2018 seems to be the year of large caps, with the benchmark S&P BSE Sensex testing fresh record highs. While the mid and small caps have plunged, the large caps have turned out to be gainers, so far this year.

If you fail to manage your downside better, you would end up losing everything you created. Thus it is very important that you hold a significant portion of your portfolio in safer large caps. They should preferably find place among core holdings in your portfolio.

Large cap funds can be considered as great investment avenue for long-term investors who aim to grow their wealth but with some element of stability. They have the potential to generate steady returns for those looking for decent returns but want to assume relatively lesser risk.

ICICI Pru Bluechip Fund as the name suggest is one such large cap fund from the stable of ICICI Pru Mutual Fund. Earlier known as ICICI Pru Focused Bluechip Fund, it use to follow a focused investment strategy and held a compact portfolio of 40-50 selected large cap stocks.

However, post re-categorization norms, the fund seems to be moving out of its comfort zone and gradually moving towards 60 stocks in its portfolio. Notably, the fund has been investing largely in companies forming a part of top 100 companies listed on the National Stock Exchange. This is well in line with the new categorization mandate as defined by SEBI. ICICI Pru Bluechip Fund now has a track record of over 10 years to its credit.

Recently ICICI Pru AMC came under SEBI’s lens for its unjustified additional bid of Rs 240 crore on the final day in the QIB portion of the IPO of its group company – ICICI Securities Ltd., so that the issue does not fail. The regulator sited that the additional bid was not in the best interest of the investors and has asked it to pay the amount equivalent to the additional bid to all the five schemes that subscribed to it. It also needs to compensate the investors who have exited the scheme post allotment, to the extent of loss incurred by them due to fall in the price of ICICI Securities. The amount has to be paid with 15% interest per annum from the date of allotment to the date of actual payment.

ICICI Pru Bluechip is one of the five schemes in which the fund house applied for and was allotted the shares of ICICI Securities Ltd. The fund holds around 26.92 lakh shares in ICICI Securities Ltd. Notably; the stock is in deep red from its IPO price of Rs 520.

In this brief analysis, we take a close look at the features and performance of ICICI Pru Bluechip Fund, and if the bluechip focus makes it capable of beating the market blues.

Investment Objective of ICICI Pru Bluechip Fund

The primary investment objective of ICICI Pru Bluechip Fund is to seek to generate long term capital appreciation by investing predominantly into equity and equity related instruments of large cap companies.

Fund Details: ICICI Pru Bluechip Fund

Fund Facts

| Category |

Large Cap Fund |

Style |

Blend |

| Type |

Open ended |

Market Cap Bias |

Large Cap Fund |

| Launch Date |

26-May-2008 |

SI Return (CAGR) |

14.50% |

| Corpus (Cr) |

Rs 17,496 |

Min./Add. Inv. |

Rs 100 / Rs 100 |

| Expense Ratio (Dir/Reg) |

1.16% / 2.12% |

Exit Load |

1% |

Portfolio Data as on June 30, 2018.

SI Return as on July 19, 2018.

(Source: ACE MF)

ICICI Pru Bluechip Fund is mandated to invest– –

-

80% - 100% to stocks of large cap companies as defined by the regulator and prepared by AMFI

-

0% - 20% to other equity and equity related instruments

-

0% - 20% to debt and money market instruments

-

0% - 10% to units of REIT/InvITs

-

0% - 10% to Non-convertible preference shares

Growth Of Rs 10,000, If Invested In ICICI Pru Bluechip Fund 5 Years Ago

Data as on July 19, 2018

(Source: ACE MF)

Over the past five years, the scheme generated a return of 16.3% compounded annualised, in comparison to the benchmark return of 15% CAGR.

Every Rs 10,000 invested in ICICI Pru Bluechip Fund five years back on July 19, 2013, would have grown to Rs 21,302 as on July 19, 2018. In comparison, a simultaneous investment of Rs 10,000 in its benchmark – NIFTY 100 - TRI index would now be worth Rs 20,133 (a CAGR of 15%). As can be seen in the chart, the fund has maintained a steady lead over the benchmark.

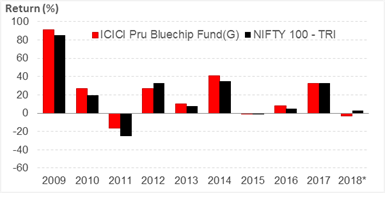

ICICI Pru Bluechip Fund: Year-on-Year Performance

YTD as on July 19, 2018

(Source: ACE MF)

ICICI Pru Bluechip Fund has a track record of over a decade. The year-on-year performance comparison of the fund vis-à-vis its benchmark – NIFTY 100 -TRI Index shows that the fund has outperformed the benchmark in 7 out of the last 10 calendar years. Barring CY 2012 and the current CY 2018, the fund has managed to outperform the benchmark by a significant margin. The fund has managed to limit its downside during gloomy and uncertain market conditions.

