The erstwhile Kotak Select Focus Fund has been converted into a multicap fund and is now known as Kotak Standard Multicap Fund. The fund’s extra-ordinary performance has seen it in a limelight for quite some time.

With a market-beating performance, the fund has caught the investors’ fancy, pushing it to the list of Top 5 largest diversified equity funds. In the last two years, the fund has seen a four-fold increase in size. And currently it has a corpus of about Rs 20,000 crore under its management, which nearly raises concern about its capacity.

However, the large cap orientation of the fund still offers it some flexibility to accept more investors. Notably, Kotak Standard Multicap Fund has now become the flagship fund of Kotak Mutual Fund, while the second largest scheme in its stable – Kotak Emerging Equity Scheme has a corpus of just around Rs 3,200 crore, followed by Kotak Equity Opportunities Fund at Rs 2,500 crore. It will be interesting to see, if Kotak Standard Multicap Fund can sustain its extra-ordinary performance or will the huge size play a spoil sport for its investors.

With an objective of generating long-term capital appreciation from a portfolio of predominantly equity & equity related securities, Kotak Standard Multicap Fund generally focuses on a few selected sectors with its portfolio being diversified across market capitalization. The new mandate adopted by the fund offers it the complete flexibility to stick to its original mandate of focusing on selected sectors as well as diversifying the portfolio across market caps, without any restriction.

Historically, the fund has held a large cap bias portfolio that has been in the range of 70% to 85% of its assets, and it is expected to continue with similar allocation in future as well. Although classified as a multicap fund, the large cap bias followed by Kotak Standard Multicap Fund is contrary to its classification and far from calling it a true to its style multicap fund.

Fund Facts – Kotak Standard Multicap Fund

| Category |

Multi Cap Fund |

Style |

Blend |

| Type |

Open ended scheme |

Market Cap Bias |

Multi Cap Fund |

| Launch Date |

17-Sep-2009 |

SI Return (CAGR) |

15.02% |

| Corpus (Cr) |

Rs 19,827 |

Min./Add. Inv. |

Rs 5,000 / Rs 1,000 |

| Expense Ratio (Dir/Reg) |

1.17% / 2.14% |

Exit Load |

1% |

Portfolio Data as on June 30, 2018.

SI Return as on July 31, 2018.

(Source: ACE MF)

Growth Of Rs 10,000, If Invested In Kotak Standard Multicap Fund 5 Years Ago

Data as on August 07, 2018

(Source: ACE MF)

Generating returns at about 25% CAGR, Kotak Standard Multicap Fund has shown stellar performance over the last 5 years. It has outperformed the benchmark Nifty 200 – TRI index by about 6 percentage points. An investment of Rs 10,000 in Kotak Standard Multicap Fund 5 years back, would now have more than tripled and appreciated to Rs 30,225. A simultaneous investment in the benchmark Nifty 200 – TRI index would have grown to Rs 23,699. Outperforming many of its peers in the multicap funds category, Kotak Standard Multicap Fund has graduated to the list of top quartile performers.

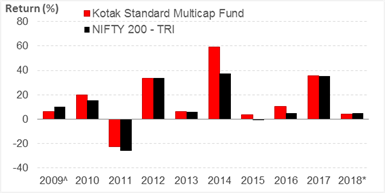

Kotak Standard Multicap Fund: Year-on-Year Performance

*YTD as on August 07, 2018

^ SI as on September 11, 2009

(Source: ACE MF)

Launched with a focused strategy in mind way back in September 2009, when the markets were recovering from the 2008 sub-prime crisis, Kotak Standard Multicap Fund now has a track record of around 9 years. During this period the fund has registered fair level of consistency and outperformance over the benchmark. More importantly it has proven the ability to steer pass the choppy market conditions. The fund has outperformed the benchmark in 7 out of the 10 calendar years of its existence. Overall, Kotak Standard Multicap Fund carries a superior long term performance track record, while its returns have gradually bettered some established funds in its category.

