(Image source: aag.com)

(Image source: aag.com)

Are equity funds for individual investors and debt funds for institutional investors?

There isn't any hard and fast rule. But purely going by numbers, it looks like investors think so.

According to data published by the Association of Mutual Funds in India (AMFI), 87% investors of equity mutual are individual investors while 54% investors of debt funds are institutional investors.

Prevalence of other competing investment products such as bank fixed deposits, company fixed deposits, and small savings schemes (SSS) often compete with debt funds.

Moreover, some recent instances of the debt funds faced default risks have endangered their popularity. Default risk is nothing but the risk of your debt fund losing its capital investments done in a specific instrument.

But did you know, if you invest prudently, debt funds can play an important role in your retirement planning.

Before we discuss how you can intelligently include debt funds in your retirement planning, you must ensure that your approach to retirement planning is right.

Do you want to ascertain it first?

Here we go!

For the reasons given below, you should plan your retirement well in advance, irrespective of your age

-

To achieve financial independence

-

To meet routine expenses post-retirement

-

To tackle inflation

-

To meet medical emergencies

-

To deal with contingencies

-

To retire early

And as you may know, while planning any goal you should take into account your time horizon and risk appetite. These two factors decide your personalised asset allocation.

To be specific, the approach to retirement planning of a 35-year-old person would be completely different from a 50-year-old.

Here're the reasons…

As you grow older, your ability to take risks declines. Similarly, as you move closer to your retirement, your risk absorption capability goes down.

Table 1: Risk taking as per age

Your Age

(in Years) |

25 |

35 |

45 |

55 |

65 |

75 |

| Your Risk Taking Capability |

HIGH ➝ MEDIUM ➝ LOW |

(For illustrative purpose)

Therefore, these two factors vastly affect your investment choices. For example, a 35-year person can absorb a loss of Rs 5 lakh and forget about it after five years if he has earned better returns. In contrast, sustaining the similar loss may not be feasible for a 50-year-old person approaching his retirement in the next few years.

Table 2: Risk taking based on time horizon

Time Horizon

(Years) |

30 |

25 |

20 |

15 |

10 |

5 |

| Your Risk Taking Capability |

HIGH ➝ MEDIUM ➝ LOW |

(For illustrative purpose)

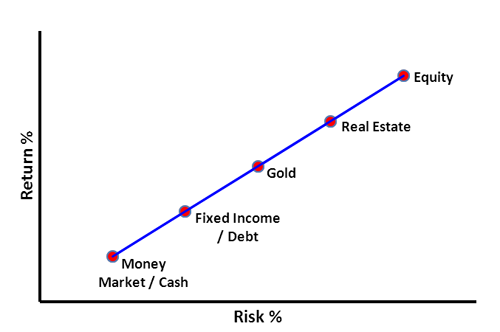

It's imperative for you to realise the risk-return trade off of every asset class and create an asset mix for yourself in such a way that it helps you achieve your retirement planning growth.

Graph 1: Risk-Return trade-off of various asset classes

(For illustrative purpose)

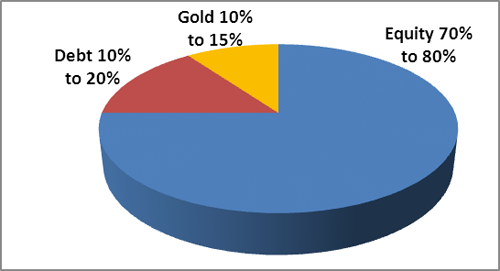

For instance, Rajesh is a 35-year old investor with high risk appetite. He will retire in 25 years. Both these factors warrant him to allocate more to equity oriented mutual funds. For equity allocations, he may rely on multi-cap funds and mid and small cap funds. And can also invest a small portion of his equity mutual fund portfolio in large cap funds.

Graph 2: Indicative allocation for Rajesh

(For illustrative purpose)

To take care of allocations to debt (or fixed income assets) he might use the combination of Public Provident Fund (PPF), National Savings Certification (NSC), and debt funds. Rajesh might divide the debt-part of his portfolio equally between debt funds and other fixed income assets-say 10% to debt funds and another 10% to rest of fixed income assets put together.

Since Rajesh has plenty of time left for his retirement, he can invest in short duration funds, long duration funds, dynamic bond funds, credit risk funds, and corporate bond funds among others. Nonetheless, he should still be careful with his allocation to various categories, especially to credit risk funds.

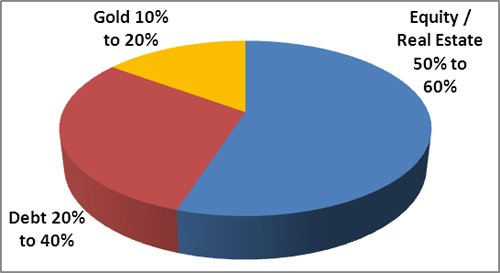

Now consider the case of Suresh. He is a 45-year salaried person. He too was a very aggressive investor about 10 years ago. But with growing responsibilities and decreasing working span, his aggression has subsided over the last 1-2years. He can't have the same asset allocation as Rajesh.

Graph 3: Indicative allocation for Suresh

(For illustrative purpose)

As far as Suresh's fixed income allocations are concerned, he should invest more in fixed-interest bearing instruments and deposits. He shouldn't invest more than 25% of his debt portfolio in

debt funds. Moreover, he should be wary of credit risk funds, since they invest up to 65% of their assets in below-highest rated instruments.

He might prefer corporate bond funds to credit risk funds since the former hold at least 80% of their portfolio in securities enjoying the highest credit ratings.

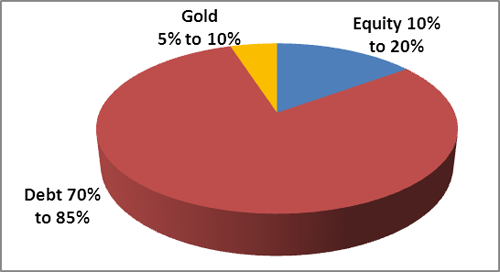

Graph 4: Indicative allocation for Rajesh and Suresh at 65

(For illustrative purpose)

As Suresh and Rajesh grow older and become 65 after 20 and 30 years respectively, their asset allocation will change further.

Then, they would have upto 85% of their overall portfolio in debt with only small allocation to debt funds—say upto 20% of their debt portfolios. Choice of categories of debt funds would defer too. In fact, Suresh and Rajesh should avoid investing in long duration funds, credit risk funds, and dynamic bond funds altogether. Consequently, they might prefer low duration and short duration funds.

What’s the key takeaway for you?

Debt funds have been dealing with tough credit conditions and some of them are losing investors’ money, you need not avoid them altogether. Debt funds aren’t safe, but they aren’t too risky to shun completely, especially if you select them wisely.

Your risk appetite and the years you have left to retirement would guide your allocation to debt funds.

PS: If you’re looking for “high investment gains at relatively moderate risk”, this report is extremely worthy. In this report, PersonalFN offers you this great opportunity:

The 2019 Edition of PersonalFN’s Premium Report, “The Strategic Funds Portfolio For 2025"

In this report, PersonalFN will provide you with a ready-made portfolio of its top equity mutual funds schemes for 2025 that have the ability to generate lucrative returns over the long term.

In this report, PersonalFN will provide you with a ready-made portfolio of its top equity mutual funds schemes for 2025 that have the ability to generate lucrative returns over the long term.

PersonalFN’s “The Strategic Funds Portfolio for 2025” is geared to potentially multiply your wealth in the years to come. Subscribe now!

Add Comments