Although Tata Mutual Fund has Index funds tracking S&P BSE Sensex and the Nifty 50 Index, it has now launched its first Exchange Traded Fund (ETF). “Tata Nifty Exchange Traded Fund” is a passively managed open-ended ETF that will track the performance of Nifty 50 Index.

This exchange traded fund or ETF will comprise of stocks that replicates the composition of its benchmark, the Nifty 50 index. ETF provides an opportunity to invest across the entire market cap on a real-time basis at lower costs, hence globally they are popular. The key benefit of an ETF over traditional open-ended index funds is liquidity and availability of real-time market price on stock exchange. They can be bought and sold on the exchange at prices that are usually close to the indicative intra-day Net Asset Value (NAV) of the Scheme.

The Nifty 50 Index is the flagship index of the National Stock Exchange (NSE) comprising of 50 stocks. The Nifty 50 represents approximately about 65% of the total float-adjusted market capitalization and is a true reflection of the Indian stock market. It tracks the behaviour of a portfolio consisting primarily of blue-chip companies, the largest and most liquid Indian securities.

Tata Nifty Exchange Traded Fund (TNETF) is suitable for those investors who wish to hold a diversified portfolio of well-known companies as represented by Nifty 50 Index and do not mind doing it vide a passively managed fund.

However, given that the Nifty 50 index is a purely equity-based index, only investors who have the stomach for high risk and an investment time horizon of at least 5 years, should consider TNETF.

[Read: Why Comparing Returns to Risk Is More Meaningful!]

Table 1: NFO Details

| Type |

Open-ended - Equity |

Category |

Exchange Traded Fund |

| Investment Objective |

To provide returns that closely corresponds to the total returns of the securities as represented by the Nifty 50 index, subject to tracking error.

However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. |

| Min. Investment |

Rs 5,000 and in multiples of Re 1 thereafter |

Face Value |

Rs 10 per unit |

| Entry Load |

Nil |

Exit Load |

Nil |

| Fund Manager |

Mr Sailesh Jain |

Benchmark Index |

Nifty 50 (Total Return Index) |

| Issue Opens |

December 17, 2018 |

Issue Closes |

December 31, 2018 |

(Source: Scheme Information Document)

How will the scheme allocate its assets?

Under normal circumstances, it is anticipated that the asset allocation of the Tata Nifty ETF will be as follows:

Table 2: TNETF ’s Asset Allocation

| Instruments |

Indicative Allocation (% of Total Assets) |

Risk Profile |

| Minimum |

Maximum |

High/Medium/Low |

| Equity and Equity related instruments covered by Nifty 50 index* |

95 |

100 |

High |

| Money Market Instruments including CBLO or any other instrument as may be permitted by SEBI and units of liquid scheme of Tata Mutual Fund |

0 |

5 |

Low |

* Exposure to equity derivatives of the index itself or its constituent stocks may be undertaken when equity shares are unavailable, insufficient or for rebalancing in case of corporate actions for a temporary period. The cumulative gross exposure through equity, debt and derivative positions shall not exceed 100% of the net assets of the scheme.

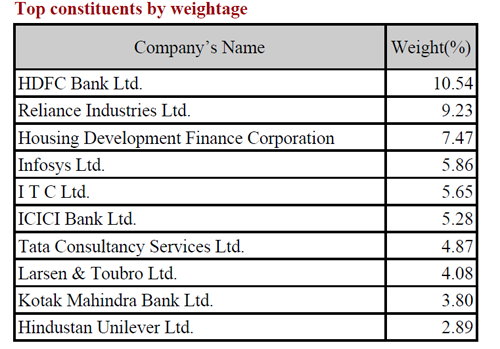

The net assets of the scheme will be invested predominantly in stocks constituting the Nifty 50. This would be done by investing in all the stocks comprising the Nifty 50 in approximately the same weightage that they represent in the Nifty 50. The scheme may take exposure through derivative transactions in the manner and up to the limit as may be specified by SEBI from time to time. A small portion of the net assets will be invested in money market instruments permitted by SEBI / RBI to meet the liquidity requirements of the Scheme.