Kotak Standard Multicap Fund: Performance Vis-à-vis Category Peers

| Scheme Name |

Corpus

(Rs Cr) |

1 Year (%) |

2 Year (%) |

3 Year (%) |

5 Year (%) |

Std Dev |

Sharpe |

| Motilal Oswal Multicap 35 Fund |

13,016 |

24.43 |

24.65 |

20.33 |

-- |

14.34 |

0.14 |

| SBI Magnum Multicap Fund |

5,413 |

21.04 |

20.59 |

16.24 |

22.22 |

13.16 |

0.13 |

| Principal Multi Cap Growth Fund |

661 |

26.22 |

25.27 |

16.20 |

22.32 |

16.63 |

0.12 |

| Aditya Birla SL Equity Fund |

9,351 |

18.82 |

23.19 |

16.16 |

23.27 |

13.67 |

0.13 |

| Invesco India Multicap Fund |

524 |

23.45 |

21.31 |

15.68 |

26.32 |

15.28 |

0.10 |

| Kotak Standard Multicap Fund |

19,827 |

19.70 |

21.36 |

15.54 |

22.19 |

12.79 |

0.15 |

| Mirae Asset India Equity Fund |

7,945 |

22.10 |

21.79 |

15.10 |

22.06 |

13.41 |

0.14 |

| BNP Paribas Multi Cap Fund |

854 |

22.57 |

20.20 |

14.45 |

20.48 |

14.40 |

0.06 |

| Parag Parikh Long Term Equity Fund |

1,107 |

21.25 |

17.91 |

13.97 |

20.17 |

10.09 |

0.19 |

| Edelweiss Multi-Cap Fund |

87 |

25.81 |

21.38 |

13.42 |

-- |

14.95 |

0.11 |

| ICICI Pru Multicap Fund |

2,753 |

14.76 |

17.90 |

13.03 |

19.78 |

12.37 |

0.11 |

| Franklin India Equity Fund |

11,470 |

16.33 |

16.05 |

12.58 |

20.11 |

11.78 |

0.07 |

| DSPBR Equity Fund |

2,503 |

19.56 |

19.94 |

12.41 |

18.78 |

15.16 |

0.08 |

| HSBC Multi Cap Equity Fund |

637 |

19.29 |

19.54 |

12.21 |

20.45 |

14.88 |

0.08 |

| IDFC Multi Cap Fund |

5,484 |

18.65 |

15.61 |

11.76 |

20.89 |

13.71 |

0.04 |

| L&T Equity Fund |

2,798 |

18.94 |

17.96 |

11.37 |

18.60 |

13.44 |

0.07 |

| IDBI Diversified Equity Fund |

363 |

17.95 |

14.51 |

11.30 |

-- |

12.24 |

0.04 |

| HDFC Equity Fund |

21,754 |

18.61 |

20.05 |

10.81 |

18.20 |

16.73 |

0.06 |

| Baroda Pioneer Multi Cap Fund |

673 |

17.13 |

16.71 |

10.21 |

16.31 |

13.57 |

0.03 |

| UTI Equity Fund |

7,986 |

18.26 |

15.27 |

10.18 |

17.48 |

12.52 |

0.11 |

| Canara Rob Equity Diver Fund |

913 |

21.21 |

17.66 |

10.09 |

15.87 |

14.44 |

0.06 |

| Reliance Multi Cap Fund |

9,732 |

19.79 |

15.10 |

9.00 |

18.15 |

15.00 |

0.00 |

| Taurus Starshare (Multi Cap) Fund |

210 |

15.40 |

15.17 |

8.58 |

14.52 |

14.67 |

-0.01 |

| Union Equity Fund |

212 |

14.60 |

13.93 |

6.32 |

12.92 |

13.09 |

0.01 |

| LIC MF Multi Cap Fund |

275 |

10.85 |

11.11 |

4.63 |

11.96 |

15.50 |

-0.04 |

| NIFTY 200 - TRI |

|

19.95 |

18.41 |

10.98 |

15.77 |

13.11 |

0.10 |

Returns are on a rolling basis and those depicted over 1-Yr are compounded annualised.

Data as on August 07, 2018

(Source: ACE MF)

*Please note, this table only represents the best performing funds based solely on past returns and is NOT a recommendation. Mutual Fund investments are subject to market risks. Read all scheme related documents carefully. Past performance is not an indicator for future returns. The percentage returns shown are only for indicative purposes.

The top quartile performance showcased by Kotak Standard Multicap Fund (erstwhile Kotak Select Focus Fund) has attracted many investors, pushing its AUM towards the Rs 20,000 crore mark. Notably the funds corpus has increased almost four folds in the last 2 years, from around Rs 5,000 crore in June 2016 to around Rs 20,000 crore at present. The fund has consistently outperformed its benchmark, the Nifty 200 – TRI index, over longer time periods of three-years and five-years, to the extent of 5-6 percentage points. In these timeframes, the fund has also fared better than many of its popular category peers.

Kotak Standard Multicap Fund has shown fair level of stability. Its standard deviation of 12.79% signifies that the funds volatility has been lower than the benchmark (13.11%), while its Risk Adjusted Return (Sharpe Ratio) of 0.15 is one of the highest in the category, and much ahead of its benchmark. The funds superior risk management strategies and ability to timely switch its focus to defensives has helped it tide uncertain market phases well.

