While large-caps are a relatively safer bet in one's investment portfolio, having some exposure to mid- and small-caps can potentially spice up your portfolio returns. Given their high return potential, they certainly come with higher risk. While identifying quality mid cap stocks is not easy, a few eminent mid-cap biased funds have been doing it with ease.

Canara Robeco Emerging Equities Fund is a mid-cap focused scheme from the stable of

Canara Robeco Mutual Fund. The fund aims to identify mid cap and small cap companies that could become tomorrow's blue chip companies, by monitoring their industry of operation, sustainability and management. It also aims to participate in their potential for growth in the long-term.

Launched over a decade back in March 2005, Canara Robeco Emerging Equities Fund has delivered returns of around 19% CAGR, as against 15.6% CAGR by its benchmark Nifty Free Float Midcap 100 (as calculated on February 12, 2018).

Canara Robeco Emerging Equities Fund's performance, especially over the past five years, has been quite impressive. While it had managed to considerably improve its performance in bear phase of 2011, the fund came to limelight with the stellar performance it delivered in the bull rally of 2014. Canara Robeco Emerging Equities Fund has been successful in outperforming broader markets and most of its prominent peers across market phases. Moreover, the risk management strategies followed at Canara Robeco Mutual Fund has worked very well for the fund.

Over the last 3 years, Canara Robeco Emerging Equities Fund has become one of the prominent choices of investors looking for midcap funds. The fund's Assets Under Management (AUM) has grown over 10 times from just about Rs 283 crore in January 2015 to around Rs 3,207 crore in January 2018.

In this brief analysis, PersonalFN takes a close look at the features and performance of Canara Robeco Emerging Equities Fund.

Investment Objective of Canara Robeco Emerging Equities Fund

The investment objective of Canara Robeco Emerging Equities Fund is to generate capital appreciation by primarily investing in diversified mid-cap stocks. However, there can be no assurance that the investment objective of the scheme will be realized.

Canara Robeco Emerging Equities Fund Details

Fund Facts

| Category |

Diversified |

Style |

Growth |

| Type |

Open ended |

Market Cap Bias |

Mid cap |

| Launch Date |

11-March-05 |

SI Return (CAGR) |

19.05% |

| Corpus (Cr) |

Rs 3,207.93 |

Min./Add. Inv. |

Rs 5,000 / Rs 1,000 |

| Expense Ratio (Dir/Reg) |

0.90% / 2.29% |

Exit Load |

1% if less than 2 Yr |

Data as on January 31, 2018.

SI Return as on February 12, 2018.

(Source: ACE MF)

Under normal circumstances, the Canara Robeco Emerging Equities Fund will allocate…

- 65% - 100% of its assets in midcap equity & equity related instruments falling within the market capitalization range of the underlying benchmark (i.e. stocks having market capitalization between the highest and the lowest components of its benchmark - Nifty Free Float Midcap 100 index, and may or may not be a constituent of the index).

- 0% - 35% in equity and equity related instruments of Companies other than the above.

- 0% - 35% in Domestic Debt and Money Market Instruments.

Growth Of Rs 10,000, If Invested In Canara Robeco Emerging Equities Fund 5 Years Back

Data as on February 12, 2018 Data as on February 12, 2018

(Source: ACE MF)

|

Had you invested Rs 10,000 in Canara Robeco Emerging Equities Fund, 5 years back on February 12, 2013, it would have grown to Rs 36,463. This translates in to a compounded annualised growth rate of 29.51%. In comparison, a simultaneous investment of Rs 10,000 in its benchmark Nifty Free Float Midcap 100 would now be worth Rs 24,990 (a growth of 20.09% CAGR).

The fund has clearly outperformed its benchmark over the period of last 5 years.

|

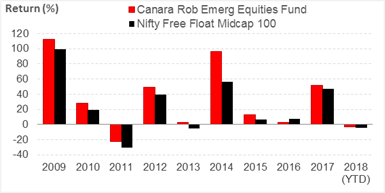

Canara Robeco Emerging Equities Fund: Year-on-Year Performance

|

Canara Robeco Emerging Equities Fund has a track record of over a decade. The year on year performance comparison of the fund vis-à-vis its benchmark - Nifty Free Float Midcap 100 shows that the fund has outperformed the benchmark in 9 out of last 10 calendar years. Barring 2016, the fund has been consistent in generating significant alpha over its benchmark.

