ABSL Top 100 Fund was launched as a large-cap mutual fund that was focused on the top 100 companies by market capitalisation. Over the past five years, the scheme maintained a portfolio of about 50-70 stocks in its portfolio.

Effective from May 21, 2018, as per its new mandate, the decade old fund will need to restrict its exposure to only 30 stocks. This concentrated portfolio will have a bearing on the overall risk of the fund and the return potential.

Maintaining a concentrated portfolio of stocks has its own pros and cons. While the return potential is higher, so is the risk. Thus, it all boils down to the fund manager’s skill and experience.

ABSL Focused Equity Fund continues to be managed by Mr Mahesh Patil, Co-Chief Investment Officer of ABSL Mutual Fund. He has over two decades of experience and has been the fund manager of this large-cap fund since July 2010.

In terms of performance, the erstwhile-diversified equity mutual fund did a reasonable job in rewarding investors over the long term. The portfolio of the fund was predominantly large-cap, with a trace of mid-caps. However, like a few other large cap funds, the scheme has struggled to deliver returns over the past one year.

It needs to be seen if the fund will be able to regain its past glory with its new investment focus.

In this brief analysis, we take a close look at the features and performance of Aditya Birla SL Focused Equity Fund.

For the entire list of scheme names changes, do read: Your Mutual Fund Scheme Renamed. What Should You Do?

Investment Objective of Aditya Birla SL Focused Equity Fund (erstwhile ABSL Top 100 Fund)

Aditya Birla SL Focused Equity Fund has an investment objective to "achieve long term capital appreciation by investing in upto 30 companies with long term sustainable competitive advantage and growth potential."

The erstwhile fund, Aditya Birla SL Top 100 Fund had an investment objective to “provide medium to long-term capital appreciation, by investing predominantly in a diversified portfolio of equity and equity related securities of top 100 companies as measured by market capitalization”

Aditya Birla SL Focused Equity Fund Details

Fund Facts

| Category |

Focused Fund |

Style |

Blend |

| Type |

Open ended |

Market Cap Bias |

Large-cap |

| Launch Date |

24-Oct-05 |

SI Return (CAGR) |

14.69% |

| Corpus (Cr) |

Rs 4,212 |

Min./Add. Inv. |

Rs 1,000 / Rs 1,000 |

| Expense Ratio (Dir/Reg) |

1.07% / 2.32% |

Exit Load |

1% |

Portfolio Data as on April 30, 2018.

SI Return as on May 30, 2018.

(Source: ACE MF)

Under normal circumstances, Aditya Birla SL Top 100 Fund allocated…

From May 21, 2018, the new scheme Aditya Birla SL Focused Equity Fund will allocate –

Growth Of Rs 10,000, If Invested In Aditya Birla SL Focused Equity Fund Plus 5 Years Ago

Data as on May 30, 2018

Data as on May 30, 2018

(Source: ACE MF)

Had you invested Rs 10,000 in ABSL Top 100 Fund five years back on May 30, 2013, it would have grown to Rs 21,817 as on May 30, 2018. This translates in to a compounded annualised growth rate of 16.87%. In comparison, a simultaneous investment of Rs 10,000 in its current benchmark – Nifty 50-TRI index would now be worth Rs 18,433 (a CAGR of 13%). Aditya BSL Top 100 has clearly outperformed its benchmark over the period of last 5 years by a decent margin. Bulk of the outperformance came in 2014-15.

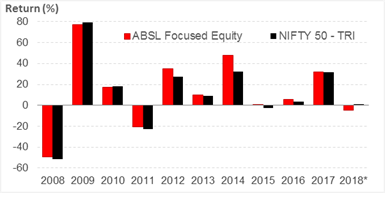

Aditya Birla SL Focused Equity Fund: Year-on-Year Performance

Data as on May 30, 2018

(Source: ACE MF)

ABSL Focused Equity Fund has a track record of over a decade. The year-on-year performance comparison of the fund vis-à-vis its benchmark – Nifty 50-TRI Index shows that the fund has outperformed the benchmark in 8 out of last 10 calendar years. The marginal underperformance of the fund was recorded in CY2009 and CY2010. The fund's best performance was generated in CY2012 and CY2014. In these years, the diversified fund delivered an excess return of 8 and 15 percentage points respectively over the benchmark. The returns have been subdued in the recent 2-3 years. For the year-to-date, the scheme has lagged the benchmark and delivered a negative return.