ICICI Pru Bluechip Fund: Performance Vis-à-vis Category Peers

Rolling Period Returns

Returns are on a rolling basis and those depicted over 1-Yr are compounded annualised.

Data as on July 19, 2018

(Source: ACE MF)

*Please note, this table only represents the best performing funds based solely on past returns and is NOT a recommendation. Mutual Fund investments are subject to market risks. Read all scheme related documents carefully. Past performance is not an indicator for future returns. The percentage returns shown are only for indicative purposes.

In terms of performance, ICICI Pru Bluechip Fund has certainly rewarded its investors. It is among the few large cap funds that have consistently outperformed the benchmark. In the long-term periods of 3-years and 5-years, the fund has delivered reasonable returns over NIFTY 100 – TRI index. On a one year rolling basis, the fund has found itself among the list of top performers in the large cap category, although it has outperformed the index only by a slight margin.

In terms of the risk-reward, IPBF has generated reasonable risk-adjusted returns, but superior to its benchmark and most of the category peers. The risk in the fund has been marginally lower than the benchmark.

Investment Strategy of ICICI Pru Bluechip Fund

Classified under large cap funds, ICICI Pru Bluechip Fund is now mandated to invest predominantly in stocks of top 100 companies by full market capitalization. The fund will maintain a minimum exposure of 80% to Large Cap stocks.

ICICI Pru Bluechip Fund follows process based investment strategy to identify quality large cap stocks forming a part of top 100 companies by market capitalization. While the fund is expected to majorly have a growth oriented approach, it has shown some flair towards value as well. Probably, it is because both the fund managers managing the scheme have different skill set and investment style, which results in blend style of investment. The fund is process driven and depends predominantly on bottom up approach to pick quality stocks for its portfolio. While picking stocks the fund managers look for scalability of the company they are considering to buy and give high weightage to management track record and scope of improving profitability. The fund typically follows buy and hold strategy, looking for long term holding period and keep churning under check.

ICICI Pru Bluechip Fund - Portfolio Allocation and Market Capitalisation Trends

Holdings (in %) as on June 30, 2018

(Source: ACEMF)

ICICI Pru Bluechip Fund is a pure large cap fund. It has seen months with almost negligible exposure to mid-caps. In the last 12 months, the allocation to large-caps has been in the range of 80% to 97% of its assets, while midcaps have barely crossed 1.5%. The fund has shown penchant to increase the cash level during uncertain and extreme market conditions. At present too, the debt and cash levels in the fund’s portfolio is at around 10% mark. It makes active use of derivatives (Futures) for hedging purpose. As on June 30, 2018, the fund maintained an exposure of 83.8% in large-caps, 1.6% in mid and small-caps, while its exposure to cash, debt and others together accounted for about 14.6% of its assets.

ICICI Pru Bluechip Fund – Top Portfolio Holdings

Top 10 Stocks

| Stocks |

% of Assets |

| Infosys Ltd. |

5.40 |

| ICICI Bank Ltd. |

5.35 |

| State Bank Of India |

5.13 |

| ITC Ltd. |

3.91 |

| Motherson Sumi Systems Ltd. |

3.75 |

| NTPC Ltd. |

3.59 |

| HDFC Bank Ltd. |

3.40 |

| Maruti Suzuki India Ltd. |

3.24 |

| Larsen & Toubro Ltd. |

3.06 |

| Bajaj Finserv Ltd. |

2.87 |

|

Top 5 Sectors

|

| Holdings (in %) as on June 30, 2018 (Source: ACEMF) |

Financials dominate the portfolio ICICI Pru Bluechip Funds, occupying around 28% of the portfolio allocation. I.T., Auto and Consumption are amongst the next top bets with a weightage of 7% to 10%. The top five sectors together account for over 50% of its assets.

Among stocks, Infosys, ICICI and SBI top the list with an exposure of over 5% each. ITC, Motherson Sumi Systems and NTPC follow closely behind. ICICI Pru Bluechip is among the rare large cap funds that have relatively lower exposure to HDFC Bank, which is the top picks of large cap mutual funds. Still the funds portfolio seems to be well place to ride the rally in the large cap space.

Traditionally, the fund has held a focused investment approach where it maintained a compact portfolio of 40-50 stocks. However, post reclassification, the fund seems to have increased its investment bucket and is moving towards 60 stocks in its portfolio.

Suitability of ICICI Pru Bluechip Fund

As large caps are established names, the biggest advantage of having them is the stability they are assumed to provide to your portfolio. However, you will have to compromise a bit on the growth potential offered by mid-caps. Large caps are considered to be relatively safer than their mid and small cap peers that carry a greater degree of risk.

ICICI Pru Bluechip Fund has been amongst the few large-cap funds that have been selective in their stock picks. However, the incidence like ICICI Securities Ltd., concluded at the fund house level, gives a bad fame to the fund. The fund management needs to be more responsible in its approach, so that investors do not suffer.

