(Image source: pixabay.com)

(Image source: pixabay.com)

While both equity and debt markets have been going through extreme turbulence, many fund houses have sought balanced advantage funds as a resolute to combat this volatility and capitalise on the gains.

Tata Mutual fund is no different. It is out with a Tata Balanced Advantage Fund (TBAF) an open-ended balanced advantage / dynamic asset allocation fund that is a sub-category of hybrid funds.

The balanced advantage / dynamic asset allocation fund mitigates the risk by dynamically managing the allocation between equity and debt as per the prevailing market valuation and sentiment in each asset class. It aims to make optimum use of equity and debt to give the best of both worlds.

[Read: Why Comparing Returns to Risk Is More Meaningful!]

TBAF has the flexibility to vary its equity exposure between 0%-100%. But under normal circumstances it aims to allocate its assets between 65% to 100% in equities, equity related instruments and equity derivatives across market cap (including unhedged and hedged equity). Plus, it will have exposure to debt instruments to counter the downside risk in equity markets.

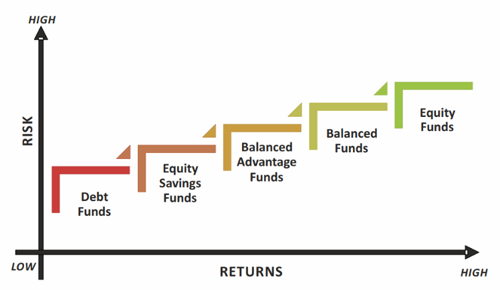

In terms of risk-return matrix, this scheme is placed at moderate-risk, moderate-return investment proposition.

Graph 1: Risk-Return Matrix

(Source: Tata Balanced Advantage Fund Brochure)

Table 1: NFO Details

| Type |

An open-ended dynamic equity scheme. |

Category |

Balanced Advantage |

| Investment Objective |

To provide capital appreciation and income distribution to the investors by using equity derivatives strategies, arbitrage opportunities and pure equity investments.

However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The scheme does not assure or guarantee any returns. |

| Min.Investment |

Rs 5,000 and in multiples of Re 1 thereafter |

Face Value |

Rs 10 per unit |

| Plans |

• Regular

• Direct |

Options |

• Growth (default option)

• Dividend

- Payout

- Re-investment (default)

|

| Entry Load |

Nil |

Exit Load |

1% of the applicable NAV, if redeemed on or before the expiry of 365 days from the date of allotment. |

| Fund Manager |

Mr Rahul Singh and Mr Sonam Udasi (Unhedged Equity), Mr Sailesh Jain (Hedged Equity) and Mr Akhil Mittal (Fixed Income) |

Benchmark Index |

CRISIL Hybrid 35+65 - Aggressive Index |

| Issue Opens |

9 January, 2019 |

Issue Closes: |

23 January, 2019 |

(Source: Scheme Information Document)

How will the scheme allocate its assets?

Under normal circumstances, it is anticipated that the asset allocation of TBAF will be as follows:

Table 2: TBAF's Asset Allocation

|

Instruments

|

Indicative allocations

(% of Total Assets) |

Risk Profile |

| Minimum |

Maximum |

| Equity and Equity related instruments and Equity Derivatives # |

65 |

100 |

High |

| Debt (including money market instruments, securitized debt & units of debt and liquid category schemes) & Cash |

0 |

35 |

Low to Medium |

# Unhedged equity exposure shall be limited to up to 80% of the portfolio value. Unhedged equity exposure means exposure to equity shares alone without a corresponding equity derivative exposure. The margin money requirement for the purposes of derivative exposure may be held in the form of Term Deposit.

Not more than 25% of the net assets of the scheme shall be deployed in securities lending. The Scheme would limit its exposure, with regards to securities lending, for a single intermediary, to the extent of 5% of the total net assets of the scheme at the time of lending. The Scheme does not seek to participate in repo/reverse repo in corporate debt securities. The Scheme does not seek to participate in credit default swaps.

(Source: Scheme Information Document)

What will be the Investment Strategy?

Tata Balanced Advantage Fund aims to generate medium to long term capital growth by investing in a diversified portfolio consisting of equity and equity related instruments across market capitalization. To achieve the investment objective of the Scheme the fund manager will invest into opportunities available across the market capitalization and would bank upon on the gains with active fund management.

As per the offer document, TBAF aims to invest in companies based on various criteria including sound professional management, track record, industry scenario, growth prospectus, the liquidity of the securities, etc. The Scheme will emphasize on well managed, good quality companies with above-average growth prospects. It will use derivatives to hedge the downside risk of the portfolio.