Aditya Birla SL Focused Equity Fund: Performance Vis-à-vis Category Peers

Rolling Period Returns

| Scheme Name |

Corpus (Rs Cr) |

1 Year (%) |

2 Year (%) |

3 Year (%) |

5 Year (%) |

Std Dev |

Sharpe |

| Axis Focused 25 Fund |

3,714 |

28.00 |

20.92 |

15.56 |

17.97 |

14.43 |

0.18 |

| JM Core 11 Fund |

35 |

25.65 |

24.93 |

15.39 |

19.17 |

18.45 |

0.13 |

| SBI Focused Equity Fund |

2,681 |

23.92 |

18.36 |

14.66 |

18.67 |

12.80 |

0.17 |

| Franklin India High Growth Cos Fund |

7,602 |

19.71 |

16.51 |

13.65 |

23.51 |

14.68 |

0.05 |

| Essel Large Cap Equity Fund |

154 |

19.65 |

16.70 |

12.72 |

15.17 |

13.08 |

0.10 |

| IDFC Focused Equity Fund |

1,561 |

35.51 |

22.33 |

12.61 |

15.11 |

14.13 |

0.12 |

| Reliance Large Cap Fund |

9,833 |

23.35 |

17.31 |

12.15 |

18.38 |

14.01 |

0.08 |

| DSPBR Focus Fund |

2,961 |

16.22 |

14.63 |

11.95 |

17.18 |

13.88 |

0.05 |

| HDFC Focused 30 Fund |

556 |

21.22 |

17.60 |

11.68 |

16.73 |

16.33 |

0.08 |

| Aditya Birla SL Focused Equity Fund |

4,212 |

18.65 |

16.32 |

11.59 |

18.45 |

12.61 |

0.08 |

| Invesco India Largecap Fund |

142 |

17.76 |

14.13 |

10.98 |

16.20 |

11.83 |

0.08 |

| HSBC Large Cap Equity Fund |

699 |

20.05 |

17.40 |

10.39 |

14.31 |

13.05 |

0.09 |

| Principal Focused Multicap Fund |

305 |

18.60 |

15.71 |

10.39 |

15.83 |

13.31 |

0.07 |

| Edelweiss Large Cap Fund |

134 |

19.58 |

14.20 |

10.26 |

16.02 |

13.09 |

0.06 |

| BNP Paribas Large Cap Fund |

932 |

18.86 |

12.69 |

10.19 |

17.37 |

13.78 |

0.03 |

| IDBI India Top 100 Equity Fund |

421 |

15.92 |

12.78 |

10.15 |

16.03 |

13.06 |

0.01 |

| DHFL Pramerica Large Cap Fund |

400 |

17.22 |

13.55 |

10.11 |

16.10 |

12.32 |

0.05 |

| HDFC Top 100 Fund |

15,031 |

19.86 |

17.90 |

9.93 |

15.88 |

15.40 |

0.06 |

| Tata Large Cap Fund |

799 |

16.99 |

13.65 |

9.88 |

14.71 |

12.53 |

0.05 |

| L&T India Large Cap Fund |

397 |

16.98 |

13.02 |

9.32 |

15.43 |

13.08 |

0.05 |

| Nifty 50 - TRI |

|

19.78 |

15.33 |

9.00 |

14.01 |

12.71 |

0.08 |

Returns are on a rolling basis and those depicted over 1-Yr are compounded annualised.

Data as on May 30, 2018

(Source: ACE MF)

*Please note, this table only represents the best performing funds based solely on past returns and is NOT a recommendation. Mutual Fund investments are subject to market risks. Read all scheme related documents carefully. Past performance is not an indicator for future returns. The percentage returns shown are only for indicative purposes.

