2018 was quite an eventful year for the Indian Mutual Fund Industry, as well as for mutual fund investors.

Apart from the implementation of SEBI categorization and rationalization norms, the regulator SEBI also mandated mutual funds to benchmark the performance of their schemes against suitable Total Return Indices (TRI).

Moreover, it also tried to bring more transparency in terms of expenses charged by the schemes, as well as imposed a ban on the upfront commissions paid to the distributors.

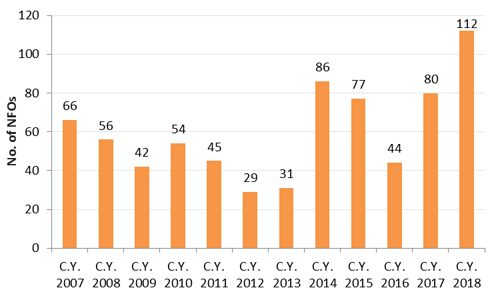

While the regulator took a number of decisions to make mutual fund investing more investor-friendly and affordable, there was one event that was probably unnoticed by many investors – The number of NFOs launched by mutual funds this year.

637 schemes in 12 months (53 schemes on an average a month)

That's the pace at which mutual fund houses launched new schemes in 2018. Quite a busy year for the product team and financial innovators at the fund houses, right?

Even if you excluded the FMPs, Interval Funds, Capital Protection Funds, and Close-ended Balanced Hybrid Funds from the list, there were 112 schemes launched by mutual funds this year.

Here is the break-up: 80 Equity Funds, 9 Hybrid Funds, 2 Fund of Funds, 14 Debt Funds, and 7 Liquid / Overnight Funds.

Well this has been the highest number of launches I have seen in many years.

Chart 1: Number of NFO's launched by mutual funds houses

(Excluding FMPs, Interval Funds, Capital Protection Funds and Close-ended Balanced Hybrid Funds)

(Source: ACEMF, PersonalFN Research)

Are mutual fund houses fair in launching NFOs? Or is it the new AUM garnering machine?

It is noteworthy that the SEBI's objective behind categorization and rationalization was to eliminate unwanted schemes and avoid duplication of schemes, in order to make the fund selection easier for investors.

But is it happening?

The pace at which the mutual fund houses launched new funds this year raises serious concern, if they are really helping the regulator meet its objective. In fact, post categorization many fund houses have found an opportunity to fill the category in which they did not have a scheme.

While SEBI has put a restriction on having duplicate open-ended type of schemes by a fund house, there is no such restriction on the close-ended schemes. In fact, many fund houses seem to have made close-ended schemes a way to garner more AUM.

For e.g., ICICI Pru Mutual Fund launched five schemes under its Bharat Consumption Funds series, Kotak Mutual Fund launched three NFOs under the Growth Fund series, Sundaram Mutual Fund launched seven close ended Small Cap Funds, two close ended Multicap Funds, and three close ended – Tax Saving Funds.

Well, there are many other fund houses that launched multiple close ended schemes of similar category and style.

Table 1: NFO Scorecard of Mutual Fund Houses – In terms of number of schemes launched in 2018