(Source: Scheme Information Document)

What Investment Strategy will the Scheme follow?

Tata Nifty Exchange Traded Fund is a passively managed exchange traded fund which will employ an investment approach designed to track the performance of Nifty 50 Index. The Scheme seeks to achieve this goal by investing in securities constituting the Nifty 50 Index in same proportion as in the Index.

The Scheme will invest at least 95% of its total assets in the securities comprising the Underlying Index (i.e. the Nifty 50 Index). The Scheme may also invest in money market instruments to meet the liquidity and expense requirements.

The AMC would monitor the tracking error (a measure of the difference in returns from the Scheme and the returns from the index) of the Scheme on an on-going basis and would seek to minimize tracking error to the maximum extent possible. Under normal market circumstances, such tracking error is not expected to exceed the range of 2%-3% p.a.

Further, subject to SEBI (Mutual Fund) Regulations, 1996, the Scheme may use techniques and instruments such as trading in derivative instruments to hedge the risk of fluctuations in the value of the investment portfolio. In accordance with the guidelines issued by the SEBI, exposure to derivative instruments will be restricted to the limit as specified in the para on asset allocation pattern of the scheme.

Who will manage the Tata Nifty ETF?

Tata Nifty ETF will be managed by Mr Sailesh Jain. Mr Jain has to his credit an MBA in Finance and a total experience of 15 years.

Before joining Tata Mutual Fund in November 2018, he served as Head Derivatives – Institutional sales at with IDFC Securities Ltd. Prior to that was Vice President of Institutional Sales – Derivatives and cash at Quant Broking Pvt Ltd, and earlier as Vice President of Institutional Sales-Head Equity Derivatives at India Infoline.

At the fund house he manages Tata Digital India Fund, Tata Equity Savings Fund (Equity Portfolio), Tata India Pharma and Healthcare Fund and Tata Resources and Energy Fund and Tata Arbitrage Fund.

What is the outlook for Tata Nifty ETF?

Tata Nifty ETF aims to capture long-term returns generated through passive management by replicating Nifty Next 50 index. Hence the performance of TNETF closes on how the underlying index performs, while there would not be any active management involved.

Table 3: Can they create wealth for you?

(Source: Nifty 50 Index fact sheet)

A sell-off in the global equity markets amid mounting concern over global economic growth in the coming year is making investors jittery worldwide.

Besides, there are other domestic macroeconomic factors in play as well: GDP growth losing momentum; farmer distress; unemployment; possibility of inflation ticking up again; vulnerable rupee; tax evasion plus revision in GST rates hurting tax collections; possible fiscal slippages, and so on.

Further, on the domestic front, upcoming Lok Sabha elections in a few months from now, would keep foreign investors on the side-line and volatility will be obvious. So, there the Indian equity market is likely to hit turbulence and the journey of wealth creation in the near-term would not be smooth.

[Read: Skip NFOs, Instead Consider Building A Strategic Mutual Fund Portfolio]

To read PersonalFN’s view click here

Editor’s Note:

If you wish to build a SOILD mutual fund portfolio, try PersonalFN’s premium mutual fund research service: FundSelect.

PersonalFN’s FundSelect is currently celebrating 15 years of wealth creation for mutual fund investors. Unlock FundSelect anniversary offer here!

PersonalFN's FundSelect has proved to be a time-tested way to beat the market by as much as 70%!

Once you subscribe to FundSelect, you will get instant access to potentially the best equity and debt mutual fund to invest and even recommendations on the ones to ‘Hold’ and ‘Sell’.

Be PersonalFN's FundSelect subscriber today!

DISCLOSURE AS PER SECURITIES AND EXCHANGE BOARD OF INDIA (RESEARCH ANALYSTS) REGULATIONS, 2014

About the Company including business activity

Quantum Information Services Private Limited (QIS) was incorporated on December 19, 1989.