On rolling return basis, ABSL Focused Equity Fund has done well in the longer-term periods. As seen in the year-on-year performance charts in the earlier section, bulk of the outperformance in the 3-5 year periods came in the 2014-15 period. Thus, if we excluded this period, the returns are lacklustre, as denoted by the 1-year and 2-year returns. In the 1-year rolling periods, the fund has trailed the benchmark.

Aditya BSL Focused Equity Fund's return comes at lower volatility when compared to its peers in the Focused Fund and Large Cap Fund categories. The risk is also marginally lower than the benchmark. However, this may dully change going ahead, given that the fund will be adopting a concentrated strategy. It needs to be seen, if the fund can deploy effective risk management strategies to keep risk low.

The top five mutual funds with a similar investment objective and market-cap bias in the 3-year rolling period performance include—Axis Focused 25 Fund, JM Core 11 Fund, SBI Focused Equity Fund, Essel Large Cap Equity Fund, and IDFC Focused Equity Fund.

Investment Strategy of Aditya Birla SL Focused Equity Fund

The erstwhile investment strategy focused on large market capitalization stocks and a growth cum value style of investing. The investment emphasis of Aditya Birla SL Focused Equity Fund would now be on investing in a maximum of 30 companies with sound corporate managements and prospects of good future growth. The Fund's focus shall be biased towards large cap companies driven by long-term fundamentals though not limited to it.

The erstwhile investment strategy focused on large market capitalization stocks and a growth cum value style of investing. The investment emphasis of Aditya Birla SL Focused Equity Fund would now be on investing in a maximum of 30 companies with sound corporate managements and prospects of good future growth. The Fund's focus shall be biased towards large cap companies driven by long-term fundamentals though not limited to it.

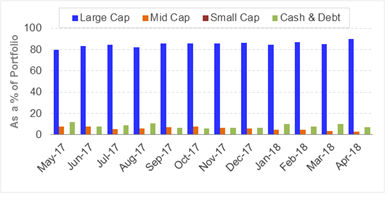

Aditya Birla SL Focused Equity Fund - Portfolio Allocation and Market Capitalisation Trends

Holdings (in %) as on April 30, 2018

Holdings (in %) as on April 30, 2018

(Source: ACEMF)

ABSL Focused Equity Fund usually remains tilted towards large caps, where it allocates over 80% of its portfolio. Mid-and small-caps account for under 10% of the total assets. Over the past year, the scheme has shifted its exposure from mid-and small-caps to large caps. Over the past year, the exposure to large-caps has increased from 80% to nearly 90%. The mid- and small-cap exposure has dropped to 3% from about 8% in the previous year. The exposure to debt and cash equivalents have moved in a narrow range of 5%-10% of the portfolio.

Aditya Birla SL Focused Equity Fund – Top Portfolio Holdings

Top 10 Stocks

| Stocks |

% of Assets |

| HDFC Bank |

8.27 |

| ITC Ltd. |

5.79 |

| ICICI Bank Ltd. |

5.64 |

| Infosys Ltd. |

5.63 |

| Maruti Suzuki India Ltd. |

4.09 |

| Larsen & Toubro Ltd. |

3.44 |

| Dabur India Ltd. |

2.98 |

| L&T Finance Holdings Ltd. |

2.94 |

| Yes Bank Ltd. |

2.92 |

| NTPC Ltd. |

2.91 |

|

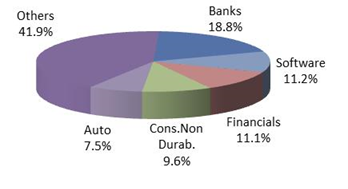

Top 5 Sectors

|

Holdings (in %) as on April 30, 2018

(Source: ACEMF) |

ABSL Focused Equity Fund usually holds around 50-70 stocks in the portfolio. The portfolio holdings averaged around 65 stocks in the past year (2017). Currently, the number of stocks as per its portfolio disclosed for April 2018, is down to 46 stocks. The number of holdings is expected to go down further to 30 stocks, as the portfolio for May 2018 needs to comply with the new categorisation norms.

