rs 1.81 lakh crore in February 2014.

Read: Are Fund Houses jeopardizing your interests in the race for more AUM?

The market rally over this period has boosted investor sentiment, and fund houses have not fallen short to capitalise on this situation. Fund houses have rushed in to launch New Fund Offers (NFOs), especially close-ended schemes. Over the past two years, as many as 63 close-ended equity schemes were launched, averaging 2-3 funds a month!

While investors should buy high and sell low, fund houses seem to be doing the opposite by encouraging investments at the market peaks.

Fund houses, through their array of distributors, aggressively sell mutual fund schemes. And thus mutual distributors / investment advisors / relationship managers are making hay while the sun shines indulging in mis-selling. As you read further, you will realise what the advisor or distributor has been telling you is in reality a myth.

PersonalFN here has debunked some of the mis-conceptions and explains why it is a closely guarded secret…

- Equity funds with a lower NAV offer better returns

This is by far the biggest myth of all.

You see, the Net Asset Value (NAV) only represents the price of the underlying stocks in the portfolio. Therefore, if the stocks in the underlying portfolio gains in value, so does the NAV and vice-versa.

Whether you have a fund with and NAV of Rs 10 or one with an NAV of Rs 100, future returns are only dependent on the performance of the underlying securities in the portfolio.

Coming to NFOs, unfortunately a number of mutual fund distributors / investment advisors / relationship manager promote them mainly to earn lucrative commissions — stating that you can invest in the fund at a NAV of just Rs 10. However merely investing at a lower NAV, which of course earns more number of units, does not mean that the fund will deliver exceptional returns. The returns will always to the portfolio construction activity and market-linked.

Unfortunately, this misconception is grossly used to sell close-ended schemes by some unscrupulous mutual fund distributors / investment advisors / relationship managers. If you aren’t aware, close-ended schemes earn a higher income as the trail commissions for the entire maturity period are paid-out as a lump sum at the time of investment.

- Equity funds with a large-sized corpus deliver lower returns

Investors tend to flock to mutual fund schemes that have delivered an exceptional performance over the past few years. So, naturally these schemes report a tremendous growth in their Assets Under Management (AUM).

But there are some mutual fund distributors / investment advisors / relationship managers who may tell you to skip these large-sized funds and invest in those with a lower corpus. If your advisor has given you this advice, proceed with caution.

While fund managers need to diligently manage schemes with a large asset base, there is no evidence to prove that these funds will deliver a poor performance going ahead. As the corpus of the fund increases, the fund manager may take some risk mitigation measures such as reducing the concentration or moving to large-cap stocks, or sometimes even ceasing fresh investment in the scheme. This may not always result in poor performance.

Sometimes, mutual fund distributors / investment advisors / relationship managers seem to be propagating this to get investors to invest money in close-ended funds that have extremely small corpuses of Rs 100-200 crore. It is not necessary that a scheme with a small corpus will outperform those with a larger asset base.

The performance of a mutual fund scheme depends how astutely the fund manager constructs the portfolio and manages it. Besides, the investment mandate, investment processes & systems, risk management measures; are pivotal to a scheme’s performance.

- Established fund houses will deliver a superior performance

There is a lot to a name, however, the same does not hold true when it comes to mutual funds.

If a mutual fund distributor / investment advisor / relationship manager comes to you selling mutual fund schemes of HSBC Mutual Fund or LIC Mutual Fund or other big names, don’t fall for it. Make sure you check the performance track record of the scheme in relation to the benchmark and other schemes in the category. Also, keep an eye on risk and risk-adjusted returns of the scheme.

Schemes of big brand names will not necessarily do well. Fund management is a skill that a few possess.

Likewise, if a mutual fund distributor / investment advisor / relationship manager is trying to push close-ended schemes from mutual fund houses with an established track record in other open-ended schemes or close-ended funds of an earlier series, beware. Just because certain schemes of the mutual fund house have done well, does not mean that even the suggested close-ended fund will perform in a similar manner.

This is just a marketing gimmick. Like we mentioned earlier, the performance is solely dependent on how stocks are picked in the portfolio and astutely the fund managers manages it. The fund may not be able to generate the same returns as another fund because the underlying portfolio may be completely different.

Remember, you will be better-off investing a fund with a consistent track-record, than placing bets on one with no track record at all.

- Close-ended equity funds are better managed, hence offer higher returns

Close-ended funds are expected to be better managed as the fund manager does not have to deal with constant inflows and outflows from investors, as in open-ended schemes.

Now, while this may be partly true, it may not necessarily translate to better returns. Only few fund managers are able to consistently outperform the market.

Secondly, in an open-ended fund, you can invest via a Systematic Investment Plan (SIP). However, no such facility is available in a close-ended fund. Therefore, the returns are entirely dependent on the timing of the entry, and of course how efficiently the fund manager is managing his portfolio.

- Expense ratios do not matter

What difference does 1-percentage point make? Not much you may think.

However, over the long term, thanks to the power of compounding , it can make a huge difference to your portfolio value.

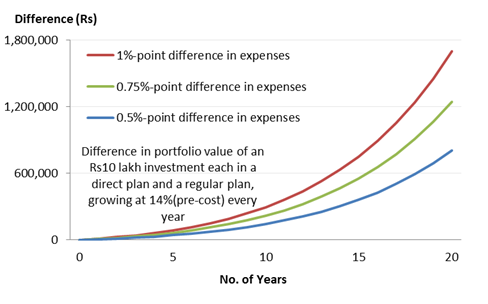

Save Huge Costs Over Long Term

(Source: PersonalFN Research)

As can be seen in the chart above, a small difference in costs can result in savings of anywhere between Rs 8-17 lakh over 20 years, on a Rs10 lakh investment. Yes, you can earn an additional amount of as much as Rs 17 lakh, if the difference in costs is as much as 1% point. The final portfolio value varies with the magnitude difference in expenses. Every 0.25%-point difference in the expense ratio works out to an additional earning of Rs 4.50 lakh in 20 years’ time, if Rs10 lakh is invested.

But many a times, mutual fund distributors / investment advisors / relationship managers may try to explain to you otherwise and deter you from investing in ‘Direct Plans investing in ‘Direct Plans’, which come with a lower expense ratio —roughly between 0.5% and 1.0%. He may also promote schemes with a higher expense ratio, through which he earns a higher commission.

Always keep an eye on costs. You do not want to be in a situation where you are losing lakhs of rupees every year.

End note…

The above points are just a few – highlighting how mutual fund distributors / investment advisors / relationship manager hide the truth from you for their own benefit. If mutual fund schemes are pushed to you citing the above reasons, it’s time you review your mutual fund portfolio.

We know that you don't really enjoy blindly putting your hard-earned money at risk on advice from your financial advisor. That's why we have developed a comprehensive A To Z e-Course to help become your own Financial Planner.

You will learn the Ins and Outs of mutual funds and other personal finance topics. Read more about this e-course here.

You may also enrol for the services of a Certified Financial Guardian, who is mark of trust and respect.

To safeguard your financial interests, you need someone you can trust. You need someone who will not just be an advisor, but will guide you through the complicated world of personal finance. Above all, that someone will always, in all dealings related to investments, put your interest before his/her own. No matter what’s at stake.

In short, you need a ‘guardian’ for your investments, not just an advisor!

Search for your financial guardian here.

If you would like to become a Certified Financial Guardian today, and earn the trust and respect of over 1.4 lakh customers across India, continue reading here.

Add Comments