While Canara Robeco Emerging Equities Fund proved its ability to limit losses during market correction witnessed in CY 2011 and CY 2013; in the upside rally seen in CY 2014 and CY 2017, the fund rewarded its investors with extra ordinary absolute return of 96% and 52% respectively.

|

YTD as on February 12, 2018 YTD as on February 12, 2018

(Source: ACE MF) )

|

Canara Robeco Emerging Equities Fund: Performance Vis-à-vis Category Peers

Rolling Period Returns

| Scheme Name |

Corpus

(Rs Cr) |

1 Year |

2 Year |

3 Year |

5 Year |

Std Dev |

Sharpe |

| Mirae Asset Emerging Bluechip |

5,301.6 |

37.51 |

24.88 |

28.48 |

31.00 |

14.65 |

0.28 |

| L&T Midcap Fund |

2,221.9 |

40.96 |

23.64 |

26.95 |

28.17 |

15.05 |

0.26 |

| L&T Emerging Businesses Fund |

4,030.9 |

49.28 |

29.53 |

26.78 |

-- |

16.85 |

0.31 |

| Canara Rob Emerg Equities Fund |

3,207.9 |

36.24 |

20.74 |

26.58 |

28.99 |

17.11 |

0.20 |

| Kotak Emerging Equity Scheme |

3,010.1 |

30.20 |

20.28 |

25.72 |

25.64 |

14.54 |

0.20 |

| Principal Emerging Bluechip Fund |

1,668.6 |

35.40 |

21.62 |

24.80 |

27.86 |

15.98 |

0.21 |

| Sundaram Select Midcap |

6,332.4 |

30.05 |

19.84 |

24.31 |

25.91 |

15.53 |

0.19 |

| Kotak Midcap Scheme |

845.7 |

29.15 |

19.67 |

23.34 |

23.31 |

14.96 |

0.19 |

| Aditya Birla SL Midcap Fund |

2,483.1 |

30.24 |

18.46 |

22.82 |

23.22 |

15.30 |

0.18 |

| HSBC Midcap Equity Fund |

640.8 |

33.59 |

19.42 |

22.79 |

24.03 |

19.08 |

0.18 |

| HDFC Mid-Cap Opportunities Fund |

20,278.2 |

30.66 |

20.01 |

22.67 |

25.90 |

14.01 |

0.20 |

| Edelweiss Mid and Small Cap Fund |

640.2 |

30.23 |

16.33 |

22.67 |

26.57 |

15.33 |

0.21 |

| Franklin India Prima Fund |

6,669.4 |

26.63 |

17.86 |

22.29 |

26.41 |

13.36 |

0.17 |

| MOSt Focused Midcap 30 Fund |

1,361.6 |

19.92 |

12.99 |

22.16 |

-- |

15.11 |

0.12 |

| SBI Magnum MidCap Fund |

4,059.6 |

19.98 |

15.20 |

21.89 |

27.36 |

13.56 |

0.18 |

| BNP Paribas Mid Cap Fund |

851.4 |

28.57 |

16.67 |

21.81 |

25.57 |

15.83 |

0.17 |

| Tata Mid Cap Growth Fund |

703.1 |

28.97 |

14.09 |

21.13 |

24.49 |

16.11 |

0.14 |

| UTI Mid Cap Fund |

4,208.4 |

23.70 |

14.33 |

20.50 |

26.39 |

15.20 |

0.14 |

| IDFC Sterling Equity Fund |

2,482.6 |

40.40 |

19.57 |

20.31 |

21.03 |

15.96 |

0.18 |

| ICICI Pru Midcap Fund |

1,502.5 |

30.64 |

16.01 |

19.95 |

24.53 |

15.34 |

0.14 |

| Nifty Free Float Midcap 100 |

|

31.30 |

19.30 |

20.23 |

19.40 |

15.97 |

0.18 |

| S&P BSE Mid-Cap |

|

30.02 |

20.14 |

20.31 |

19.22 |

15.49 |

0.19 |

Returns are on a rolling basis and those depicted over 1-Yr are compounded annualised.

Data as on February 12, 2018

(Source: ACE MF)

On rolling return basis, Canara Robeco Emerging Equities Fund stands strong among top performers in the mid cap funds category. It has delivered superior returns across rolling periods of 1-Yr, 2-Yr, 3-Yr and 5-Yr. and has done well to beat its benchmark and most of its category peers by a distinct margin. However, the funds high return comes at a higher volatility. Its Standard Deviation of 17.11 signifies that the fund's total risk is one of the highest in the category and is substantially higher than the benchmark and its top performing peers. However, its Sharpe Ratio of 0.20 shows that it has fairly rewarded investors for the level of risk taken.

Investment Strategy of Canara Robeco Emerging Equities Fund

Canara Robeco Emerging Equities Fund is positioned as a diversified equity fund focusing on the opportunities in the mid & small cap space. The fund has a mandate to invest at least 65% of its assets in mid cap companies, whose market capitalization is between the highest and the lowest components of the underlying benchmark - Nifty Free Float Midcap 100. However, it is not necessary that the stock may be a constituent of the benchmark index. The fund may also invest up to 35% of its assets in companies falling outside the aforesaid selection. Investments in domestic debt and money market instruments can also be made up to 35% of the fund's net assets.