The top 10 holdings account for 45% of the entire portfolio. HDFC Bank, ITC, ICICI Bank, Infosys and Maruti Suzuki are the top 5 holdings. The top four stocks command an exposure of 5% each.

The sector allocation of ABSL Focused Equity Fund remains skewed towards banks. While banks account for 19% of the entire portfolio, HDFC Bank contributes 8% to the entire holdings. The remaining part of the portfolio remains reasonably diversified across the top 5 sectors.

Top Gainers in Aditya Birla SL Focused Equity Fund's portfolio

Out of the 46 stocks, about 29 stocks have been held for over a year. This gives a sense that Aditya Birla SL Focused Equity Fund prefers to hold the stock for the long term. Among the top performers in the portfolio, with an average holding above 1%, were Tech Mahindra, Tata Steel and Reliance Industries. These stocks gained 61%, 39%, and 38% respectively over the past year.

There were a few laggards as well. India Oil Corp, Tata Motors, and Bharat Electronics were among the large-caps that declined in value. These stocks fell by 26%, 26%, and 21% respectively.

Suitability of Aditya Birla SL Focused Equity Fund

A number of equity schemes maintain a focused or concentrated stock portfolio. While some have done exceedingly well, others have faltered. A few sour stocks can create a drag on returns. Therefore, while these schemes come with the potential to deliver high returns, the risk involved is even higher.

At the same time, funds that are restrictive in their investment approach or those funds that invest only in a concentrated portfolio can be volatile and may fail to generate adequate returns over the long term.

Hence, a deeper look is required to understand how is the fund likely to perform going ahead. But one thing for sure, with a concentrated portfolio, the fund will not be devoid of volatility. But unlike a few other funds in the focused category, ABSL Focused Equity Fund maintains a large cap bias. Hence, this focus of the fund will help it to provide stability to the returns.

That said, large-cap oriented funds are better poised to handle market volatility vis-à-vis mid-and-small caps. Stable businesses, greater market share, quality of management and the sustainability prospects are factors that seem convincing to take exposure to large-caps at the current level.

Large blue chip companies with strong balance sheets and proven track-records could help ride the wave of short-term volatility to a certain extent. Therefore, diversified equity funds with a predominant large-cap allocation can offer stability to your investment portfolio.

Some large-caps take an opportunistic allocation to mid-caps and offer the perfect mix of stability and growth. Therefore, it is pertinent to review large cap funds even on its ability to limit downside during falling markets. However, this has not been the case with ABSL Focused Equity Fund. Hence, its returns are in line with the benchmark, unlike other schemes that took an opportunistic exposure to mid caps.

As ABSL Focused Equity Fund will now adopt a new strategy, it needs to be seen how it plays out, both in terms of risk and return, over the next 6 months to 1 year.

If you plan to invest in Focused Funds or Large Cap Funds, or both, like in the case of Aditya Birla Sun Life Focused Equity Fund, do ensure that the investments are in line with your financial goals. If you are not sure about how to align these schemes with your tax planning or financial goals, do consult your financial planner or investment advisor.

Note: This write up is for information purpose and not a recommendation to buy or sell the mutual fund scheme. As an investor, you need to pick the right fund to meet your financial goals. If you are not sure about your risk appetite, do consult your investment consultant/advisor.

|

Editor's note:

PersonalFN has a long track record of offering unbiased mutual fund research services. It analyses thousands of data points to shortlist schemes and also applies a whole host of qualitative parameters to select only a handful schemes for your portfolio.

Do try PersonalFN’s Premium Mutual Fund Research service ‘FundSelect’

Every month, our FundSelect service will provide you with an insightful and practical guidance on which mutual fund schemes to buy, hold or sell, which will assist in creating the ultimate portfolio that has the potential to beat the market.

And there’s more great news!

FundSelect is turning FIFTEEN.

And on this auspicious 15th anniversary of FundSelect, we intend to make it “ultra-special” for you.

How?

Well, how about getting 1 Year of access to FundSelect virtually Free?

And if you wish, perhaps even MORE...

