(Image source: unsplash.com)

(Image source: unsplash.com)

Recent market corrections have made it conducive to pick stocks at fair pricing. Several fund houses seek this opportunity to buy small-cap stocks with a potential to generate returns over long term.

Edelweiss Mutual Fund has come up with Edelweiss Small Cap Fund (ESCF), an open-ended equity scheme predominantly investing in small-cap stocks, as the fund house believes that small-cap stocks are future multi-baggers. There are many untapped sectors like the Staffing Companies, Chemicals, Industrial/Infra to name a few in the small-cap space.

However, ESCF will not be biased towards any sector and as per the mandate. ESCF will aim to invest at least 65% of its assets in equity and equity related instruments of small cap companies. SEBI has classified small-cap companies as those that fall beyond the 250th stock in terms of full market capitalization.

A noteworthy trait about small-cap stocks is, due to their size, usually, have a low trading volume. Thus, the risk associated with small-cap funds is greater than mid-cap funds. Small-cap funds have the tendency to go from thrilling highs to dangerous lows.

Therefore, as an investor, you need to be ready for high volatility and have the appetite for very high risk. If you are looking to boost your long-term returns where your investment time horizon is over 10 years, you may consider investing some portion in a small-cap fund/s.

Table 1: NFO details

| Type |

An open-ended equity scheme |

Category |

Small-cap Funds |

| Investment Objective |

To generate long term capital appreciation from a portfolio that predominantly invests in equity and equity-related securities of small cap companies.

However, there is no assurance that the investment objective of the Scheme will be realized, and the Scheme does not assure or guarantee any returns. |

| Min. Investment |

Rs 5,000 and in multiples of Re 1 thereafter |

Face Value |

Rs 10 per unit |

| Plans |

• Direct

• Regular |

Options |

• Growth*

• Dividend (Reinvestment#, Payout and Sweep)

*Default option

# Default option for Dividend |

| Entry Load |

Nil |

Exit Load |

- If the Units are redeemed/switched out on or before 365 days from the date of allotment – 1.00%

- If the Units are redeemed/switched out after 365 days from the date of allotment – Nil

|

| Fund Manager |

Mr Harshad Patwardhan |

Benchmark Index |

Nifty Small cap 250 TR Index |

| Issue Opens |

January 18, 2019 |

Issue Closes: |

February 1, 2019 |

(Source: Scheme Information Document)

How will the scheme allocate its assets?

Under normal circumstances, the scheme’s asset allocation will be as under:

Table 2: ESCF’s Asset Allocation

| Instruments |

Indicative Allocation (% of Total Assets) |

Risk Profile |

| Equity and Equity related securities of Small Cap companies* |

65% to 100% |

Medium to High |

| Equity and Equity related securities of other companies |

0% to 35% |

Medium to High |

| Debt and money market instruments^ |

0% to 35% |

Low |

*Small Cap: 251st company onwards in terms of full market capitalization

^Money market instruments include Commercial Papers, Commercial Bills, Treasury Bills, Tri-party Repo, government securities having unexpired maturity up to one year, Call or Notice Money, Certificate of Deposits, Usance Bills, Repo (with approved government & Corporate Debt Securities as collateral), and any other like securities as specified by the RBI from time to time.

- Investment in securitised debt may be up to 35% of net assets of the Scheme.

- The Scheme may take derivative exposure up to 50 % of the net assets of the Scheme. The Scheme may also take exposure into fixed income derivatives within the overall limit of 35% for hedging and portfolio rebalancing purpose.

- The total exposure related to option premium paid will not exceed 20% of the net assets of the Scheme.

- The Scheme may invest in foreign securities up to 50% of the permissible investments of net assets of the Scheme.

- The Scheme may engage in Stock Lending. Not more than 20% of the net assets of the Scheme can generally be deployed in stock lending and not more than 5% of the net assets of the Scheme will be deployed in Stock lending to any single counterparty.

- The cumulative gross exposure through equity, debt and derivative positions should not exceed 100% of the net assets of the Scheme. Cash, cash equivalent with residual maturity up to 91 days will be treated as not creating any exposure.

(Source: Scheme Information Document)

What will be the Investment Strategy?

The Scheme will be a diversified equity fund which will invest mainly in small-cap equity and equity related securities of the companies that are likely to benefit in the long term.

The investment approach will be bottom‐up stock picking – where investments will be selected primarily based on specific criteria relevant to the company in question rather than general macroeconomic considerations. There will be no bias against any sector. The focus will be on Small Cap stocks listed on Indian Domestic exchanges.

The strategy will be to identify companies early or which have the potential to grow significantly to become materially larger in the medium to long term. The Scheme will always endeavour to remain fully invested in equity and equity related instruments.

