(Image source: freepik.com)

(Image source: freepik.com)

If you’ve watched Sooryavansham, Avatar (the one starring Rajesh Khanna, not the Hollywood flick), Baghban,and Sansar, you realise the central theme among these movies is how conservative, hardworking, loving parents are left penniless by their kids.

So, imagine my predicament when post the usual family lunch, we all sat down and decided to watch Avatar. In the movie, Rajesh Khanna retires and earns a decent corpus from his employer but ends up spending it on his children, who ultimately ditch him and leave him penniless.

In Baghban, Amitabh Bacchan spends his life's earning on his children.Not only do they leave him penniless and to fend for himself, they separate him from his beloved wife as well.

The fact that Rajesh Khanna invents a Carburettor and Amitabh Bacchan becomes a bestselling author is just the clichéd Bollywood happy ending.

'See, this is precisely why one shouldn't spend their entire retirement fortune on their children’, remarked my father slyly.

'Indeed, you shouldn't!‘ I replied.

'Oh, so you won't help us in retirement Deepika? We have spent our entire lives trying to provide for you but you won't provide for us?‘ Asked my mother inquisitively.

'That's not what I meant. I meant that if you can self-finance your entire retirement, why would there be a need to be dependent on anyone?‘ I replied.

'What do you mean plan your retirement?' my father enquired.' What is there to plan? like everything in life, it'll come when it comes and if we don't have enough, we'll just have to adjust our spending, surely we can't go back to work like Rajesh Khanna or write a book like Amitabh Bacchan'.

‘There is no concept of a ‘rich retirement’ for a middle class man. If you don’t have enough retirement corpus, you reduce your spending. That is the middle class way of retiring rich’,he continued.

To give you a background about my father, he is 45 years old, conservative, live-within-your-means kind of a person. A hardworking individual who isn’t greedy and this is indeed reflected in his investments, which are mostly in government backed instruments and FD from SBI bank. He has zero investment in Equities and even though I have explained him the benefit of equities in the long term, he just doesn’t get it.

‘I will lose money, only when the country goes bust’, he remarked proudly.

‘That very well may be, but what will happen if even after reducing your spending, the corpus just isn’t sufficient? What if you outlive your corpus?What happens then dad?’ I questioned.

‘That will never happen’ , my father remarked, though I could sense his confidence waning a bit.

Let me show you.

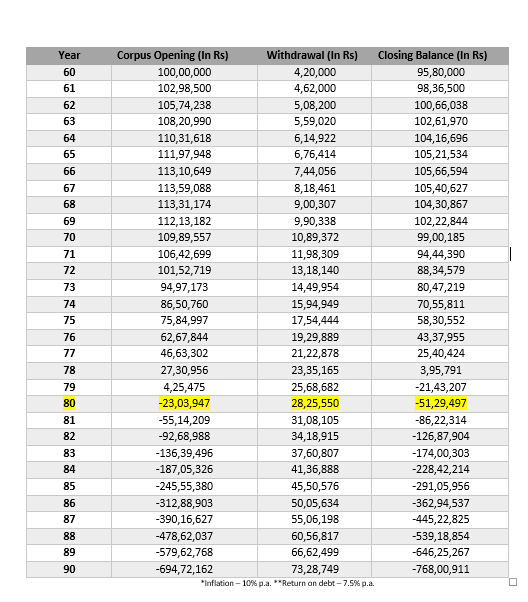

Table 1: Retirement Planning through 100% Debt  ‘If you start with 1 Crore and assuming you spend only Rs 35,000 per month, then too if you keep investing in debt, the money will be completely over at 79th year. Then what would you and mom do? Don’t tell me that you will reduce your expenses even further, that won’t help’.

‘If you start with 1 Crore and assuming you spend only Rs 35,000 per month, then too if you keep investing in debt, the money will be completely over at 79th year. Then what would you and mom do? Don’t tell me that you will reduce your expenses even further, that won’t help’.I questioned.

So, what do I do? This tosses my “so-called” retirement planning. Do I postpone my retirement? My father asked a bit shaken with the above figures.

No, no need for that. A simple strategy will ensure that you successfully achieve your retirement’, I reassured my father.