The derivatives may also be used for generating returns through arbitrage opportunities. The Scheme may take a call on the hedge ratio after weighing various factors including but not limited to, the following:

-

The earnings growth of the stock

-

The quantitative valuation parameters in the historical as well global context:

a. P/E Ratio

b. P/ BV Ratio

c. Price / Earnings Growth Ratio

d. Price / Free Cash Flow

e. Price / Cash EPS

-

Expected Fund Flow

-

Market Sentiment and outlook

TBAF will seek to reduce the volatility of returns by actively using derivatives as a hedge. The derivatives may also be used for generating returns through arbitrage opportunities. This may make the scheme forgo some upside but shall protect the downside.

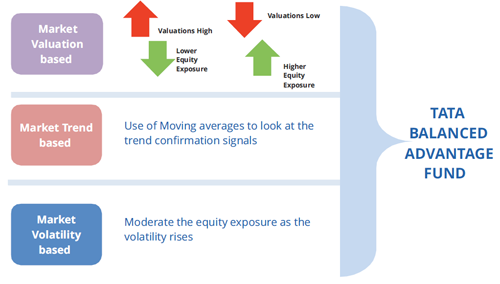

In short, TBAF implements a smart proprietary asset allocation model for allocating assets between equity and debt dynamically.

Figure 1: Asset Allocation Approach

(Source: Tata Balanced Advantage Fund Presentation)

The model permits 10% variation to the basic PE based equity allocation; driven by:

-

Correlation to select global markets related to the Indian equities

-

Implied volumes (to identify extremes – fear vs. complacency)

-

Momentum indicators (price-based indicators to avoid early entry/exits in a directional market)

Who will manage the Tata Balanced Advantage Fund?

Tata Balanced Advantage fund will be managed by Mr Rahul Singh, Mr Sonam Udasi, Mr Shailesh Jain and Mr Akhil Mittal.

Mr Rahul Singh is the lead fund manager to oversee the unhedged equity portfolio of the scheme at the fund house along with Mr Sonam Udasi. He holds a Bachelor's degree in Engineering (B.E.) and has a PGDM to his credit. He is Chief Investment Officer - Equities at Tata Asset Management Ltd. Prior to it, he has worked with Ampersand Capital Investment Advisors LLP as Managing Partner for 3 years. Besides that, for 5 years he worked as a Managing Director at Standard Chartered Securities Ltd and with Citigroup Global Markets for nearly 5 years as Senior Research Analyst reporting to Head of Research.

Mr Sonam Udasi will also be managing the unhedged equity portfolio of the scheme. He holds a bachelor's degree in commerce (B. Com) and has a PGDM. From April 2014 he has been associated with Tata Asset Management Ltd. He joined in as the Head of PMS to get promoted as the Head of Research and currently is a Fund Manager of schemes. Prior to that Mr, Sonam was a Head of Research at IDBI Capital Market Services Ltd. He has also served at BRICS Securities, Prime Securities and JM Financial AMC.

Currently at the Tata Mutual Fund , he manages Tata Equity P/E Fund, Tata Index Fund Sensex & Tata Index Fund-Nifty, Tata Banking & Financial Services Fund, Tata India Consumer Fund, Tata Retirement Savings Fund -Equity Portfolio of Progressive, Moderate & Conservative Plan, Tata Young Citizen Fund, Tata Multicap Fund, Tata Value Fund Series 1 & 2.

Mr Shailesh Jain will manage the hedged equity portfolio of the scheme. He has done his MBA in Finance and has been a part of Tata Asset Management Ltd since November 2018 as a fund manager. Preceding to it he has been with IDFC Securities Ltd., Quant Broking Pvt. Ltd. and IIFL (India Infoline).

Currently, at the fund house, he manages Tata Digital India Fund, Tata Equity Savings Fund (Equity Portfolio), Tata India Pharma and Healthcare Fund, Tata Resources and Energy Fund, Tata Arbitrage Fund, Tata Nifty Exchange Traded Fund.

Mr Akhil Mittal is a Senior Fund Manager manging the fixed income of the portfolio and is with the fund house since June 2014. Mr Mittal reports to Head-Fixed Income at Tata Asset Management Ltd. Prior to joining Tata Mutual Fund, he has worked as a Senior Fund Manager - Fixed Income at Canara Robeco Asset Management Ltd. Prior to that he was with Principal PNB Asset Management Co Ltd. and has also worked at Edelweiss Securities Ltd.

Currently at the Tata Mutual Fund , he manages Tata Treasury Advantage Fund, Tata Dynamic Bond Fund, Tata Income Fund, Tata Young Citizen Fund (Debt Portfolio) and various series of FMPs at Tata Mutual Fund.

Outlook for Tata Balanced Advantage Fund

Tata Balanced Advantage Fund aims to achieve the schemes' objective of capitalizing gains with reduced risk by following the asset allocation approach with its proprietary model. The fund managers would make use of hedged and unhedged equity and arbitrage to avoid any downside risks in the volatile markets. Hence the performance of the scheme weighs on portfolio and risk management strategies employed by the fund managers.