The exposure to various derivatives instruments is likely for the purposes of hedging, portfolio balancing and optimizing returns. The Scheme may invest in arbitrage opportunities between spot and futures prices of exchange-traded equities

Further, the Scheme may invest in other schemes managed by the AMC or in the schemes of any other Mutual Funds, provided it is in conformity with the investment objective of the Scheme and in terms of the prevailing Regulations.

At present, the Scheme does not intend to enter underwriting obligations. However, if the Scheme does enter into an underwriting agreement, it would do so after complying with the Regulations and with the prior approval of the Board of the AMC/Trustee.

The Fund may also invest in depository receipts including American Depository Receipts (ADRs) and Global Depository Receipts (GDRs).

The Scheme may take advantage of situations that present an investment opportunity to Fund Manager who can judge the implications of that opportunity that can unlock value for investors. Some of these situations are a merger of businesses or companies which may result in synergies in business activities.

The Scheme may also invest in debt and money market instruments, in compliance with Regulations, to accomplish its stated investment objective.

Who will manage ESCF?

ESCF will be managed by Mr Harshad Patwardhan.

Mr Harshad Patwardhan is a B.Tech. (IIT), MBA (IIM) and a CFA by qualification. Mr Patwardhan has an overall work experience of over 23 years in the investment management function and is the Chief Investment Officer of Equity and key personnel at Edelweiss Mutual Fund.

Prior to joining Edelweiss AMC, he was associated with JPMorgan Asset Management India Private as CIO‐ Equities. Prior to that, he worked for two years with Deutsche Equities India Private Limited as a senior research analyst.

At the Edelweiss Mutual Fund, some of the other equity mutual fund schemes he manages are: Edelweiss Large & Mid Cap Fund, Edelweiss Tax Advantage Fund, Edelweiss Multi‐Cap Fund, Edelweiss Mid Cap Fund and Edelweiss Long Term Equity Fund (Tax Savings)

Table 3: Performance of schemes managed by Mr Harshad Patwardhan

(Source: ACE MF, PersonalFN Research)

(Data as on 18th January 2019)

As can be seen from the table, most of the schemes managed by Mr Harshad Patwardhan have been more or less trailing with their respective benchmark indices, except Edelweiss Mid Cap Fund (G)-Direct Plan being the outperformer.

The outlook for ESCF:

Given the asset allocation, the fortune of ESCF will be closely linked to small-cap companies. The Nifty Small cap 250 TR Index in the last 1 year is down -28.60%, while over a 3-year period, +10.76% CAGR. The corrected valuations in the small-cap space will provide the fund manager opportunity to do value picking. During market rallies, small-caps usually tend to outperform large-caps.

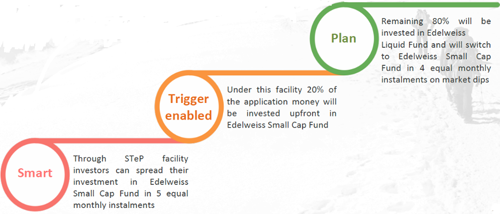

For you investors, ESCF offers a STeP (Smart Trigger enabled Plan) as mentioned in the presentation. The STeP facility would help to reduce the high risk of investing in small-cap stocks.

Figure 1: STeP Facility Illustrated

(Source: Edelweiss Small Cap Fund Presentation)

Further, the presentation also states that based on the fund strategy, “portfolio is defined under 4 different buckets to ensure consistency in performance”.

-

Strategic Allocation (Core Portfolio)

-

Tactical approach for leverage of cyclical uptrends

-

The option of pay-off for risk

-

Defensive act for any probable market underperformance

PersonalFN is of the view that, one should not get lured to these fancy strategies and instead, understand the overall implications of investing in a small cap fund. Note that small-cap funds are placed at the higher end of the risk-return spectrum.

The year 2019 is not going to be easy; it could test the patience of several investors. We are in an election mode in the run-up to Lok Sabha elections in April-May 2019, and surrounded by factors viz. loss in economic momentum, pace of job creation is very slow, farm loan waiver and increased Minimum Support Prices (MSP) may weigh on fiscal deficit, domestic liquidity has been surreal, and people, in general, seem disgruntled after high hopes of Acche Din.

Hence, constructing the portfolio would be a challenging task for the fund manager, and if the Indian equity markets hit more turbulence ahead it may inflict high-risk.

Invest in small-cap funds only if:

PS: If you wish to take a calculated risk and invest in equity funds, PersonalFN can help you pick hidden gems or lesser-known funds that are capable of generating big gains for you.