Investment Strategy of Kotak Standard Multicap Fund

Launched with a mandate to follow focused investment strategy, Kotak Select Focus Fund has been renamed as Kotak Standard Multicap Fund and classified under multi-cap funds category. The newly defined multi-cap mandate still allows the fund to continue with its strategy of focusing on selected sectors, while holding exposure across market caps with a large cap bias.

Kotak Standard Multicap Fund follows a combination of top down and bottom up approach to stock picking. It focuses on select sectors that the fund manager believes will perform better in the economy, and applies bottom up approach to pick stocks within selected sectors. The funds core portfolio comprises of 5-6 sectors together totaling to around 60-70% of its assets. Even though it follows a focused approach towards few selected sectors, it tries to ensure that the top 10 stocks does not breach the 40% mark.

Kotak Standard Multicap Fund - Portfolio Allocation and Market Capitalisation Trends

Holdings (in %) as on June 30, 2018

(Source: ACEMF)

Despite following a multicap strategy, the funds portfolio has remained biased towards large caps, that account for atleast 70% of its assets. Over the past year or so, the market cap allocation in the funds portfolio has remained almost steady. The exposure to large-caps has remained around 75% to 80% of its assets, while mid and small caps have well been below the 20% mark. Although the fund has been classfied as multi-cap fund, it cannot be termed as a true to its style multicap fund. Over the last 6-8 months the fund has remained heavy weight on large caps, compared to a typical multicap fund.

Kotak Standard Multicap Fund – Top Portfolio Holdings

Top 10 Stocks

| Stocks |

% of Assets |

| HDFC Bank Ltd. |

7.66 |

| Reliance Industries Ltd. |

4.90 |

| Larsen & Toubro Ltd. |

4.89 |

| HDFC Ltd. |

4.72 |

| Infosys Ltd. |

4.28 |

| ICICI Bank Ltd. |

3.47 |

| Hero MotoCorp Ltd. |

2.89 |

| RBL Bank Ltd. |

2.79 |

| State Bank Of India |

2.68 |

| Maruti Suzuki India Ltd. |

2.67 |

|

Top 5 Sectors

|

| Holdings (in %) as on June 30, 2018 (Source: ACEMF) |

Kotak Standard Multicap Fund holds a well-diversified portfolio of around 50 to 60 stocks. As on June 30, 2018, the fund held 57 stocks in its portfolio, with top 10 stocks together accounting to about 41% of its assets. Typical large cap names like HDFC Bank, Reliance Industries, L&T, HDFC Ltd., Infosys, ICICI Bank etc. have been among the core holdings in the fund’s portfolio. While creating the portfolio, the fund manager limits his picks to not more than 5-6 stocks from a single industry. He also makes active use of derivatives to take position in few stocks at a discount.

Around one-third of the fund’s portfolio is allocated to stocks in the Banking and Financial sector, followed by Auto, Consumption and Engineering. The top 5 sectors together account for around 58% of its assets. I.T., Cement, Petroleum and Oil & Gas are among the other core sectors in the fund’s portfolio with an allocation of about 5-6% each. While the fund remains heavyweight on cyclicals to ride the market boom and rallies, it also makes well use of defensives during extreme market conditions.

Major Gainers: Stocks like Avenue Supermarts, Bajaj Finance and Bata India have contributed to the fund’s outperformance in the last one year, gaining over 60-80%. Other stocks in the funds portfolio like Bajaj Finserv, Reliance Industries, Infosys, Solar Industries, Whirlpool India, Ashok Leyland and IndusInd Bank have appreciated over 30% in value, in a year's time.

Major Losers: Among the list of losers, the fund held Kirloskar Oil Engines, Techno Electric & Engineering Co., Cadila Healthcare, The Federal Bank and Bharat Electronics, that lost about 25-35% in value. Nevertheless, the exposures to these stocks have been less than 2% of its assets.

Suitability of Kotak Standard Multicap Fund

Multi cap funds should ideally offer the benefit of diversification across market caps. In the absence of any limit on market cap segment, Kotak Standard Multicap Fund can easily continue with its large cap orientation. However, the new classification offers it the flexibility to switch its allocation across market caps, without any limit or restriction.

The extra-ordinary performance of the fund has been driven by its smart sector and stock selection strategy. However, its heavyweight position towards few selected sectors may even result in short term underperformance, if any of its core sectors remains temporarily out of favour. While it is quite easier to switch sector focus with a small size, the larger size of the fund may become a hurdle in switching focus instantly across sectors. Although the fund has shown extra-ordinary performance in the past, investors need to keep a realistic return expectation from the fund.

While Kotak Standard Multicap Fund has turned out to be a rewarding proposition for investors, it is necessary to understand your risk appetite while investing in equity mutual funds and have a decent time horizon in mind. Selecting best mutual funds is not everyone's cup of tea. It needs a sheer focus and much detailed analysis across both quantitative and qualitative parameters.

