Invesco India Small-cap Fund (IISF), an open-ended equity scheme, is the latest offering from Invesco Mutual Fund. A scheme investing in companies that fall under the small-cap category.

As per SEBI classification of the market capitalisation of stocks, small-cap companies are those that fall in the list that starts from 251st onwards in terms of full market capitalization. As per SEBI mandate, Small-cap equity funds should invest at least 65% of their assets in companies below the top 250 by market capitalisation.

Therefore, Invesco India Small-cap Fund will allocate and incline it assets mainly towards equity and equity related instruments of small-cap stocks in such a manner. However, IISF could invest up to 35% of its assets in equity and equity related instruments of other than small-cap companies.

Generally, small-cap companies are smaller than their mid-cap counterparts and in the initial development phase. Small-cap funds have the tendency to go from thrilling highs to dangerous lows. Plus, small-cap stocks, due to their size, usually have a low trading volume. Thus, note that the risk associated with small-cap funds is greater than mid-cap funds.

Therefore, on the risk-return matrix, IISF is very-high-risk high-return investment proposition. So, IISF is suitable for investors who have the stomach to bear very high-risk and have a time horizon of at least 8-10 years while they endeavour to generate wealth.

[Read: Why Comparing Returns to Risk Is More Meaningful!]

Table 1:NFO Details

| NFO Details of Invesco India Small-cap Fund |

| Type |

An open-ended equity scheme investing in small-cap stocks. |

Category |

Diversified Equity Scheme – Small-cap Fund |

| Investment Objective |

To generate capital appreciation by investing predominantly in stocks of small-cap companies.

However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. |

| Min. Investment |

Rs 5,000 and in multiples of Re 1 thereafter |

Face Value |

Rs 10 per unit |

| Plans |

• Regular

• Direct |

Options |

• Growth

• Dividend# (Payout and Reinvestment)

*Default option

#Default option for Dividend |

| Entry Load |

Nil |

Exit Load |

- In respect of each purchase/switch-in of units, an exit load of 1% is payable if units are redeemed/ switched-out on or before 1 year from the date of allotment.

- In respect of each purchase/switch-in of units, no exit load is payable if units are redeemed/ switched-out after 1 year from the date of allotment

|

| Fund Manager |

Mr Taher Badshah and Mr Neelesh Dhamnaskar (for foreign securities |

Benchmark Index |

S&P BSE 250 Small-cap index |

| Issue Opens |

10th October 2018 |

Issue Closes: |

24th October 2018 |

(Source: Scheme Information Document)

How will the scheme allocate its assets?

Under normal circumstances, the scheme’s asset allocation will be as under:

Table 2: IISF’s Asset Allocation

| Instruments |

Indicative Allocation (% of Total Assets) |

Risk Profile |

| Minimum |

Maximum |

| Equity and Equity Related Instruments of Small-cap companies |

65 |

100 |

High |

| Equity and Equity Related Instruments of companies other than Small-cap companies |

0 |

35 |

High |

| Debt and Money Market Instruments |

0 |

35 |

Low to Medium |

(Source: Scheme Information Document)

Further, it is stated in the Scheme information document that:

-

Debt instruments may include Government Securities. It may also include securitized debt (including pass-through certificates (PTC)) up to 35% of the net assets of the Scheme.

-

The Scheme will not invest in foreign securitized debt.

-

The Scheme may seek investment opportunity in foreign securities in accordance with the guidelines stipulated by SEBI and RBI from time to time.

-

The exposure to foreign securities (including mutual fund and other approved securities) shall not exceed 50% of the net assets of the Scheme.

-

The Scheme may use derivatives for purposes as may be permitted from time to time. The maximum derivative position will be restricted to 50% of the net assets of the Scheme. The cumulative gross exposure through equity, debt and derivative positions shall not exceed 100% of the net assets of the Scheme, as per SEBI circular dated August 18, 2010, with respect to investment in derivatives.

-

The scheme may enter repos/reverse repos other than repo in corporate debt securities by RBI’s permission from time to time.

-

The Scheme may hold cash. A part of the net assets may be invested in the Collateralized Borrowing & Lending Obligations (CBLO) or repo or in an alternative investment as may be provided by RBI to meet the liquidity requirements.

-

The Scheme may engage in short selling of securities in accordance with the framework relating to short selling and securities lending and borrowing, specified by SEBI from time to time.