| Fund House |

No of Schemes |

Category |

No. of Schemes |

AUM (First Portfolio)(Cr.) |

Total Corpus |

| ICICI Pru Mutual Fund |

87 |

Balanced Hybrid Funds |

1 |

35.53 |

29,575.33 |

| Capital Protection Funds |

2 |

-- |

| ETFs |

3 |

11,866.52 |

| Fixed Maturity Plans |

69 |

11,323.79 |

| FoFs (Domestic) |

1 |

26.79 |

| Liquid Funds |

1 |

8.16 |

| Mid Cap Funds |

1 |

-- |

| Overnight Funds |

1 |

1,552.08 |

| Sector Funds |

6 |

2,973.50 |

| Thematic Funds |

1 |

1,271.76 |

| Value Funds |

1 |

517.20 |

| Aditya Birla Mutual Fund |

81 |

ETFs |

1 |

-- |

12,146.40 |

| Fixed Maturity Plans |

77 |

9,992.69 |

| Multi Cap Funds |

2 |

754.05 |

| Overnight Funds |

1 |

1,399.65 |

| Reliance Mutual Fund |

69 |

Debt -Interval Funds |

2 |

61.49 |

9,915.18 |

| ETFs |

1 |

-- |

| Fixed Maturity Plans |

63 |

9,051.70 |

| Long Duration |

1 |

192.81 |

| Mid Cap Funds |

1 |

609.19 |

| Overnight Funds |

1 |

-- |

| UTI Mutual Fund |

49 |

Capital Protection Funds |

2 |

25.95 |

6,191.97 |

| Corporate Bond |

1 |

202.28 |

| Equity Savings Fund |

1 |

332.80 |

| Fixed Maturity Plans |

42 |

4,858.92 |

| Floating Rate |

1 |

246.57 |

| Focused Funds |

1 |

311.77 |

| Index Funds |

1 |

213.68 |

| Kotak Mutual Fund |

46 |

Debt -Interval Funds |

2 |

145.82 |

10,675.33 |

| Dynamic Asset Allocation |

1 |

2,053.31 |

| Fixed Maturity Plans |

40 |

7,645.69 |

| Multi Cap Funds |

3 |

830.51 |

| HDFC Mutual Fund |

43 |

Fixed Maturity Plans |

42 |

9,253.99 |

10,545.53 |

| Ultra Short Duration |

1 |

1,291.54 |

| DSP Mutual Fund |

35 |

Arbitrage Funds |

1 |

216.96 |

5,010.77 |

| Corporate Bond |

1 |

77.32 |

| Fixed Maturity Plans |

29 |

4,599.51 |

| Index Funds |

1 |

-- |

| Liquid Funds |

1 |

39.94 |

| Multi Cap Funds |

1 |

77.04 |

| Sector Funds |

1 |

-- |

| SBI Mutual Fund |

34 |

Balanced Hybrid Funds |

5 |

4,901.14 |

12,342.76 |

| Tax Saving Fund - ELSS |

1 |

216.34 |

| ETFs |

2 |

10.70 |

| Fixed Maturity Plans |

26 |

7,214.59 |

| IDFC Mutual Fund |

26 |

Fixed Maturity Plans |

23 |

2,129.60 |

3,409.40 |

| Multi Cap Funds |

2 |

711.99 |

| Ultra Short Duration |

1 |

567.81 |

| Tata Mutual Fund |

26 |

Arbitrage Funds |

1 |

-- |

3,795.64 |

| ETFs |

1 |

-- |

| Fixed Maturity Plans |

20 |

1,230.57 |

| Multi Cap Funds |

1 |

1,301.95 |

| Small Cap Funds |

1 |

201.08 |

| Value Funds |

2 |

1,062.04 |

| Sundaram Mutual Fund |

25 |

Tax Saving Fund - ELSS |

3 |

29.38 |

2,485.60 |

| Equity Savings Fund |

1 |

-- |

| Fixed Maturity Plans |

10 |

368.01 |

| Money Market |

1 |

139.79 |

| Multi Cap Funds |

2 |

136.20 |

| Sector Funds |

1 |

1,036.61 |

| Small Cap Funds |

7 |

775.61 |

|

|

|

|

|

|

| Industry Total |

637 |

-- |

637 |

1,23,585.16 |

1,23,585.16 |

(Source: ACEMF, PersonalFN Research)

Surprisingly, mutual funds garnered about Rs 1,25,000 crore through NFOs in 2018. That too at a time when many of their existing schemes have been struggling to generate alpha over their benchmark.

Instead of trying to improve the performance of existing funds, many fund houses were busy launching new funds. Aren't they confident enough to attract investors through the track record of their existing schemes, instead of trying to sell on the novelty factor?

While it is not wrong to come up with NFOs (if it's a unique proposition), what worries me is that many new funds have been assigned to the fund managers who are already managing 5-7 schemes or even more.

I do not think it is right to burden the fund manager/s more when they are already under pressure to improve the performance of his/her existing schemes. Naturally, the fund manager may lose focus on existing ones and may even lack the capacity to manage them efficiently. Not in the best interest of investors, in my opinion.

I just hope AMCs are not under pressure to garner more AUM just for the sake of increasing their revenues, so that the salaries and incentives of their CEOs and top executives can be justified.

Hope the New Year 2019, makes the fund house more responsible. Instead of being in the race to garner more AUM, they should pass some resolution of focusing on improving performance, which will be in the best interest of investors.

Let us see what measures the regulator takes to apply the brakes on the NFO machines. Probably it should be strict and define a limit to the number of schemes a fund house can launch in a year.

While there is already a plethora of funds for one to choose from, picking the right one may be difficult for you. That is where PersonalFN's unbiased research backed by comprehensive rating methodology can help you select winning mutual fund schemes to meet your goals.

PS: PersonalFN's exclusive report 5 Undiscovered Equity Funds may help you pick some hidden gems that are capable of generating big gains over the next 3-5 years.

These 5 high potential funds, recommended in the report, have passed through a stringent scheme selection criteria set by PersonalFN, and can be considered for investing in current market conditions.

Add Comments