At PersonalFN we have been very careful, when it comes to picking funds in our recommended mutual fund portfolios. Large cap funds like ICICI Pru Bluechip Fund are suitable for long-term investors who aim to grow their wealth but with some element of stability. Although large caps may not be very appropriate, for aggressive investors, willing to take higher risk for higher returns, it is always advisable to have significant exposure to large caps, as they could not only add the much needed stability to the portfolio, but may also reward in conditions like these.

P.S.: If you are not sure about how to go about creating an optimum mutual fund portfolio, we have a ready solution for you. But your chance to access this solution is limited. So act right now.

Note: This write up is for information purpose and not a recommendation to buy or sell the mutual fund scheme. As an investor, you need to pick the right fund to meet your financial goals. If you are not sure about your risk appetite, do consult your investment consultant/advisor.

DISCLOSURE AS PER SECURITIES AND EXCHANGE BOARD OF INDIA (RESEARCH ANALYSTS) REGULATIONS, 2014

About the Company including business activity

Quantum Information Services Private Limited (QIS) was incorporated on December 19, 1989.

QIS was promoted by Mr. Ajit Dayal with an objective of providing value-based information / views on news related to equity markets, the economy in general, sector analysis, budget review and various personal products and investments options available to the Public. It was the first company to start equity research on an institutional level.

'PersonalFN' is a service brand of QIS and was started in the year 1999. In 1999, the Company registered the Domain name www.personalfn.com for providing information on mutual funds and personal financial planning, financial markets in general, etc and services related to financial planning and research in various financial instruments including mutual funds, insurance and fixed income products to customers. It offers asset allocation and researched investment recommendations through its financial planning services.

Quantum Information Services Private Limited (QIS) is registered as Investment Adviser under SEBI (Investment Adviser) Regulations, 2013 and having Registration No.: INA000000680. In terms of second proviso to Regulation 3 (1) of SEBI (Research Analysts) Regulations, 2014 the Company is not required to obtain Certificate of registration from SEBI.

Disciplinary history

There are no outstanding litigations against the Company, it subsidiaries and its Directors.

and condition on which its offer research report. For the terms and condition for research report click here.

Details of associates

- Money Simplified Services Private Limited;

- PersonalFN Insurance Services India Private Limited;

- Equitymaster Agora Research Private Limited;

- Common Sense Living Private Limited;

- Quantum Advisors Private Limited;

- Quantum Asset Management Company Private Limited;

- HelpYourNGO Private Limited;

- HelpYourNGO Foundation;

- Natural Streets for Performing Arts Foundation;

- Primary Real Estate Advisors Private Limited;

- Rahul Goel;

- I V Subramaniam.

Disclosure with regard to ownership and material conflicts of interest

- Neither QIS, it’s Associates, Research Analyst or his/her relative have any financial interest in the subject Company , except QIS receives fees for providing research to Quantum Equity Fund of Fund (QEFoF) which is Fund of Fund scheme managed by QMF.

- Neither QIS, it's Associates, Research Analyst or his/her relative have actual/beneficial ownership of one per cent or more securities of the subject Company, at the end of the month immediately preceding the date of publication of the research report.

- Neither QIS, it's Associates, Research Analyst or his/her relative has any other material conflict of interest at the time of publication of the research report except that QIS (PersonalFN) is, as per SEBI (Mutual Funds) Regulations 1996, an associate / group Company of Quantum Asset Management Company Private Limited and Trustees and Sponsor of Quantum Mutual Fund (QMF) and to that extent there may be conflict of interest while recommending any schemes of QMF. However any such recommendation or reference made is based on the standard evaluation and selection process, which applies uniformly for all Mutual Fund Schemes. The payment of commission (upfront /annualized & trail), if any, for any Schemes by QMF to QIS (PersonalFN) is also at arm's length and as per prevailing market practices

Disclosure with regard to receipt of Compensation

- Neither QIS nor it's Associates have any compensation from the subject Company in the past twelve months.

- Neither QIS nor it's Associates have managed or co-managed public offering of securities for the subject Company in the past twelve months.

- Neither QIS nor it's Associates have received any compensation for investment banking or merchant banking or brokerage services from the subject Company in the past twelve months.

- Neither QIS nor it’s Associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months except from Axis Bank Limited under a service agreement.

- Neither QIS nor it's Associates have received any compensation or other benefits from the subject Company or third party in connection with the research report

General disclosure

- The Research Analyst has not served as an officer, director or employee of the subject Company.

- QIS or the Research Analyst has not been engaged in market making activity for the subject Company.

Subject Company means Mutual Fund Schemes

Quantum Information Services Private Limited CIN: U65990MH1989PTC054667 Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021 Corp. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021. Email: info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013

Add Comments