The recent correction in equity markets have made fund houses believe that investing in equities during this time can help generate decent returns in the long term, especially the mid and small caps. Since the stocks in this segment have significantly moved towards fair valuations, few fund houses have been proactive in launching small-cap funds. After the launch of Tata Small-cap Fund and Invesco India Small-cap Fund, BOI AXA Small-cap Fund is another fund to join the bandwagon of the recently launched funds that will invest primarily in stocks of companies falling under the small-cap category.

BOI AXA Small-cap Fund is the new offering from BOI AXA Mutual Fund. It is an open-ended equity scheme mandated to invest in companies that fall under the small-cap category. As per SEBI’s definition, Small-cap equity funds should invest at least 65% of their assets in stocks of small-cap companies. SEBI has classified small-cap companies as those that fall beyond the 250th stock in terms of full market capitalization.

While small-cap companies do have the potential of a multi-bagger, they exhibit a pattern to move from steep high to dangerously low. Thus, the risk associated with a small-cap fund is probably bigger than any other category of funds. BASCF, is extremely a high-risk high-return investment proposition, suitable only for investors having very high-risk appetite and longer investment time horizon.

[Read: Why Comparing Returns to Risk Is More Meaningful!]

Table1: NFO Details of BASCF

| Type |

An open-ended equity scheme predominantly investing in small-cap stocks |

Category |

Small Cap Fund |

| Investment Objective |

To generate long-term capital appreciation by investing predominantly in equity and equity-related securities of small cap companies. However, there can be no assurance that the investment objectives of the Scheme will be realized. |

| Min Investment |

Rs 5,000 and in multiples of Re 1 thereafter |

Face Value |

Rs 10 per unit |

| Plans |

• Direct

• Regular |

Options |

•Growth

•Dividend (Reinvestment & Payout) |

| Entry Load |

Not Applicable |

Exit Load |

It is 1% if redeemed within 1 year from the date of allotment. |

| Fund Manager |

Mr Saurabh Kataria and Mr Ajay Khandelwal |

Benchmark Index |

Nifty Small-cap 100 Total Return Index |

| Issue Opens |

November 28, 2018 |

Issue Closes: |

December 12, 2018 |

(Source: Scheme Information Document)

How will BOI AXA Small Cap Fund allocate its assets?

Under normal circumstances, the scheme will allocate its assets as follows:

Instruments |

Indicative allocation

(% of Net Assets)

(Minimum-Maximum) |

Risk Profile (High/ Medium/ Low) |

| Equity and Equity related instruments of Small Cap Companies |

65% to 100% |

High |

| Equity and Equity related instruments of Companies other than Small Cap Companies |

0 to 35% |

High |

| Debt and Money Market instruments |

0 to 35% |

Low to Medium |

| Units issued by REITs and InvITs |

0 to 10% |

Medium to High |

(Source: Scheme Information Document)

Therefore, within the prescribed limit the BOI AXA Small-cap Fund will allocate its assets predominately in equity and equity related instruments of small-cap stocks. The scheme may even invest up to 35% of its assets in equity and equity related instruments of companies other than small-cap companies. For the risk-management purpose, the fund may also choose to allocate some portion of its assets into debt and money market instruments and units of REITs and InvITs.

[ Read: Why You Should Not Ignore Personalized Asset Allocation While Investing]

What will be the Investment Strategy?

To achieve its objective of generating long-term capital appreciation by investing predominantly in equity and equity-related securities of small cap companies, BASCF would follow an active fund management approach allowing it the flexibility to pursue opportunities having an unbiased approach of sectoral allocations. The investment environment, valuation parameters and other investment criteria will be the factors to determine the above-mentioned asset allocation and investment style

Equity Investment Strategy:

As per the scheme information document, under normal market conditions, the Fund Managers would invest the scheme’s assets across stocks that represent a broad range of sectors of the economy, in order to ensure adequate portfolio diversification.

