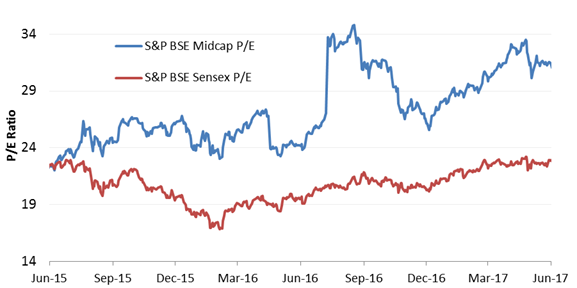

The S&P BSE Mid-Cap index is championing a valuation (in terms of price-to-earnings) greater than that of the S&P BSE Sensex.

But given the high volatility and low liquidity in the mid-cap space, are these mutual fund schemes investing in these stocks well equipped to manage the downside risk? Let’s find out…

It seems like stocks in this investment space are following the “greater-fool” theory of investing. The “greater-fool” theory has been around for centuries, as smart traders have always found a way to find gullible buyers. Sadly the current situation for retail investors, who are buying mid-cap mutual funds, may turn out proving this theory right.

Soaring Mid-cap Valuations

Data as on June 27, 2017

(Source: BSEIndia.com, PersonalFN Research)

Have you heard about the Tulip Mania of the 17th century? In January 1637, prices for tulip bulbs (of scarce and sought-after varieties) soared to point where could buy you one of the grandest homes in Amsterdam. A month later, the buyers disappeared unable to keep up with the soaring prices. With a lack of demand, Tulip prices tumbled to a tenth from their former value.

The “greater-fool” theory supports the belief that stocks prices (no matter how unrealistic) can be justified if there is another buyer or a “greater fool” who will pay a higher price for the same stock. Certainly, the “greater-fool” theory is a great way to make money, but you do not want to be the one holding the stock (or a mutual fund investing in that stock) when the bubble bursts.

The Great Crash of 1929, the tech-stock boom in the late 1990’s, the housing debacle of 2008, etc. – all find their roots in the “greater-fool” theory.

Most investors will be able to recollect the phenomenal bull run of the Indian equity market between 2004 and 2007, and the crash after the US sub-prime mortgage crisis triggered.

Over the Indian equity market rally from May 31, 2004 to January 8, 2008, the S&P BSE Sensex returned a whopping 300% absolute returns or about 50% compounded annualised. An investment of Rs 1 lakh would have more than quadrupled to Rs 4.39 lakh. However in the market crash that followed, your portfolio would have been reduced to less than half— Rs 1.71 lakh—as the market tanked 60% between January 8, 2008 and March 9, 2009.

The mid-cap and small-cap indices met with a similar fate. A similar investment in the S&P BSE Mid-Cap index would have grown to as much as Rs 5.17 lakh in the bull period. The S&P BSE Small-Cap index, on the other hand, would have grown your investment to an incredible Rs 7.64 lakh. Both the indices outperformed their large-cap counterpart by a wide margin. Investors were willing to pay astronomical prices with little heed to valuations or the risk involved. Many hoped to sell their stocks at a higher price, but as history has it, that was not to be.

Euphoric Gains Were Short-lived

Data as on May 31, 2009

(Source: ACE MF, PersonalFN Research)

In the bear market that followed, the S&P BSE Mid-Cap and the S&P BSE Small-Cap collapsed by 74% and 79% respectively. Because of this, the resultant value was worth a mere Rs 1.34 lakh and Rs 1.61 lakh respectively –- both lower than the final of Rs 1.71 lakh on the S&P BSE Sensex. Mid and small caps suffered a far deeper than the large-cap counterparts.

How did mid-cap mutual fund schemes fare before and after the onset of the Global Financial crisis in 2008-09?

Most mid-cap schemes delivered returns in line with their benchmark. While they delivered supernormal returns in the bull market, the bear market that ensued wiped out most of the gains. The mid-cap schemes delivered an average compounded return of 62% in the bull period. In the bear period, the schemes declined by an average of 69% absolute.

While this data may be colluded by survivorship bias and most mid-cap schemes came in to existence post-2006, it still serves the purpose of delivering home the message that speculating and following the crowd can be dangerous.

Those who exited mid-and small-cap schemes at the market’s peak laughed their way to the bank. But those who stayed put driven by greed, unfortunately learnt a lesson for life.

The fund-flow data of that period reveals that a bulk of mutual fund investments were made in the 2006-07 period, lured by the projected market returns. However, soon as the market tanked, funds started flowing out from mutual fund schemes, only to return until 2014.

In search of the greater fool…

From August 28, 2013 till date (June 27, 2017), the S&P BSE Sensex has soared by 15% compounded annualised. The S&P BSE Mid-Cap and the S&P BSE Small-Cap have left their large-cap counterpart behind with compounded annualised returns of 32% and 34% respectively over the near 4-year period.

Mid-Cap Stocks In A Bubble Zone?

Data as on June 27, 2017

(Source: ACE MF, PersonalFN Research)

Though valuations seem stretched, the markets may not be in a crisis-like situation yet, but they seem to be headed in that direction.

Are mid-cap mutual funds equipped to cut losses when disaster strikes? Are they paying heed to their exposure in stocks that command obscure valuations?

In case markets fall substantially, the fund will have two options: 1) sell stocks that are liquid (ignoring their attractiveness), or 2) sell weaker and illiquid assets. If a fund chooses to exercise the first alternative, it will end up holding a poor quality portfolio of illiquid assets. Alternatively, by popping off weak and illiquid stocks, it may incur heavy losses.