-

The Scheme shall not deploy more than 50% of its net assets in securities lending. And, to the above limit, in the case of debt instruments, the Scheme shall not deploy more than 5% of the net assets in securities lending to any single counterparty.

What will be the Investment Strategy?

IISF will predominantly invest in stocks of small-cap companies with a view to generating capital appreciation over the long-term.

The strategy of the scheme is to maintain a diversified portfolio of small-cap companies which will be selected based on a bottom-up investment approach.

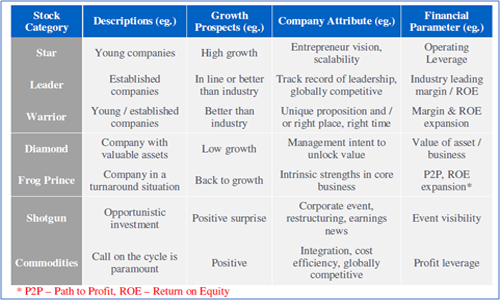

In addition, the stock selection of the fund will be guided by the fund house internal proprietary stock categorization framework, which enables the fund management team in filtering the stock universe to identify the best investment opportunities.

Table 3: Stock Categorization System

(Source: Scheme Information Document)

Stocks that fit into one of these categories typically display superior return profiles, but more importantly, this enables fund managers to focus on the attributes that drive stock price performance and keep a watch for red flags.

The financial parameters under stock selection process are:

-

Margin – EBITDA margin or PAT Margin

-

EBITDA – Earnings before interest, taxes, depreciation and amortization

-

EBITDA Margin – Earning before interest, taxes, depreciation and amortization / Revenues

-

PAT – Profit after Tax

-

PAT margin – Profit after Tax / Revenues

-

Return on Equity (ROE) – Profit after Tax / Net Worth

-

Net worth i.e. Equity share capital + Reserves

-

ROE Expansion – would look for increasing trend in ROE over time.

-

Value of Asset or business – Market or replacement value of the assets after accounting for liabilities.

-

Operating Leverage – Sensitivity of margins to increase in revenues.

-

Profit Leverage – Sensitivity of Profits (EBITDA or PAT) to changes in unit price or total revenues.

-

Path 2 Profit – refers to the various levers such as, but not limited to, cost reduction, revenue growth, revenue mix, discontinuing of a product / business, asset sales, change in capital structure that a company might adopt to improve profitability / reduce losses.

The process involves company, industry, the economic and technical analysis in alignment with the investment objective of the underlying fund. The Scheme’s investment objective has implications for the definition of the universe, company selection, industry and asset allocation.

As a part of the matrix analysis, IISF will follow a bottom-up, that consists of the fundamentals of the companies that are part of the universe.

The fund managers may also use external research to find it as a source of information along with financial models. However, their direct and in-depth interaction with a company and its competitors, suppliers and buyers-wherever feasible and possible, would help them select the company with a unique insight. The maximum inefficiency in the markets is at the company level and an in-depth research effort can generate a knowledge advantage and superior performance.

The AMC has incorporated adequate safety measure to manage risk in the portfolio construction process. Risk control strategy would involve managing risk to keep it in line with the investment objective of the Scheme. The risk control process involves identifying and measuring the risk through various risk measurement tools like but not limited to VAR, tracking error etc.

Further AMC has implemented Bloomberg Asset and Investment Management System as Front Office System (FOS) for managing risk. The system has an inbuilt feature which enables the fund manager to calculate various risk ratios, average duration and analyse the same.

Who will manage IISF?

Invesco India Small-cap Fund will be managed by Mr Taher Badshah and Mr Neelesh Dhamnaskar (for foreign securities).

Mr Taher Badshah will be the lead fund manager overlooking the scheme’s investments. He holds a BE(Electronics) degree followed by MMS (Finance) from Mumbai University.

Mr Badshah has more than 23 years of experience in the Financial Service Industry. He has worked with Kotak Investment Advisors Ltd. as a Fund Manager for 3 years, Motilal Oswal Asset Management Company Ltd. as Senior Vice President and was the Head of Equities for 6.5 years before joining Invesco Asset Management (India) Pvt. Ltd. in January 2017.

Some of the other funds managed by Mr Badshah at the Invesco AMC include Invesco India Multi-cap Fund, Invesco India Dynamic Equity Fund, Invesco India Contra Fund, Invesco India Growth Opportunities Fund and Invesco India Equity & Bond Fund.