PersonalFN has released a report 5 Undiscovered Equity Funds especially for investors like you.

These undiscovered funds can help you counter inflation by a substantial margin. Subscribe today!

DISCLOSURE AS PER SECURITIES AND EXCHANGE BOARD OF INDIA (RESEARCH ANALYSTS) REGULATIONS, 2014

DISCLOSURE AS PER SECURITIES AND EXCHANGE BOARD OF INDIA (RESEARCH ANALYSTS) REGULATIONS, 2014

About the Company including business activity

Quantum Information Services Private Limited (QIS) was incorporated on December 19, 1989.

QIS was promoted by Mr. Ajit Dayal with an objective of providing value-based information / views on news related to equity markets, the economy in general, sector analysis, budget review and various personal products and investments options available to the Public. It was the first company to start equity research on an institutional level.

'PersonalFN' is a service brand of QIS and was started in the year 1999. In 1999, the Company registered the Domain name www.personalfn.com for providing information on mutual funds and personal financial planning, financial markets in general, etc. and services related to financial planning and research in various financial instruments including mutual funds, insurance and fixed income products to customers. It offers asset allocation and researched investment recommendations through its financial planning services.

Quantum Information Services Private Limited (QIS) is registered as Investment Adviser under SEBI (Investment Adviser) Regulations, 2013 and having Registration No.: INA000000680. In terms of second proviso to Regulation 3 (1) of SEBI (Research Analysts) Regulations, 2014 the Company is not required to obtain Certificate of registration from SEBI.

Disciplinary history

There are no outstanding litigations against the Company, it subsidiaries and its Directors.

Terms and condition on which its offer research report

For the terms and condition for research report click here.

Details of associates

-

Money Simplified Services Private Limited;

-

PersonalFN Insurance Services India Private Limited ;

-

Equitymaster Agora Research Private Limited;

-

Common Sense Living Private Limited;

-

Quantum Advisors Private Limited;

-

Quantum Asset Management Company Private Limited;

-

HelpYourNGO.com India Private Limited;

-

HelpYourNGO Foundation;

-

Natural Streets for Performing Arts Foundation;

-

Primary Real Estate Advisors Private Limited;

-

HYNGO India Private Limited;

-

Rahul Goel;

-

I V Subramaniam.

Disclosure with regard to ownership and material conflicts of interest

-

‘subject company’ is a company on which a buy/sell/hold view or target price is given/changed in this Research Report;

-

Neither QIS, it's Associates, Research Analyst or his/her relative have any financial interest in the subject Company;

-

Neither QIS, it's Associates, Research Analyst or his/her relative have actual/beneficial ownership of one per cent or more securities of the subject Company, at the end of the month immediately preceding the date of publication of the research report;

-

Neither QIS, it's Associates, Research Analyst or his/her relative has any other material conflict of interest at the time of publication of the research report except that QIS (PersonalFN) is, as per SEBI (Mutual Funds) Regulations 1996, an associate / group Company of Quantum Asset Management Company Private Limited and Trustees and Sponsor of Quantum Mutual Fund (QMF) and to that extent there may be conflict of interest while recommending any schemes of QMF. However, any such recommendation or reference made is based on the standard evaluation and selection process, which applies uniformly for all Mutual Fund Schemes. The payment of commission (upfront / annualized & trail), if any, for any Schemes by QMF to QIS (PersonalFN) is also at arm's length and as per prevailing market practices.

Disclosure with regard to receipt of Compensation

-

Neither QIS nor it's Associates have received any compensation from the subject Company in the past twelve months;

-

Neither QIS nor it's Associates have managed or co-managed public offering of securities for the subject Company;

-

Neither QIS nor it's Associates have received any compensation for investment banking or merchant banking or brokerage services from the subject Company;

-

Neither QIS nor it's Associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

-

Neither QIS nor it's Associates have received any compensation or other benefits from the subject Company or third party in connection with the research report

General disclosure

-

The Research Analyst has not served as an officer, director or employee of the subject Company.

-

QIS or the Research Analyst has not been engaged in market making activity for the subject Company.

Definitions of Terms Used

-

Buy recommendation:This means that the subscriber could consider buying the concerned fund keeping in mind the tenure and objective of the recommendation service.

-

Hold recommendation:This means that the subscriber could consider holding on to the fund until further update. However, additional purchase via ongoing SIP can be considered.

-

Sell recommendation: This means that the subscriber could consider selling the fund keeping in mind the objective of the recommendation service.

Click here to read PersonalFN’s Mutual Fund Rating Methodology

Quantum Information Services Private Limited CIN: U65990MH1989PTC054667 Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021 Corp. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021. Email: info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013

Add Comments