(Image source: Image by dawnfu from Pixabay)

(Image source: Image by dawnfu from Pixabay)

Jatin has nineteen mutual fund schemes in his mutual fund portfolio.

Out of these, four are Equity Linked Savings Schemes (ELSS) and three are large cap funds, mid cap funds, and small cap funds respectively. Since he has a bank account with four leading private sector banks, he deals with four different relationship managers who sold him most of these equity funds.

Moreover, he has invested in two dynamic bond funds offered by different fund houses based on his friend's advice. Last year, one of his relatives suggested a couple of credit risk funds and a gilt fund, which according to him had a high-return potential.

Jatin has invested in ultra-short term bond fund for his contingency requirements.

He feels his portfolio is well-diversified since he has invested in schemes offered by 7-8 different fund houses.

Don't you think, he's taking diversification too far?

Investing across the market capitalisation curve and picking schemes managed by fund houses following different styles might sound like a suitable investment plan. But investing in four schemes that have the same investment objectives stretches the idea of diversification beyond its natural semantics.

Having too many mutual fund schemes in your portfolio serves the same purpose as that of having dozens of clothes in your wardrobe that you hardly use.

Jatin realised this last year, i.e.in 2018. All his small cap funds lost in the range of 22%-25%. Buying small cap funds offered by three different mutual fund houses didn't help him. The performance of all mid cap funds was also similar to that of one another.

Speaking about the debt portfolio, one of the credit risk funds in which Jatin had invested Rs 5 lakh caught up in the IL&FS fiasco. When the Net Asset Value (NAV) of the fund dropped like that of an equity fund, Jatin realised the possibility of a higher return was subject to high risk.

On the brighter side, a large cap fund in Jatin's portfolio did so exceptionally well in 2018 that it not only outperformed the benchmark index and the category of large cap funds, but it went on to become one of the most outperforming schemes across categories.

Unfortunately, Jatin had invested only 2% of his portfolio in that scheme.

Beyond a point, every scheme you add to your mutual fund portfolio;

-

Just occupies a place in your portfolio

-

Offers no extra benefit

-

Doesn't help lower risk

-

Increases the burden of monitoring

-

Discourages optimum use of resources

Remember, "Too much of anything is good for nothing!" Over-diversification doesn't help create wealth.

For all these reasons, every addition beyond a point can actually interrupt your journey of wealth creation. Imagine, instead of holding three large cap schemes, if Jatin's portfolio had held just one---one that outperformed.

What were the mistakes Jatin made with scheme selection and how should you avoid them in your case?

-

Jatin listened to everybody that offered him advice-friends, relationship managers, relatives-without bothering to know if they were qualified to give investment advice.

-

He didn't invest as per his financial goals and risk appetite. Jatin was shell-shocked when his credit risk fund made losses and small cap funds shed one fourth of their value in just one year.

-

He missed out on several fund categories which would have offered him true diversification. For example, he didn't even consider value funds or contra funds. It would have made much more sense in holding a multi cap fund instead of holding four schemes each in large cap, mid cap and small cap categories respectively.

-

Small and mid cap funds occupied more than 50% of his portfolio-again something extremely contrary to his risk appetite.

-

Four ELSS schemes offered no value as their investment styles heavily overlapped.

-

Jatin should have invested in overnight funds for his contingency requirements.

[Read: Liquid Funds v/s Overnight Funds: Where To Park Your Short-Term Money?]

Here's how you can diversify intelligently...

The primary objective of diversification is to reduce portfolio risk. However, before you think of diversification, you must know your financial goals and risk appetite. Like Jatin, if you hold three small cap funds despite having a low risk appetite, it would serve no purpose.

Investing in equity mutual funds is a high-risk activity. Debt funds aren't as risky as equity funds are but they aren't completely risk free.

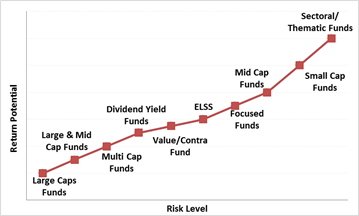

Among equity funds, large cap funds is the safest category. As you move down the market capitalisation pyramid, the risk component increases. Similarly, risk varies according to management styles and portfolio concentrations.

Graph: 1 Equity funds: Risk-Return trade off

For example, contra funds invest in out-of-favour stocks; thus, they experience high volatility in the short run. On the other hand, focused funds take concentrated exposures in select high-conviction stocks.

Sector and thematic funds bank on opportunities limited only to a specific sector or a theme.

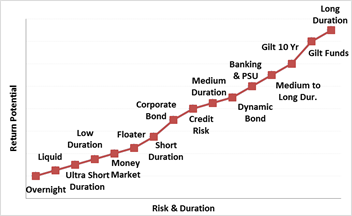

Graph: 2 Debt funds: Risk-Return trade off

Speaking about debt funds, overnight funds and liquid funds are the safest options. As the portfolio duration increases or the credit quality reduces, the risk component increases. Thus, credit risk funds and medium duration funds involve higher risk as compared to short duration funds and corporate bond funds. Long duration funds expose investors to the highest possible risk in the debt funds space.

Once you know your financial goals and risk appetite, you should analyse all available mutual fund scheme options. Preferably invest in schemes that have been consistent across timeframes and market cycles and come from stable fund houses following strong investment and risk management processes.

Watch this video to know how to select a winning mutual fund

It is advisable to seek the advice of a financial expert when shortlisting schemes for your portfolio.

Editor's note: If you are looking for funds that carry a Potential to Beat the market by as much as 70%!

Subscribe to PersonalFN's 'FundSelect' service.

It is a credible mutual fund research service with a track record of more than 15 years.

Once you subscribe to FundSelect, you will get instant access to potentially the best equity and debt mutual fund to invest and even recommendations on the ones to 'Hold' and 'Sell'.

Add Comments