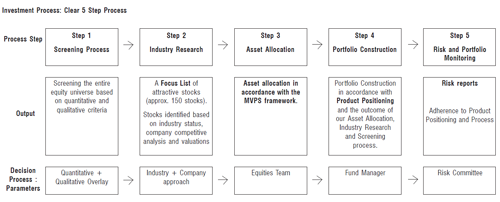

The fund managers would follow a top-down approach to shortlist stocks for portfolio construction in line with the process outlined below. Under this process, the Fund Manager would look at the global and Indian economy, the domestic policy environment and stock valuations. This would help in identification of themes which have a potential to outperform.

For the final stock selection process, the fund manager would follow a bottoms-up process wherein stocks from the short-listed themes would be picked up based on valuations.

For asset allocation, the Fund Manager would take the help of qualitative framework of MVPS (Macro, Valuation, Policy and Sentiment). Sentiment would be evaluated from factors like the positive/negative breadth of the market, inflows/outflows into equity mutual funds and FII buying/selling figures.

Diagram 1: 5-step Investment Process Explained

(Source: Scheme Information Document)

Who will manage BOI AXA Small Cap Fund?

BASCF will be managed by Mr Saurabh Kataria and Mr Ajay Khandelwal

Mr Saurabh Kataria is a fund manager – equity at BOI AXA Investment Managers Pvt. Ltd. He joined BOI AXA Investment Managers in August 2009 and has over 12 years of experience in equity markets. Mr Kataria has an Honorary Bachelor’s degree in Commerce with an MBA in finance to his credit. He has also been associated with organizations like Irevna Research Services Pvt. Ltd, Goldman Sachs India Private Ltd and Askar Capital Private Equity before joining BOI AXA Mutual Fund.

Some of the funds that he handles as the lead fund manager include BOI AXA Tax Advantage Fund, BOI AXA Capital Protection Oriented Fund Series 5, BOI AXA Mid Cap Tax Fund- Series 1 and BOI AXA Mid Cap Tax Fund- Series 2

Mr Ajay Khandelwal will be the lead co-fund manager overlooking the scheme’s investments. He holds a BE degree followed by MBA with a decade of experience in Equity Research. Prior to joining BOI AXA Mutual Fund, he worked with B&K Securities and Infosys.

At the fund house, he co-manages BOI AXA Small & Mid Cap Equity & Debt Fund and BOI AXA Arbitrage

The Outlook for BOI AXA Small Cap Fund:

The launch of BOI AXA small-cap fund coincides with the drastic fall in the mid and small cap segment. Amidst the market corrections, the fund managers see this as a vantage point to invest in small cap stocks.

The product note released by the fund house mentions following reasons behind investing in small caps:

-

Exhibit higher returns as they remain out of the spotlight until they attain a noteworthy size in terms of revenues and profits.

-

Inefficiencies in price discovery mean the potential for higher returns. Typically, lesser number of analysts track these companies, and the institutional ownership is lower vis-a-vis large caps.

While creating a portfolio of small cap stocks, the fund managers will follow qualitative and quantitative research of the 5-step investment process right from stock screening, to industry analysis, asset allocation, portfolio construction and risk management. Although the process looks robust, the fund house does not have a dedicated mid cap-oriented fund in its basket of open-ended funds, which could help judge its expertise in the mid and small cap space. Its mid and small cap oriented Aggressive hybrid fund is an underperformer and still to complete 3 years; while both its mid cap oriented close-ended tax saving funds are less than a year old to form any view.

Small caps are not everyone’s cup of tea. Only if you are willing to bear the high risk associated with small caps and have an investment time horizon of more than 5 years, should you consider investing in small cap funds. However, before that make sure you have fair exposure to Large and mid-caps.

To read PersonalFN’s view click here.

PS: Want to know which mutual fund schemes to SIP in, the ones worthy for your tax planning, and the lesser-known funds (called hidden gems) capable of generating big gains for you? PersonalFN brings to you an exclusive three-in-one combo offer. Click here to know more.

DISCLOSURE AS PER SECURITIES AND EXCHANGE BOARD OF INDIA (RESEARCH ANALYSTS) REGULATIONS, 2014

About the Company including business activity

Quantum Information Services Private Limited (QIS) was incorporated on December 19, 1989.