Mr Neelesh Dhamnaskar is the dedicated fund manager for making an investment in foreign securities. Mr Dhamnaskar is a Commerce Graduate with MMS (Finance) to his credit. He has around 13 years of experience in equity research.

He has worked with Anand Rathi Securities Ltd. as Commodities Research Analyst for a brief tenure, later joined KR Choksey Shares and Securities Pvt. Ltd. where he worked for 1.5 years. Thereafter joined ENAM Securities Direct Pvt. Ltd. where he worked for 3.5 years before joining Invesco Asset Management (India) Pvt.

Neelesh Dhamnaskar is also the fund manager of Invesco India Feeder - Invesco Pan European Equity Fund and Invesco India Feeder - Invesco Global Equity Income Fund.

Outlook of Invesco India Small-cap Fund:

As mentioned earlier, the aim of IISF is capital appreciation by investing in small-cap companies. Based on the fund strategy of stock selection of small-cap companies, fund managers will try to maintain the investment objective of the scheme.

There are many small-cap companies that show robustness in terms of development. The fund wants to capture the benefit of such growth by managing the risk.

In the current market conditions where small-cap and mid-cap companies are beaten and so have large-caps toppled; it provides an opportunity to do some value buying to the fund managers. However, amidst the extreme turbulence constructing the portfolio would be a challenging task for the lead fund manager, and if the Indian equity markets hit more turbulence ahead that may inflict extremely-high-risk.

Amidst the macroeconomic uncertainties looming, the fortune of the fund would closely be linked to how the fund manager plays the investment strategy in the endeavour to accomplish the investment objective of IISF.

[Read: Skip NFOs, Instead Consider Building A Strategic Mutual Fund Portfolio ]

Editors' note:

At PersonalFN to handle the turbulence of the Indian equity market we will tell you the best mutual funds to invest in and one to dump straight away.

PersonalFN, an independent unbiased mutual fund research house, follows a robust mutual fund research methodology. PersonalFN follows a S.M.A.R.T. score matrix:

S – Systems and Processes

M– Market Cycle Performance

A - Asset Management Style

R - Risk-Reward Ratios

T - Performance Track Record

PersonalFN's stringent scoring model ensures the scheme is tested holistically.

Personal's flagship research service, FundSelect has 15+ years of impeccable track record.

Every month, our FundSelect service will provide you with an insightful and practical guidance on equity funds and debt schemes——the ones to buy, hold, or sell——to assist you in creating the ultimate portfolio that has the potential to beat the market.

PersonalFN is currently celebrating 15 years of wealth creation for mutual fund investors. Unlock FundSelect anniversary offer here!

PersonalFN's FundSelect has proved to be a time-tested way to beat the market by as much as 70%!

Be PersonalFN's FundSelect subscriber today!

Happy Investing!

© Quanutm Information Services Pvt. Ltd. All rights reserved.

Any act of copying, reproducing or distributing this newsletter whether wholly or in part, for any purpose without the permission of PersonalFN is strictly prohibited and shall be deemed to be copyright infringement.

Disclaimer: Quantum Information Services Pvt. Limited (PersonalFN) is not providing any investment advice through this service and, does not constitute or is not intended to constitute an offer to buy or sell, or a solicitation to an offer to buy or sell financial products, units or securities. All content and information is provided on an 'As Is' basis by PersonalFN. Information herein is believed to be reliable but PersonalFN does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. PersonalFN and its subsidiaries / affiliates / sponsors or employees, personnel, directors will not be responsible for any direct / indirect loss or liability incurred by the user as a consequence of him or any other person on his behalf taking any investment decisions based on the contents and information provided herein. This is not a specific advisory service to meet the requirements of a specific client. Use of this information is at the user's own risk. The user must make his own investment decisions based on his specific investment objective and financial position and using such independent advisors as he believes necessary. All intellectual property rights emerging from this newsletter are and shall remain with PersonalFN. This is for your personal use and you shall not resell, copy, or redistribute this newsletter or any part of it, or use it for any commercial purpose. The performance data quoted represents past performance and does not guarantee future results. As a condition to accessing PersonalFN's content and website, you agree to our Terms and Conditions of Use, available here.

Quantum Information Services Pvt. Ltd. Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021 Corp. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021. Email: info@personalfn.com CIN: U65990MH1989PTC054667

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013

Add Comments