Most mutual funds define mid-caps as those companies having a market cap between the highest market-cap stock and lowest market-cap stock on the BSE Mid-Cap Index or the Nifty Free Float Mid-cap 100 index. Such funds also allow an allocation of upto 25%-30% to large-cap stocks.

With the burgeoning of certain funds’ assets, the high allocation to certain mid-cap stocks can certainly pose a high liquidity risk for these schemes. If these stocks buckle under pressure, it will be difficult for the fund manager to get rid of them in time.

Thus, for an investor, it is pertinent to check how liquid (or illiquid) the fund’s portfolio is. Else, in the quest to earn high returns, you may end up being the ‘greater fool’.

On running a liquidity check (how many days it would take to sell all shares of a stock) of the top-10 portfolio of the largest mid-and small-cap schemes, we find that it would take fund managers as many as 2-3 years to liquidate certain mid-cap stocks entirely.

These stocks form about 2%-15% of the total assets of the scheme. A distribution analysis of the top-10 portfolio allocation reveals most schemes have a high allocation to stocks that would take over 180 trading days to liquidate. However, as seen in the table below, certain schemes have held larger stocks in their top holdings to maintain high liquidity of the portfolio.

Distribution of Top-10 Holdings, wrt. Days Required to Liquidate

| Scheme Name |

Top 10 Holdings |

Exposure of Top 10 Holdings That Can Be Liquidated in |

| 0-30 Days |

30-90 Days |

90-180 Days |

180+ Days |

| HDFC Mid-Cap Opportunities Fund |

23.46% |

0.00% |

8.67% |

4.54% |

10.24% |

| IDFC Premier Equity Fund |

32.37% |

6.34% |

3.12% |

7.07% |

15.84% |

| DSPBR Micro-Cap Fund |

27.14% |

0.00% |

0.00% |

5.60% |

21.54% |

| Franklin India Prima Fund |

26.25% |

6.39% |

5.30% |

2.19% |

12.37% |

| Franklin India Smaller Cos Fund |

23.67% |

4.41% |

4.67% |

1.98% |

12.60% |

| Sundaram Select Midcap |

29.00% |

0.00% |

16.88% |

5.59% |

6.53% |

| DSPBR Small & Mid Cap Fund |

28.78% |

4.57% |

15.10% |

5.39% |

3.71% |

| Mirae Asset Emerging Bluechipk |

32.40% |

14.43% |

15.16% |

2.81% |

0.00% |

| UTI Mid Cap Fund |

29.07% |

6.46% |

17.23% |

2.81% |

2.56% |

| SBI Magnum MidCap Fund |

33.16% |

0.00% |

10.02% |

10.94% |

12.19% |

Data as on May 31, 2017

Assumption: Trading of the fund accounts for 33% of the total trades on any given day. Average of daily volume over 1-year considered.

(Source: ACE MF, PersonalFN Research)

While the fund manager is not expected to sell the entire holdings, a high allocation to illiquid stocks can be a concern and create dead-wood on the portfolio, if the stock fails to perform and the fund manager is unable to sell it in time.

And to deal with the market risk, some fund houses have even diversified over a large number of stocks and increased their allocation to cash.

| Scheme Name |

Corpus (Rs Cr.) |

No Of Stocks |

Allocation to Cash & Debt (%) |

| HDFC Mid-Cap Opportunities Fund |

16,606 |

76 |

4.18 |

| IDFC Premier Equity Fund |

5,903 |

56 |

6.93 |

| DSPBR Micro-Cap Fund |

5,818 |

82 |

6.51 |

| Franklin India Prima Fund |

5,778 |

61 |

9.91 |

| Franklin India Smaller Cos Fund |

5,696 |

74 |

9.67 |

| Sundaram Select Midcap |

5,269 |

67 |

1.42 |

| DSPBR Small & Mid Cap Fund |

4,018 |

66 |

9.46 |

| Mirae Asset Emerging Bluechip |

3,898 |

60 |

2.59 |

| UTI Mid Cap Fund |

3,880 |

80 |

1.41 |

| SBI Magnum MidCap Fund |

3,733 |

58 |

7.55 |

Data as on May 31, 2017

(Source: ACE MF, PersonalFN Research)

As seen in the table above, for lack of attractive opportunities in the mid-cap space, the cash component in certain schemes ranged between 5%-10%. This is possibly to deal with the redemption pressure if it arises. The number of stocks too, in most schemes is above 50 and went up to nearly 80 stocks in certain schemes.

So, how should you approach mid-cap funds?

As an investor, there’s little say on how the fund manager chooses to manage your portfolio. This is why you need to prudently select the right mutual fund schemes. This should be combined with factors like your age, risk tolerance, investment horizon, investment objective, financial goals and so on.

It’s difficult to predict when the market will favour large-cap or mid-cap stocks. So, it’s a good idea to include a mix of different categories of fund strategically in your portfolio. Given the high valuations in the mid-cap space, mid-cap mutual funds may run into high volatility ahead.

An investor with a looking for lesser volatility or relatively stable returns can consider investing in large-cap funds or balanced funds.

Those who are unsure about which mutual fund schemes to invest in, try PersonalFN’s unbiased mutual fund research services. Along with quantitative parameters such as performance, PersonalFN also considers qualitative parameters such as portfolio characteristics while analysing mutual fund schemes. You may subscribe to PersonalFN’s FundSelect service here.

And in current times if you wish to strategically invest, PersonalFN has launched a new service: Strategic Portfolio for 2025 that is based on a Core and Satellite approach to investing, aimed at combining the best of both worlds – that is, short-term high-rewarding opportunities and long-term steady-return investing. You’ll be exposed to the top-performing funds across varying market caps and investment styles - be it large-cap, mid-cap, multi-cap, value-based or balanced funds. We highly recommend that you opt for this service.

Add Comments