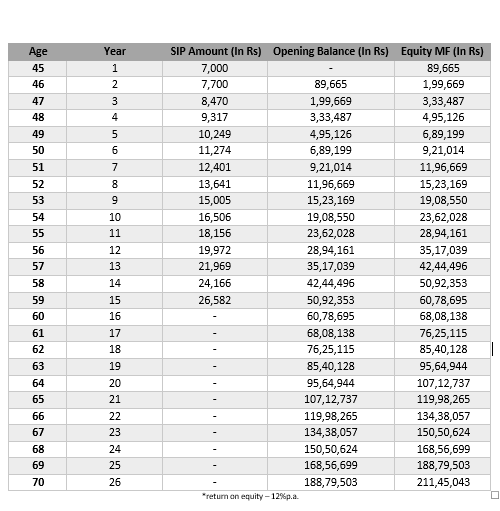

Table 2: Alternate planning for retirement - Equity  You simply need to start with a SIP of Rs 7,000 and increase the SIP amount by 10% p.a. every year till retirement. This Rs 7,000 will be invested in a 100% Equity Mutual Fund and till your retirement you will have an additional corpus of Rs 60.78 Lakhs. Post this, your withdrawals will start from the existing debt corpus of Rs 1 Crore. This debt corpus will last you from 60 years till 79th year, this means that the equity corpus will have additional 19 years to grow. Assuming that in the final 9 years you shift from equity to debt, still your corpus has 10 more years to grow. These 10 year will ensure that the corpus will grow and accumulate to Rs 2.11 crore.

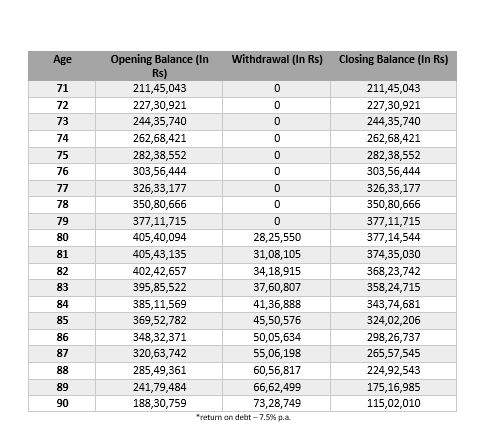

Table 3: Leveraging the time horizon

You simply need to start with a SIP of Rs 7,000 and increase the SIP amount by 10% p.a. every year till retirement. This Rs 7,000 will be invested in a 100% Equity Mutual Fund and till your retirement you will have an additional corpus of Rs 60.78 Lakhs. Post this, your withdrawals will start from the existing debt corpus of Rs 1 Crore. This debt corpus will last you from 60 years till 79th year, this means that the equity corpus will have additional 19 years to grow. Assuming that in the final 9 years you shift from equity to debt, still your corpus has 10 more years to grow. These 10 year will ensure that the corpus will grow and accumulate to Rs 2.11 crore.

Table 3: Leveraging the time horizon  In the final 9 years, let it grow completely in debt. The Rs 2.11 crore will grow to Rs 4.05 crore in debt; and thereafter again your withdrawals will start. At the end of 90th year, you will have enough to even gift us as an inheritance!’,

In the final 9 years, let it grow completely in debt. The Rs 2.11 crore will grow to Rs 4.05 crore in debt; and thereafter again your withdrawals will start. At the end of 90th year, you will have enough to even gift us as an inheritance!’, I explained.

‘This is real right, not some advisor hocus-pocus?’ my father enquired.

‘Of course, it’s real, why will I risk my own inheritance dad!And we all burst into laughter.

‘Wow, now-a-days anyone can retire rich, huh?Sachme acche din aagye kya?’, my dad remarked

‘Acche din hamesha se hi the, and rahenge, acchi planning important hai!’, I casually remarked.

This conversation with my mom and dad over his retirement made me realise that an average middle class person gives priority to every other goal but not retirement. We assume that our PPF, EPF, NPS will be enough, and then they are not enough. We seldom fight for our right to a blissful and stress-free retirement.

Maybe, it’s time for the aamadami to enjoy a

blissful and stress-free retirement. Retirement planning is no longer a luxury, but a basic requirement.

PersonalFN has been in the business of planning for a stress-free retirement for the last 18 years and we have helped hundreds of individuals plan their blissful retirement through such strategies. These strategies and their successful implementation is what segregates us from the crowd of Robo & virtual advisors.

If you too wish to have a personalised strategy for retirement instead of following herd mentality, get in touch with PersonalFN’s financial guardian on 022-61361200 or write to info@personalfn.com. You may also

fill in this form , and soon our

experienced financial planners will reach out to you.

Till then Happy Investing& Happy Retirement!

PS: So, is your plan to retire rich underway? Or like my father, your retirement plan is also waiting for its ‘acche din’? Don’t wait, your ‘acche din’ are finally here, as PersonalFN is launching a service to cater to your dreams of retiring rich. Click here to know more!

Add Comments