QIS was promoted by Mr. Ajit Dayal with an objective of providing value-based information / views on news related to equity markets, the economy in general, sector analysis, budget review and various personal products and investments options available to the Public. It was the first company to start equity research on an institutional level.

'PersonalFN' is a service brand of QIS and was started in the year 1999. In 1999, the Company registered the Domain name www.personalfn.com for providing information on mutual funds and personal financial planning, financial markets in general, etc. and services related to financial planning and research in various financial instruments including mutual funds, insurance and fixed income products to customers. It offers asset allocation and researched investment recommendations through its financial planning services.

Quantum Information Services Private Limited (QIS) is registered as Investment Adviser under SEBI (Investment Adviser) Regulations, 2013 and having Registration No.: INA000000680. In terms of second proviso to Regulation 3 (1) of SEBI (Research Analysts) Regulations, 2014 the Company is not required to obtain Certificate of registration from SEBI.

Disciplinary history

There are no outstanding litigations against the Company, it subsidiaries and its Directors.

Terms and condition on which its offer research report

For the terms and condition for research report click here.

Details of associates

-

Money Simplified Services Private Limited;

-

PersonalFN Insurance Services India Private Limited ;

-

Equitymaster Agora Research Private Limited;

-

Common Sense Living Private Limited;

-

Quantum Advisors Private Limited;

-

Quantum Asset Management Company Private Limited;

-

HelpYourNGO.com India Private Limited;

-

HelpYourNGO Foundation;

-

Natural Streets for Performing Arts Foundation;

-

Primary Real Estate Advisors Private Limited;

-

HYNGO India Private Limited;

-

Rahul Goel;

-

I V Subramaniam.

Disclosure with regard to ownership and material conflicts of interest

-

‘subject company’ is a company on which a buy/sell/hold view or target price is given/changed in this Research Report;

-

Neither QIS, it's Associates, Research Analyst or his/her relative have any financial interest in the subject Company;

-

Neither QIS, it's Associates, Research Analyst or his/her relative have actual/beneficial ownership of one per cent or more securities of the subject Company, at the end of the month immediately preceding the date of publication of the research report;

-

Neither QIS, it's Associates, Research Analyst or his/her relative has any other material conflict of interest at the time of publication of the research report except that QIS (PersonalFN) is, as per SEBI (Mutual Funds) Regulations 1996, an associate / group Company of Quantum Asset Management Company Private Limited and Trustees and Sponsor of Quantum Mutual Fund (QMF) and to that extent there may be conflict of interest while recommending any schemes of QMF. However, any such recommendation or reference made is based on the standard evaluation and selection process, which applies uniformly for all Mutual Fund Schemes. The payment of commission (upfront / annualized & trail), if any, for any Schemes by QMF to QIS (PersonalFN) is also at arm's length and as per prevailing market practices.

Disclosure with regard to receipt of Compensation

-

Neither QIS nor it's Associates have received any compensation from the subject Company in the past twelve months;

-

Neither QIS nor it's Associates have managed or co-managed public offering of securities for the subject Company;

-

Neither QIS nor it's Associates have received any compensation for investment banking or merchant banking or brokerage services from the subject Company;

-

Neither QIS nor it's Associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

-

Neither QIS nor it's Associates have received any compensation or other benefits from the subject Company or third party in connection with the research report

General disclosure

-

The Research Analyst has not served as an officer, director or employee of the subject Company.

-

QIS or the Research Analyst has not been engaged in market making activity for the subject Company.

Definitions of Terms Used

-

Buy recommendation: This means that the subscriber could consider buying the concerned fund keeping in mind the tenure and objective of the recommendation service.

-

Hold recommendation: This means that the subscriber could consider holding on to the fund until further update. However, additional purchase via ongoing SIP can be considered.

-

Sell recommendation: This means that the subscriber could consider selling the fund keeping in mind the objective of the recommendation service.

Click here to read PersonalFN’s Mutual Fund Rating Methodology

Quantum Information Services Private Limited CIN: U65990MH1989PTC054667 Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021 Corp. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021. Email: info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013

Add Comments