For the purpose of investment, the fund focuses on companies with a low P/E ratio (as compared to the industry P/E), those having a low market capitalisation at present, consistent growth potential, operating in niche businesses with high and increasing profit margin, huge untapped market potential, research driven companies, scope for value added services, companies with opportunities on account of outsourcing namely, contract research and manufacturing, scope for increasing PE to Growth.

Midcaps being a risky bet, the fund also uses diversification as a tool to control risk. Canara Robeco Emerging Equities Fund usually holds about 50-70 stocks in its portfolio. The individual stock exposure rarely goes above the 5% mark. The fund is actively managed, and the fund manager does not hesitate to churn the fund’s portfolio to generate alpha returns.

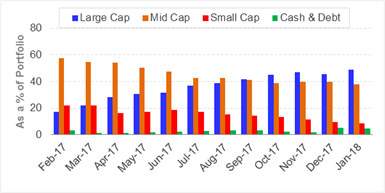

Canara Robeco Emerging Equities Fund - Portfolio Allocation and Market Capitalisation Trends

Holdings (in %) as on January 31, 2018 Holdings (in %) as on January 31, 2018

(Source: ACEMF)

|

Canara Robeco Emerging Equities Fund has a mandate to hold 65% of its assets in mid and small cap stocks. While the fund usually remains heavy weight on mid and small caps, where it allocates about 60% to 80% of its portfolio, of late, the allocation has gradually shifted towards large caps. From around 17.4% in February 2017, the funds allocation to large caps increased to 49% in January 2018. At the same time the mid and small cap allocation has reduced from 79% to 46% of its portfolio.

|

Canara Robeco Emerging Equities Fund – Top Portfolio Holdings

Top 10 Stocks

| Stocks |

% of Assets |

| Reliance Industries Ltd. |

3.66 |

| Bajaj Finserv Ltd. |

3.43 |

| Minda Industries Ltd. |

3.33 |

| ITC Ltd. |

2.92 |

| Atul Ltd. |

2.91 |

| Container Corporation Of India Ltd. |

2.74 |

| Piramal Enterprises Ltd. |

2.70 |

| Dabur India Ltd. |

2.33 |

| Biocon Ltd. |

2.32 |

| Britannia Industries Ltd. |

2.21 |

|

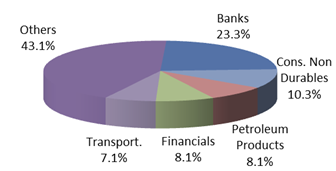

Top 5 Sectors

|

Holdings (in %) as on January 31, 2018

(Source: ACEMF) |

Canara Robeco Emerging Equities Fund's portfolio is heavy weight on stocks in the Engineering sector. Banking and financials too form a significant portion of its portfolio. The fund also bets on Consumption, Auto, Pharma, Chemicals and Petroleum among others. Its focus on growth and high beta sectors has helped it generate alpha returns in the past. However, while aiming for returns it does not ignore risk and uses diversification to mitigate its risk. Canara Robeco Emerging Equities Fund usually holds about 50 to 70 stocks in its portfolio. Currently stocks like Reliance Industries, Bajaj Finserv, Minda Industries, ITC and Atul Ltd are among the top 5 holdings in the fund's portfolio.

Top Gainers in Canara Robeco Emerging Equities Fund's portfolio

In the last 12 months, some stocks present in the fund’s portfolio like Minda Industries, IIFL Holdings, Escorts and Raymond, have more than doubled in value.

Its exposure to stocks like Honeywell Automation India, TCI Express, Transport Corporation Of India, Sundram Fasteners, Bajaj Finance, Dalmia Bharat, V-Guard Industries, Whirlpool Of India, Bharat Forge, Solar Industries (India) and Century Plyboards too have helped the fund deliver significant alpha for its investors.

Suitability of Canara Robeco Emerging Equities Fund

Mid and Small caps are under-researched and therefore, more likely to be priced wrongly. Moreover, the shortage of information about these companies in public domain makes them a risky proposition. However, from a long-term perspective, mid and small cap stocks offer high growth potential vis-à-vis their large cap peers, provided the investor is willing to take higher risk and hold on to his investment for a longer period.

Canara Robeco Emerging Equities Fund focuses on identifying such mid and small cap companies that could become tomorrow's blue chip companies. While the strategy has helped the fund generate substantial returns for its investors during mid cap rallies, the highly volatile nature of the fund clearly makes it suitable only for investors having high risk appetite. Mid and small cap segment are still trending in an overvalued zone. Thus, investors need to be careful and understand their suitability while considering such mid and small cap biased funds for their portfolio.