QIS was promoted by Mr. Ajit Dayal with an objective of providing value-based information / views on news related to equity markets, the economy in general, sector analysis, budget review and various personal products and investments options available to the Public. It was the first company to start equity research on an institutional level.

'PersonalFN' is a service brand of QIS and was started in the year 1999. In 1999, the Company registered the Domain name www.personalfn.com for providing information on mutual funds and personal financial planning, financial markets in general, etc. and services related to financial planning and research in various financial instruments including mutual funds, insurance and fixed income products to customers. It offers asset allocation and researched investment recommendations through its financial planning services.

Quantum Information Services Private Limited (QIS) is registered as Investment Adviser under SEBI (Investment Adviser) Regulations, 2013 and having Registration No.: INA000000680. In terms of second proviso to Regulation 3 (1) of SEBI (Research Analysts) Regulations, 2014 the Company is not required to obtain Certificate of registration from SEBI.

Disciplinary history

There are no outstanding litigations against the Company, it subsidiaries and its Directors.

Terms and condition on which its offer research report

For the terms and condition for research report click here.

Details of associates

-

Money Simplified Services Private Limited;

-

PersonalFN Insurance Services India Private Limited ;

-

Equitymaster Agora Research Private Limited;

-

Common Sense Living Private Limited;

-

Quantum Advisors Private Limited;

-

Quantum Asset Management Company Private Limited;

-

HelpYourNGO.com India Private Limited;

-

HelpYourNGO Foundation;

-

Natural Streets for Performing Arts Foundation;

-

Primary Real Estate Advisors Private Limited;

-

HYNGO India Private Limited;

-

Rahul Goel;

-

I V Subramaniam.

Disclosure with regard to ownership and material conflicts of interest

-

‘subject company’ is a company on which a buy/sell/hold view or target price is given/changed in this Research Report;

-

Neither QIS, it's Associates, Research Analyst or his/her relative have any financial interest in the subject Company;

-

Neither QIS, it's Associates, Research Analyst or his/her relative have actual/beneficial ownership of one per cent or more securities of the subject Company, at the end of the month immediately preceding the date of publication of the research report;

-

Neither QIS, it's Associates, Research Analyst or his/her relative has any other material conflict of interest at the time of publication of the research report except that QIS (PersonalFN) is, as per SEBI (Mutual Funds) Regulations 1996, an associate / group Company of Quantum Asset Management Company Private Limited and Trustees and Sponsor of Quantum Mutual Fund (QMF) and to that extent there may be conflict of interest while recommending any schemes of QMF. However, any such recommendation or reference made is based on the standard evaluation and selection process, which applies uniformly for all Mutual Fund Schemes. The payment of commission (upfront / annualized & trail), if any, for any Schemes by QMF to QIS (PersonalFN) is also at arm's length and as per prevailing market practices.

Disclosure with regard to receipt of Compensation

-

Neither QIS nor it's Associates have received any compensation from the subject Company in the past twelve months;

-

Neither QIS nor it's Associates have managed or co-managed public offering of securities for the subject Company;

-

Neither QIS nor it's Associates have received any compensation for investment banking or merchant banking or brokerage services from the subject Company;

-

Neither QIS nor it's Associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

-

Neither QIS nor it's Associates have received any compensation or other benefits from the subject Company or third party in connection with the research report

General disclosure

-

The Research Analyst has not served as an officer, director or employee of the subject Company.

-

QIS or the Research Analyst has not been engaged in market making activity for the subject Company.

Definitions of Terms Used

-

Buy recommendation: This means that the subscriber could consider buying the concerned fund keeping in mind the tenure and objective of the recommendation service.

-

Hold recommendation: This means that the subscriber could consider holding on to the fund until further update. However, additional purchase via ongoing SIP can be considered.

-

Sell recommendation: This means that the subscriber could consider selling the fund keeping in mind the objective of the recommendation service.

Click here to read PersonalFN’s Mutual Fund Rating Methodology

Quantum Information Services Private Limited CIN: U65990MH1989PTC054667 Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021 Corp. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021. Email: info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013

Add Comments