Check out the exciting offers that can be availed on subscriptions to FundSelect here.

Go ahead and subscribe to PersonalFN’s FundSelect NOW!

|

DISCLOSURE AS PER SECURITIES AND EXCHANGE BOARD OF INDIA (RESEARCH ANALYSTS) REGULATIONS, 2014

About the Company including business activity

Quantum Information Services Private Limited (QIS) was incorporated on December 19, 1989.

QIS was promoted by Mr. Ajit Dayal with an objective of providing value-based information / views on news related to equity markets, the economy in general, sector analysis, budget review and various personal products and investments options available to the Public. It was the first company to start equity research on an institutional level.

'PersonalFN' is a service brand of QIS and was started in the year 1999. In 1999, the Company registered the Domain name www.personalfn.com for providing information on mutual funds and personal financial planning, financial markets in general, etc and services related to financial planning and research in various financial instruments including mutual funds, insurance and fixed income products to customers. It offers asset allocation and researched investment recommendations through its financial planning services.

Quantum Information Services Private Limited (QIS) is registered as Investment Adviser under SEBI (Investment Adviser) Regulations, 2013 and having Registration No.: INA000000680. In terms of second proviso to Regulation 3 (1) of SEBI (Research Analysts) Regulations, 2014 the Company is not required to obtain Certificate of registration from SEBI.

Disciplinary history

There are no outstanding litigations against the Company, it subsidiaries and its Directors.

and condition on which its offer research report. For the terms and condition for research report click here.

Details of associates

- Money Simplified Services Private Limited;

- PersonalFN Insurance Services India Private Limited;

- Equitymaster Agora Research Private Limited;

- Common Sense Living Private Limited;

- Quantum Advisors Private Limited;

- Quantum Asset Management Company Private Limited;

- HelpYourNGO Private Limited;

- HelpYourNGO Foundation;

- Natural Streets for Performing Arts Foundation;

- Primary Real Estate Advisors Private Limited;

- Rahul Goel;

- I V Subramaniam.

Disclosure with regard to ownership and material conflicts of interest

- Neither QIS, it’s Associates, Research Analyst or his/her relative have any financial interest in the subject Company , except QIS receives fees for providing research to Quantum Equity Fund of Fund (QEFoF) which is Fund of Fund scheme managed by QMF.

- Neither QIS, it's Associates, Research Analyst or his/her relative have actual/beneficial ownership of one per cent or more securities of the subject Company, at the end of the month immediately preceding the date of publication of the research report.

- Neither QIS, it's Associates, Research Analyst or his/her relative has any other material conflict of interest at the time of publication of the research report except that QIS (PersonalFN) is, as per SEBI (Mutual Funds) Regulations 1996, an associate / group Company of Quantum Asset Management Company Private Limited and Trustees and Sponsor of Quantum Mutual Fund (QMF) and to that extent there may be conflict of interest while recommending any schemes of QMF. However any such recommendation or reference made is based on the standard evaluation and selection process, which applies uniformly for all Mutual Fund Schemes. The payment of commission (upfront /annualized & trail), if any, for any Schemes by QMF to QIS (PersonalFN) is also at arm's length and as per prevailing market practices

Disclosure with regard to receipt of Compensation

- Neither QIS nor it's Associates have any compensation from the subject Company in the past twelve months.

- Neither QIS nor it's Associates have managed or co-managed public offering of securities for the subject Company in the past twelve months.

- Neither QIS nor it's Associates have received any compensation for investment banking or merchant banking or brokerage services from the subject Company in the past twelve months.

- Neither QIS nor it’s Associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months except from Axis Bank Limited under a service agreement.

- Neither QIS nor it's Associates have received any compensation or other benefits from the subject Company or third party in connection with the research report

General disclosure

- The Research Analyst has not served as an officer, director or employee of the subject Company.

- QIS or the Research Analyst has not been engaged in market making activity for the subject Company.

Subject Company means Mutual Fund Schemes

Quantum Information Services Private Limited CIN: U65990MH1989PTC054667 Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021 Corp. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021. Email: info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013

Add Comments