Note: This write up is for information purpose and not a recommendation to buy or sell the mutual fund scheme. As an investor, you need to pick the right fund to meet your financial goals. If you are not sure about your risk appetite, do consult your investment consultant/advisor.

|

Editor's note:

If you are worried about the unpredictability of the equity markets and confused about which mutual funds to invest in this year, don’t worry. PersonalFN’s latest exclusive report: Top 5 Equity Funds To Invest In 2018 has been created keeping the current Investment Scenario in mind. This exclusive report is already gaining popularity among our readers. So do not miss it for anything. Subscribe now!

|

DISCLOSURE AS PER SECURITIES AND EXCHANGE BOARD OF INDIA (RESEARCH ANALYSTS) REGULATIONS, 2014

About the Company including business activity

Quantum Information Services Private Limited (QIS) was incorporated on December 19, 1989.

QIS was promoted by Mr. Ajit Dayal with an objective of providing value-based information / views on news related to equity markets, the economy in general, sector analysis, budget review and various personal products and investments options available to the Public. It was the first company to start equity research on an institutional level.

'PersonalFN' is a service brand of QIS and was started in the year 1999. In 1999, the Company registered the Domain name www.personalfn.com for providing information on mutual funds and personal financial planning, financial markets in general, etc and services related to financial planning and research in various financial instruments including mutual funds, insurance and fixed income products to customers. It offers asset allocation and researched investment recommendations through its financial planning services.

Quantum Information Services Private Limited (QIS) is registered as Investment Adviser under SEBI (Investment Adviser) Regulations, 2013 and having Registration No.: INA000000680. In terms of second proviso to Regulation 3 (1) of SEBI (Research Analysts) Regulations, 2014 the Company is not required to obtain Certificate of registration from SEBI.

Disciplinary history

There are no outstanding litigations against the Company, it subsidiaries and its Directors.

and condition on which its offer research report. For the terms and condition for research report click here.

Details of associates

- Money Simplified Services Private Limited;

- PersonalFN Insurance Services India Private Limited;

- Equitymaster Agora Research Private Limited;

- Common Sense Living Private Limited;

- Quantum Advisors Private Limited;

- Quantum Asset Management Company Private Limited;

- HelpYourNGO Private Limited;

- HelpYourNGO Foundation;

- Natural Streets for Performing Arts Foundation;

- Primary Real Estate Advisors Private Limited;

- Rahul Goel;

- I V Subramaniam.

Disclosure with regard to ownership and material conflicts of interest

- Neither QIS, it’s Associates, Research Analyst or his/her relative have any financial interest in the subject Company , except QIS receives fees for providing research to Quantum Equity Fund of Fund (QEFoF) which is Fund of Fund scheme managed by QMF.

- Neither QIS, it's Associates, Research Analyst or his/her relative have actual/beneficial ownership of one per cent or more securities of the subject Company, at the end of the month immediately preceding the date of publication of the research report.

- Neither QIS, it's Associates, Research Analyst or his/her relative has any other material conflict of interest at the time of publication of the research report except that QIS (PersonalFN) is, as per SEBI (Mutual Funds) Regulations 1996, an associate / group Company of Quantum Asset Management Company Private Limited and Trustees and Sponsor of Quantum Mutual Fund (QMF) and to that extent there may be conflict of interest while recommending any schemes of QMF. However any such recommendation or reference made is based on the standard evaluation and selection process, which applies uniformly for all Mutual Fund Schemes. The payment of commission (upfront /annualized & trail), if any, for any Schemes by QMF to QIS (PersonalFN) is also at arm's length and as per prevailing market practices

Disclosure with regard to receipt of Compensation

- Neither QIS nor it's Associates have any compensation from the subject Company in the past twelve months.

- Neither QIS nor it's Associates have managed or co-managed public offering of securities for the subject Company in the past twelve months.

- Neither QIS nor it's Associates have received any compensation for investment banking or merchant banking or brokerage services from the subject Company in the past twelve months.

- Neither QIS nor it’s Associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months except from Axis Bank Limited under a service agreement.

- Neither QIS nor it's Associates have received any compensation or other benefits from the subject Company or third party in connection with the research report

General disclosure

- The Research Analyst has not served as an officer, director or employee of the subject Company.

- QIS or the Research Analyst has not been engaged in market making activity for the subject Company.

Subject Company means Mutual Fund Schemes

Quantum Information Services Private Limited CIN: U65990MH1989PTC054667 Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021 Corp. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021. Email: info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013

Add Comments

| Comments |

goutamiharish@Yahoo.com

Nov 11, 2018

Good |

goutamiharish@Yahoo.com

Nov 11, 2018

Good |

goutamiharish@Yahoo.com

Nov 11, 2018

Good |

1