PersonalFN's SMART score matrix has been designed to evaluate mutual funds on host of such quantitative as well as qualitative parameters.

The SMART Score Matrix

| S |

Systems and Processes |

| M |

Market Cycle Performance |

| A |

Asset Management Style |

| R |

Risk-Reward Ratios |

| T |

Performance Track Record |

All the parameters listed above are crucial to test and identify solid mutual funds that have the potential to reward investors in the long run. Using this 5 point evaluation matrix, PersonalFN has successfully guided investors in selecting right mutual funds with a solid growth potential.

Note: This write up is for information purpose and not a recommendation to buy or sell the mutual fund scheme. As an investor, you need to pick the right fund to meet your financial goals. If you are not sure about your risk appetite, do consult your financial planner or investment advisor.

DISCLOSURE AS PER SECURITIES AND EXCHANGE BOARD OF INDIA (RESEARCH ANALYSTS) REGULATIONS, 2014

About the Company including business activity

Quantum Information Services Private Limited (QIS) was incorporated on December 19, 1989.

QIS was promoted by Mr. Ajit Dayal with an objective of providing value-based information / views on news related to equity markets, the economy in general, sector analysis, budget review and various personal products and investments options available to the Public. It was the first company to start equity research on an institutional level.

'PersonalFN' is a service brand of QIS and was started in the year 1999. In 1999, the Company registered the Domain name www.personalfn.com for providing information on mutual funds and personal financial planning, financial markets in general, etc and services related to financial planning and research in various financial instruments including mutual funds, insurance and fixed income products to customers. It offers asset allocation and researched investment recommendations through its financial planning services.

Quantum Information Services Private Limited (QIS) is registered as Investment Adviser under SEBI (Investment Adviser) Regulations, 2013 and having Registration No.: INA000000680. In terms of second proviso to Regulation 3 (1) of SEBI (Research Analysts) Regulations, 2014 the Company is not required to obtain Certificate of registration from SEBI.

Disciplinary history

There are no outstanding litigations against the Company, it subsidiaries and its Directors.

and condition on which its offer research report. For the terms and condition for research report click here.

Details of associates

- Money Simplified Services Private Limited;

- PersonalFN Insurance Services India Private Limited;

- Equitymaster Agora Research Private Limited;

- Common Sense Living Private Limited;

- Quantum Advisors Private Limited;

- Quantum Asset Management Company Private Limited;

- HelpYourNGO Private Limited;

- HelpYourNGO Foundation;

- Natural Streets for Performing Arts Foundation;

- Primary Real Estate Advisors Private Limited;

- Rahul Goel;

- I V Subramaniam.

Disclosure with regard to ownership and material conflicts of interest

- Neither QIS, it’s Associates, Research Analyst or his/her relative have any financial interest in the subject Company , except QIS receives fees for providing research to Quantum Equity Fund of Fund (QEFoF) which is Fund of Fund scheme managed by QMF.

- Neither QIS, it's Associates, Research Analyst or his/her relative have actual/beneficial ownership of one per cent or more securities of the subject Company, at the end of the month immediately preceding the date of publication of the research report.

- Neither QIS, it's Associates, Research Analyst or his/her relative has any other material conflict of interest at the time of publication of the research report except that QIS (PersonalFN) is, as per SEBI (Mutual Funds) Regulations 1996, an associate / group Company of Quantum Asset Management Company Private Limited and Trustees and Sponsor of Quantum Mutual Fund (QMF) and to that extent there may be conflict of interest while recommending any schemes of QMF. However any such recommendation or reference made is based on the standard evaluation and selection process, which applies uniformly for all Mutual Fund Schemes. The payment of commission (upfront /annualized & trail), if any, for any Schemes by QMF to QIS (PersonalFN) is also at arm's length and as per prevailing market practices

Disclosure with regard to receipt of Compensation

- Neither QIS nor it's Associates have any compensation from the subject Company in the past twelve months.

- Neither QIS nor it's Associates have managed or co-managed public offering of securities for the subject Company in the past twelve months.

- Neither QIS nor it's Associates have received any compensation for investment banking or merchant banking or brokerage services from the subject Company in the past twelve months.

- Neither QIS nor it’s Associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months except from Axis Bank Limited under a service agreement.

- Neither QIS nor it's Associates have received any compensation or other benefits from the subject Company or third party in connection with the research report

General disclosure

- The Research Analyst has not served as an officer, director or employee of the subject Company.

- QIS or the Research Analyst has not been engaged in market making activity for the subject Company.

Subject Company means Mutual Fund Schemes

Quantum Information Services Private Limited CIN: U65990MH1989PTC054667 Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021 Corp. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021. Email: info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013

Add Comments