With dynamic allocation across asset class, TBAF is expected to be moderately volatile, while its returns too would be moderate. The effectiveness of the model the fund house plans to follow to dynamically allocate assets will be tested over complete market cycle. The fund deserves time to build a track record and prove its efficiency, for one to consider it as a strategic pick in the investment portfolio.

[Read: Skip NFOs, Instead Consider Building A Strategic Mutual Fund Portfolio]

PS: If you wish to take a calculated risk and invest in equity funds, PersonalFN can help you pick hidden gems or lesser-known funds that are capable of generating big gains for you.

PersonalFN has released a report 5 Undiscovered Equity Funds especially for investors like you.

These undiscovered funds can help you counter inflation by a substantial margin. Subscribe today!

DISCLOSURE AS PER SECURITIES AND EXCHANGE BOARD OF INDIA (RESEARCH ANALYSTS) REGULATIONS, 2014

About the Company including business activity

Quantum Information Services Private Limited (QIS) was incorporated on December 19, 1989.

QIS was promoted by Mr. Ajit Dayal with an objective of providing value-based information / views on news related to equity markets, the economy in general, sector analysis, budget review and various personal products and investments options available to the Public. It was the first company to start equity research on an institutional level.

'PersonalFN' is a service brand of QIS and was started in the year 1999. In 1999, the Company registered the Domain name www.personalfn.com for providing information on mutual funds and personal financial planning, financial markets in general, etc. and services related to financial planning and research in various financial instruments including mutual funds, insurance and fixed income products to customers. It offers asset allocation and researched investment recommendations through its financial planning services.

Quantum Information Services Private Limited (QIS) is registered as Investment Adviser under SEBI (Investment Adviser) Regulations, 2013 and having Registration No.: INA000000680. In terms of second proviso to Regulation 3 (1) of SEBI (Research Analysts) Regulations, 2014 the Company is not required to obtain Certificate of registration from SEBI.

Disciplinary history

There are no outstanding litigations against the Company, it subsidiaries and its Directors.

Terms and condition on which its offer research report

For the terms and condition for research report click here.

Details of associates

-

Money Simplified Services Private Limited;

-

PersonalFN Insurance Services India Private Limited ;

-

Equitymaster Agora Research Private Limited;

-

Common Sense Living Private Limited;

-

Quantum Advisors Private Limited;

-

Quantum Asset Management Company Private Limited;

-

HelpYourNGO.com India Private Limited;

-

HelpYourNGO Foundation;

-

Natural Streets for Performing Arts Foundation;

-

Primary Real Estate Advisors Private Limited;

-

HYNGO India Private Limited;

-

Rahul Goel;

-

I V Subramaniam.

Disclosure with regard to ownership and material conflicts of interest

-

‘subject company’ is a company on which a buy/sell/hold view or target price is given/changed in this Research Report;

-

Neither QIS, it's Associates, Research Analyst or his/her relative have any financial interest in the subject Company;

-

Neither QIS, it's Associates, Research Analyst or his/her relative have actual/beneficial ownership of one per cent or more securities of the subject Company, at the end of the month immediately preceding the date of publication of the research report;

-

Neither QIS, it's Associates, Research Analyst or his/her relative has any other material conflict of interest at the time of publication of the research report except that QIS (PersonalFN) is, as per SEBI (Mutual Funds) Regulations 1996, an associate / group Company of Quantum Asset Management Company Private Limited and Trustees and Sponsor of Quantum Mutual Fund (QMF) and to that extent there may be conflict of interest while recommending any schemes of QMF. However, any such recommendation or reference made is based on the standard evaluation and selection process, which applies uniformly for all Mutual Fund Schemes. The payment of commission (upfront / annualized & trail), if any, for any Schemes by QMF to QIS (PersonalFN) is also at arm's length and as per prevailing market practices.

Disclosure with regard to receipt of Compensation

-

Neither QIS nor it's Associates have received any compensation from the subject Company in the past twelve months;

-

Neither QIS nor it's Associates have managed or co-managed public offering of securities for the subject Company;

-

Neither QIS nor it's Associates have received any compensation for investment banking or merchant banking or brokerage services from the subject Company;

-

Neither QIS nor it's Associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

-

Neither QIS nor it's Associates have received any compensation or other benefits from the subject Company or third party in connection with the research report

General disclosure

-

The Research Analyst has not served as an officer, director or employee of the subject Company.

-

QIS or the Research Analyst has not been engaged in market making activity for the subject Company.

Definitions of Terms Used

-

Buy recommendation:This means that the subscriber could consider buying the concerned fund keeping in mind the tenure and objective of the recommendation service.

-

Hold recommendation:This means that the subscriber could consider holding on to the fund until further update. However, additional purchase via ongoing SIP can be considered.

-

Sell recommendation: This means that the subscriber could consider selling the fund keeping in mind the objective of the recommendation service.

Click here to read PersonalFN’s Mutual Fund Rating Methodology

Quantum Information Services Private Limited CIN: U65990MH1989PTC054667 Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021 Corp. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021. Email: info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013

Add Comments